- UK construction activity forecast to continue to contract in September

- Will Brazil’s annual industrial output sink deeper into the red for August?

- Is the Mexican peso’s strength linked to Donald Trump’s stumbling campaign?

The UK economy remains in focus today with the September report on the Construction PMI —data that follows yesterday’s surprisingly strong update on the UK Manufacturing PMI for last month. Later, the crowd will turn to Brazil’s release on industrial production for August for deciding if Latin America’s biggest economy is still emerging from a deep recession. Meantime, keep your eye on the Mexican peso, which has been strengthening against the US dollar in recent days after reaching a record low last week.

An upside surprise in the UK Construction PMI would keep rumours spinning about the Bank of England’s next move for monetary policy. Photo: iStock

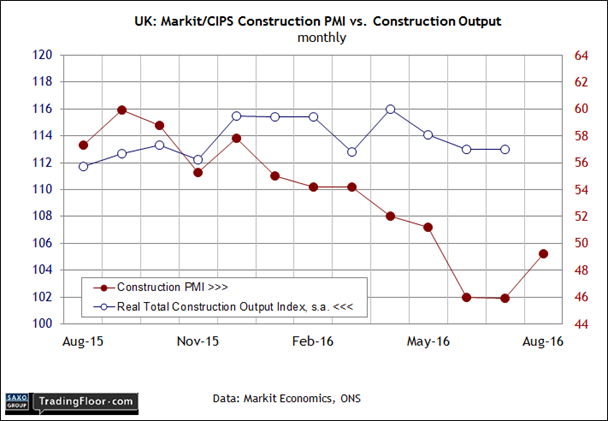

UK: Construction PMI (0830 GMT) Economic data for Britain continues to surprise on the upside, raising doubts about the prospects for another rate cut.

Yesterday’s update of the Manufacturing PMI for September is the latest example. The index rose to a 10-month high, beating expectations for a modest decline.

“September saw the UK Manufacturing PMI rise to its highest level since mid-2014, recovering further from its EU referendum-inspired low in July,” said a Markit economist. “The rebound over the past two months has been encouragingly strong, and puts the sector on course to provide a further positive contribution to GDP in the third quarter."

A firmer manufacturing sector may not be all that surprising in the wake of a sharp fall in the British pound. A weaker currency, after all, implies an increase in exports as UK products and services become less expensive in foreign markets.

"If the sharp rebound in the manufacturing PMI is mirrored in the services PMI, which covers more than half of the UK economy, chances are that the [the central bank] would not cut ... in November," Citi economists advised clients in a note. The Services PMI, which is due for an update tomorrow, rose sharply in August, albeit after tumbling to a seven-year low in July — the first month after the Brexit vote shocked the markets.

Meanwhile, Econoday.com’s consensus forecast sees today’s Construction PMI for September remaining in contractionary territory and easing to 49.0, down fractionally from 49.2 in the previous month, slightly below the no-change 50 mark. Another upside surprise, however, will keep the rumours spinning about the Bank of England’s next move for monetary policy.

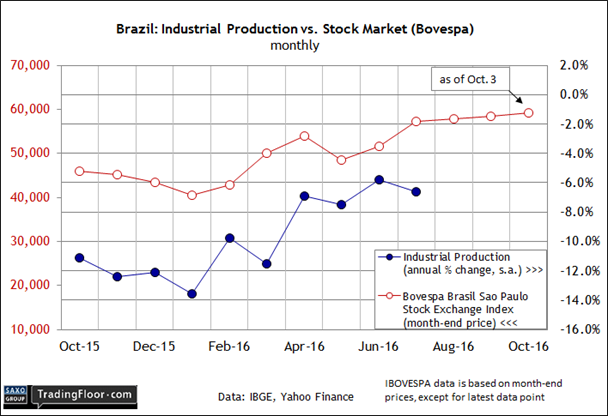

Brazil: Industrial Production (1200 GMT) South America’s economy still appears to be emerging from its worst recession in decades, a Moody’s analyst said last week. “The key is that on the growth front, the worst is probably behind us.”

Consumers are inclined to agree. FGV’s benchmark of consumer sentiment rose for a fifth month in September.

But there are still plenty of challenges ahead, as Brazil’s President Michel Temer advised last week. Without fiscal reform, including cutting public spending, the risk of bankruptcy can’t be ruled out. “Public debt could reach 100% of the GDP in 2024 or before,” he said. “It would be the bankruptcy of the Brazilian state.”

Meantime, the stakes are considerably lower for today’s update on industrial production. Nonetheless, one can argue that the stock market is becoming anxious. After trending higher for much of the year, Brazil’s Bovespa stock index has been treading water in recent weeks. Another weak report for today’s release on August industrial activity, which dipped a bit deeper into the red in year-over-year terms in July, and investors may have a new excuse to take some profits.

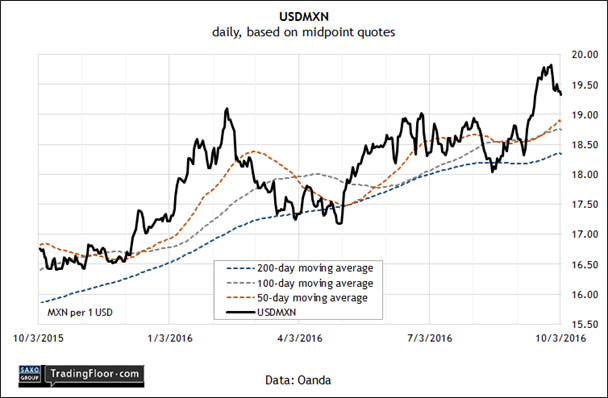

USDMXN The Mexican peso has been strengthening over the past week. Does the firmer trend have anything to do with the latest setback for Donald Trump’s presidential campaign? If the answer is “yes”, is there any economic logic for the rebound?

Perhaps, according to one analyst. The director of research at EPFR Global, an advisory firm, told Forbes that “there does seem to be a rough correlation between Trump’s popularity and fund flows. When Trump was losing ground, we saw some money coming back to Mexican equity funds.”

Whatever the reason, the peso has been rising against the US dollar after touching a record low late last month at nearly 19.92 on an intraday basis. But the currency has rebounded in the days since. USDMXN, which falls when the peso strengthens, was trading at just below 19.34 as of midday trading on Tuesday.

It’s premature to see the latest move as a decisive turn for the peso. But if Trump’s controversial campaign events of recent vintage offer a clue, USDMXN’s downside prospects remain encouraging.

The question, of course, is whether there are other reasons for the peso’s generally weak performance so far in 2016? Absolutely, according to one analyst. “The media has been playing this up a bit, but Mexico’s already suffering from low oil prices, sluggish growth,” the global head of emerging market currency strategy at Brown Brothers Harriman said last week. “The peso is often used as a proxy for the wider emerging markets, so there’s all these other factors that to me are more important to determining the peso exchange rather than Trump.”

Disclosure: Originally published at Saxo Bank TradingFloor.com