- Slowing manufacturing will weigh on German factory orders in today's update

- It may be time to trim expectations of slightly faster German GDP growth in Q1

- Will Eurozone investor confidence continue to ease in today’s report from Sentix?

- The Eurozone outlook has become weaker but no new recession looks imminent

- The Fed’s Labour Market Index should confirm the strong gain in payrolls

Germany’s export machine is the main event today for economic updates in Europe via the monthly numbers on factory orders for the country’s industrial sector. Later, Sentix publishes new survey figures for investor sentiment in Europe. In addition, the Federal Reserve revises its Labour Market Conditions Index for the US.

Germany: Factory Orders (0700 GMT): Roubini Economics thinks that global recession risk “is still running high, particularly as the remaining stock of countervailing policy tools is limited". That's what the consultancy’s managing director wrote in a note to clients late last week.

That’s a worry for Germany, one of the world’s leading exporters. But for the moment, the near-term outlook still looks encouraging for the macro trend in Europe’s largest economy, based on expectations for GDP growth in this year’s first quarter.

FocusEconomics last week reported that economists are expecting a slightly faster expansion in Q1. GDP for Germany is on track to tick up to a 0.4% quarter-over-quarter rate from 0.3% in last year’s Q4, based survey numbers for a range of analysts.

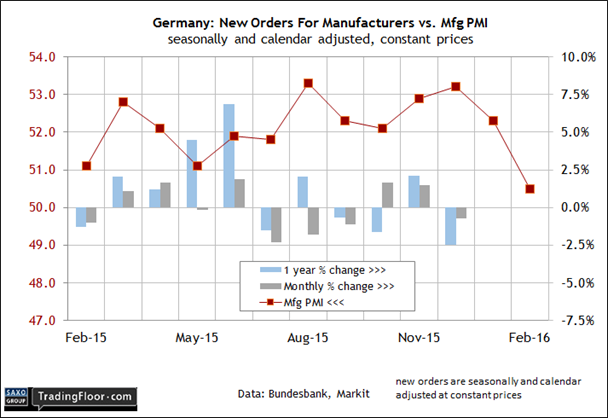

Nonetheless, recent updates for Germany’s industrial sector reflect a slowdown in growth, which is starting to squeeze factory orders. The last update for December showed new orders eased vs. the previous month, pushing the year-over-year rate down by 2.5% – the biggest annual decline since 2012. The main culprit: weak demand from within the Eurozone. By contrast, orders beyond the euro area were up at a robust rate, suggesting that Germany’s export business may be less vulnerable than it appears from a European perspective.

Survey data for manufacturing, however, implies that the headwinds are set to strengthen. Markit’s purchasing managers’ index for the sector slumped to 50.5 in February, just above the stagnation mark of 50.0.

Today’s hard data on factory orders for January isn’t expected to provide much relief. The consensus forecast sees no change in orders and only a slight gain of just 0.3% for the annual comparison, based on Econoday.com’s consensus view. If the actual change ends up well below expectations, it may be time to trim the outlook for a slightly faster pace in Germany’s GDP trend for this year’s first quarter.

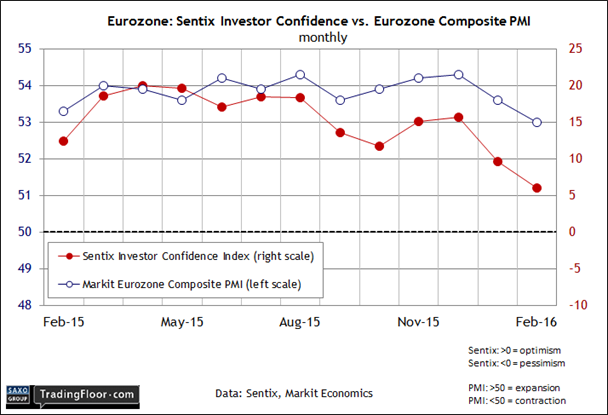

Eurozone: Sentix Investor Confidence (0930 GMT):The outlook for this year’s first-quarter macro trend in the Eurozone is stabilising at the mid-0.2% range for the quarter-over-quarter forecast, according to Now-casting.com’s weekly update on Friday. That still represents a mildly lower gain vs. the previously reported 0.3% rise for last year’s Q4.

The good news is that the recent run of lower estimates for this year's Q1, which cut the growth forecast from 0.5%-plus as recently as mid-January, has rebounded slightly in recent weeks.

The near-term outlook for Eurozone growth is still weaker compared with the view from a couple of months ago, but it’s not obvious that a new recession is imminent. If that’s still too optimistic we may see the evidence in today’s monthly sentiment data from Sentix. Unfortunately, recent history doesn’t look encouraging on this front.

The Sentix Investor Confidence Index eased for the second month in a row in the February report, dipping to the lowest level – 6.0 – in just over a year. The Eurozone Composite PMI for last month is also stumbling, signalling the weakest economic growth for the single currency union in 13 months. “The survey data raise the prospect of economic growth deteriorating further from the already meagre pace seen late last year, when GDP rose only 0.3%,” said Markit’s chief economist last week.

Markit’s warning will resonate a bit deeper if we see another dip in today’s Sentix data for March.

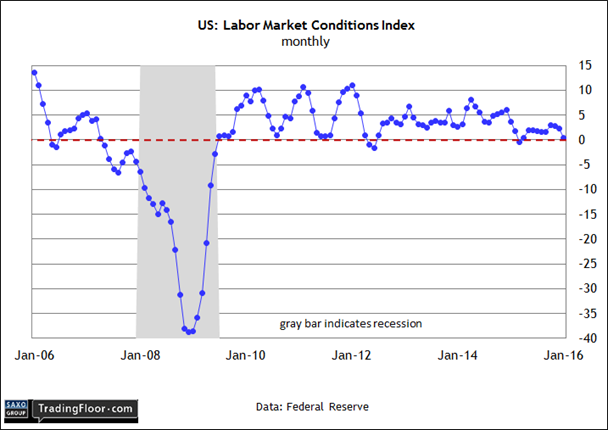

US: Labour Market Conditions Index (1500 GMT): Payrolls rebounded strongly in February, posting a solid 242,000 advance – well above January’s 172,000 increase. The year-over-year trend continues to ease, but for the moment it's still rising at a healthy pace: payrolls advance 1.9% last month vs. the year-earlier level.

In short, there’s no sign of imminent recession risk, based on last month's payrolls data. In turn, the possibility for a rate hike remains in play for the Federal Reserve's monetary policy meeting next week.

“The payroll numbers are startlingly strong,” noted Ian Shepherdson of Pantheon Macroeconomics viaThe Wall Street Journal. “In the household survey, the fifth straight big gain the labour force is starting to look like a trend, as employers dig deeper into the pool of labour, but the unemployment rate remains under downward pressure and will hit new lows in the spring".

A fresh estimate for deciding if that’s a reasonable forecast arrives in today’s update via the Federal Reserve’s Labor Market Conditions Index, a broad-minded measure of labour-market activity. Given what we learned on Friday, it would be surprising if we don’t see an improvement for this benchmark after the previous update that reflected a sluggish profile. LMCI dipped to 0.4 in January, the lowest since the previous April.

A stronger reading for today's February release is a reasonable bet for today’s update. The chief economist at PNC Financial (NYSE:PNC) Services described the last month's pop in payrolls as “consistent with continued moderate economic growth.” Today’s LMCI data is on track to confirm that view with a deeper and relatively objective read on the labour market.

Disclosure: Originally published at Saxo Bank TradingFloor.com