One of the key themes that I presented at the start of 2014 was the notion that capital would begin shifting abroad. Attractive valuations compared to U.S. equities, ongoing stimulative measures in Europe as well as “carry trade” funding of higher-yielding assets contributed to several high conviction purchases.

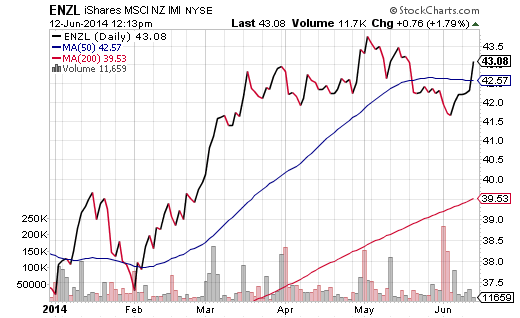

Chief among them? iShares MSCI N.Z. Investable Mar. (NYSE:ENZL). While smaller nations often get overlooked when it comes to investor asset allocation, I argued that New Zealand presented a unique opportunity to participate in one of the fastest growing economies in the developed world. In addition, ENZL did not depend largely on global demand of basic materials the way that iShares MSCI Australia (NYSE:EWA) did. In fact, ENZL still represents respectable diversification across a wide range of economic segments, including health care, consumer goods and industrials.

Fortunately, the thesis extended beyond impressive economic fundamentals and desirable diversification. Currency traders worldwide sell low-yielding currencies to raise capital for acquisitions of higher-yielding currencies and higher-appreciating assets. At the beginning of the year, I anticipated that Abenomics in Japan would further erode the yen such that institutional traders would sell (or short) Japan’s currency to acquire the New Zealand dollar and/or buy New Zealand equities.

In truth, that may or may not have happened. While the yen dropped precipitously in 2013, it has actually snapped back a bit in 2014. The Japanese yen still remains low enough for borrowers to keep acquiring higher-yielding currencies and/or funds like ENZL. However, if the yen manages to move significantly higher and the Bank of Japan cannot “walk it back,” institutional traders may be forced to dump New Zealand stocks in a flash to avoid paying bank loans on an appreciating yen.

That said, the fortunes of ENZL are not tied solely to the fate of Japan’s currency. As it turns out, New Zealand recently hiked rates for the third consecutive time in 2014 on bullish expectations for its economy. Its official cash rate is now 3.25%. In contrast, the European Central Bank (ECB) recently slashed its overnight lending rate and decided to charge other banks money (i.e. negative deposit rate) for storing cash in ECB vaults. Consequently, the euro hit a 13-month low against the “kiwi” (New Zealand dollar).

What does this mean? It implies that institutions will now borrow the euro to fund purchases of the kiwi for that 3.25% yield. Even better, investors may borrow the euro to purchase New Zealand equities. For ETF enthusiasts, funds like ENZL offer the added attraction of a 3.5% annual dividend. Many of my clients continue to own this ETF, benefiting from year-to-date gains of 15%.

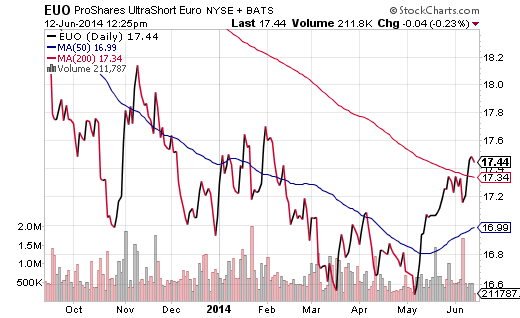

There are several other ways that investors can seek profits from persistent euro-dollar weakness. For example, although the ECB did not cut its lending rate to a negligible percentage until June 5, the move had been widely telegraphed. That is why I suggested that aggressive traders consider ProShares UltraShort Euro (NYSE:EUO) in my April 22 commentary. The leveraged ETF traded at 16.88 at the time; Thursday, it traded at 17.44.

A 3.3% move may not sound like a whole heck of a lot. Then again, seven weeks is hardly an eternity. This is not an investment to hold for an extended period, though I am confident that the euro will continue to weaken against the greenback. A trader might look for an attractive entry point to take advantage of the probability that the ECB will take additional steps to depreciate the euro on the world stage.

Finally, I anticipate that the ECB will ultimately embrace “QE.” The Bank of England, the Bank of Japan and the Federal Reserve all created money electronically to acquire bonds and to stimulate their respective economies. The effectiveness in stimulating respective economies via quantitative easing programs is still being debated. On the other hand, reflation of asset prices and the simultaneous depreciation of country currency certainly occurred. If a “do-what-it-takes” mentality truly exists across the countries of the Euro-zone, leaders will likely agree on a QE-type program.

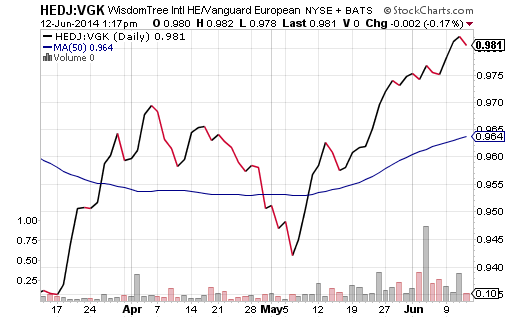

It follows that investors are likely to embrace central bank intervention as they have in other parts of the world. European stocks will benefit from the perception of QE benefits, actual capital shifting into the region as well as better valuations relative to U.S. equities. Yet, is there a way to offset the weakening euro? For those who believe that they might augment their returns by mitigating persistent euro weakness, WisdomTree Intl Hedged Equity Fund (NYSE:HEDJ) allows you to invest in strong European brands while simultaneously capitalizing on the relative strength of the U.S. dollar. The benefits can already be seen in the HEDJ:VGK price ratio.