MedTech continues to face challenges since the Republicans have taken over the House and Senate. Things started getting dramatic since President Trump forged ahead with his efforts to completely repeal Obamacare. After quite a few rounds of failing attempts, the Trump government resorted to the “skinny repeal” of the Obamacare Act.

The Consequences of the Skinny Repeal

The Trump administration had been targeting the “individual mandate,” “employer mandate” and “Cadillac taxes” under the skinny repeal.

However, last month witnessed increased political conundrum as the Republicans lost the debate over skinny repeal of the Obamacare Act, largely because of the three Republican who voted in favor of the existing Healthcare Act.

Their view may partially be based on the latest cost estimate by the Congressional Budget Office (CBO) and the staff of the Joint Committee on Taxation’s (JCT). As per the report, with the rollback of the Affordable Care Act (ACA) or Obamacare the number of uninsured people will increase by 17 million in 2018. This will further intensify to 27 million more uninsured in 2020 and will increase to 32 million in 2026.

As per the voters who were against the skinny repeal, revoking of the individual and employer mandate could have indirectly affected the customer base within the healthcare as it would have resulted in expensive health insurance and contracted health insurance coverage.

However, the industry is looking forward to the abolishment of the Cadillac tax (40% excise tax on high-cost healthcare plans). Though the Trump administration has been targeting a complete annulment of the tax, it has been able to delay the Cadillac tax until 2026.

Is There a Silver Lining for MedTech?

While the healthcare fraternity has been in a confusing state with the developments at the Capitol Hills over the past one-and-a-half years, the MedTech industry has always been content with the new government on probabilities of full abolition of major healthcare taxes, including Cadillac tax and the 2.3% MedTech tax.

The latest delay in the Cadillac tax has to some extent come as a sigh of relief for MedTech players as it raises the possibilities that they will gradually be exempt from the 2.3% medical device tax too.

Why Choose a Value Stock?

While markets have been oscillating between hope and despair, we believe an inherently defensive investment strategy would be apt for the moment. The goal is to focus on stocks that are trading at tantalizing discounts and have a market value lower than the intrinsic value.

Such stocks may not make it to the list of prominent names. However, at a point when the economy is set to make a rebound, it is more meaningful to invest in stocks which are currently trading cheap.

Stocks in Focus

Let’s take a look at three companies which are great value bargains and poised for stellar gains.

Zacks has designed the Style Score System to compare each parameter of a stock with the peer group for an analysis of whether the stock is attractive from the value perspective. Notably, we have zeroed in on five stocks that sport a Zacks Rank #1 (Strong Buy) or 2 (Buy) with VGM Score of A or B.

The VGM Score (V stands for Value, G for Growth and M for Momentum) essentially highlights critical factors in a stock that have the potential to drive its price in the near term. Also, we have considered stocks with a Value Style Score of A to fine tune the screening process.

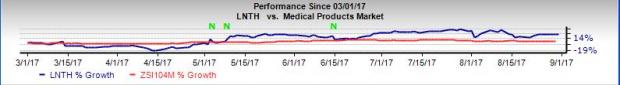

Lantheus Holdings, Inc. (NASDAQ:LNTH) : Headquartered in North Billerica, MA, the company operates as a developer and manufacturer of diagnostic medical imaging agents and also commercializes these products for the diagnosis and treatment of cardiovascular and other diseases worldwide. Lantheus Holdingscarries a Zacks Rank #1, VGM Score of ‘A’ and Value Style Score of ‘A.'

Coming to price performance, over the last six months Lantheus Holdings represented a stellar return of 26.5%, much higher than the broader industry’s increase of roughly 5%.

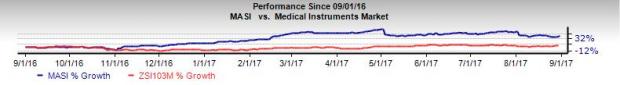

Masimo Corporation (NASDAQ:MASI) : Headquartered in Irvine, CA,Masimo designs, manufactures and sells noninvasive monitoring technologies globally. The stock carries a Zacks Rank #2 and Value Style Score of B. The company has a VGM Score of A.

Over the last year, the company represents a stellar return of 40.1%, much better than the broader industry’s gain of roughly 5.3%.

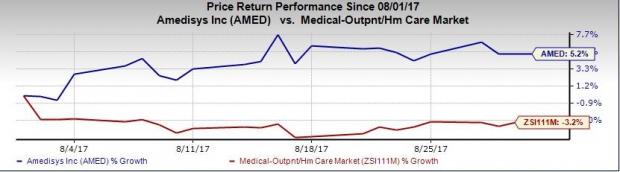

Amedisys, Inc. (NASDAQ:AMED) : Headquartered in Baton Rouge, LA, Amedisys operating through three segments: Home Health, Hospice and Personal Care, provides healthcare services in the United States. The stock carries a Zacks Rank #2, Value Style Score of B and VGM Score of B.

Over the last month, Amedisys represented a return of 5.1%, outshining the broader industry’s 3.5% fall.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Masimo Corporation (MASI): Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH): Free Stock Analysis Report

Amedisys Inc (AMED): Free Stock Analysis Report

Original post

Zacks Investment Research