- Spatial data company MTTR stock is up about 80% since going public in late July.

- Because Matterport's 3D technology enables users to create digital twins of physical spaces, metaverse bulls are paying close attention to the stock.

- Long-term investors looking for exposure to the metaverse could consider buying MTTR shares, especially if they decline below $25.

Investors in software application name Matterport (NASDAQ:MTTR), whose technology focuses on digitizing and indexing spatial data, have seen mouth-watering returns on the company's shares since it went public via a reverse merger with a special purpose acquisition company (SPAC) in late July. Since then, MTTR stock is up close to 80%. By comparison, the tech-heavy NASDAQ 100 index has returned about 5% within the same time frame.

On Dec. 1, Matterport shares went over $37.50 to hit a record high. But since that peak, the stock is down over 30%. As of Monday's close, MTTR is trading at $23.36, while its market capitalization stands at $5.9 billion.

Launched in 2011, Matterport is gaining traction in the spatial data arena, which comprises “information that describes objects, events or other features with a location on or near the surface of the earth,” according to International Business Machines (NYSE:IBM).

Users of Matterport’s 3D platform can turn space into accurate digital twins, which “are at the center of where the physical world and the virtual world collide…and eventually in the metaverse!”

Therefore, since the rebranding of Facebook (NASDAQ:FB) as Meta Platforms in late October, Wall Street has been paying close attention to stocks like MTTR, which could benefit from the metaverse. In fact, the two companies already collaborate “to advance Habitat, Facebook AI’s simulation platform.”

In addition, construction, real estate and hospitality firms also use the Matterport platform. The group has a mobile app for 3D capturing as well.

Matterport issued Q3 metrics on Nov. 3. Revenue came in at $27.65 million, up 10% year-over-year (YOY). Investors also noted the strong subscription revenue of $15.7 million, which increased 36% YOY. But non-GAAP net loss was $14.03 million, or an adjusted loss of 6 cents per share.

Prior to the release of the quarterly results, MTTR stock was trading around $25. On Dec, 1, it hit $37.60, but shares have now retreated to just above $23.

What To Expect From Matterport Stock

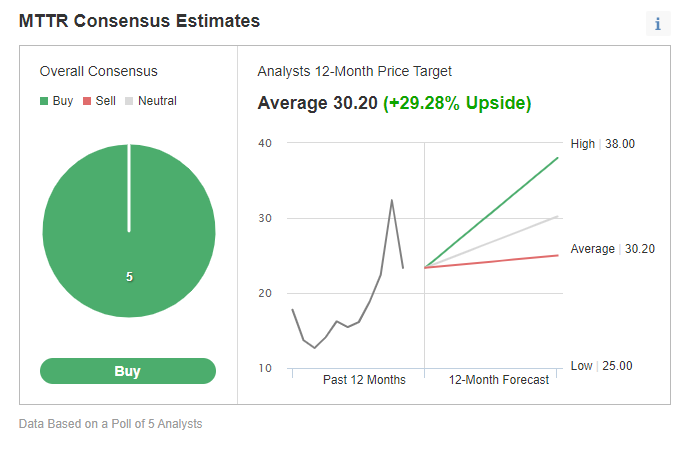

Among 5 analysts polled via Investing.com, MTTR stock has a “buy" rating.

Chart: Investing.com

Analysts also have a 12-month median price target of $30.20, implying an increase of about 30% from current levels. The 12-month price range currently stands between $25 and $38.

However, according to a number of valuation models, such as those that might consider dividends, P/E multiples or the 10-year Discounted Cash Flow (DCF) growth exit method, the average fair value for MTTR stock stands at $19.05.

Moreover, we can look at the company’s financial health by ranking it on more than 100 factors against peers in the information technology (IT) sector. With an overall score of 3 out of 5, it has a fair performance.

We should highlight that P/B and P/S (based on Last Twelve Months or LTM) ratios for Matterport stock stand at 31.3x and 59.9x, respectively. By comparison, average ratios for the sector are 2.3x and 2.0x. Put another way, even for a growth name, MTTR shares are richly valued.

Readers who watch technical charts might also be interested to know that a number of MTTR stock’s short-term indicators are cautioning investors. There could be some more profit-taking soon, especially if the current sell-off in tech names continues into the rest of the month.

Our first expectation is for MTTR to continue to slide below $25, possibly toward $22, after which it should find support. Then it will likely trade sideways between $22 and $25, and establish a new base. Afterwards, a new bullish move could likely start.

With a market cap of about $6 billion, Matterport should enjoy many quarters of solid growth. Meanwhile, the company could also find itself as a takeover candidate.

3 Possible Trades On MTTR Stock

1. Buy Matterport Shares At Current Levels

Investors who are not concerned with daily moves in price and who believe in the long-term potential of the company could consider investing in MTTR stock now.

On Dec. 6 shares closed at $23.36. Buy-and-hold investors should expect to keep this long position for several months while the stock potentially makes an attempt toward $30.30, a level which matches analysts’ estimates. Such an up move would mean a return of over 30% from the current level.

Readers who plan to invest soon but are worried about large declines might also consider placing a stop-loss at about 3-5% below their entry point.

2. Buy An ETF With MTTR As A Holding

Readers who do not want to commit capital to Matterport stock but would still like to have exposure to the shares could consider researching a fund that has the company as a holding.

Examples of such ETFs include:

- The De-SPAC ETF (NYSE:DSPC): The fund is down close to 18% since listing in May, and MTTR stock’s weighting is 6.12%;

- Defiance Next Gen SPAC Derived ETF (NYSE:SPAK): The fund is down 22.2% YTD, and MTTR stock’s weighting is 1.07%;

On the other hand, if you are short-term bearish on Matterport stock as well as other companies that have recently gone public via reverse mergers with SPACs, you could research The Short De-SPAC ETF (NYSE:SOGU), an inverse ETF.

Since its first day of trading in May, SOGU has remained just about flat. We should remind readers that inverse funds are not appropriate as buy-and-hold investments. Instead, they are better suited for short-term trades, and hence would not be appropriate for all market participants.

3. Cash-Secured Put Selling

Investors who are bullish on the stock, or would consider buying Matterport shares at a level less than the current price could consider selling a cash-secured put option in MTTR stock. As it involves options, this set-up will not be appropriate for all investors.

A put option contract on Matterport stock is the option to sell 100 shares. Cash-secured means the investor has enough money in his or her brokerage account to purchase the security if the stock price falls and the option is assigned.

Let's assume an investor wants to buy MTTR stock, but does not want to pay the current price per share. Instead, the investor would prefer to buy the shares at a discount within the next several months.

One possibility would be to wait for Matterport stock to fall, which it might or might not do. The other possibility is to sell one contract of a cash-secured MTTR put option.

So the trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let's assume the trader is putting on this trade until the option expiry date of 18 February 2022. As the stock is $23.36 at time of writing, an OTM put option would have a strike of $22.50.

Thus the seller would have to buy 100 shares of Matterport at the strike of $22.50 if the option buyer were to exercise the option to assign it to the seller.

The MTTR 18 February 2022, 22.50-strike put option is currently offered at a price (or premium) of $4.10.

An option buyer would have to pay $4.10 X 100, or $410, in premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future. The put option will stop trading on Friday, Feb. 18.

Assuming a trader would enter this cash-secured put option trade at 25.51 now, at expiration on Feb. 18, the maximum return for the seller would be $410, excluding trading commissions and costs.

The seller's maximum gain is this premium amount if MTTR stock closes above the strike price of $22.50. Should that happen, the option expires worthless.

If the put option is in the money (meaning the market price of Matterport stock is lower than the strike price of $22.50) at any time before or at expiration on Feb. 18, this put option can be assigned. The seller would then be obligated to buy 100 shares of MTTR stock at the put option's strike price of $22.50 (i.e., at a total of $2,250).

The break-even point for our example is the strike price ($22.50) less the option premium received ($4.10), i.e., $18.40. This is the price at which the seller would start to incur a loss.

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This can be a way to capitalize on the choppiness in MTTR stock in the coming weeks.

Investors who end up owning Matterport shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares. Thus, selling cash-secured puts could be regarded as the first step in stock ownership.