A contrarian indicator just flashed, and it’s telling us that now is the time to buy one of my favorite high-yield investments: closed-end funds (CEFs). Today we’re going to look at three yielding an outsized 11.6%.

Yield hunters that we are, we know the power of such a payout: with a $520,000 investment, we can kickstart a $60,000-a-year income stream. That’s a cool $5,000 averaged out on a monthly basis. And the three funds we’re going to cover in a moment give us the safety of diversification, going well beyond stocks to give us access to bonds, gold (a decent inflation hedge on its own) and real estate (ditto!).

First, though, let’s talk about why stocks are setting us up for a nice entry now.

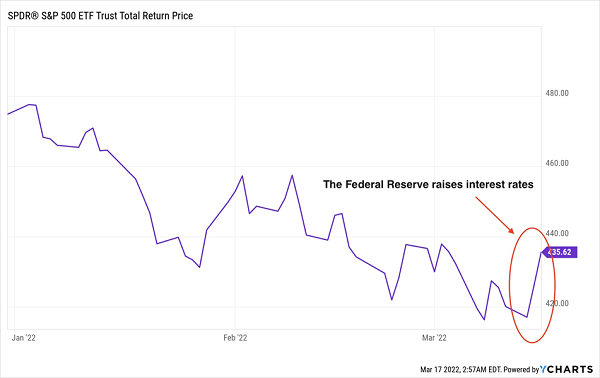

Higher Rates = Higher Stocks?

As you can see above, something funny happened when the Federal Reserve finally announced its first in an expected series of rate hikes last week: the S&P 500 bounced.

This isn’t how it was supposed to go. For a long time, pundits and the press have warned that rate hikes would cause stocks to plummet, and this fear did cause markets to see double-digit declines before the war in Ukraine started. It’s a sign that worries over higher rates and the war might be priced in.

Which brings me to closed-end funds (CEFs), an asset class known for its high yields (they yield an average of 7%+ across the board today). Thanks to those healthy payouts, CEFs are likely to remain attractive as rates rise because it’ll be a long time—if ever!—before Treasuries will be able to offer anything close to that.

This means that now, thanks to the selloff, we’re in a good position to buy high-yielding CEFs at attractive levels—and secure a massive income stream at the same time. Here are three examples yielding that outsized 11.6% I mentioned at the top.

Start With A Powerhouse US Equity Fund Yielding 10.5%…

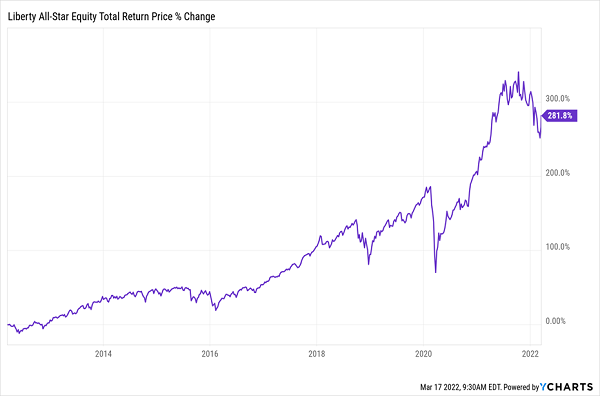

First up is the Liberty All Star Equity Closed Fund (NYSE:USA), an American large-cap stock fund yielding an impressive 10.5% and boasting a tremendous track record.

USA Soars—With Most Of Its Return In Dividend Cash

With an annualized total return of 14.4% over the last decade, USA has out-earned its massive dividend stream and given investors capital gains, thanks to a portfolio that’s changed with the times. Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOG), and health insurer UnitedHealth Group (NYSE:UNH)—all companies profiting from massive pandemic (and post-pandemic) shifts, such as rising e-commerce and increased healthcare spending—are top holdings.

If you’d invested $520K in this fund a decade ago, you’d now have $1.5 million, with most of your return in dividend cash, thanks to USA’s high payout.

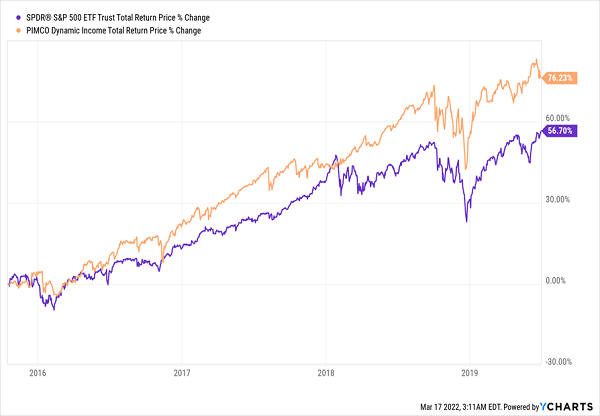

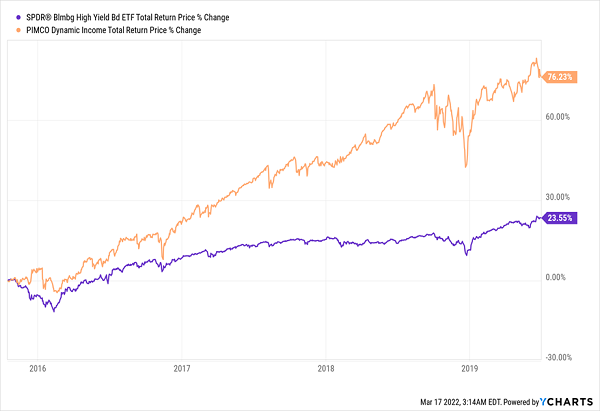

…Add A Bond Fund CEF Yielding 11.5% (With A History Of Rising With Rates)…

Now let’s diversify with the PIMCO Dynamic Income Fund (NYSE:PDI), which yields 11.5%, thanks to its portfolio of bonds and bond derivatives managed by PIMCO, one of the world’s leading bond-fund managers. As you can see below, the fund has a history of rising with rates.

PDI Loves Rising Rates

During the last rate-hiking cycle, from 2015 to mid-2019, PDI beat stocks by a massive margin. This is in large part because it took time for people to understand how the fund works.

Most bond funds’ assets decline as rates rise because higher rates make already-issued bonds less valuable. Good bond-fund managers won’t take this lying down, however. While that applies to most bonds, it doesn’t apply to all bonds, and there are ways of positioning the portfolio (by changing duration or using bond derivatives to hedge interest-rate exposure) to make it rise with rates. Hence the chart above.

Not all bond funds do this—and if you just buy a bond index fund in times of rising rates, you could miss out on major profits.

PDI Crushes The ETF Option

This is why PDI is particularly compelling with the period of higher rates we’re now entering. And we can say the same for our third fund.

…And Finish With A Highly Diversified 12.9%-Yielder

Finally, let’s zero in on the RiverNorth Opportunities Fund (NYSE:RIV), which invests in a variety of high-yield assets ranging from gold and silver to loans to mid-sized corporations and even some real estate.

This broad diversification makes RIV interesting on its own, but what makes it really stand out is its upside potential. You see, RIV yields a whopping 12.9%—one of the biggest yields in CEFs—and that big yield is like catnip to investors looking for income.

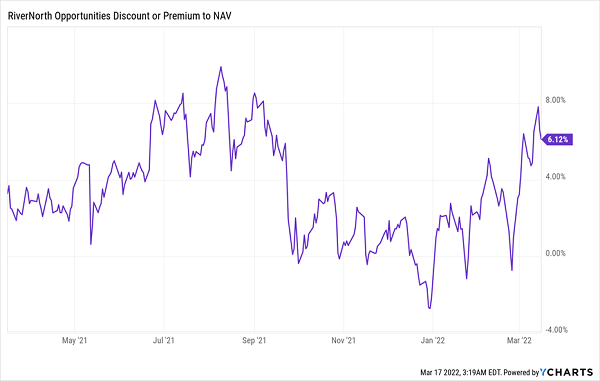

RIV Trades At A Premium That’s About To Get Bigger

We already see that market momentum in RIV’s pricing; after trading at a discount to net asset value (NAV, or the value of its portfolio) in early 2022, it’s begun to trade at a premium in recent weeks, something it also did in mid-2021 (and, I should add, in mid-2019 and mid-2020).

In fact, just about every time the market swings from fear to greed, RIV’s discount turns into a premium—and a big premium at times (it hit 10% in mid-2018, for instance). If we buy RIV now, we can get a 12.9% income stream and wait to sell it at an inflated price as the market swings from fear to greed.

(That’s a similar story with USA and PDI, by the way, which trade at 6% and 4% premiums, respectively, but have traded at double-digit premiums numerous times in the past year.)

Put these three together and you’ve got that 11.6% average yield, which would deliver you $5,039 in monthly income from a $520,000 investment. That’s a middle-class income! It’s the kind of income stream you can expect with CEFs, and it’s why they make a great cornerstone for your portfolio.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."