One odd fact no one has yet mentioned is how—for the second month in a row—the S&P 500 had a very rough last week of the month, taking a gain to a loss.

It seems like ancient history with the coronavirus captivation, but the last week of January ’20 saw the S&P 500 drop 1.26% which seems trivial after this week’s 11.5% decline, but then February 3rd the rally reignited up till the last week of the month.

The S&P 500’s total return for January ’20 was -0.04%, thus triggering the “as January goes, so goes the market” meme.

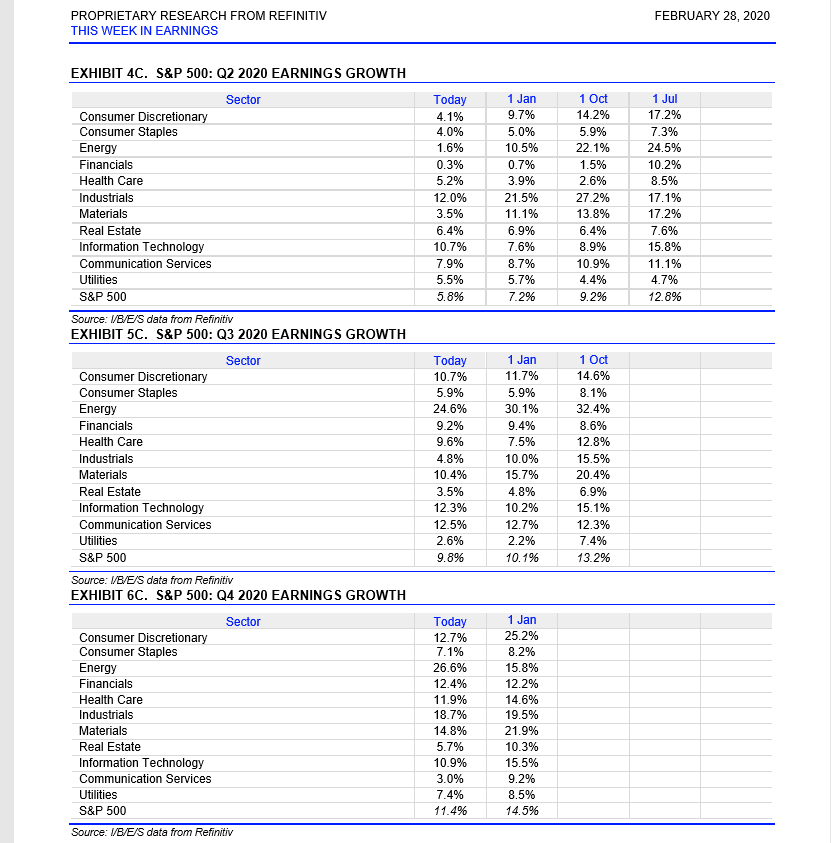

In yesterday's post we showed readers the revisions for the sectors for Q1 ’20, which – given the headlines – you’d expect to see.

However let’s look at the rest of 2020:

The reason I prefer IBES by Refinitv data is that it tracks the chronology of sector growth rates over several times periods, rather than Factset’s two data points in time.

Here is a couple of quick thoughts on the above so readers aren’t punished by grinding over the data:

Summary / conclusion: Given the typical number of deaths each year IN the U.S. from just the ordinary winter flu (20,000?), the worries over the coronavirus seem quite bizarre, but given the way information is disseminated in the media, it isn’t surprising. The S&P 500 has seen three 20% corrections since the secular bull market beginning in March ’09, and the 2015-2016 correction, didn’t even get to 20%, and probably closer to 14%.

The “average” S&P 500 correction each year is 13% per JP Morgan’s work.

No predictions will be made for readers as to what the market will do here next week or over the next few months, but the improving odds of another fed funds rate cut might keep a floor under any correction.

The latest estimate seen of China GDP was that it was expected to contract 6% next quarter. That’s a sharp drop for the world’s 2nd largest economy.

You would think as long as the U.S. consumer stays healthy, the U.S. could weather any decent contraction in U.S. GDP growth based on the C-virus.

The close on Friday was a big positive in my opinion and February ’20 nonfarm payrolls gets reported next week, with the Briefing,com consensus expecting 170,000 in net new jobs added to the U.S. economy and the Briefing.com forecast calling for 185,000 net new jobs added.

A lot of retailers report this week, i.e. Target (NYSE:TGT), Costco Wholesale (NASDAQ:COST), etc. and while U.S. consumer demand probably will not see a C-Virus impact, it will be interesting to hear what is said from a supply-chain perspective.