The value of any investment is the sum of its future cash flows discounted to present value.

The key criteria in valuing an investment are:

- Price-to-cash-flows (is it a good value?)

- Growth of cash flows (is it growing?)

- Appropriate discount rate (is it risky?)

- Total number of future cash flows (will it last?)

Value investing is a rich and robust investment style that focuses on the first criteria for estimating the worth of an investment.

Value investing looks it price-to-earnings, price-to-book value, dividend yield, price-to-free-cash-flow, enterprise value to EBITDA, and a number of other ratios. The goal is to find businesses trading at a discount to either their assets or cash flows. Basically, buying cash flows for cheap.

Growth investors look for businesses with rapidly rising revenue or earnings numbers. Social media and biotech companies are viewed as the best bets to deliver rapid growth in today’s environment. Growth investors look at the second criteria for valuing an investment.

The first two criteria for an investment are very well covered. This makes sense, because they are very important. They are also much easier to measure and quantify than the last 2 criteria.

It is easy to say that a stock has a price-to-earnings multiple of 10, or that it is growing at 15% a year. It is more difficult to determine – with any sort of precision – how far into the future the company will thrive, and how risky a business is.

This article looks at 3 dividend growth stocks that stand out for their low risk and expected longevity. These 3 stocks operate in slow changing industries. They have long histories of growth and will likely be around for a very long time.

#1 – Coca-Cola

Coca-Cola Company (NYSE:KO) is has paid increasing dividends for 52 consecutive years, making the company a Dividend King.

When investors think of Coca-Cola, they think of the companies iconic Coca-Cola soda. Coca-Cola is not a soda company. It is a global non-alcoholic beverage business. The distinction is critical and is the reason Coca-Cola will be much larger 20 years from now than it is today.

Coca-Cola owns 20 ‘billion dollar brands’ – brands that generate $1 billion or more a year in sales. Of these 20 brands, 14 are non-carbonated. Coca-Cola has significantly more large non-carbonated brands than carbonated brands.

The investment thesis for Coca-Cola is simple. The company will continue to create and acquire beverage brands and sell them on a global scale. As the dual trends of converging global tastes from globalization and rising consumer incomes continue, Coca-Cola will continue to grow.

Coca-Cola is currently a Top 10 stock using The 8 Rules of Dividend Investing thanks to its exceptionally low risk and reasonable valuation. Coca-Cola has a long-term stock price standard deviation of just 18.6%. The company is trading for an adjusted price-to-earnings ratio of 20.2, about in line with the S&P 500.

Coca-Cola is expected to grow earnings-per-share at 7% to 9% going forward. The company has maintained a similar growth rate for decades, and will likely continue to do so. Coca-Cola’s growth rate combined with its current dividend yield of 3.2% gives investors expected total returns of 10% to 12% a year – with very low risk of business obsolescence.

#2 – Wal-Mart (NYSE:WMT)

Wal-Mart is the leader in discount retail. The company has generated over $485 billion in sales in the last 12 months. That is more sales than Costco (NASDAQ:COST), Target Corporation (NYSE:TGT), Amazon (NASDAQ:AMZN), Whole Foods Market Inc (NASDAQ:WFM), and Kroger (NYSE:KR) combined.

Wal-Mart was founded in 1962 by Sam Walton. Wal-Mart’s success over the last 50+ year has been nothing short of remarkable. If Sam Walton were still alive today, he would be the richest man in the world thanks to Wal-Mart. Wal-Mart is a Dividend Aristocrat thanks to its 42 consecutive years of dividend increases.

Wal-Mart has managed to grow consistently over the last 5 decades thanks to its strong competitive advantage. Wal-Mart is the biggest retailer in the world. It commands the best prices from its suppliers. The company pressures suppliers to lower their prices and then passes savings on to consumers, which results in a positive feedback loop.

Wal-Mart is a discount retailer. As long as consumers want low-priced merchandise, the company will generate strong sales. The company can evolve with changing consumer preferences by stocking its stores with whatever is most appealing at the time. The company’s size and scale allows it to both buy and sell consumer goods at a discount.

Wal-Mart’s easy-to-understand business model in a slow changing industry makes it very likely the company will be larger in 20 years than it is today.

Now is an excellent time to buy into the king of discount retail. Wal-Mart is currently trading for a price-to-earnings ratio of 14.6. The company appears extremely cheap given its industry leading size and strong expected future cash flows.

In addition to its low valuation, Wal-Mart also offers investors a 2.7% dividend yield. The company’s stock is a low-risk investment that offers current income and solid total return potential. This combination should be irresistible to long-term dividend growth investors.

#3 – Church & Dwight Company Inc (NYSE:CHD)

Church & Dwight (CHD) was founded in 1846. The company now has a market cap of 11.2 billion. The company has paid steady or increasing dividends for 25 consecutive years.

Around 60% of Church & Dwight’s profits are generated from just 4 key brands. These brands are listed below:

- Arm & Hammer baking soda and products

- OxiClean cleaning products

- Trojan condoms

- VitaFusion/Lil’ Critters vitamins

The four brands listed above all have something in common: the industries in which they compete have changed very little over the last several decades – or over a century in the case of Arm & Hammer banking soda.

People 20 years from now will very likely still need baking soda, cleaning products, laundry detergent, condoms, and vitamins.

Church & Dwight’s strong brands are supported by large marketing spending. Church & Dwight spends around $400 million a year on advertising. Church & Dwight currently generates the bulk of its revenue in the United States. Over 75% of sales come from the United States. As a result, the company can focus its advertising budget in one country, whereas larger consumer products businesses spread their advertising budget over a much larger geographic audience.

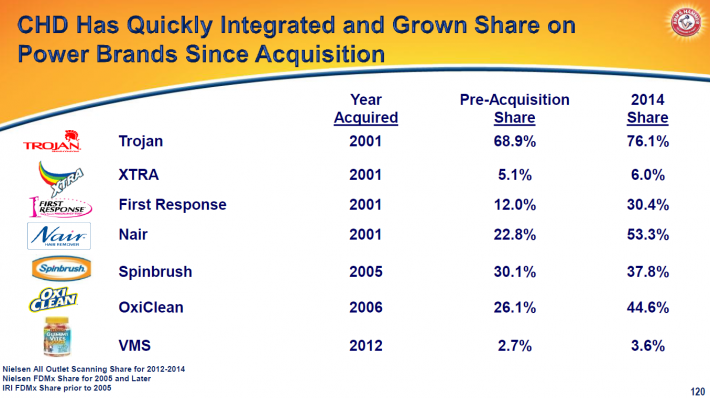

Church & Dwight has grown rapidly since 2000. The company acquired Trojan in 2001, OxiClean in 2006, and VitaFusion/Lil’ Critters in 2012. These acquisitions have fueled growth for Church & Dwight. The image below shows how Church & Dwight has combined its advertising spending with new acquisitions to increase market share:

Over the last decade, Church & Dwight has grown earnings-per-share at 14.1% a year. The company is expected to grow earnings-per-share at between 8% and 10% a year going forward.

Growth will come from a mix of organic revenue increases and new acquisitions. Share repurchases and margin improvements will also help Church & Dwight to reach its 8% to 10% a year growth targets. In addition, the company’s stock has a 1.6% dividend yield. Church & Dwight’s dividend yield plus its expected growth give investors a target total return of between 9.6% and 11.6% a year going forward.

There is no doubt that Church & Dwight is a high quality business with a long growth runway ahead. There is just one problem with the stock – its success over the last decade has driven up the share price. Church & Dwight currently trades for a price-to-earnings ratio of 27.8. Now is not the best time to buy into this high quality company.