The UK is in the spotlight with today’s economic calendar, starting with the government’s monthly update on industrial production. Later, the National Institute of Economic and Social Research (NIESR) publishes its widely read monthly estimate of UK GDP. We’ll also see another revision to the Atlanta Fed’s Q1 nowcast for US GDP, which is due shortly after the monthly release of wholesale trade data at 1500 GMT.

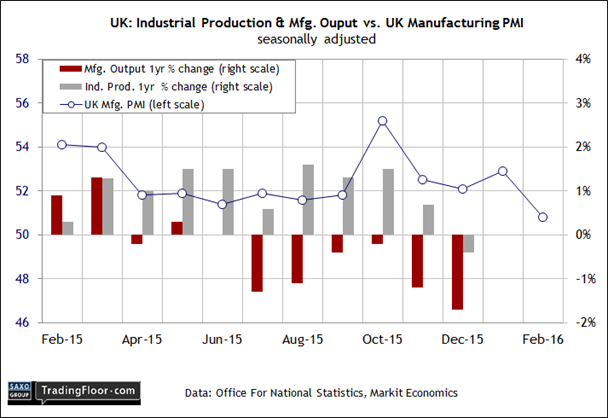

UK: Industrial Production (0930 GMT): Industrial activity in Britain is weak and getting weaker, or so recent data suggests. Last year was a turning point for the recovery in this sector, and for all the wrong reasons. The only question is whether the decline is set to roll on in 2016?

Today’s January release will be widely read as the market looks for fresh guidance on managing expectations for the UK macro trend. Although growth remains intact for the big picture, there’s concern that the weakness in the industrial sector could be a prelude for the broader economy in the months ahead.

The current view from the manufacturing trenches isn’t encouraging. A new survey by EEF, an association representing manufacturing employees, reported that the sector has been cutting investment lately. “High uncertainty about the outlook for global and domestic markets weighed on the confidence of manufacturers to invest,” the group explained.

Yet the EEF’s economic outlook for UK GDP continues to anticipate a “reasonable pace” of growth in the quarters ahead, according to its March economic briefing.

Perhaps, but the weak data in manufacturing may endure. Markit’s survey data for the sector reflected activity at a 34-month low last month.

The purchasing managers’ index (PMI) for manufacturing, at 50.8 in February, is just above the stagnation mark of 50.0. “The breadth of the slowdown is especially worrisome,” a Markit economist said last week. “The domestic market is showing signs of weakening while export business continued to fall.”

The blowback still looks contained for the broader economy. Nonetheless, strong headwinds are still blowing for manufacturing in the UK, and around the world. Some analysts are looking for a rebound in today's update, but it's going to take time before optimism returns to this battered sector

.

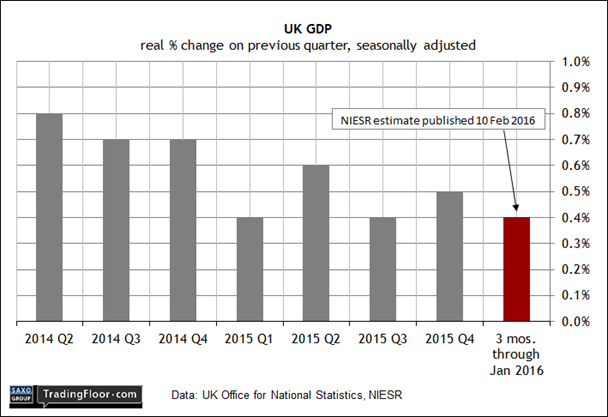

UK: NIESR GDP Estimate (1500 GMT): Although manufacturing is taking it on the chin lately, today’s monthly macro outlook from the National Institute of Economic and Social Research (NIESR), a London consultancy, will likely paint a brighter picture.

The case for expecting moderate growth still looks convincing, although NIESR’s projections have ticked down lately. Last month the group announced a 0.4% gain for GDP during the three months through January, slightly below the 0.5% rise for the quarter through December. “The softening of growth in the three months to January was primarily driven by weakness in the production sector in November and December,” NIESR said.

But in a sign of the times, NIESR research fellow James Warren laid out the road ahead, which could get bumpy. “We do expect the economy to grow by 2.3% this year, primarily driven by consumer spending,” he noted last month. “However, negative contributions from net trade are expected to weigh heavily on growth. There exist a number of downside risks that have the potential to exacerbate this, should they materialise.”

For the moment, however, the near-term trend remains encouraging. This month’s survey of forecasts from economists via FocusEconomics points to a 2.1% growth rate for UK GDP - just slightly below NIESR’s estimate from last month. But if the relatively upbeat numbers are vulnerable to downside revisions in the spring, we may see an early warning in today’s monthly projection from NIESR.

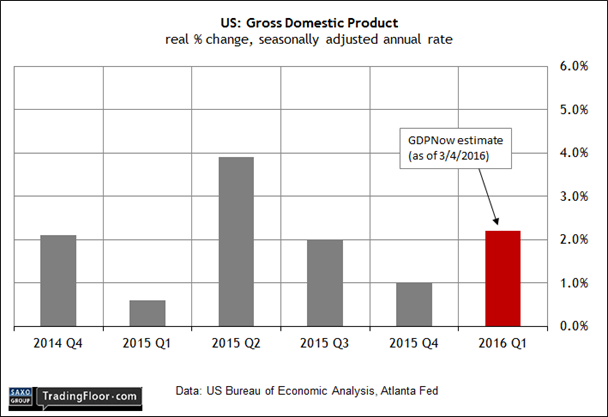

US: Atlanta Fed Q1 GDP Nowcast (~1500 GMT): The outlook for the global economy is brighter than the gloomy analysis of late suggests, the Peterson Institute for International Economics (PIIE) said in a research report yesterday.

Although economic and financial developments have raised anxiety about the US macro outlook, the economic expansion “remains on track” the group advised.

“Perhaps the clearest signal that the expansion is proceeding at a healthy clip comes from the labor market,” wrote David Stockton, a senior fellow at PIIE. “Gains in nonfarm payroll employment have averaged over 230,000 per month over the past three months and 215,000 per month over the past six months. Only about 100,000 per month are needed to stabilize the unemployment rate.”

Why, then, did the Federal Reserve’s Labor Market Conditions Index - a multi-factor measure of the trend in the labour market - dip for the second month in a row in February, slipping to its weakest reading in nearly seven years? The decline reflects a labour market that’s weaker than it appears payrolls data alone.

Most analysts think the Fed’s benchmark of labour conditions is wrong. If so, today’s revised nowcast of first-quarter GDP will stick close to the recent projections for 2% plus growth. The March 4 estimate called for a 2.2% increase in Q1, which is more than double the sluggish 1%rise reported for last year’s Q4 (seasonally adjusted annual rate).

As long as the Atlanta Fed’s widely followed GDPNow model continues to project a doubling in US economic output for this year’s first quarter, the crowd will continue to see the Fed’s labour market warning as an anomaly.

Disclosure: Originally published at Saxo Bank TradingFloor.com