There’s not much question that the U.S. stock market is — in a traditional sense — overvalued. The S&P 500 currently flashes a price-to-earnings (P/E) ratio that is 20% higher than its historical average over a trailing 12-month period. Similarly, its price-to-sales (P/S) ratio of 1.6 is, conservatively speaking, 25% greater than a more typical ratio of 1.2.

The dwindling number of bearish prognosticators suggests that the easy money has already been made, and that billionaires are already dumping shares. For example, Warren Buffett’s holding company, Berkshire Hathaway (BRK.A) , decreased its exposure to consumer companies by 21%. John Paulson’s hedge fund, Paulson and Company, significantly reduced its stake in J.P. Morgan Chase (JPM), while exiting its position in Family Dollar Stores Inc, (FDO) altogether. George Soros? He bid farewell to many of the big financial companies like Goldman Sachs Group Inc, (GS) and Citigroup Inc, (C). (Note: Due in large part to the hangover from 2008-09, the financial sector still remains cheaper than a number of other sectors that make up the S&P 500.)

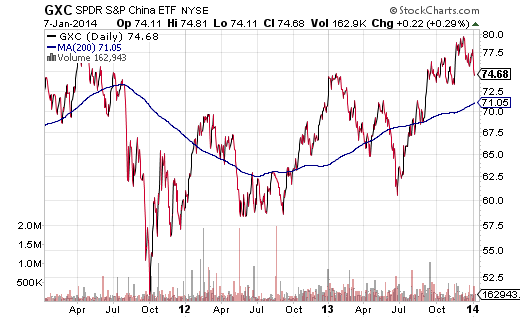

Perhaps ironically, many foreign and emerging market stock ETFs remain relatively cheap. Whereas the S&P 500’s P/E jockeys around 18.6, the SPDR S&P China ETF (GXC) has a P/E near 9.9 and the iShares Emerging Markets Fund (EEM) has a multiple near 11.2. The discrepancies in valuations are what develop after one country’s equity market dominates for three years. At this point, however, one might anticipate that the valuation differences will eventually lead to some capital flowing out of U.S. equity ETFs and into foreign stock ETFs.

When will it begin? It may be fair to assume that some of that activity will occur in 2014, particularly if foreign central banks find the need to further stimulate their respective economies. The U.S. Federal Reserve, while still stimulating in a massive capacity, is still planning to wind down its unconventional program of creating dollars electronically and acquiring U.S. debt to suppress borrowing costs. In other words, a perception that foreign countries are still loosening monetary policy while the U.S. may be tightening and/or maintaining its monetary stance could lead to a changing of the guard.

Here are 3 ETFs that may be direct beneficiaries of capital shifting abroad:

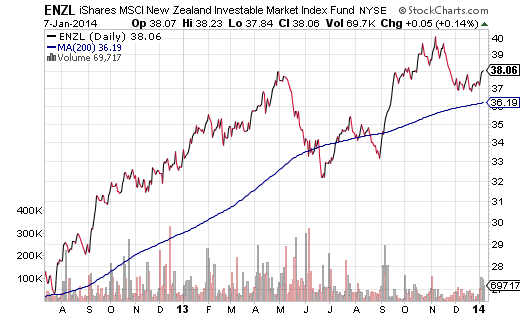

1. iShares MSCI New Zealand (ENZL). Developed Asia-Pacific funds often focus on Japan and Australia, excluding significant contributions from smaller nations like New Zealand. Yet HSBC Bank forecasts annualized economic growth of 3.4% in 2014 for the “Kiwi” crowd. Not only is that the fastest pace in seven years for the island nation, but the solid gross domestic product (GDP) means that New Zealand will not need to engage in any controversial forms of monetary gamesmanship. It is true that the country’s well-being is often tied to the fortunes of Australia. That said, iShares Australia (EWA) is known for rising and falling alongside demand for global materials. In contrast, ENZL is diversified across a wider range of sectors, including health care, consumer discretionary and industrials.

Solid economic fundamentals are only one piece of the puzzle. ENZL is also a probable beneficiary of the “yen carry trade.” Currency traders worldwide sell yen to buy higher-yielding currencies like the New Zealand dollar and/or the Australian dollar. ENZL should benefit from this practice. ENZL also offers an enviable 4% annualized yield that is desirable in a rate environment that should be more stable in 2014. Keep in mind, since the May-June tapering swoon that crushed bonds and yield-oriented investments last year, ENZL has stayed above its 52-week lows.

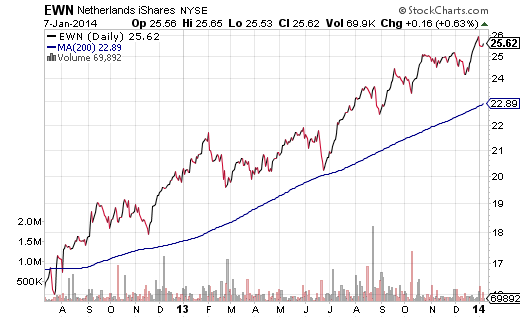

2. iShares MSCI Netherlands (EWN). It is true that Standard & Poor’s recently downgraded Dutch debt. And losing one’s triple AAA rating should be a big deal, at least theoretically. On the other hand, Fitch and Moody’s reaffirmed the heralded triple AAA ratings, and the Dutch bond market has not skipped a beat. Even better, a rising number of folks believe that the Netherlands may have turned the proverbial corner by placing recessionary forces in the rear-view mirror.

Economic concerns notwithstanding, EWN largely focuses on non-cyclical stalwarts like Unilever and Heineken with a 27% weighting to the consumer staples sector. Furthermore, EWN remains in a strong price uptrend with limited volatility over the previous 18 months.

3. SPDR S&P China (GXC). This particular basket of Chinese equities could qualify as a must-own from both a technical and fundamental basis. The Chinese economy grows at a clip that is the envy of the industrialized world and it does so without an unconventional quantitative easing (QE) package. Corporations in GXC are trading at a collective P/E below 10. In fact, the current price of GXC is below the highs reached in April of 2011, nearly three years ago. Have these companies grown their earnings since 4/2011? You bet! What’s more, GXC is above its long-term 200-day moving average. You may need to be patient with China, but its a country worthy of an allocation.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 ETFs That Will Benefit From The Capital Shift Overseas

Published 01/08/2014, 01:09 AM

Updated 03/09/2019, 08:30 AM

3 ETFs That Will Benefit From The Capital Shift Overseas

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.