- Shares of Chinese e-commerce giant Alibaba are down almost 8% in 2022

- Pace of China’s economic recovery key driver for future share price performance

- Long-term investors could consider buying BABA stock at current levels

Chinese tech giant Alibaba (NYSE:BABA) is the largest online commerce company in China. Its Taobao and Tmall marketplaces reach the largest consumer base in China with roughly 1.3 billion annual active consumers. Alibaba is also the top cloud service provider in the country.

Shareholders of BABA have seen the value of their investment drop almost 48% over the past 52 weeks and 8% so far this year. By comparison, China’s benchmark CSI 300 index has lost 12% in 2022. Meanwhile, shares of Tencent (OTC:TCEHY)) and Baidu (NASDAQ:BIDU) have declined 25.9% and 2.7%, respectively, over the same period.

Source: Investing.com

On July 15, 2021, BABA shares went over $216, to hit a record high. Then, earlier this year, on March 15, they plunged to a multi-year low of $73.28.

Alibaba and JD.Com (NASDAQ:JD), the two “largest B2C e-commerce market players in China [have] … a current joint market share of more than 60%”. E-commerce enjoyed robust growth in China, reaching almost $2.5 trillion in 2021. That number will likely exceed $3.6 trillion in 2025. Therefore, we can expect Alibaba to create shareholder value in the coming quarters.

Recent Metrics

Alibaba released Q4 and full-year 2022 metrics in late May. Revenue increased 9% year-over-year to hit $32.2 billion, marking its slowest growth as a public company. Adjusted net income came in at $3.1 billion. Free cash flow was an outflow of $2.38 billion.

On the results, CFO Toby Xu stated:

“We delivered healthy results this quarter with revenue growth of 9% year-over-year. Total revenue for the fiscal year grew 19% year-over-year, despite a challenging macro environment. Our continued investments in strategic initiatives have generated promising growth momentum and improved operating efficiency.”

Investors noted that while Alibaba delivered more than 30% revenue growth through the first half of fiscal year 2022, it saw a growth of about 10% during the second half.

In the coming months, there could be both headwinds and tailwinds for BABA stock. Geopolitical uncertainties, as well as a global recession, may dampen the group’s international expansion efforts.

On the other hand, China’s crackdown on the technology sector seems to be easing. As a result, Ant Group, where Alibaba has a one-third stake, could take steps to go public.

Prior to the release of the fourth-quarter results, BABA stock was changing hands at around $85. At the time of writing, they were at $108.70, up roughly 27%.

What To Expect From Alibaba Stock

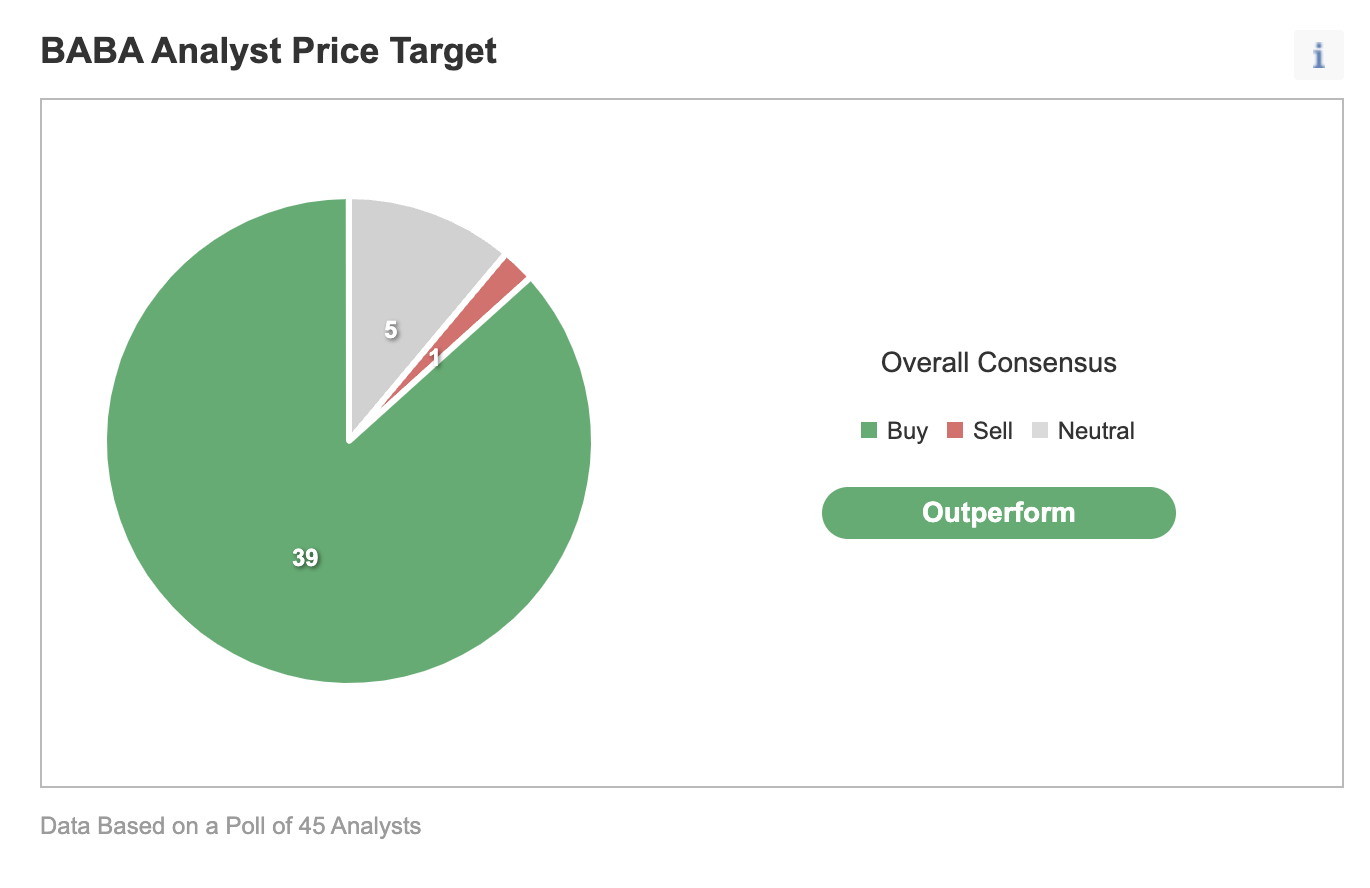

Among 45 analysts polled via Investing.com, BABA stock has an "outperform" rating.

Wall Street has a 12-month median price target of $150.18 for the stock, implying an increase of 38% from the current price. The 12-month price range currently stands between $104.50 and $229.41.

Source: Investing.com

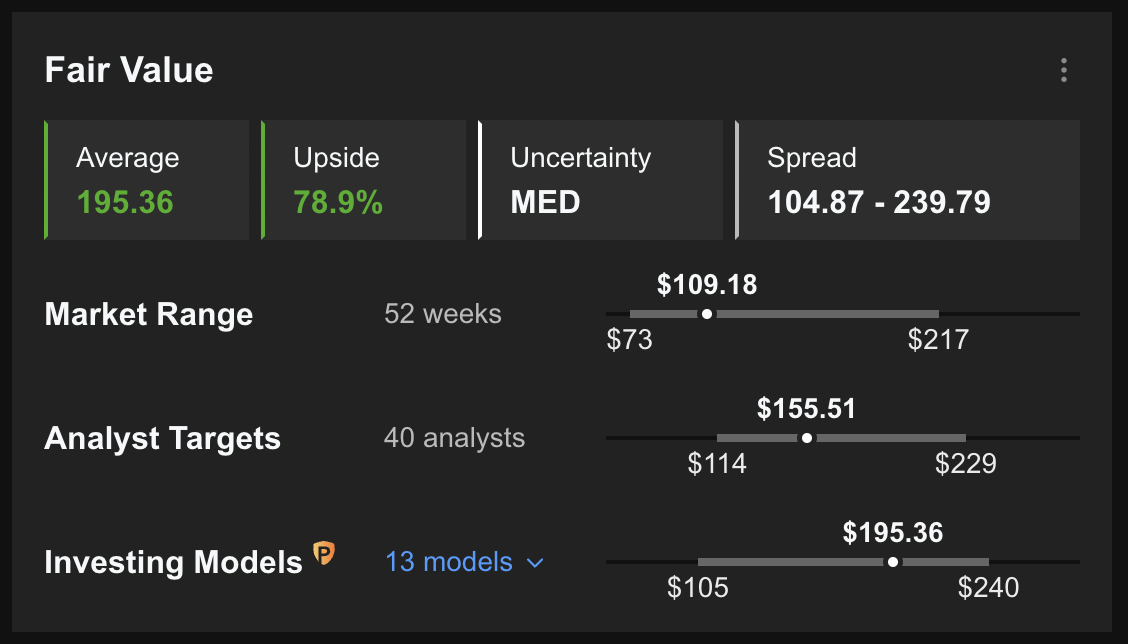

Similarly, according to a number of valuation models, like those that might consider P/E or P/S multiples or terminal values, the average fair value for BABA stock on InvestingPro stands at $195.36.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase by more than 80%.

We can also look at BABA’s financial health as determined by ranking more than 100 factors against peers in the consumer discretionary sector.

For instance, in terms of profitability, growth, and relative value, it scores 3 out of 5. Its overall score of 3 points is a good performance ranking.

At present, BABA’s P/E, P/B, and P/S ratios are 31.8x, 2.1x, and 2.3x. Comparable metrics for peers stand at 27.0x, 1.8x, and 0.7x. These numbers show that despite the decline in price over the past year, the fundamental valuation for BABA stock is still on the rich side.

Our expectation is for BABA stock to build a base between $100 and $110 in the coming weeks. Afterwards, shares could potentially start a new leg up.

Adding BABA Stock To Portfolios

Alibaba bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $150.18, as per the target provided by analysts.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has BABA stock as a holding. Examples include:

- ProShares Online Retail (NYSE:ONLN)

- First Trust Dow Jones International Internet ETF (NASDAQ:FDNI)

- Invesco Golden Dragon China ETF (NASDAQ:PGJ)

- Global X Emerging Markets Internet & E-commerce ETF (NASDAQ:EWEB)

- SPDR® S&P China ETF (NYSE:GXC)

Finally, investors who expect BABA stock to bounce back in the weeks ahead could consider setting up a bull call spread.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on BABA stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bull Call Spread On Alibaba Stock

Intraday Price At Time Of Writing: $108.70

In a bull call spread, a trader has a long call with a lower strike price and a short call with a higher strike price. Both legs of the trade have the same underlying stock (i.e., Alibaba) and the same expiration date.

The trader wants BABA stock to increase in price. In this strategy, both the potential profit and the potential loss levels are limited. The trade is established for a net cost (or net debit), which represents the maximum loss.

Today’s bull call spread trade involves buying the Sep.16 expiry 110 strike call for $11.10 and selling the 115 strike call for $9.05.

Buying this call spread costs the investor around $2.05, or $205 per contract, which is also the maximum risk for this trade.

We should note that the trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the BABA stock price at expiration is below the strike price of the long call, or $110 in our example.

To calculate the maximum potential gain, we can subtract the premium paid from the spread between the two strikes, and multiply the result by 100. In other words: ($5.00 – $2.05) x 100 = $295.

The trader will realize this maximum profit if the price of Alibaba stock is at or above the strike price of the short call (higher strike) at expiration, or $115 in our example.

Finally, we can also calculate the break-even price at expiration. In our example, it is $110 + $2.05 = $112.05. In other words, we add the net premium paid to the strike price of the long call, which is the lower strike, or $110 here. Therefore, on the day of expiry, the trader would need Alibaba shares to close above $112.05 to break even.

Traders expecting a gradual price increase in BABA stock toward the strike price of the short call (i.e., $120 here) could consider a bull call trade. Please note that the numbers we have used in the calculations do not include brokerage commission or fees.

Bottom Line

Despite the recent increase in Alibaba share price, the stock is far from its record highs. Experienced traders could also set up an options trade to benefit from a potential run-up in the price of BABA stock.

Disclosure: Tezcan Gecgil, Ph.D., does not have any positions in the securities mentioned in this article.