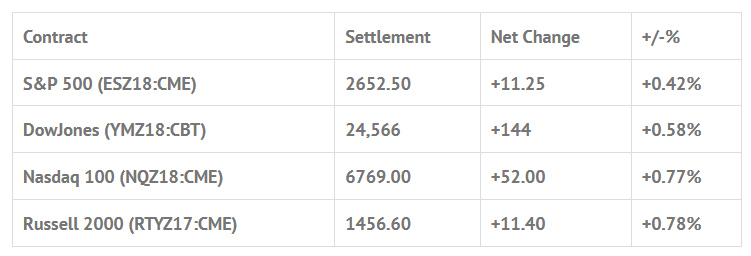

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed higher: Shanghai Comp +1.23%, Hang Seng +1.29%, Nikkei +0.99%

- In Europe 9 out of 13 markets are trading lower: CAC -0.08%, DAX +0.16%, FTSE -0.19%

- Fair Value: S&P +4.23, NASDAQ +27.60, Dow +26.11

- Total Volume: 1.88mil ESZ & 1,795 SPZ traded in the pit

As of 8:00 AM EST

Today’s Economic Calendar:

Today’s economic calendar includes the Weekly Bill Settlement, Jobless Claims 8:30 AM ET, Import and Export Prices 8:30 AM ET, EIA Natural Gas Report 10:30 AM ET, a 30-Yr Bond Auction 1:00 PM ET, Treasury Budget 2:00 PM ET, Fed Balance Sheet and Money Supply 4:30 PM ET.

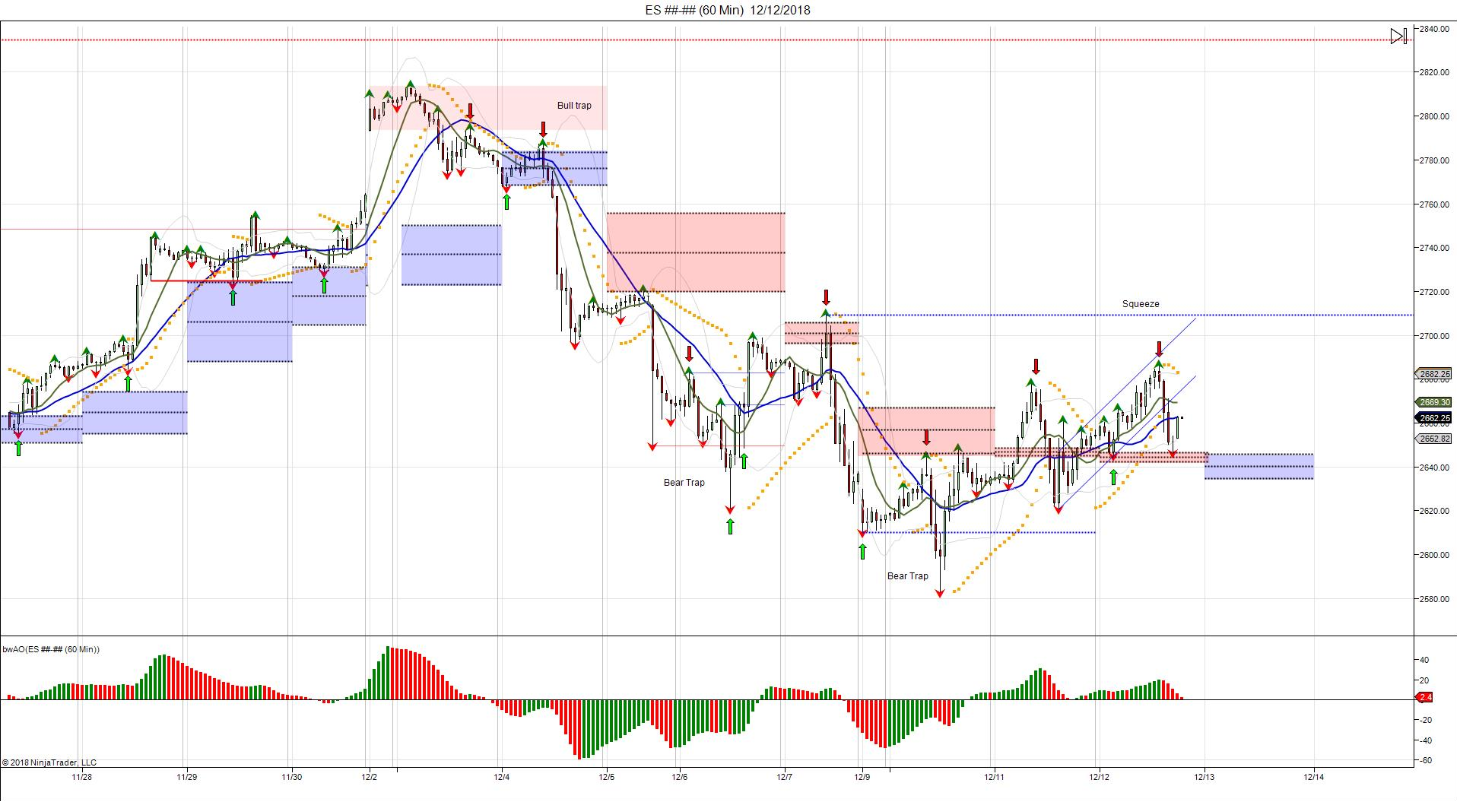

S&P 500 Futures: Patterns Fitting, Big Up Then Drop

After trading higher in the overnight session, the S&P 500 futures opened yesterday’s RTH at 2671.50, and in the first half hour traded down to the low of day at 2661.50 before rallying through the morning up to 2684.75 heading into noon.

The afternoon saw what would be the high of day at 2686.25 just before 12:30. After that, the market began to turn over, leading to some sharp, quick selling. The ES made an afternoon low of 2656.00, a 30.25 handle pullback, then bounced to 2671.25, and printed 2651.50 on the 3:00 cash close before settling the day at 2652.50 up +11.25 handles or +0.42%.

In the end, the tone of the day was about the early thin to win type of price action, with each small dip getting shallower as the 10 handle rule was working. However, the afternoon turned into a sell program that kept a lid on the futures into the close.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.