This weekend, we will examine some of the long-term market cycles across various assets to help set the stage for the coming months as we begin to look toward 2025. All charts below come from cycles.org, which is from the Foundation for the Study of Cycles, of which I am a member.

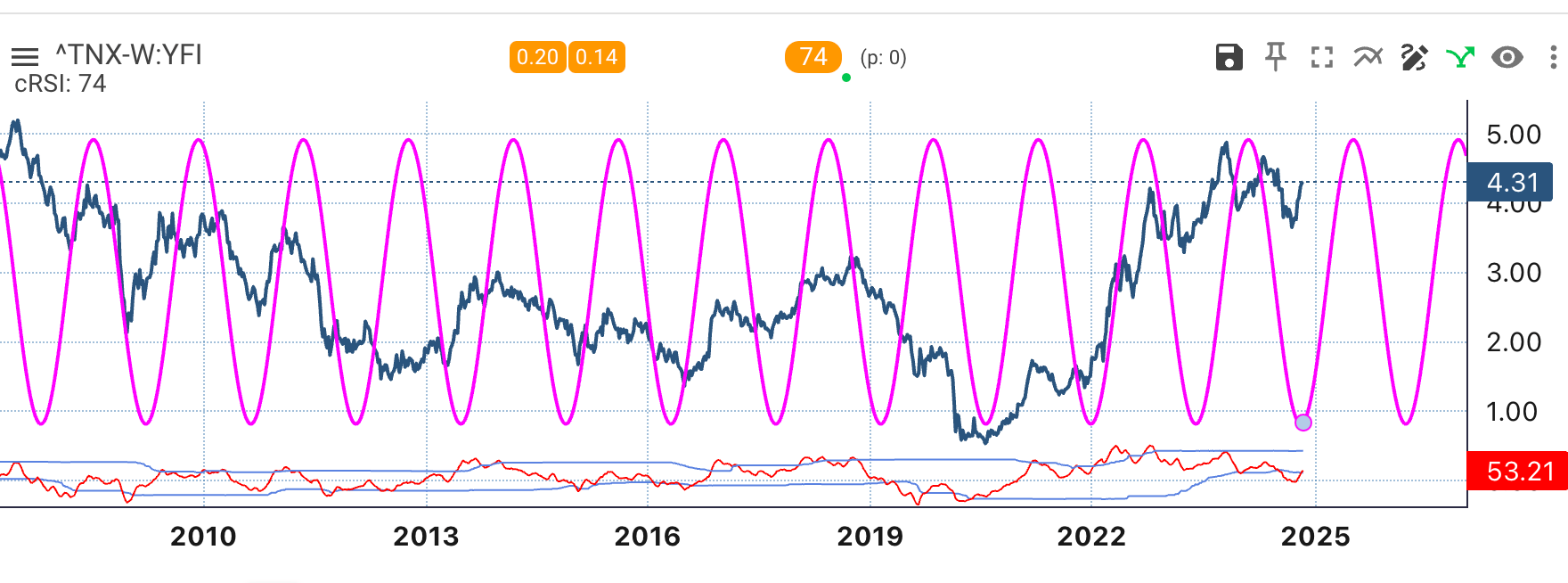

1. S&P 500

The strongest weekly cycle is the 180-week cycle for the S&P 500. It has marked some notable tops and bottoms in the past, particularly in 2000 and 2008 for both the tops and bottoms. More recently, it marked the 2022 top and was slightly late in marking the 2023 low.

The setup shows that the index is now just about peaking on the cycle, while the cyclic RSI indicates that the index has already reached overbought conditions. This suggests that we are nearing a point where the index either consolidates in a sideways pattern, similar to what was seen in 2015 and 2016 or in 2018 and much of 2019, or experiences a pullback similar to that of 2000, 2008, and 2022.

Given valuations today are much more akin to the 2000 and 2008 cycles, I would favor a sharper pullback, as stocks weren’t all that expensive in 2015, 2016, 2018, and 2019, by comparison.

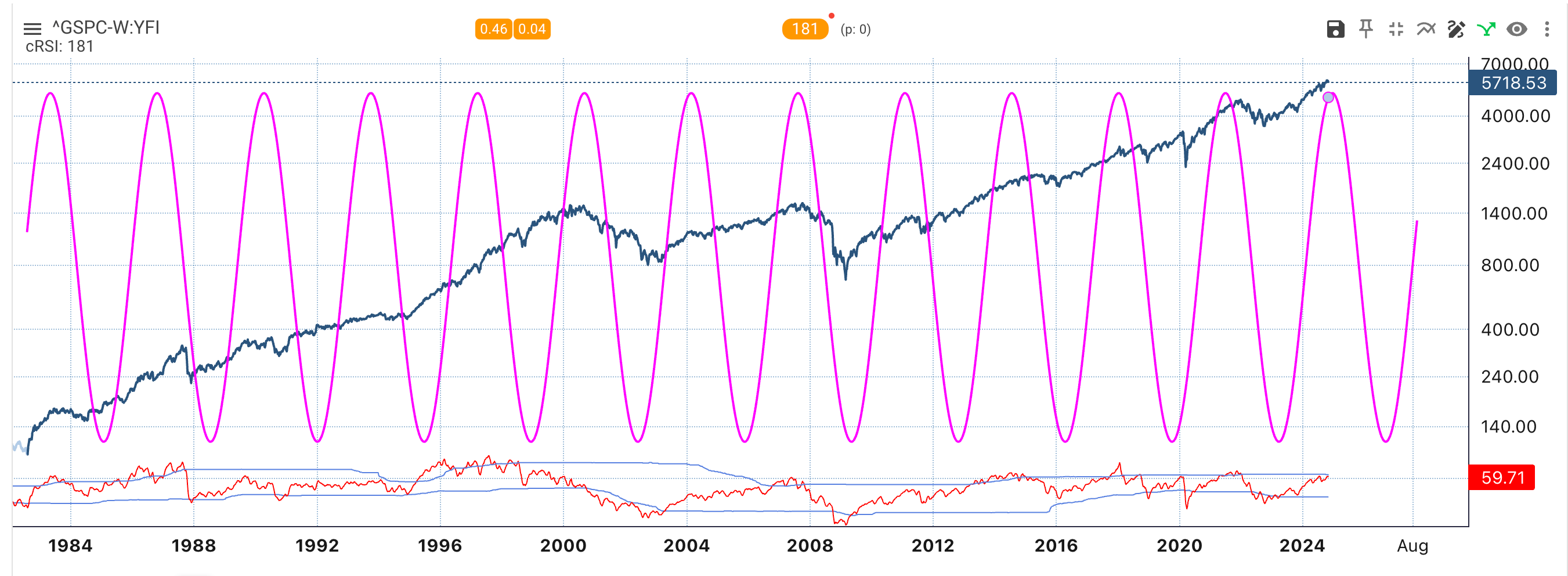

2. US Dollar

The dollar is also at a point where we will likely see it strengthen against the euro (EUR/USD). The euro has gone through a fairly long period of sideways consolidation, and now the 183-week cycle suggests that this consolidation is coming to an end, with the next leg of the dollar strengthening approaching.

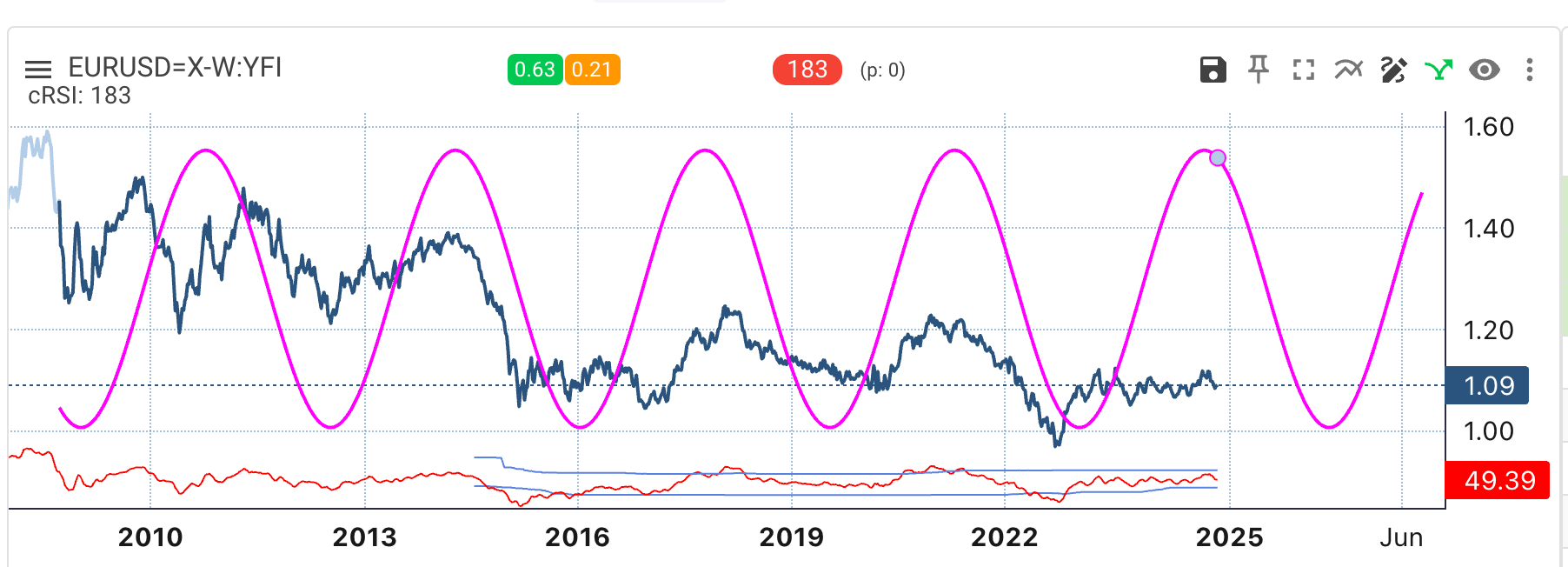

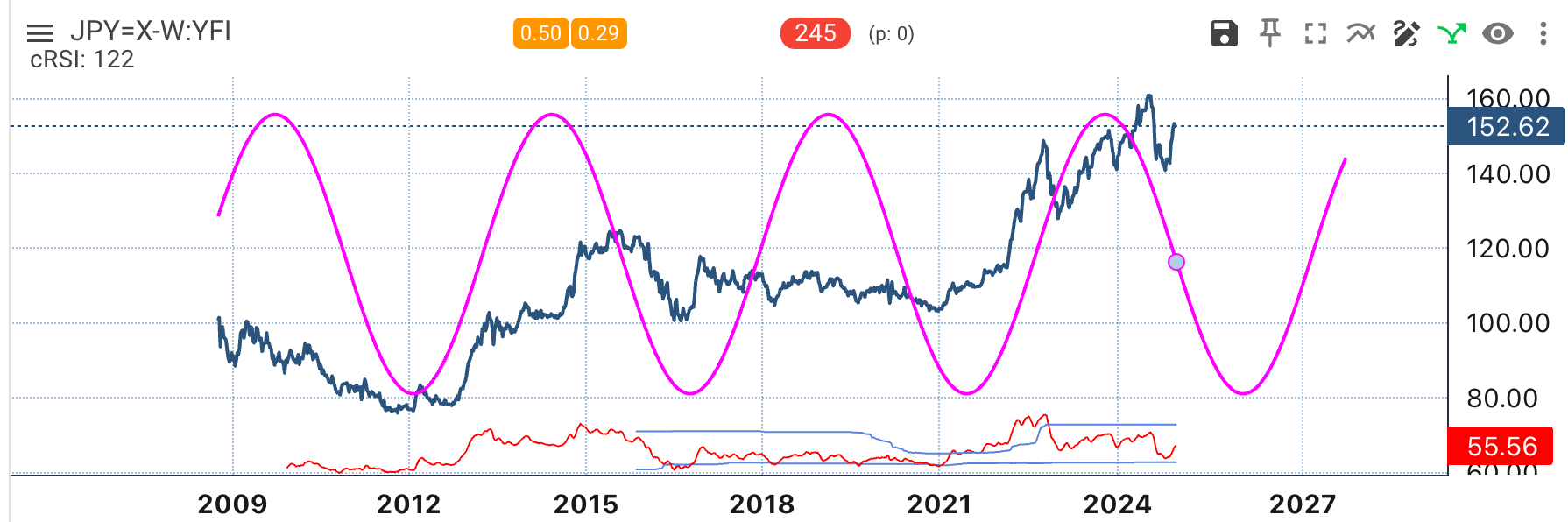

Interestingly, the second most dominant cycle in the yen (USD/JPY), the 49-week cycle, shows that the yen may weaken against the dollar through March.

However, the dominant cycle, the 245-week cycle, shows that the yen strengthens versus the dollar through the summer of 2025. Overall, this suggests that over the near term, we may see the yen strengthen versus the dollar through the summer. This could make sense if the BOJ starts to raise rates again starting in January or March.

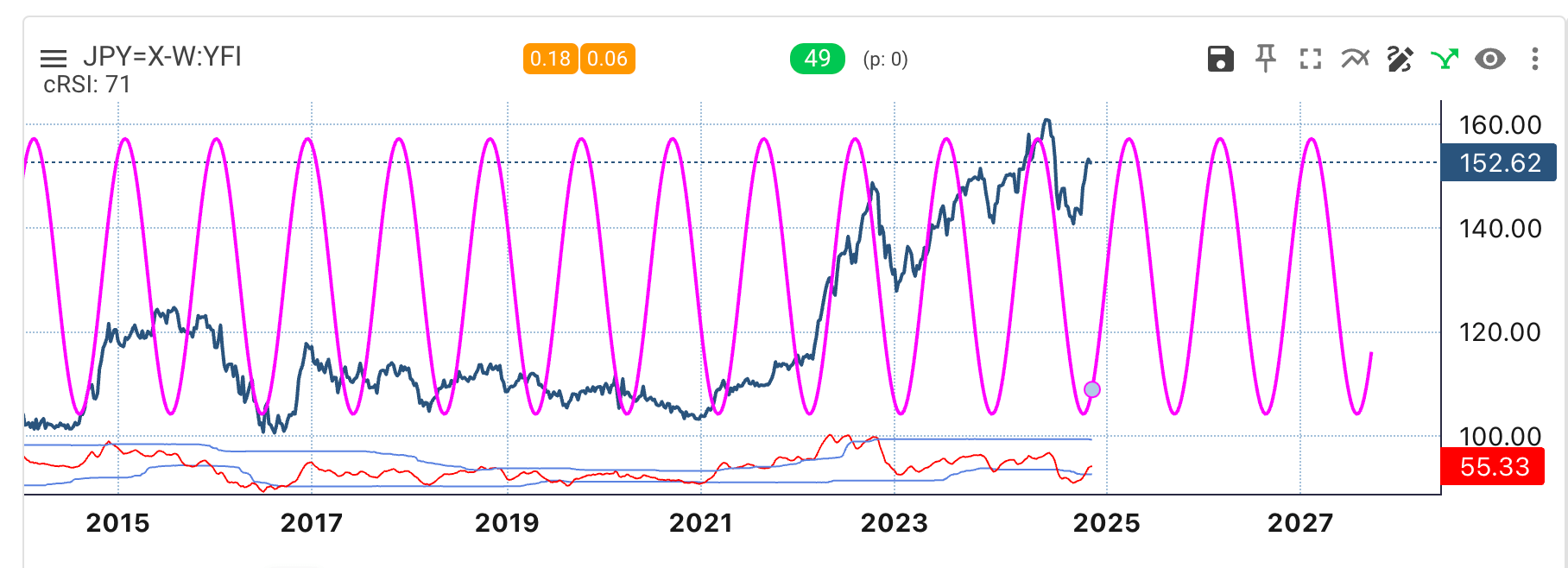

3. 10-Year Rate

For the 10-year Treasury, it appears that the weekly cycles are pointing to rates rising at least until the summer of 2025. Rates have likely bottomed, as indicated by the dominant 74-week cycle and the cyclic RSI, which shows that rates have hit oversold conditions.