Further to my post of October 21, the U.S. Homebuilders ETF (NYSE:XHB) decline continues. Price is now sitting just beneath its long-term 38.2% Fibonacci retracement level of 32.33, which had represented a first major support level (now major resistance). Second major support level (50% Fib retracement) sits at 27.60.

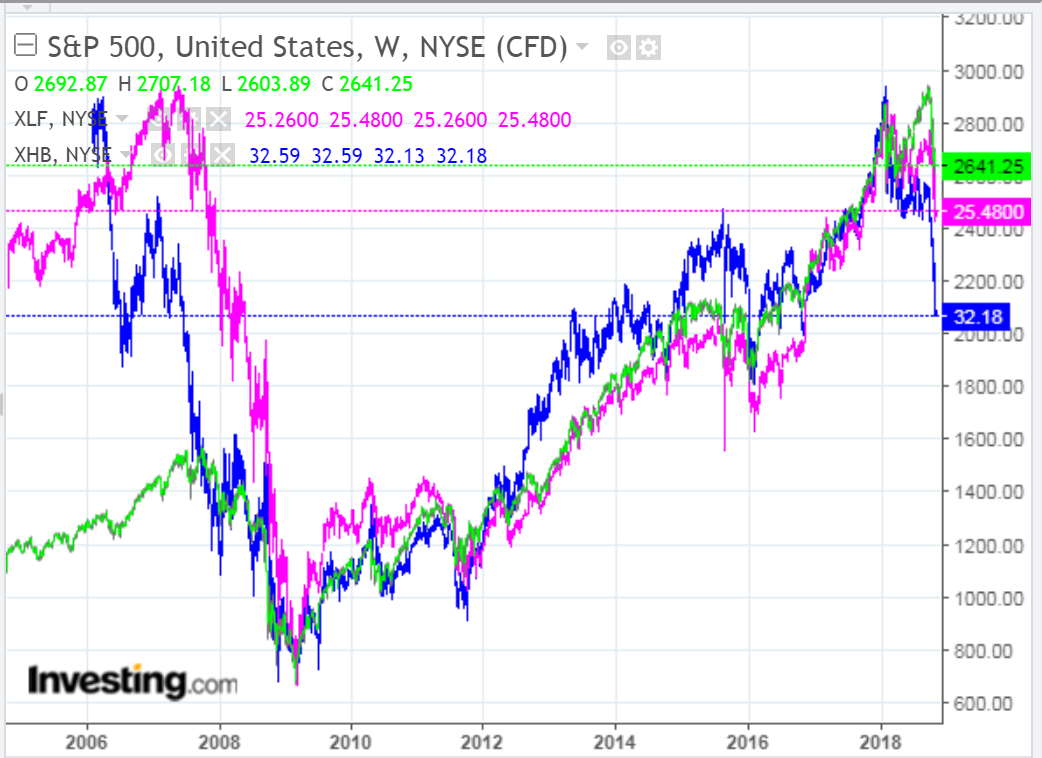

The following weekly comparison chart shows price action of the SPX (green bars), XLF (pink) and XHB (blue) pre and post-2008/09 financial crisis.

You'll note that the XHB entered into a steep decline well ahead of the SPX and XLF in mid-2006...which was a strong indicator of major weakness in that sector and a precursor and barometer of systemic weakness in U.S. equities, in general.

Conversely, it began to accelerate at a faster pace in mid-2012 before it moved lock-step with the other two until they all peaked in January of this year.

All three, subsequently, pulled back, but while the SPX then rallied to new highs, the XLF and, in particular, the XHB did not. In fact the XHB has declined at an alarming rate since early September.

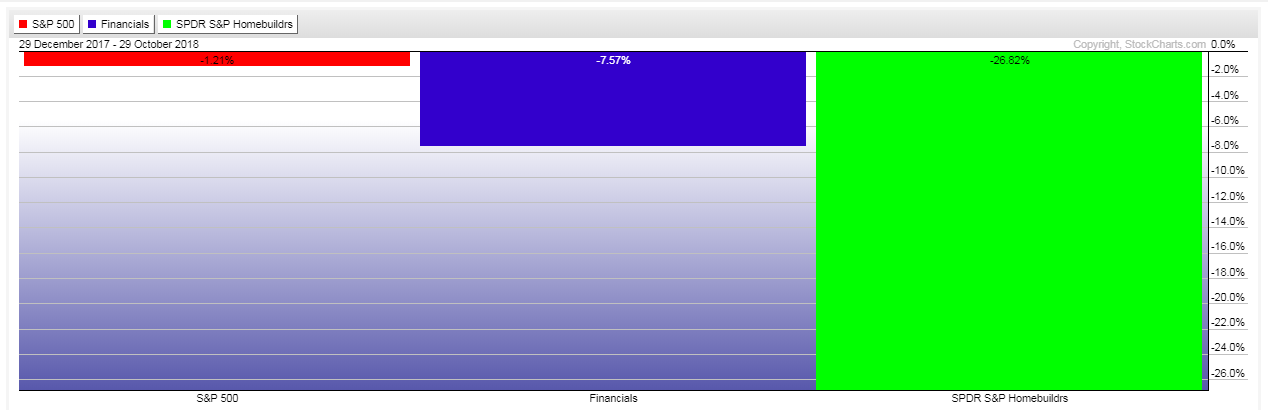

The following year-to-date percentages gained/lost graph illustrates the comparative weakness of the XHB for 2018.

A failure of the XHB to take a leadership role in regaining strength would, no doubt, drag the SPX and XLF down further...assuming that historical movements in markets haven't dramatically changed recently.

In that regard, watch for a break and hold below 2600 on the SPX (a level I had identified as near-term major support in my post of October 11) as a signal that further SPX weakness lies ahead...possibly to its next major support level as low as 2400, which correlates to a long-term uptrending Fibonacci fan line, as shown in my post of August 6.

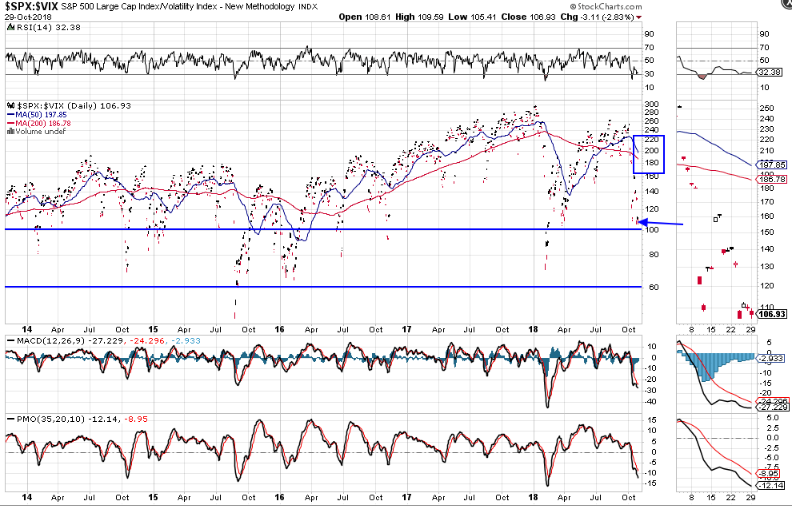

Keep an eye on the 100 level on the following daily SPX:VIX ratio chart, inasmuch as a break and hold below could see the SPX reach that 2400 level...especially if it breaks and holds below 60 and we see another bearish moving average Death Cross form.