The markets are in waiting mode as the Bank of Japan and Federal Reserve meet this week.

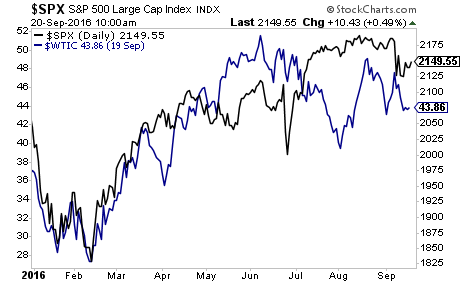

However, smarter markets than stocks are already adjusting to a weak global economy. Oil, which lead the S&P 500 to the upside from the February bottom is now rolling over sharply.

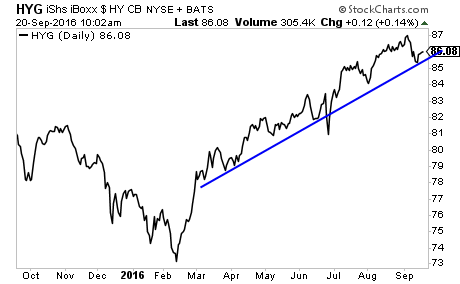

The iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG)market which is the fuse of the global bond bubble is on the verge of taking out its bull market trendline.

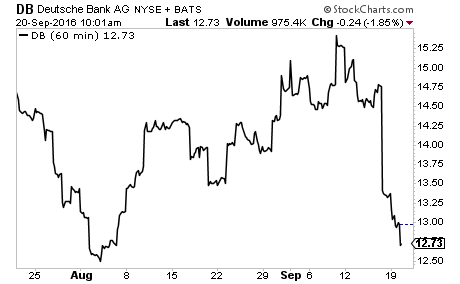

And then there’s Deutsche Bank (DE:DBKGn) (DB) the 11th largest bank in the world, which has collapsed over 20% in the last eight days. Something VERY bad is brewing in Europe.

We believe the global markets are on the verge of another Crisis.

2008 was Round 1. This next round, Round 2, will be even worse.