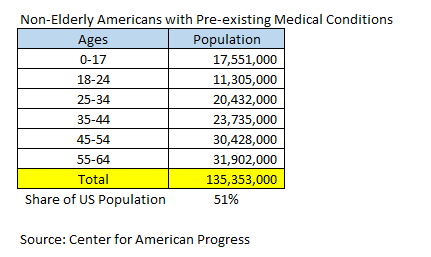

The COVID-19 virus has shown to be particularly deadly for people with pre-existing medical conditions and those of advanced age (65+). According to an 2019 study by the Center for American Progress, 51% of non-elderly Americans have pre-existing medical conditions. That is 135 million people. There are about 65 million elderly Americans who are aged 65 and older. That means getting infected with the COVID-19 virus is an immediate death threat to about 200 million people in America. The US population is just north of 330 million so that means about 60% of the US population feels under life-and-death threat from this virus. Even if the US government reopens the economy, the question remains whether those 200 million people will have the confidence to re-engage in an economy in which the COVID-19 virus is present. China has reopened its economy for weeks now and its post-COVID economy is significantly smaller than its pre-COVID economy. That is because the elderly and people with medical conditions are afraid to reengage until a vaccine is found and they feel safe. This is something we can now expect to happen in the US economy as well.

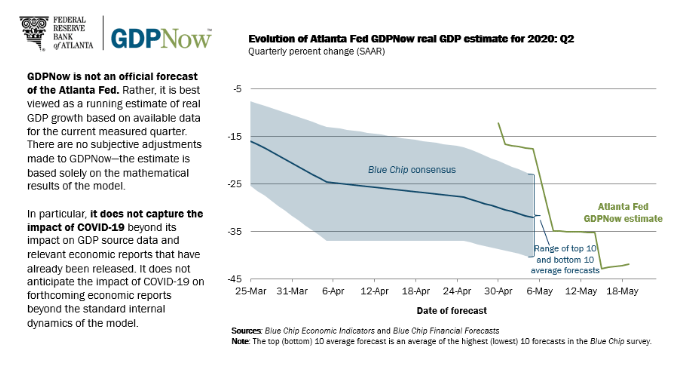

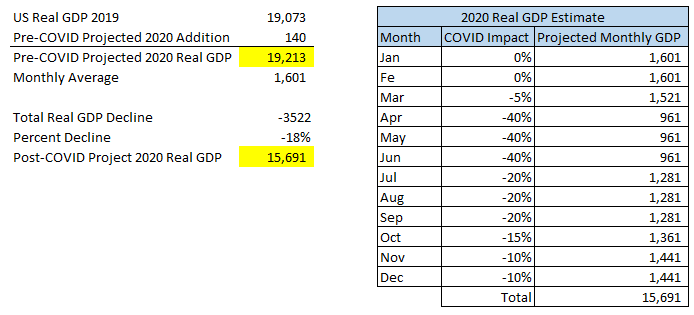

As we learn more about the COVID-19 virus and how populations in various countries react to it, the initial rosy expectations of an immediate V-shaped recovery fade away. The Atlanta FED GDP Now shows that the US economy will contract -40% on an annualized basis in Q2 and some estimates show that the economy will contract even further in Q3 by an additional -10% on annualized basis EVEN after most of the states have reopened. The CBO projects 10% unemployed by the end of 2021. Absent a vaccine, the US economy will simply become smaller as many businesses that rely on close proximity and in-person human interaction such travel, hospitality and entertainment stop being viable. I have modeled US GDP for 2020 by taking the monthly average GDP based on Pre-COVID 2019 data and then reduced it by what I think will be negative impact on the economy from COVID. I assume that Q2 Atlanta FED projection of -40% in Q2 is true. I also assume that about half of the economic activity lost in Q2 returns in Q3 and then another quarter more returns in Q4. But still I think by Q4 we have at best an economy that operates at 90% rate compared to 2019. Q2 and Q3 alone will do a ton of damage to US GDP from which there is no quick recovery. We end up with $15.6 trillion in real US GDP for 2020 vs $19 trillion (Real GDP is calculated in 2012 dollars), a dramatic -18% deterioration. This is a very big hole from which the economy will not be able to recover all the way back in 2021 as the earliest realistic estimates for the mass production of a COVID-19 vaccine are slated for Q3 of 2021. Unfortunately, we are more than year away from a practical medical solution to this very significant economic problem.

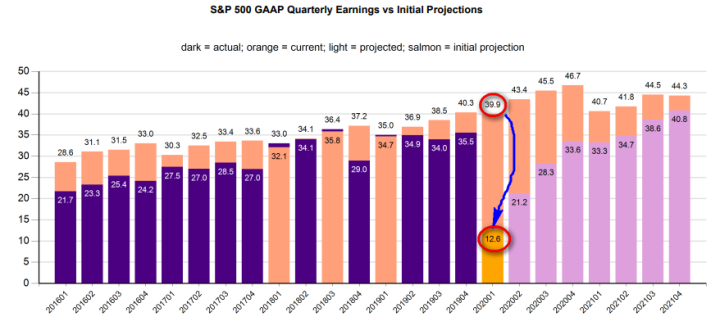

As you can imagine, S&P 500 (SPX) earnings have cratered during this dramatic economic slowdown. In Q1, in which the pandemic shutdowns were in effect for only the last 2 weeks of March, we have seen SPX GAAP earnings crater from initial projections of about $40 per share to $12.6 as of this writing. This is -68% decline! In addition, earnings expectations have been downgraded significantly for every quarter in 2020 and 2021. However, I don’t think these downgrades go far enough. There is a clear cut V-shape recovery in the earnings picture as early as Q4 that is simply unrealistic absent a vaccine. 2020 GAAP earnings have declined to $95 on the year already and will continue to decline even further in coming months to some unthinkable levels. We have seen the economic deterioration in the high-frequency data, it is just a matter of time before the quarterly data catch up in July and August.