The lithium mining and battery industry has enjoyed increasing attention from investors and the financial media in recent years. There is good reason for this, as the industry has experienced rapid growth over the past decade due to the explosive growth of the electronics industry. Lithium is a key mineral used in the production of electronic devices like smartphones, while it also has a broader range of industrial purposes.

Future growth of the lithium industry is likely, due to the rising demand for electric vehicles. But while there is an abundance of lithium stocks to choose from, investors should focus on those with the most attractive growth prospects and strongest business models.

Albemarle Corp (NYSE:ALB)

Albemarle is a top lithium stock because it has a highly profitable business, and rewards shareholders with a dividend. It is a lithium mining company, with the core of its operations in Chile and Australia. The company had revenue of $3.1 billion last year. Lithium is its largest production segment, constituting nearly half of annual sales. The company posted 13% earnings growth in the most quarter, boosted by higher lithium prices.

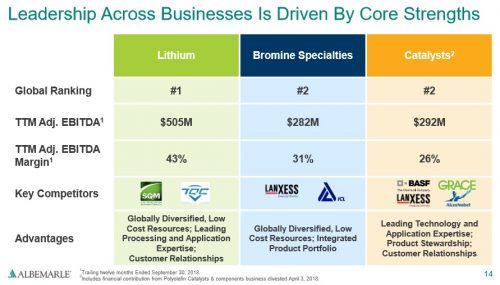

Albemarle’s competitive advantage is its global footprint and leading presence in the industry. It has either the #1 or #2 position across its three main areas of production.

Source: Investor Presentation, page 14

This gives it the opportunity to capitalize on growth projects. The company has positive growth potential moving forward due to production growth from new agreements, such as the recent announcement of a pending joint venture. Albemarle and its joint venture partner will own and operate a new hard-rock lithium mine in Australia with an estimated production life span exceeding 30 years.

From an industry perspective, Albemarle will continue to generate steady growth from consumer electronics and industrial usage of lithium. The major growth driver over the next several years will come from the transportation industry, due to the massive expected growth of electric vehicles. Albemarle expects lithium demand growth of 35% for the transportation industry from 2017 to 2025.

With such promising growth potential going forward, Albemarle stock is reasonably valued, with a P/E ratio of 18 using the midpoint of management’s earnings per share guidance for 2018. The stock valuation is below that of the S&P 500 Index, which means Albemarle shares could be undervalued, especially since the company is growing earnings at a double-digit rate.

The stock is also attractive for income investors, because Albemarle pays a dividend to shareholders. The current annual payout of $1.34 per share represents a current yield of 1.4%, and the company regularly increases its dividend, including a 5% raise in 2018. The company has a long history of steady dividend growth. Albemarle has increased its annual dividends paid to shareholders for 24 years in a row, since the company went public in 1994. Albemarle has a dividend payout ratio slightly above 20%, which leaves ample room for continued dividend hikes each year.

Sociedad Quimica y Minera SA (NYSE:SQM)

Sociedad Quimica Y Minera de Chile, or SQM for short, is a diversified materials company based in Chile. In addition to its core lithium operations, the company also manufactures fertilizers and specialty chemicals. The company generated revenue of $2.3 billion in the last year, along with $911 million in adjusted EBITDA. SQM operates the following segments:

- Potassium (13% of revenue)

- Specialty Plant Nutrients (36% of revenue)

- Iodine & Derivatives (14% of revenue)

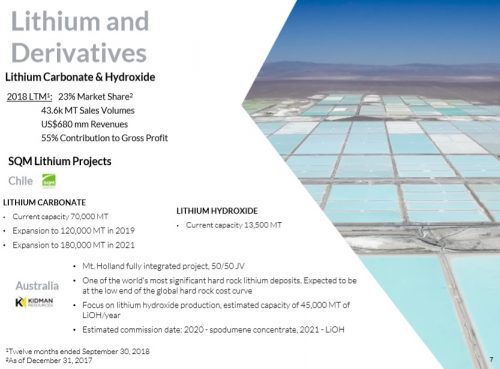

- Lithium & Derivatives (29% of revenue)

- Industrial Chemicals (6% of revenue)

The Lithium segment is not the company’s largest by revenue, but it is by far the most important contributor to the bottom line. Lithium operations represent more than half of SQM’s annual gross profit.

Source: Investor Presentation, page 7

SQM has performed well over the course of 2018. Revenue of $543 million declined 2.8% in the most recent quarter, but have increased 7.5% through the first three quarters combined. Production interruptions dampened third-quarter revenue, but the company expects output to get back on track in 2019 and beyond. Meanwhile, earnings per share increased 4.1% through the first three quarters of the year. Lithium will continue to be a key growth catalyst for SQM. The company expects total lithium demand growth will surpass 25% this year.

In addition, SQM is in strong financial condition. It has a net-debt-to-EBITDA ratio of 0.5x, and a high credit rating of BBB+ from Standard & Poor’s. A healthy balance sheet helps the company keep a low cost of capital, leaving more money to invest in growth and return cash to shareholders.

In the past year, the company distributed total dividends of $1.79 per share, equivalent to a yield of 3.9%, or 2.5% after accounting for dividend withholding taxes. This is an attractive yield that exceeds the average dividend yield of the S&P 500 Index.

Panasonic Corp PK (OTC:PCRFY)

Panasonic is a more indirect play on lithium. As opposed to lithium mining companies such as Albemarle and SQM, Panasonic has a broader business model. The company generated sales of $75 billion last year, with a diverse product portfolio including electronics, appliances, and automotive and industrial systems. Still, Panasonic does have a significant lithium business, as it supplies batteries for electronic vehicle manufacturer Tesla (NASDAQ:TSLA).

Panasonic reported earnings-per-share of $0.97 and paid out $0.27 in per-share dividends over the last 12 months. That equates to a trailing price to earnings ratio of 10.7, with a 2.2% after-tax dividend yield (Japan has a dividend withholding tax rate of 15% for U.S. investors). Panasonic has a trailing dividend payout ratio less than 30%, which leaves room for future dividend increases. The stock is attractive on the basis of valuation and dividends. It also has a strong balance sheet, with a long-term credit rating of A- from Standard & Poor’s.

In the most recent quarter, Panasonic reported 6.9% sales growth, or 1% after excluding the impact of foreign exchange. The company was negatively impacted by rising costs of raw materials, which has dragged down profitability. However, conditions are expected to measurably improve in 2019. Panasonic expects to return to growth next year, with a forecast of 4.1% sales growth and 5.9% profit growth in fiscal 2019.

Panasonic has a diversified business portfolio, extending beyond the lithium battery market. It also has a heavy presence in electronics, appliances, and home building products. While this gives investors the benefit of diversification and some protection if and when one particular segment enters a downturn, Panasonic is not as highly exposed to the explosive growth of a pure-play lithium mining company. Still, Panasonic is a highly profitable company with an attractive valuation and dividend, as well as a significant position in the lithium industry.

Final Thoughts

The lithium industry has a positive growth outlook moving forward. According to Bloomberg, electric vehicle sales are anticipated to rise to 11 million by 2025 and 30 million by 2030, compared with just over 1 million in 2017. The transition from the internal combustion engine to electric battery is expected to result in significantly higher demand for lithium going forward, particularly from emerging markets like China.

As a result, investors could find buying opportunities among lithium stocks. Albemarle, SQM, and Panasonic are all engaged in the lithium industry, and each company has a highly profitable business model with attractive growth potential and dividends.