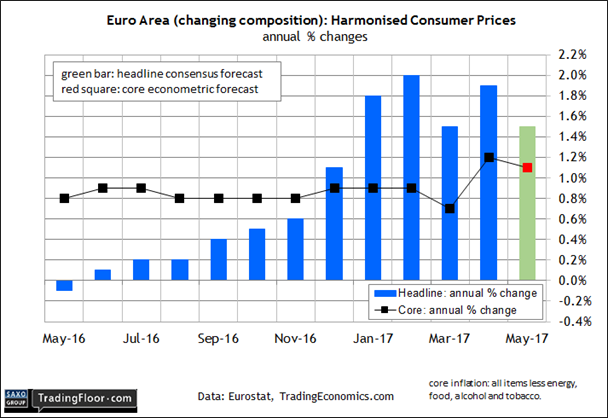

- Consumer inflation in Eurozone on track to decelerate in today's flash report for May

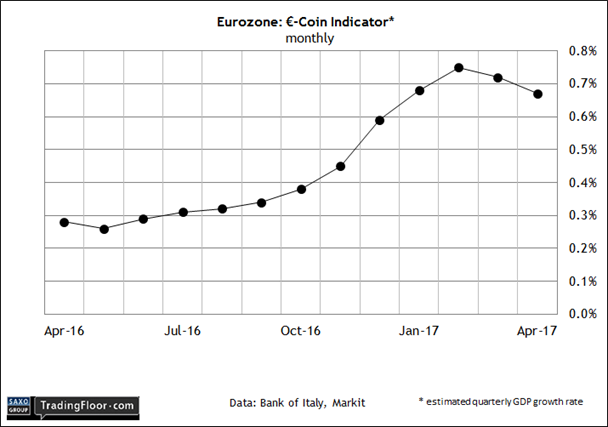

- Euro-Coin Indicator’s GDP estimate for EZ likely to reaffirm stronger growth outlook

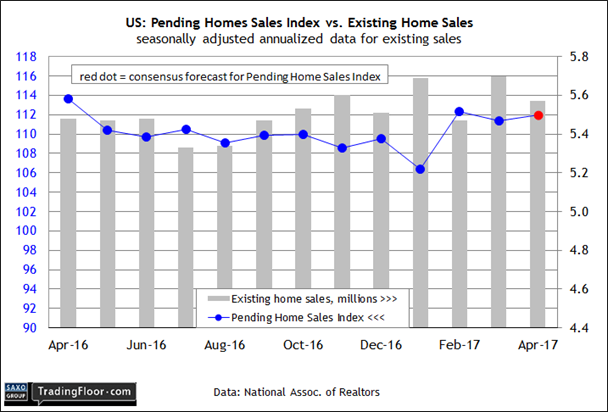

- The US Pending Home Sales Index is on track to tick up in today’s April release

A busy day of economic releases awaits for Wednesday, including a new estimate of Eurozone economic growth via the Euro-Coin Indicator.

We'll also see the flash release of the Eurozone’s Consumer Price Index for May. Meanwhile, the Pending Home Sales Index for the US is projected to rise for April, suggesting that the weak start for housing in Q2 is only a temporary setback.

The annual rate of consumer inflation for the euro area is set to decelerate to 1.5%. Photo: Shutterstock

Eurozone: Euro-Coin Indicator (0730 GMT) Economic growth has picked up this year, according to several sources, and today’s monthly release isn’t likely to tell us otherwise.

The Euro-Coin Indicator (ECI), a GDP proxy, has been consistently running above 0.6% this year. That's a sign that second-quarter output will probably show improvement over Q1’s 0.5% rise.

Now-casting.com's Q2 estimate offers support. The consultancy on Friday advised that its model is currently forecasting growth at nearly 0.8%, based on last week’s update. Business surveys are also anticipating a firmer growth rate. Last week’s flash release of the Eurozone Composite PMI held steady at a six-year higher. Meantime, the European Union recently nudged up its full-year growth forecast for the Eurozone to 1.7% and predicts that unemployment will continue to fall.

Stock markets in Europe are generally on board with the brighter outlook. The Euro Stoxx 50 Index is up more than 7% so far this year.

Today’s May release of the Euro-Coin Indicator will likely strengthen the view that the faster growth rate that's been bubbling since last year's second half will carry over into Q2.

Eurozone: Consumer Price Index (0900 GMT) The recent rebound in inflation is expected to take a pause in today’s flash data for May, providing the European Central Bank (ECB) with an excuse to keep monetary policy on hold.

The annual rate of consumer inflation for the euro area is set to decelerate to 1.5%, according to Econoday.com’s consensus forecast. The projection represents a conspicuously softer rate compared with the 1.9% increase in April. The projected 1.5% increase is also moderately below the ECB’s target of just below 2%.

A hint of softer inflation for this month was seen in yesterday’s updates for Germany and Spain. In both cases, the rate of growth weakened relative to April’s pace. Europe’s biggest economy reported annual consumer inflation of 1.4%, down from 2.0% in May.

ECB President Mario Draghi yesterday reasoned that the Eurozone economy still needs a hefty degree of stimulus. “Overall, we remain firmly convinced that an extraordinary amount of monetary policy support, including through our forward guidance, is still necessary for the present level of underutilised resources to be re-absorbed and for inflation to return to and durably stabilise around levels close to 2% within a meaningful medium-term horizon,” he said.

Draghi’s recommendation will certainly resonate if economists are right that today's inflation trend is due to backtrack in May.

US: Pending Home Sales Index (1400 GMT) The housing sector is off to a mixed start in the second quarter. Today’s April update of the Pending Home Sales Index (PHSI) will help clarify if the stumble is a sign of things to come.

Residential housing construction and existing home sales both fell in April vs. the previous month – the first simultaneous monthly slide for both metrics in 18 months. But the economy is still growing and so last month’s red ink is probably noise. The case for thinking so will strengthen if PHSI logs an increase today.

Analysts think that’s likely. Econoday.com’s consensus forecast calls for a 0.5% rise in PHSI, pushing the index close to its highest level since the recession ended. A firmer reading in PHSI, considered a leading indicator for existing sales, will boost confidence that the setback in the hard data last month was a one-off event.

Builders are certainly upbeat. The Housing Market Index, a measure of sentiment in the home building industry, ticked up to 70 in May, the second-highest reading since the economy started rebounding in 2009. “This report shows that builders’ optimism in the housing market is solidifying, even as they deal with higher building material costs and shortages of lots and labour,” said the chairman of the National Association of Home Builders earlier this month.

That’s a clue for thinking that PHSI will continue to project healthy demand for housing in the near-term future.

Expectations for a solid rebound in second-quarter GDP growth suggest as much too. CNBC’s latest Rapid Update survey of Wall Street economists points to a 3.2% increase in output in Q2, sharply above Q1’s sluggish 1.2% advance. Yesterday’s update on consumer spending for April strengthens the forecast – personal consumption expenditures rose 0.4% last month, the biggest monthly jump so far this year.

Disclosure: Originally published at Saxo Bank TradingFloor.com