Dividend growth stocks are companies with stable cash flow and the ability to increase their distributions annually. They are important for investors because they provide a stable return and leverage for portfolio growth. The ever-increasing per-share dividend distribution provides an increasing annual return that can be reinvested and compounded over time into market-beating performance.

The stocks on the list today are also growth stocks, growing if at a slower pace than riskier high-growth names, adding to the potential for total returns. Total returns are the combined amount of shareholder gains, including share price appreciation and dividends, which, in the case of Packaging (NYSE:PKG) Corporation of America, Cintas (NASDAQ:CTAS), and Casey's General Stores (NASDAQ:CASY), runs in the high-double-digits in 2024, triple digits over the last five years and quadruple for the last ten.

Additionally, dividend growth stocks can help reduce portfolio volatility and offset inflation. The stocks on this list have averaged a 12% distribution CAGR over the last five years; the lowest is 9% or more than triple the pace of inflation. Their buy-and-hold quality reduces portfolio volatility because their investors are less likely to sell stock, a factor seen in the beta statistic. Beta measures a stock’s volatility relative to the S&P 500, and these average 0.66x, ranging from a very low 0.4x for Casey’s General Store to a relatively high 0.9x for Cintas.

Packaging Corporation of America Reverted to Growth in 2024

Packaging Corporation of America experienced business normalization following the pandemic and supply chain log-jams, but you can barely see it in the price action. Up nearly 100% in the last eighteen months, this 2% yielding stock is growing in 2024, and the quarterly results show growth accelerating compared to last year. The outlook for next year, F2025, is for growth to slow to the high-single digits and be compounded by a wider margin. Adjusted EPS is forecasted to grow by nearly 25%, but the estimates may be too low.

Packaging Corporation of America has increased its dividend for 15 years and will likely continue for the next 15 years. The payout ratio is low at only 55% of the earnings, and the forecast for earnings growth is robust. The payout ratio falls to only 45% versus the F2025 outlook, and dividend health is compounded by balance sheet strength. The company utilizes corporate debt to boost cash flow, but leverage is low at 0.5x equity and 0.25x assets, leaving it in solid financial condition.

Analysts' sentiment shifted for the better for PKG stock in 2024. The analysts lowered targets in the year’s first half but switched to increases in the back half, lifting the consensus by nearly 50% compared to late 2023. The consensus lags the price action in December 2024, but the revision trend is positive and leads to the high-end range, sufficient for a fresh all-time high.

Cintas: High-Quality Operation Supported by Secular Tailwinds

Cintas is among the best-operated companies on the market, self-funding growth while maintaining a fortress balance sheet, paying dividends, and buying back shares. This company is a Dividend Aristocrat that can extend its 42-year streak well beyond the 50-year mark required to become a Dividend King.

Highlights in 2024 include growth sustained in the high single digits, well above the pace of GDP, and improving guidance as widening territory, deepening penetration, and labor market expansion compound to drive results. Share repurchases reduced the count by 1% in FQ1 2025/CQ3 2024, strengthening the dividend growth outlook. Few shares mean the company can increase the per-share payout annually without increasing the total amount paid out as dividends.

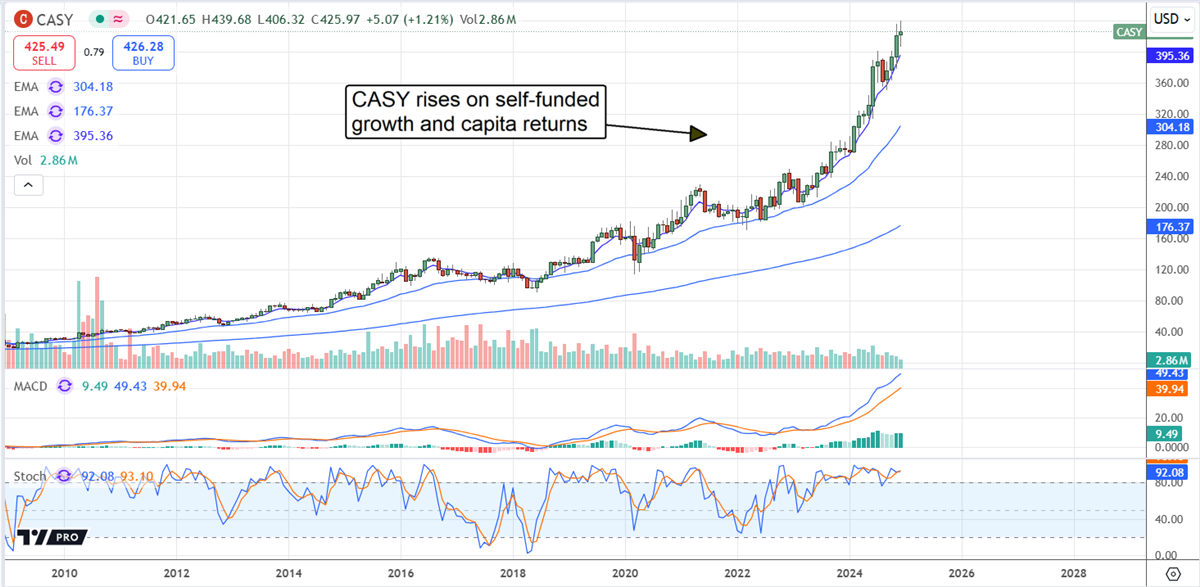

Casey’s General Stores: Sustaining Margins in the Face of Headwinds

Casey’s General Stores faces some headwinds in 2024 but can sustain its margin, drive robust cash flow, self-fund its growth, and return capital to shareholders. The highlights from 2024 include the acquisition of Fikes Wholesale, a Texas-based convenience store chain, and the infrastructure to support them. The move bolsters the company's regional presence, providing a foundation to expand its services in the southwest.

Casey’s suspended share repurchases in 2024 to bolster cash ahead of the deal. It will likely resume buybacks in 2025.

Regarding the dividend, Casey’s pays less than 15% of its earnings, so it is well-positioned to extend its 25-year history of distribution increases to 50.