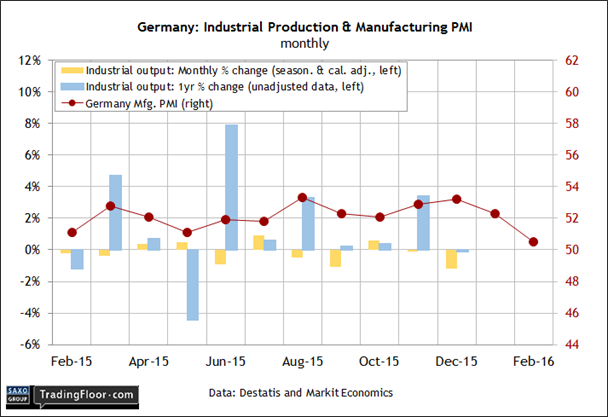

- Some data shows that German manufacturing is struggling

- But German industrial output should post its first monthly rise in three months

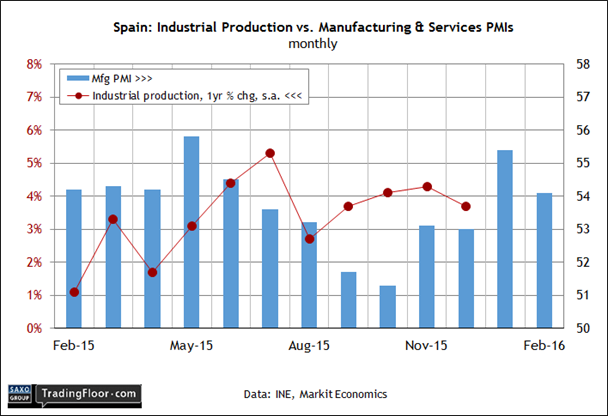

- Spanish industrial output has maintained a robust pace in recent months

- But the political stalemate may weaken Spain’s industrial activity

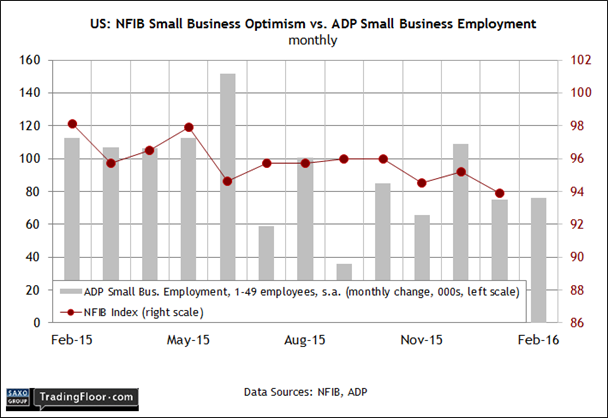

- A modest rebound is expected in US small business optimism

January updates on industrial activity for Germany and Spain are on tap today, offering fresh macro perspective for the euro area ahead of Thursday’s monetary policy announcement from the European Central Bank.

Later, we’ll see new sentiment data for the US small business sector via the monthly release from the National Federation of Independent Business. Meantime, keep in mind that revised data for last year's fourth-quarter Eurozone GDP is scheduled for

Germany: Industrial Production (0700 GMT) Yesterday’s monthly update on factory orders for Europe’s largest economy revealed a second consecutive month of contraction. Orders slipped 0.1% in January, although that was slightly better than the 0.3% decline that analysts were projecting.

By some accounts, the fact that orders beat expectations implies that the global slowdown will be limited for Germany’s manufacturing sector. Optimists point out that most of the weakness in orders was due to soft European demand. Otherwise, orders perked up. But to the extent the euro area troubles are a factor, the headwind is expected to continue.

“The Eurozone suffers from the loss of economic momentum of the global economy,” Sentix’s managing director said yesterday. The comment arrived with the consultancy’s March update of its Eurozone investor confidence index, which slumped to an 11-month low. Germany’s investor confidence index, by contrast, ticked up, Sentix advised, although the improvement still leaves the sentiment benchmark at a low level relative to recent history.

Today’s update on industrial output for January will offer more context for deciding how Germany’s faring. The report will be closely read ahead of Thursday’s monetary announcement from the ECB. A weak number today will boost expectations that the ECB will expand its stimulus program.

The crowd’s expecting a mixed bag for today’s release. Econoday.com’s consensus forecast sees industrial production rebounding in the monthly column, posting a solid 0.6% gain in January. If so, that will mark the first monthly increase since last October. The year-over-year trend, however, is on track to slide 1.2%, matching the annual decline in the previous report.

Meantime, Markit’s survey data suggests that Germany’s manufacturing sector is still struggling. The purchasing managers’ index for the sector dipped to 50.5 in February, close to stagnation. “It looks as if the German manufacturing engine has run out of steam,” a Markit economist advised last month. The question is whether today’s hard data will fall in line with the deteriorating sentiment numbers.

Spain: Industrial Production (0800 GMT) Europe’s fourth-largest economy also publishes new numbers on industrial activity today. But in contrast with Germany’s softer trend lately, Spain’s output has maintained a robust pace in recent months. It’ll be interesting to see if today’s industrial report for January can hold on to the recent progress.

In the previous release, output increased 3.7% in December vs. the year-earlier level. Although that’s below the 4%-plus rate in the previous two months, it’s still a healthy gain.

Meanwhile, Markit’s sentiment data for manufacturing suggests that the robust trend will continue. The PMI for the sector in the two months through February posted moderately stronger increases relative to updates for late 2015. Last month’s PMI profile continues to signal a “solid improvement” for Spain’s manufacturing sector, Markit noted.

But there’s growing anxiety related to political risk these days. The ongoing stalemate in efforts to form a government after December’s election is convincing businesses to delay investments and hiring. If today’s hard data on industrial activity stumbles, the crowd may start to manage expectations down for Spain’s macro trend as long as the impasse in Madrid rolls on.

US: Small Business Optimism Index (1100 GMT) Last week’s bullish report on payrolls revived expectations for the US economic outlook, but does the optimism extend to the small-business sector? Today’s update on sentiment will offer a new clue.

Recent history shows that the mood among small-business owners is ticking lower. In the January update, the Small Business Optimism Index eased to 93.9 — a two-year low. The key sources of downward pressure at the start of 2016: faltering expectations for business conditions and sales, according to the chief economist at the National Federation of Independent Business, the group that publishes the data. “Uncertainty continues to cloud the future,” he said last month.

A bit of relief is expected in today’s update for February. Econoday.com’s consensus forecast sees NFIB’s index inching higher, rising to 94.2 for February. That’s still a relatively soft number in relation to last year’s high points. The trend on this front isn’t terrible, but today’s report is on track to show that the small business sector is still wary about its near-term prospects for stronger growth.

Disclosure: Originally published at Saxo Bank TradingFloor.com