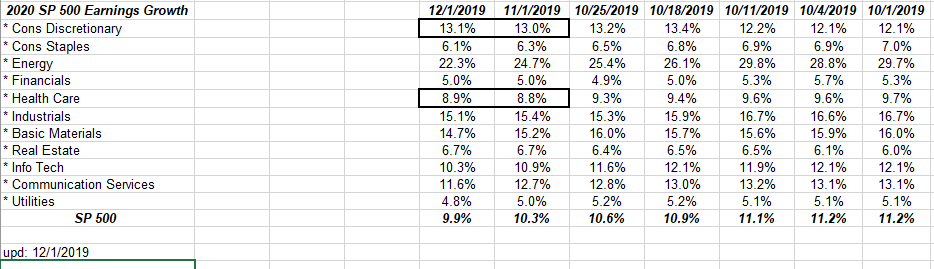

The two sectors highlighted in heavy black borders are the sectors which are seeing higher estimated earnings growth revisions of late, or at least in the case of the Consumer Discretionary sector, higher estimates growth rates over the last 60 days.

This Bespoke chart just above (from the sector snapshot report dated 11/29/19) shows the recent breakout for the Consumer Discretionary sector, which corresponds to the higher expected 2020 growth rate revisions.

Here’s how Bespoke described the above Sector Snapshot chart last Friday, 11/29/19:

“We’d been noting weakness for Consumer Discretionary relative strength over the last month or so, but from atechnical perspective, the chart for Discretionary now looks bullish as it just broke above a flag pattern that suggests a big leg higher.”

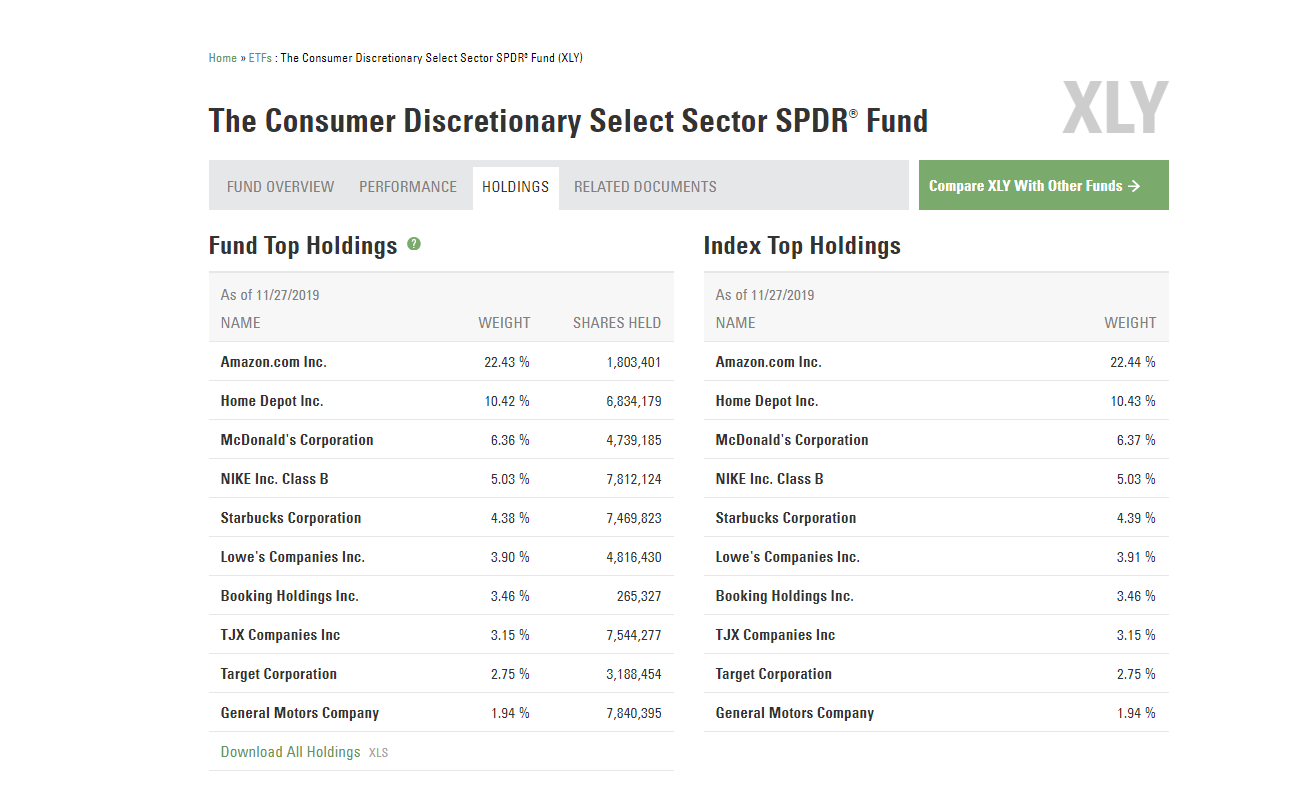

Top 10 Consumer Discretionary weights:

This snapshot of State Street’s Consumer Discretionary ETF shows not just the XLY’s Top 10 holdings, but how this compares to the SP 500 benchmark, and as the reader can see, the Consumer Discretionary Select Sector SPDR® Fund (NYSE:XLY) is identical to the S&P 500’s weightings for the Consumer Discretionary sector.

Summary / Conclusion: On the first Excel spreadsheet at the top of the page, one aspect to the expected S&P 500 EPS growth for the full benchmark for 2020 was that from October 1 to November 1, 2019, the expected S&P 500 growth rate fell a full 1%. But the change from November 1 ’19 to December 1 ’19 was just 4/10th of a percent, or less degradation.

Important ? Maybe, but definitely worth noting.

Consumer Discretionary is housing, auto’s with the biggest component in the sector being Amazon (NASDAQ:AMZN), since Amazon is tied to consumer spending.

Both the fundamentals and technicals of the Consumer Discretionary sector are lining up.