Preparing yesterday’s post, the decline in the “forward 4-quarter” growth rate for the S&P 500 below 3% was a bit of a surprise.

However, perusing the IBES by Refinitiv 2020 Expected S&P 500 Earnings data shows that revisions are positive for next year (at least for now) which historically has been positive for “expected returns” for the S&P 500.

Ed Yardeni, Jeff Miller, Sam Stovall, and a few others who follow S&P 500 earnings regularly have noted over the years that the “revisions” trend is usually negative into the release of quarterly earnings and then historically anyway, the “upside surprise” for the S&P 500 every quarter is usually 2% – 5% from the first though the last day of the quarter.

So what does all this mean ?

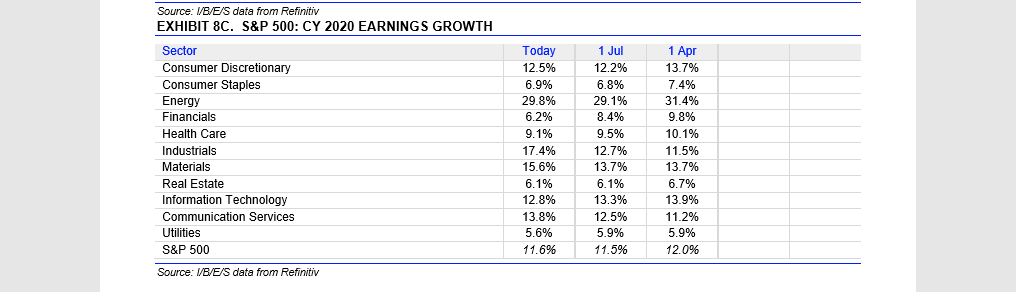

Look at the table for 2020 S&P 500 earnings data from IBES this weekend:

The key statistical change in the last 4 weeks per the numbers is that expeced 2020 S&P 500 EPS growth has been revised higher since June 1 ’19, and that the biggest revisions are NOT the Financial and Health Care sectors, but rather Industrial's, Energy, Basic Materials, etc.

Could we be looking at stronger global growth in 2020? It’s too early to make a call right now, BUT during a time when the estimate revisions are usually negative, the positive revisions to the expected S&P 500 earnings growth and those sectors, is a positive.

This data will be looked at again around the Labor Day holiday.

Summary / Conclusion: S&P 500 earnings data is a poor timing tool I’ve found over the years, but the key “tells” or early-warning indicators are to look for revisions in the sector data, and I’ve found over the last 10 years, that positive revisions are usually more significant than negative revisions.

Using the quarterly bottom-up estimates, the S&P 500 has been looking for 12% earnings growth for 2020 for 27 consecutive weeks or since Feb 1 ’19.

That’s important. If the numbers haven’t come down with Q2 ’19 earnings data so far, it’s a good sign, particularly with the FOMC expected to reduce interest rates on Wednesday afternoon.