- A right-wing political win in France may drive down Germany's 10-year yield

- A Frexit could spell the beginning of the end for the EU and the euro

- Brazil’s stock market anticipates an end to the country's deep recession this year

- South Africa’s improving economy provides fuel to keep USDZAR's downtrend intact

Wednesday’s a slow day for economic releases. While we’re waiting for the macro numbers to start rolling in again on Thursday, let’s review some of the more topical market trends of late, including the German 10-year yield, Brazil’s stock market, and the South African rand.

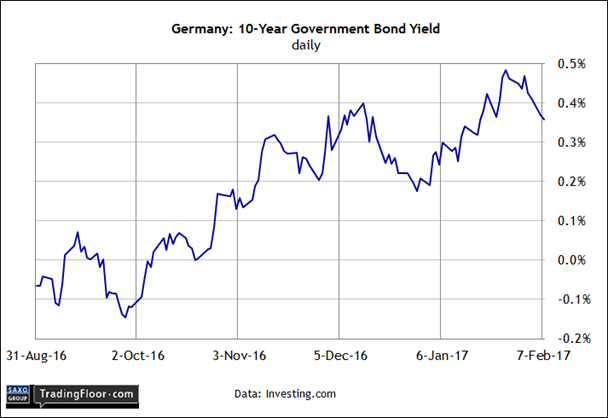

Germany: 10-Year yield: Worries over upcoming elections in France appear to be driving investors into the safe-haven trade of German bonds. The catalyst: recent polls favouring Marine Le Pen, the far-right politician who wants France to leave the European Union, in the presidential election that’s scheduled for April.

A Frexit, some analysts warn, could spell the beginning of the end for the EU and the euro. That possibility has encouraged fresh buying of German bonds, which are widely considered among the safest securities in the world, regardless of the EU's future.

The yield on the 10-year bond has slipped to roughly 0.35% in midday trading (New York time) on Tuesday, down from the recent peak of around 0.46% on January 26. Bond yields fall when prices rise.

The decline in the German 10-year yield has been accompanied by a rise in the French equivalent. As a result, the spread in French over German yields has increased to the highest in more than four years. The widening spread is “reflecting the increasing risk that ... Le Pen poses to the European political establishment,” said the director of foreign exchange trading at Bank of the West.

“The division is no longer between the right and the left,” Le Pen declared in a speech this past weekend, “but between patriots and [believers in] globalisation.”

There’s still a long way to go before Le Pen becomes president, including the hurdle of winning the runoff election in May that will follow the first round of voting in April. Political analysts say that while she appears on track to win the first round, victory in the second round is currently expected to be more challenging.

Nonetheless, the combination of uncertainty and high stakes for the EU will likely keep a lid on German yields until the election. A sharp selloff in bonds (i.e. a spike in yields) could be coming if Le Pen ends up losing the second round. But until or if her polling numbers fade, the 10-year yield could drift lower.

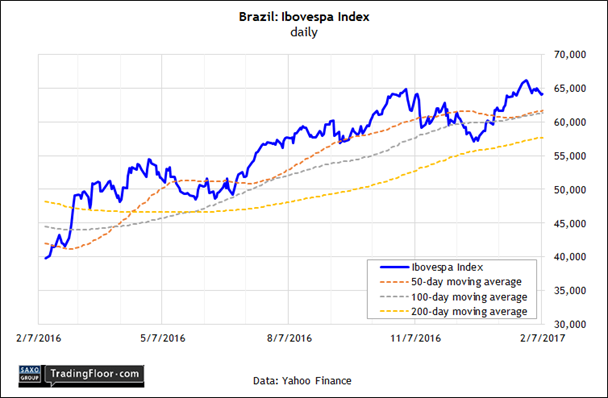

Brazil: Ibovespa Index: The stock market has been pricing in a recovery for South America’s largest economy. Economists are cautiously climbing on board with that forecast by upgrading their outlook for Brazil’s economy.

Credit Suisse Group’s Brazil division is projecting growth at a 2% annual pace by the close of this year. If the forecast holds, the country is on track to emerge from the deep recession that’s squeezed the economy since 2014. A 2% trend is modest, but it's a bold projection for Brazil at the moment, and one that’s well above the IMF’s latest estimate for a relatively weak 0.2% rise for this year's annual growth rate.

The larger point is that most forecasts are assuming that the economic slump will end this year, an outlook that the stock market has been anticipating for months. “We are past the worst of the cycle,” the head of macro for Latin America Oxford Economics told FT this week.

Brazil’s equity market agrees. In fact, the Ibovespa Index has been trending higher for months, touching a six-year high in January before a moderate pullback over the past week. Nonetheless, the bullish trend remains intact.

Keep in mind, however, that the rally over the past year or so has lifted the market by 70%-plus from the January 2016 low in anticipation of economic recovery. Further gains can’t be ruled out, assuming the incoming macro numbers remain encouraging. But the low-hanging fruit for hefty performance gains in the broad market has already been picked.

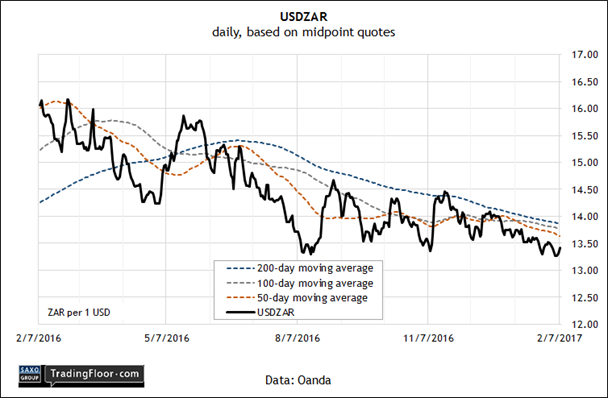

USD/ZAR: A Deutsche Bank analyst sees an improving trend for Africa’s biggest sub-Saharan economy. “The recent data suggest that we could be at the start of an economic turnaround. As such we expect this resilience to continue and remain bullish on ZAR,” an emerging-markets strategist at Deutsche recently wrote.

NKC African Economics, a consultancy based in South Africa, agrees. “Higher commodity prices in combination with lower inflation, stable interest rates and a recovery in the agricultural sector should drive 2017 growth somewhat stronger than in 2016,” an economist at the firm told Reuters last week.

The question is whether political turbulence threatens to derail the long-running rally in the rand vs. the US dollar? Pundits note the possibility that President Jacob Zuma will reshuffle his cabinet. The removal of the finance minister in particular will reportedly risk another credit downgrade for the government’s bonds.

Yet the technical profile for the rand still looks bullish. USD/ZAR continues to trade well below key moving averages and there’s no sign that a change in the trend is imminent. (A falling USD/ZAR equates with a stronger rand.) If anything, a stronger growth rate for the economy will provide more fuel to keep USD/ZAR's downtrend intact.

Disclosure: Originally published at Saxo Bank TradingFloor.com