The following charts depict 2018 market action in the S&P 500 Index (SPX), as well as the MSCI World Index. One word describes 2018 markets...volatile.

Volatility was extreme, as uncertainty gripped, not only U.S. markets, but markets world-wide, as well, as I had posited in my 2018 Market Forecast at the end of 2017. I believe it will continue to apply in 2019, and we'll see a world market slowdown, as I described in my 2019 Market Forecast.

Key levels that I'm watching on the SPX are 2600, 2400, 2250 and 2000, as illustrated in my post of December 27.

Market gauges that I'm monitoring in the weeks/months ahead are outlined in the above-mentioned posts, as the charts below are simply presented without comment (on the SPX) to depict this volatile price action.

Happy New Year and best of luck in 2019!

SPX -- Each candle on the following chart represents a period of one year.

SPX -- Each candle on the following chart represents a period of one quarter.

SPX -- Each candle on the following chart represents a period of one month.

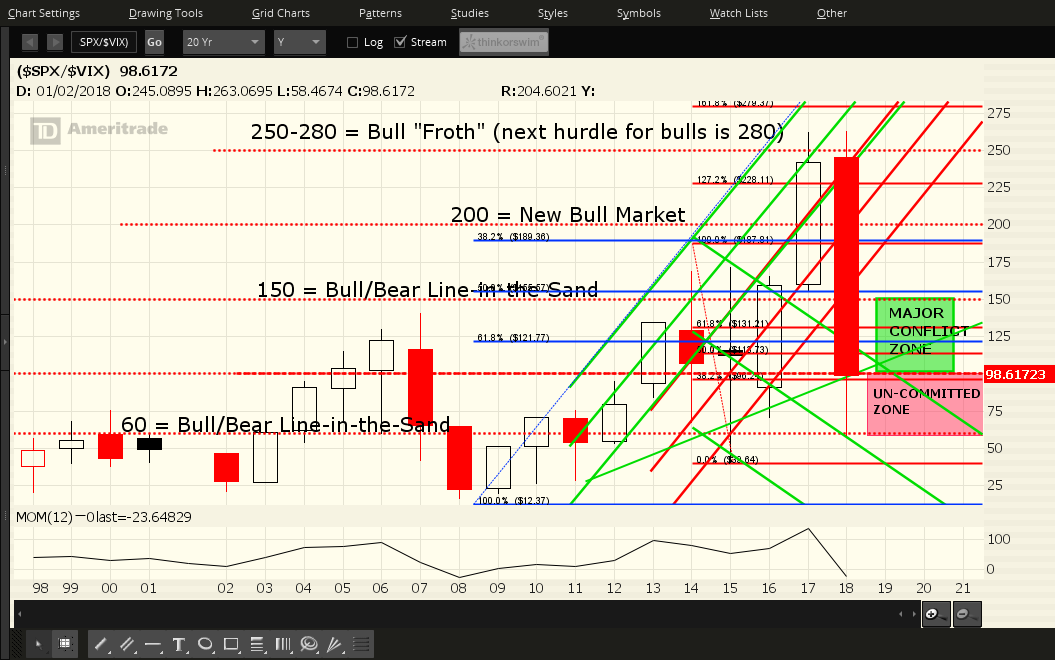

SPX:VIX Ratio -- Each candle on the following ratio chart represents a period of one year.

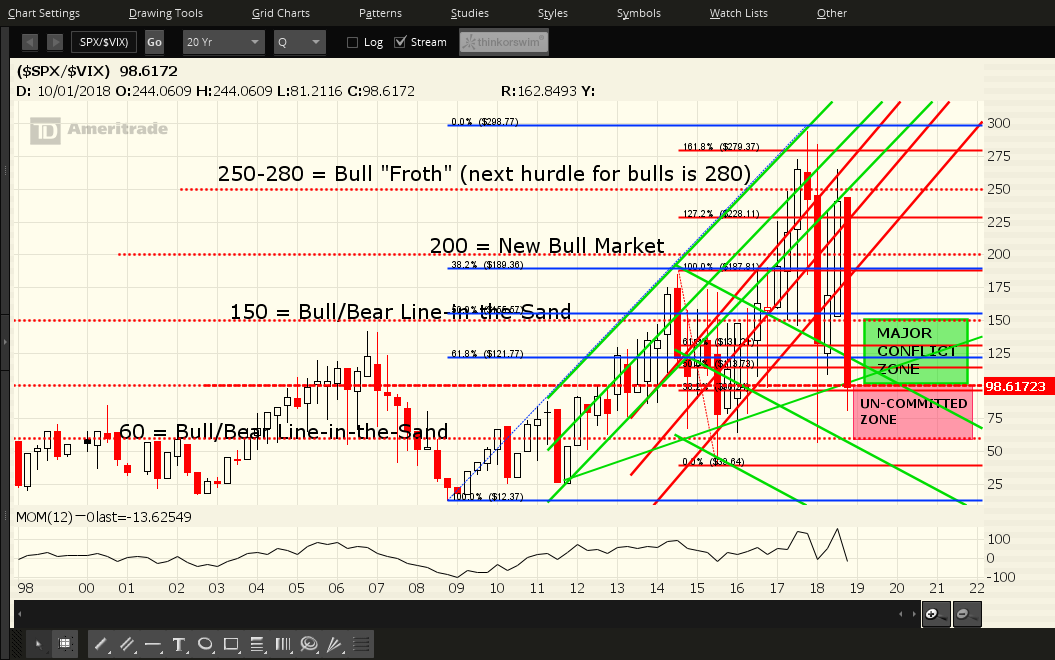

SPX -- VIX Ratio -- Each candle on the following ratio chart represents a period of one quarter.

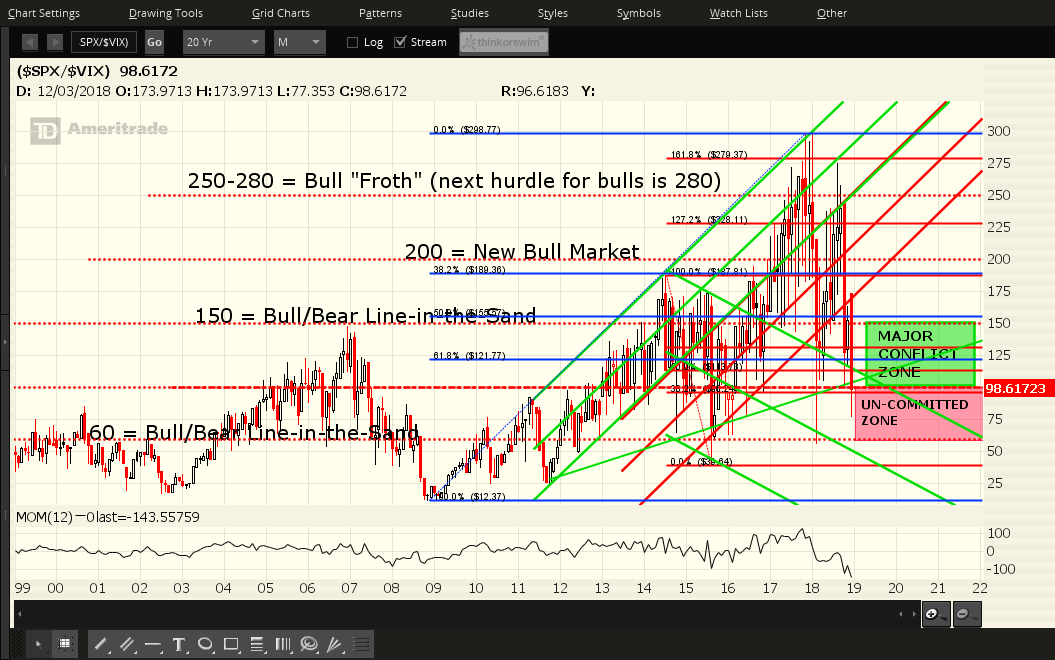

SPX --VIX Ratio -- Each candle on the following ratio chart represents a period of one month.

MSCI World Index -- Each candle on the following chart represents a period of one week.

N.B. 1800 is a critical level, as a break and hold below will drag U.S. equities down, as well. It was briefly pierced during the last week of December and may be retested before, either resuming its plunge, or reversing course.

A tepid reversal will not produce lasting confidence or commitment in world markets, nor sustain a meaningful longer-term rally. In this regard, I've shown the input value as "one" on the three technical indicators (MOM, ROC and ATR) to illustrate and gauge the strength and velocity of either direction.