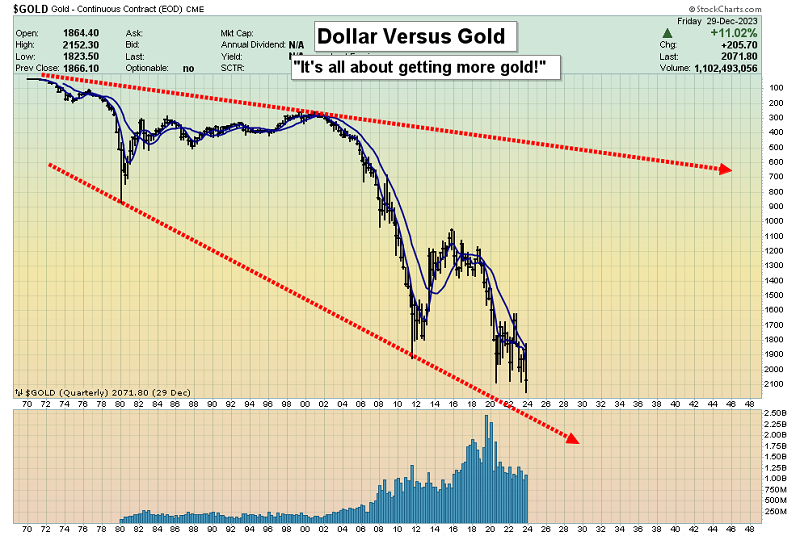

A new year begins, and the big theme for savvy investors is going to be using great tools like mining stocks, crypto, commodities, and the stock market to get more money.

More of the ultimate money that can only be gold.

Sometimes (like recently with rates hitting 5%), investors can focus on fiat, but as a rule of thumb, an investor’s currency of choice should be gold. Looking at this chart, it’s obvious that if the world’s most popular fiat fails against gold, the others do too. The failure is immense, and the awesomeness of gold is real.

Mainstream media and crypto gurus are hyping the current crypto market rally, and that hype can make investors forget to use the crypto asset tool to get more gold.

The key to using a tool like crypto to get more gold is to sell crypto for fiat as it approaches key resistance zones. Then wait for a significant gold versus fiat price sale and put the juicy fiat profits from crypto into gold!

The $48,000-$50,000 zone is the next zone where crypto investors can do that.

What about oil? As the horrifying Gaza war becomes a murderous quagmire like Ukraine (or worse), oil is again a key commodity in play.

An oil price rally from my $70 buy zone to $93 (and higher) is becoming more likely by the day.

I used the last oil price rally to get investors (and myself) more ultimate money gold at $1810, by selling oil at $93. If Iranian government maniacs get into a serious confrontation with US government maniacs in the Red Sea area, oil could rise not just to $93, but to $100 and higher.

That would ruin the forecasts of Wall Street analysts who are calling for a barrage of rate cuts this year. The bottom 2021-2025 war cycle line: The Fed may have to pivot, but to even higher rates rather than to cuts!

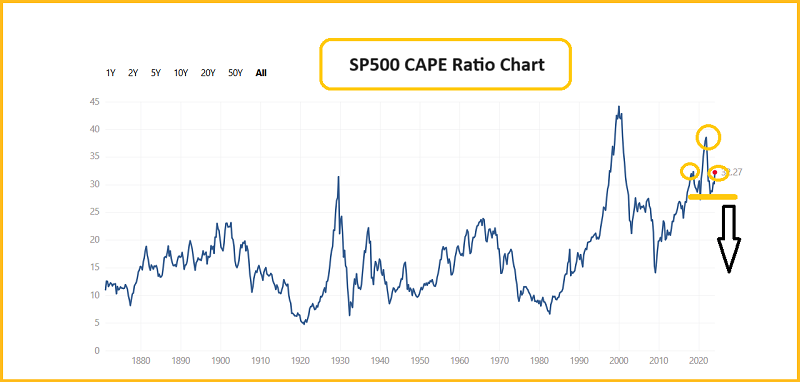

There’s not much opportunity to use the over-valued US stock market to get more gold. But there is some for gamblers who are willing to bet that the stock market falls. If $100+ oil is on the horizon, a stock market meltdown could occur. The 37,000 zone for the Dow is significant resistance, as is round number 40,000.

The Jan 5 US jobs report (this Friday) caps off the first week of trading. If the Dow is down for the week, it’s likely a sign for what lies ahead for the rest of the year.

Ominous CAPE ratio chart (inflation-adjusted PE ratio for the S&P 500). There’s a H&S top in play for the CAPE, and a break under the neckline zone (about 28) could usher in a major tumble for stocks.

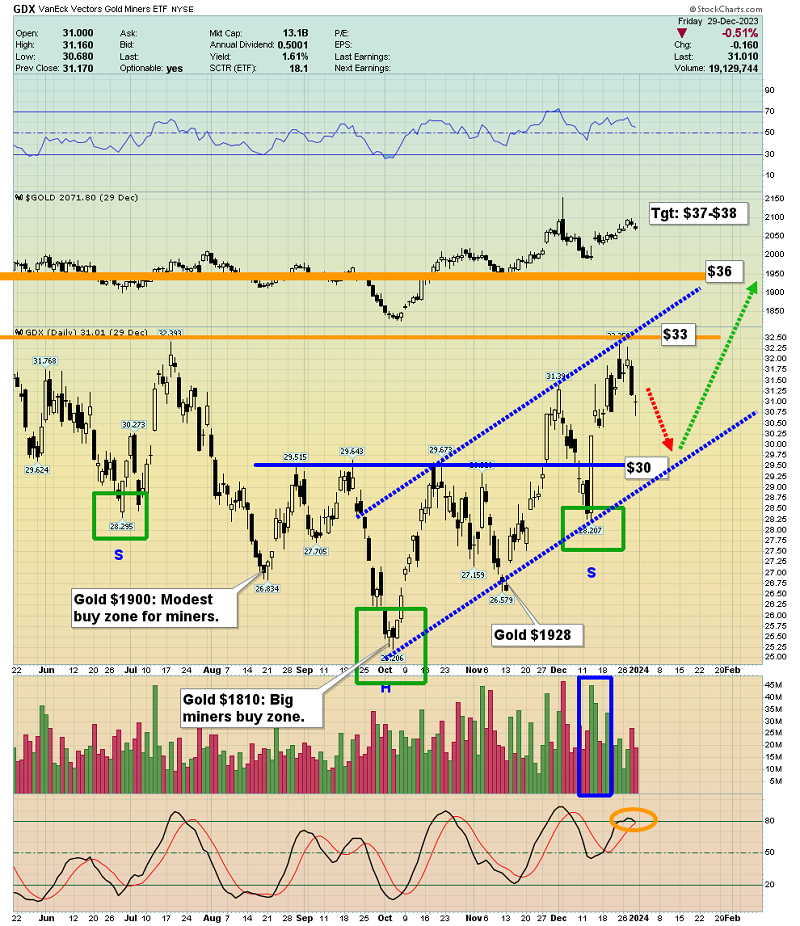

It’s critical that investors act professionally as they accumulate ultimate money gold. Forecasting the price higher based on rates, debt, war, and Asian weddings is interesting, but it’s the big price sales into big support zones that investors should buy.

Gamblers should focus on $2045-$2040 and $2020-$2010. For investors, the big buy zone is $1980-$1970. There’s a small H&S top in play that could benefit gamblers, but investors may have to wait for their chance to eagerly buy more gold.

The miners have been roaring higher, with some seniors up 50% in just two months from the last buy zone. A look at the price action via GDX (NYSE:GDX). Double-click to enlarge. There’s a beautiful uptrend in play. With the stock market tumbling and the US Dollar surging, GDX and many individual miners are trading up ahead of the NYSE open. It’s a great sign of things to come, in what should be a very golden year!