The S&P 500 fell 2.5% yesterday, and is down 5% in the last week.

With the S&P 500 down about 7.5% YTD already, needless to say, this wasn’t the start expected to 2016.

At a Chicago CFA Society luncheon yesterday, Jason Trennert, the managing partner of Strategas Research Partners, noted he thought the S&P 500 would be up 10% in 2016, exactly what I was thinking here in mid to late December ’15.

With JP Morgan (N:JPM) and Intel (O:INTC) set to report this today, finally, Q4 ’15 earnings and ’16 guidance aren’t just a guess.

So what’s been a surprise so far in 2016 ?

- Freeport (N:FCX) looks like it is going bankrupt, the way it is trading. Jason Trennert mentioned yesterday we might see one major energy sector bankruptcy before this correction ends. Chesapeake (N:CHK)? Freeport? Peabody (N:BTU)? (All my suggestions, not Jason’s).

- Neither Value nor Growth is working this year. The FANG stocks have gotten crushed. Amazon (O:AMZN) is down $100 from its all time, late December ’15, high. The stock is testing its upward sloping trendline off the ’15 low. It needs to hold here.

- Back in the bull market of the 1990’s, there used to be a graph or chart that circulated that showed that bear market bottoms were put in usually when a big Financial blew up. Continental Bank in the mid 80’s, Drexel Burnham in 1990, Orange County and the Mexico devaluation in late 1994 may not have been bear market finales but they typically marked the end of major corrections. Could be something like that is looming today, in another sector.

- The dollar index closed at 98.94 yesterday. Hasn't changed much as all and in fact is still under its March ’15 multi-year high near 100. A steady dollar or a lower dollar is still, “net-net” a positive in my opinion.

- Banks and Financials have gotten just hammered YTD, possibly due to the flatter yield curve. I do think Financials offer good value here. Corporate loan growth should be decent. When we hear from JP Morgan, Wells Fargo (N:WFC), Citigroup (N:C), and US Bancorp (N:USB), it will give us a good look at the consumer and corporate loan books.

- The Russell 2000 is down over 20% from its all time highs. That is a real bear market.

- The iShares iBoxx $ High Yield Corporate Bond ETF (N:HYG) has not made a new 52-week low even with the equity carnage.

Our only change to portfolios thus far this year is to sell the Brazil ETF (iShares MSCI Brazil Capped (N:EWZ)) and depending on the client, some Energy exposure, both of which was added in October ’15.

Clients have no exposure to the Russell 2000 or to biotechs (those two are related), Transports, Basic Materials, and have just a 3%-4% exposure to Emerging Markets (Long some Vanguard FTSE Emerging Markets (N:VWO) and iShares MSCI Emerging Markets (N:EEM)) and Energy (Energy Select Sector SPDR (N:XLE) and iShares US Energy (N:IYE)), and yet I still feel pretty stupid.

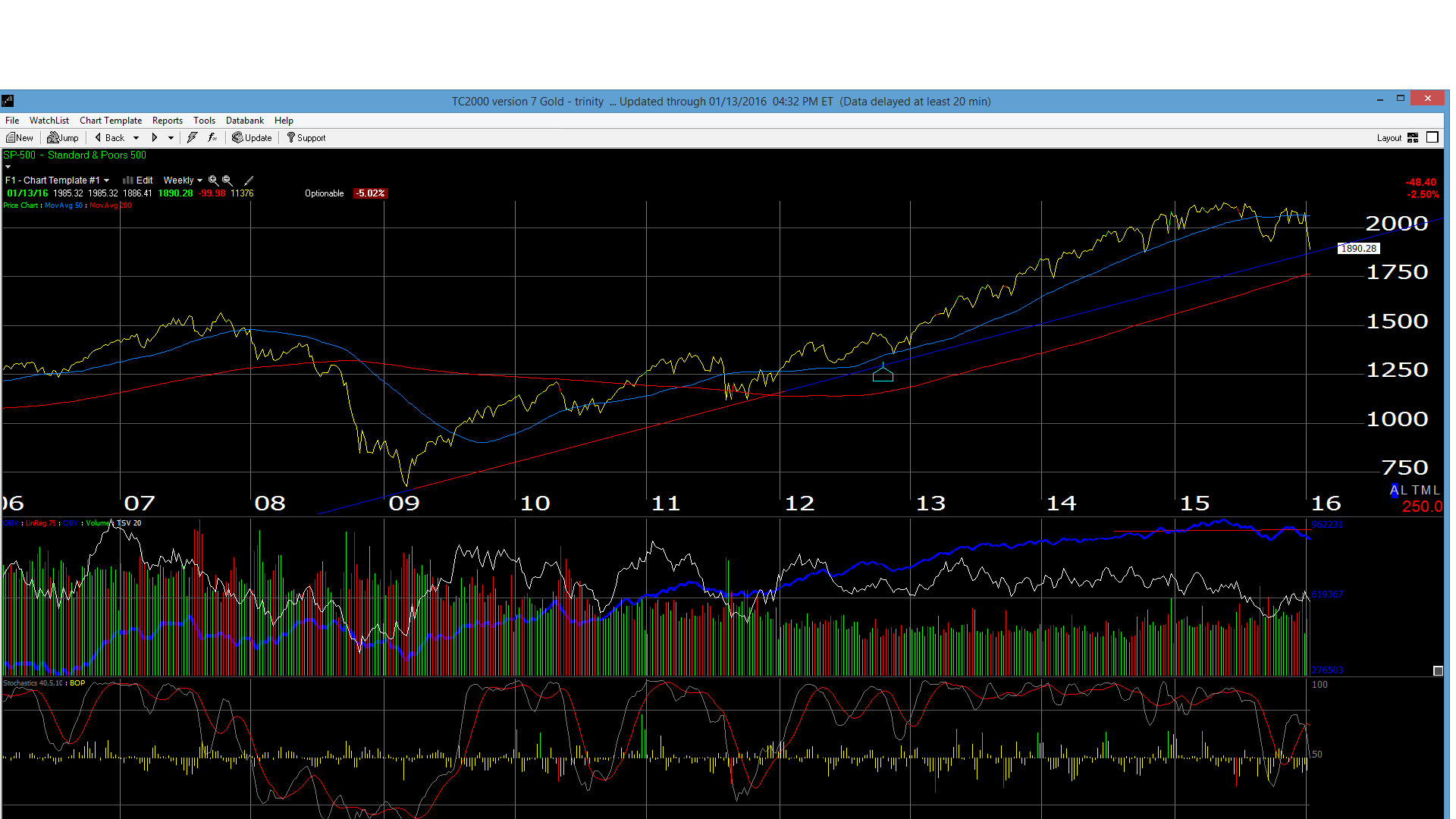

We’ll leave readers with one chart. Some technicians think the August ’15 lows of 1,867 could be tested now. The overnight futures low in August ’15 was 1,831. Note the 200-week moving average on the chart above, near 1,750.

We'll get a great look at the big bank earnings over the next two days. Read the conference call notes.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.