- Brazil’s economic recovery seems headed for a setback in December’s macro profile

- U.S. housing starts on track to increase in January, but just barely

- U.S. jobless claims projected to rise, but implied economic forecast remains bullish

An update on Brazil’s battered economy is due today via the central bank’s monthly estimate of economic activity. Later, two U.S. reports will provide more perspective on how the macro trend is faring in early 2017 from the perspective of initial jobless claims and housing construction.

Inching higher, the odds of an accelerating housing sector appear low.

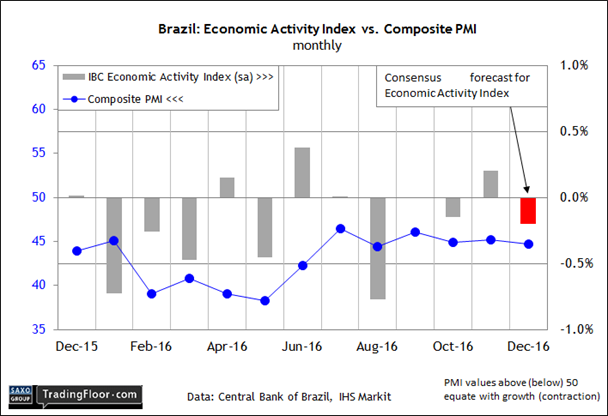

Brazil Economic Activity Index (1030 GMT): Brazil’s stock market continues to anticipate an economic recovery and more economists are projecting upbeat news. But a setback is expected in today’s estimate of economic activity for December via the central bank's review.

TradingEconomics.com’s consensus forecast sees the Index of Economic Activity of the Central Bank sliding back into negative territory at last year’s close. The index, which is considered a monthly proxy for the country’s GDP, is projected to dip 0.2%, reversing November’s 0.2% increase, the first advance since July.

But any setback is expected to be temporary, or so the Bovespa Stock Index suggests. At mid-day trading on Wednesday, the equity benchmark was only slightly below the record high set on Tuesday.

Economists think growth will soon return to Brazil’s economy, which is still struggling from a deep multi-year recession. Reuters earlier this week noted that “several economists are turning bullish on a return to growth in the Brazilian economy following months of downward revisions to forecasts as slowing inflation fuels bets on aggressive interest rate cuts.”

Gustavo Arruda of BNP Paribas, for instance, advises that:

The combination of stronger sentiment, lower rates and advancing reforms is likely to confirm that the recession has been left behind.

Based on expectations for today’s numbers from the central bank, however, making that case will remain challenging until the 2017 numbers begin arriving.

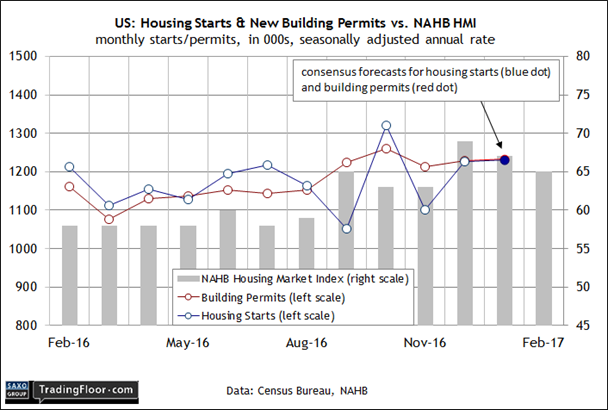

U.S. Housing Starts (1330 GMT): Builder confidence eased in February, but industry leaders are still expecting a healthy tailwind for construction activity in the near-term future.

The Home Building Index dipped for a second month in a row this month, the National Association of Home Builders (NAHB) reported, but the sentiment benchmark remained elevated relative to recent history. “While builders remain optimistic, we are seeing the numbers settling back into a normal range,” said NAHB’s chairman.

Today’s hard data on housing starts is expected to inch higher for January, according to Econoday.com’s consensus forecast. The projected rise to 1.232 million units (seasonally adjusted) marks a three-month high, but the outlook for another month of generally flat activity will be hard to shake if the estimate is accurate.

Bottom line: the odds look low that the housing sector is due to accelerate, based on the backsliding in HMI this year following December’s surge. Although the near-term outlook for construction still looks healthy, it appears that growth has slowed to a crawl.

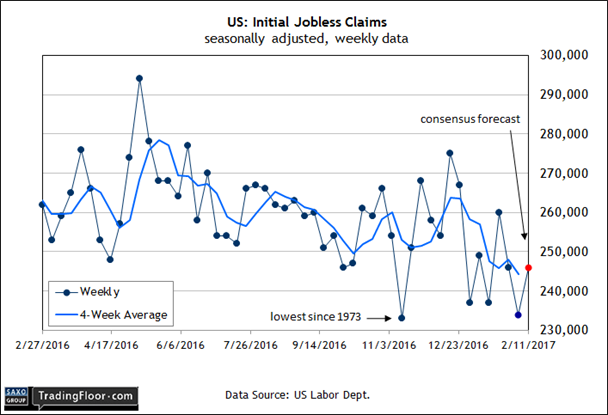

U.S.: Initial Jobless Claims (1330 GMT): The U.S. labour market has been expanding every month for over six years and there’s no sign that the gravy train is set to end.

New filings for unemployment benefits, a leading indicator for the jobs market, are set to remain close to a 43-year low in today’s weekly report, based on Econoday.com’s consensus forecast. Although analysts project that claims will rise 12,000 to a seasonally adjusted 246,000, that’s still near the lowest level since Richard Nixon was in the White House.

By some accounts, the labour market’s sturdy growth trend is set to accelerate once the Trump administration’s economic policies kick in. Perhaps, but it’s already clear that the newly minted president inherits an economy with a moderately strong tail wind. Payrolls increased by 227,000 in January, the government reported earlier this month – the biggest monthly advance since September.

Some economists wonder if the low rate of new layoffs is a warning sign that the labour market is too tight. This could be a problem if the economy starts to run hotter. Economist Scott Grannis asked:

Where will an expanding economy find more workers? There are precious few to be found among the ranks of those receiving unemployment benefits – fewer than ever before.

That could become an issue down the road, but at the moment it’s a sign that the labour market’s near-term outlook remains encouraging – an outlook that’s on track to find fresh support in today’s release.

Disclosure: Originally published at Saxo Bank TradingFloor.com