Monday’s a slow day for economic news, in part because US markets are closed for the President’s Day holiday. The pace picks up in the days ahead.

Meanwhile, today’s update on India’s wholesale price inflation will provide a fresh insight into deflation risk for one of the world’s fastest-growing economies. We’ll also see new numbers on Eurozone’s merchandise trade activity in December. Along the way, keep your eye on Germany’s 10-year yield for clues on risk sentiment for the week ahead.

India: Wholesale Price Index (0630 GMT): India’s stock market has tumbled this year, dragged down by a sour investment mood in trading capitals around the world. But don’t confuse the slide in the BSE Sensex Index with the economic trend on the subcontinent. Although the softer trend for the global economy is a risk factor, India’s macro trend continues to impress while China – the other big “emerging market” – remains on the defensive as it grapples with decelerating growth.

Last week, India reported that its economy increased by 7.3% in last year’s fourth quarter. That’s a relatively brisk pace by current standards around the world. It’s also a healthy acceleration from the 6.6% rise for the same period a year earlier.

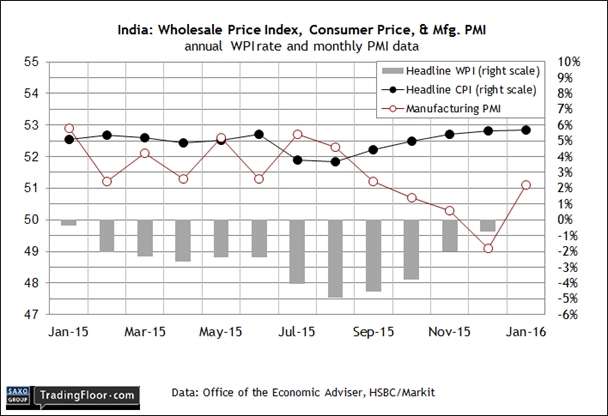

One concern has been the ongoing presence of deflation, based on India’s wholesale price index, which is widely followed as a benchmark for pricing pressure (or the lack thereof) in the country. By this gauge, deflation has had a firm grip on the economy: WPI fell for 14 straight months through last December, sliding 0.73% in 2015’s final month vs. the year-earlier level.

Although WPI has been negative for more than a year, there are signs that deflation’s bite is easing as the trend moves closer to zero. Note too that manufacturing activity last month rebounded sharply, based on the manufacturing purchasing managers’ index for India. Meanwhile, there's no sign of a deflation view via Indian consumer prices, which have been rising steadily in the 5% to 6% range lately.

Analysts are expecting that deflation will continue to fade in today’s WPI report for January. If so, the news will boost confidence that India’s robust growth trend of late isn’t under threat from deflation risk. In fact, global deflationary forces have been a boon for the country, which imports most of its oil.

“So far, the economy's modest recovery has been shaped by good luck on crude oil and commodities, and a supportive policy environment,” advised a report last week from Crisil Research. If today’s WPI report matches expectations for only a fractional year-over-year decline, India’s bulls will have one less problem to worry about.

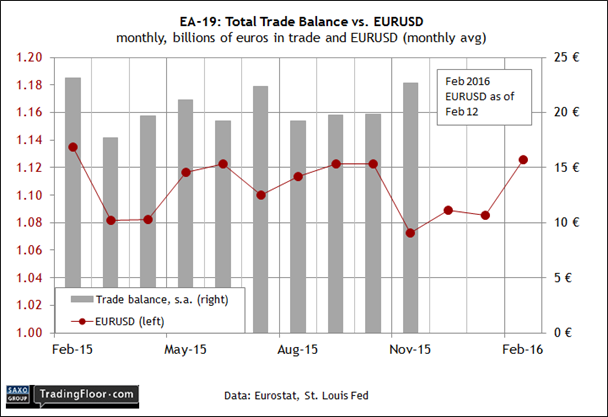

Eurozone: Trade Balance (1000 GMT): Last week’s updates for the Eurozone economy hint at the possibility that the economic recovery, which has been modest at best, may be headed for a new run of deceleration.

True, Eurozone GDP growth in last year’s fourth quarter remained stable at 0.3% in Friday’s flash estimate, matching Q3’s pace. But industrial output fell sharply in December, slumping 1% on a monthly basis and falling by an equivalent amount for the year-over-year comparison.

The data suggests that “the fragile global environment, tensions in financial markets and the recent appreciation of the euro are taking their toll on the Eurozone economy at the turn of the year, underlining once again the need for a swift monetary policy reaction,” noted Dominic Bryant at BNP Paribas.

Now-casting.com’s latest projection for first-quarter GDP doesn’t help the case for optimism. The consultancy on Friday downgraded its Q1 estimate to 0.28% (quarter over quarter change). On the surface, this looks mildly encouraging since it nearly matches the pace in the previous two quarters. But a closer look reveals that the downward revision is the fourth weekly downgrade in a row and the lowest projection since October for Q1. Meanwhile, Q2’s current estimate is even weaker at 0.21%.

The question for today: Is another warning about Europe’s macro trend lurking in the trade data for December? Some analysts are recommending to manage expectations down, in part because of concerns that global trade generally has peaked for this cycle.

“The worsening international backdrop has taken the wind out of the Eurozone’s sails,” said the deputy director of the Center for European Reform on Friday. If so, the evidence may show up in today’s release in the form of weaker exports.

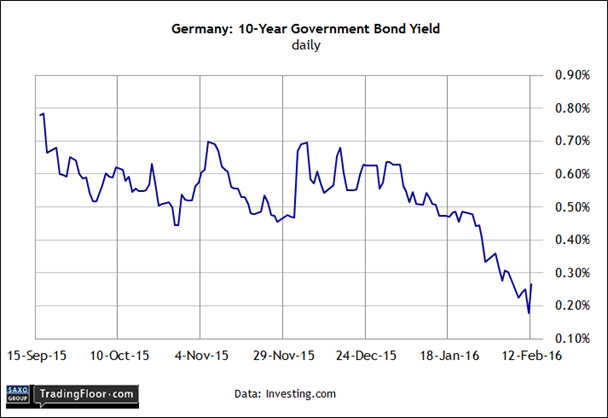

Germany: 10-Year Yield: Markets in the US are closed for the President’s Day holiday, which means that Germany’s 10-year yield will attract even more attention than usual as the crowd looks for early guidance on the risk appetite for the week ahead.

Last week’s trading ended with a round of stability after the surge in the safe-haven trade in the preceding days. Investors rushed into government bonds on both sides of the Atlantic through Thursday, pushing government bond yields to new multi-year lows.

At one point, the 10-year German Treasury yield fell below 0.20% – the lowest since the global financial crisis in 2008-09. But animal spirits returned on Friday, raising equity prices around the world and lifting Treasury yields off the previous lows.

Was last week a blow-off event that purged the market of its worst fears? Keep your eye on Europe’s benchmark yield for an early clue as the crowd struggles to figure out if the worst has passed. There was a hint of that in Friday’s trading. After falling steadily this year, Germany’s 10-year yield – after dipping below 0.18% on Thursday – bounced the next day, ending the week at nearly 0.27%, based on data at Investing.com.

Friday’s yield rebound is partly due to a worldwide risk-on bias that marked last week’s close after several days of sharp losses in equities. Will the rebound continue today? In search of clues, investors will focus on a speech scheduled for Monday (1400 GMT) by European Central Bank President Mario Draghi.

The question is whether there’s more monetary stimulus coming? If Draghi suggests otherwise, will we see a revival in the safe-haven trade that sends yields tumbling?

Disclosure: Originally published at Saxo Bank TradingFloor.com