As always, I provide no predictions or forecasts for the future.

As a successful long term investor, I remain faithful to Warren Buffett’s life long commitment in investing by observing his two rules.

Rule #1 – do not lose money.

Rule #2 – do not forget rule #1.

Looking back on 2016

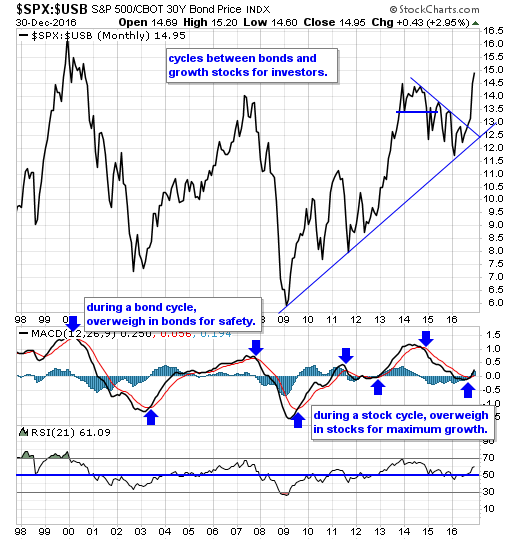

Our long term investment model has switched back to favoring equities after placing us on the defensive in 2015. A false alarm in hindsight.

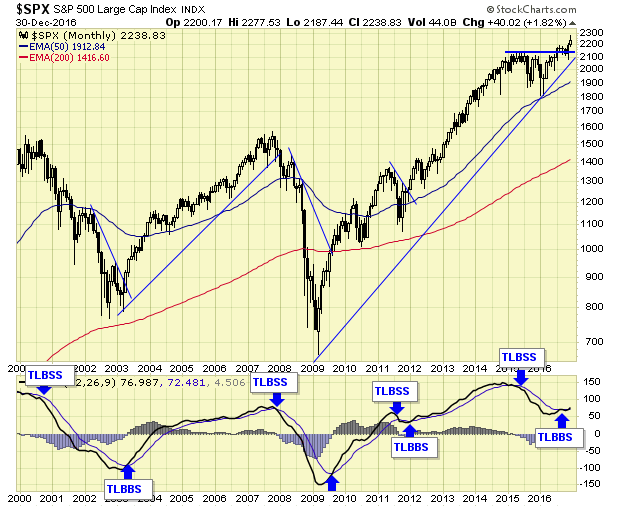

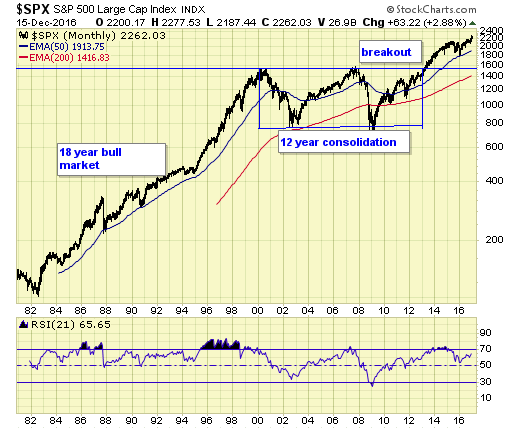

The growth sector as represented by S&P 500 also switched back to a major buy signal in late 2016.

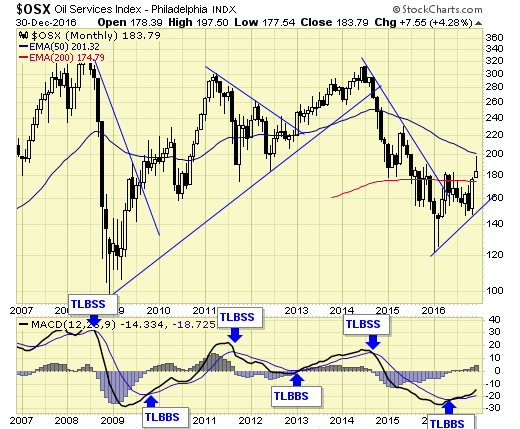

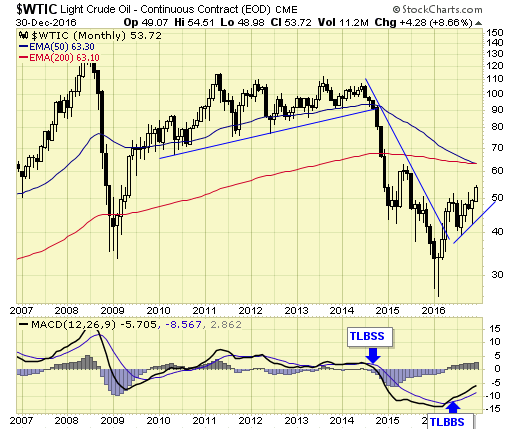

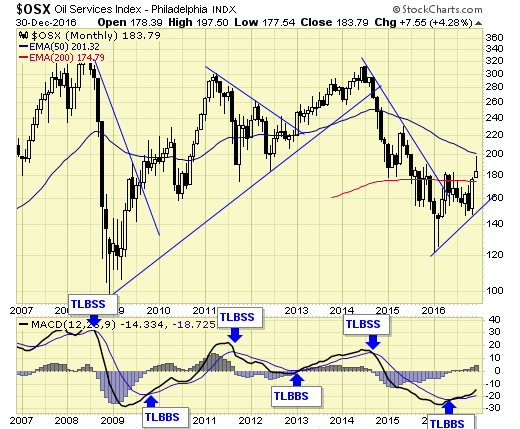

The oil and energy sector as represented by PHLX Oil Service had a major buy signal in early 2016, ending the major sell signal from 2014. The multi month consolidation after the new major buy signal provided us with excellent entries, with a 40% allocation for the long term.

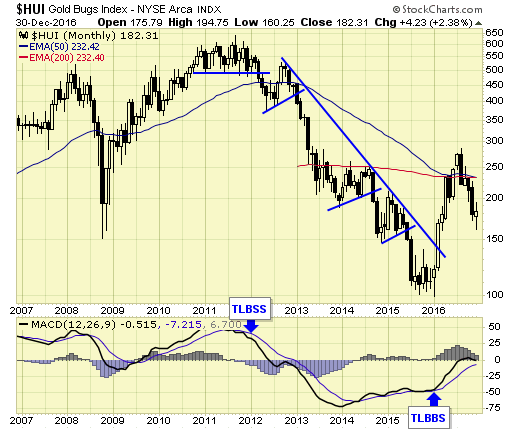

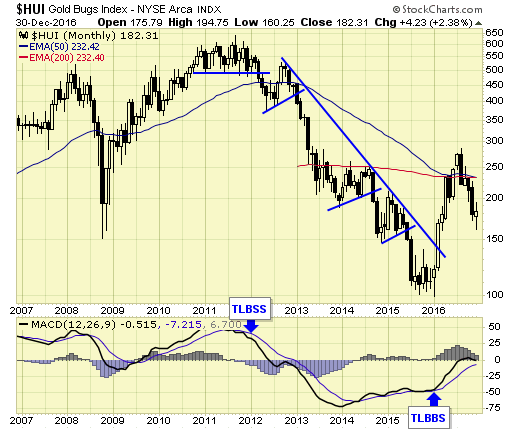

The gold sector as represented by ARCA Gold BUGS had a major buy signal early in 2016, but it was a price spike and no entries could be made, and no consolidation with no trendline support established so far to set up for a long term allocation.

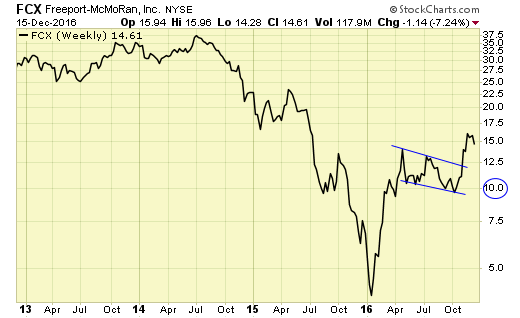

Copper sector also had a major buy signal in 2016. Teck Resources Ltd B (NYSE:TECK) went straight up, while Freeport-McMoran Copper & Gold Inc (NYSE:FCX) consolidated and we entered near the bottom of the consolidation range, with a 10% allocation for the long term.

Summary

All three sectors are on major buy signals at the end of 2016.

The best opportunities were in the energy sector where we took a 40% allocation intended to be held for the long term.

These positions are up on average of 14.8% as of 12/31.

We also took a 10% long term position in FCX, a giant in the copper sector.

FCX is up 23% as of 12/31.

It was another profitable year.

Looking forward to 2017

Our long term stocks/bond model switched back to favoring equities in 2016, therefore, I’m looking for new opportunities to be fully invested in 2017.

The growth sector is in a super bull market with no overhead resistance.

The major breakout in 2013 after a 12 year consolidation rendered this a young bull and should have plenty of upside in coming years.

Any sharp correction with a spike in VIX will be buying opportunities in 2017.

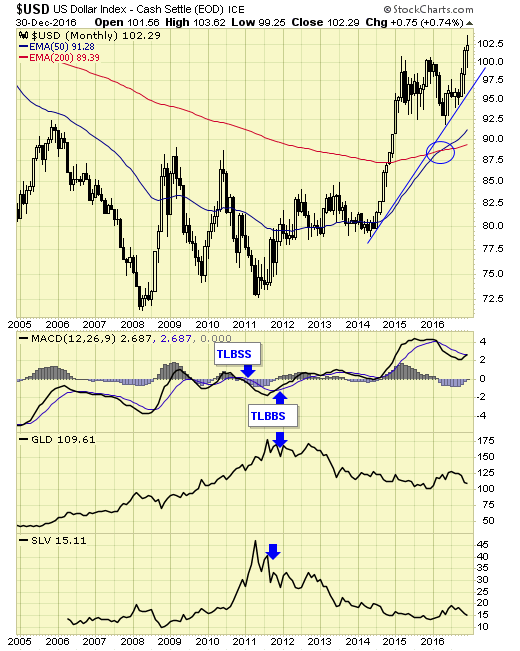

USD remains on a major buy signal since 2011.

As long as the dollar remains in a bull market, precious metals will be under pressure overall although we may see some sharp bounces periodically.

$HUI is on a major buy signal, and we need to see a multi month consolidation, with trendline support established before considering any long term allocations.

Crude oil bottomed in 2016 and a new bull market is in progress.

OSX is on major buy signal with established trendline support.

We look for new buying opportunities in 2017 at cycle bottoms.

Summary

All three sectors are on major buy signals.

Growth sector has no overhead resistance, any sharp correction with a spike in VIX in 2017 will be buying opportunities, ideally confirmed with a cycle bottom.

Energy sector has trendline support and plenty of potential upside, looking for new buying opportunities at cycle bottoms in 2017.

Gold sector needs to establish trendline support on the monthly chart, ideally after a multi month consolidation. If so, I may consider some long term positions at a cycle bottom.

FCX is an individual stock and I am content with a 10% long term holding. However, should we see a correction to the 50/200ema in 2017, I may consider adding to positions if there is investable capital.

I will also consider some short term trading upon set ups and if risks are manageable.

Looking for new opportunities in 2017 to put the remaining capital to work to become fully invested.

Thank you for your continuous support and looking forward to another profitable year together.

End of review