by Clement Thibault

It's been quite a while since cigarettes were considered glamorous. At least in the developed world.

With a population that grows more acutely aware of health concerns each day, who would have guessed that tobacco companies would be the next stock market buy? Especially because right now, one would be hard pressed to find a medical professional condoning, let alone recommending, tobacco products.

Nevertheless, Philip Morris International Inc (N:PM), British American Tobacco PLC (N:BTI), Altria Group (N:MO) and Reynolds American Inc (N:RAI) have all gotten recent thumbs-up from investors amid the larger, bear market agitation over the past few months. So, is this a good time to invest in tobacco companies?

Performance

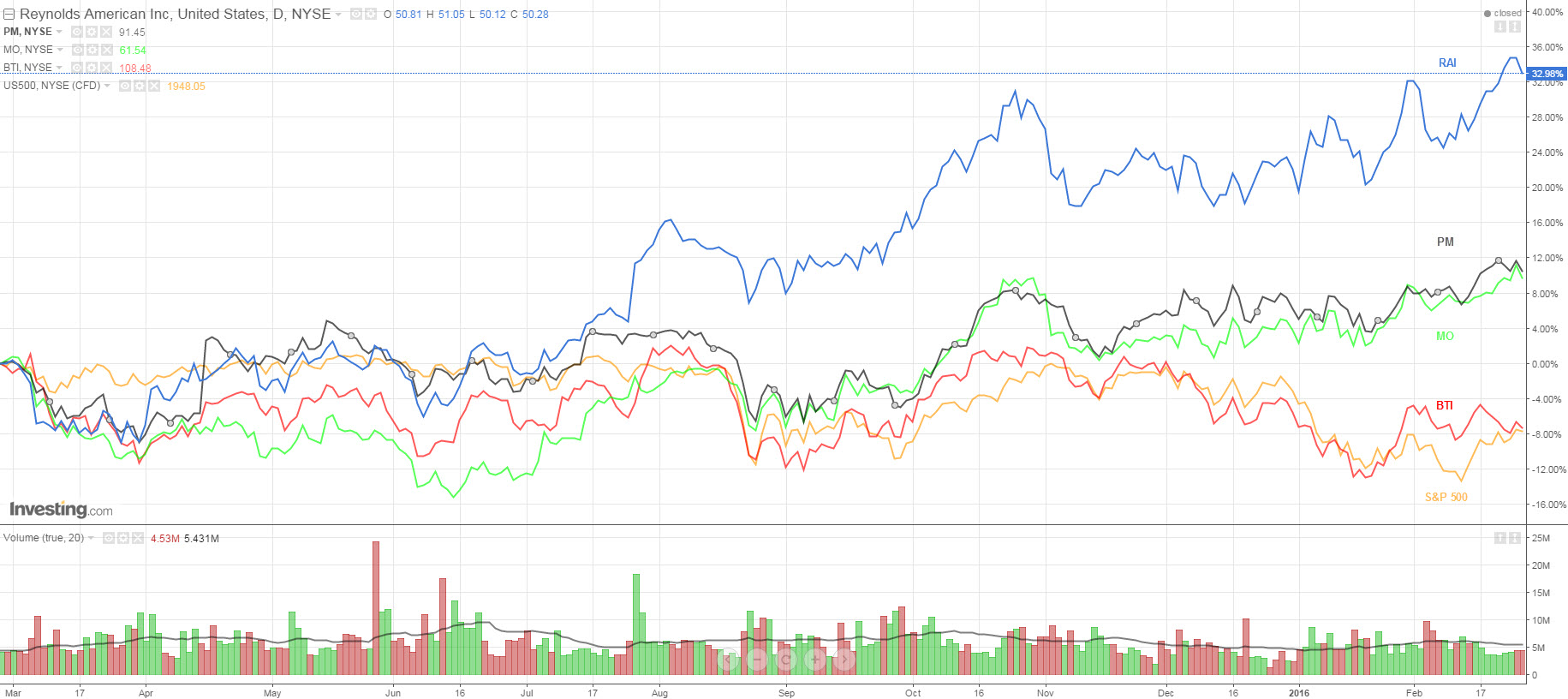

Since the beginning of the year each of the four companies mentioned above outperformed the S&P 500, with three out of four posting nice gains for the first two months of the year. Quite a feat, considering market conditions.

Since the first trading day of 2016, Reynolds—which owns Newport, Camel, Pall Mall and Kent, among other global brands—leads the pack, with a gain of 11.24%. Next is Altria Group—whose brands include Chesterfield, Parliament, L&M and Marlboro—which increased by 7.2%. The remaining company in the green, Philip Morris International—which co-owns Marlboro as well as other Altria properties—rose 5.08% over the same period.

At the same time, British American Tobacco is down 0.01%, while the S&P 500 lost 3.24%.

A look at each stock's individual performance over the past year, above, tells roughly the same story. Reynolds is the front-runner with a 32.98% surge, Philip Morris and Altria grew by 10.07% and 9.45% respectively, while British American and the S&P 500 both fell a little over 7%. All this excludes dividends, which we'll look at next.

Dividends

One of the major benefits of tobacco company stocks is their handsome dividend payouts. And during a period when markets are turbulent and unreliable, and interest rates are low to potentially negative, a dividend's importance grows tenfold; Too often it can mean the difference between pocketing a gain or watching the value of your investment shrink.

It is worth noting that the average dividend yield for Consumer Goods stocks is 2.47%, which isn't bad. But when a satisfactory yield is considered somewhere upward of 3%, it isn’t so good either.

Top performer Reynolds American hands out an annual dividend of $1.68, for a yield of 3.34% per share, 35% higher than the average dividend. Altria gives back $2.26 annually, a yield of 3.67% per share, 48% more than the average. Philip Morris pays out an annual $4.08 per share, for a 4.46% yield. That's 80% higher than the average.

However, the tobacco dividend king is, without a doubt, British American Tobacco. Every year, the company's investors enjoy a $5.82 dividend, making for a hefty 5.36% yield—more than double the average for this sector.

Each of these companies is also dedicated to giving cash back to their shareholders. Over the past 10 years, each has reliably paid a dividend; Collectively they have a payout ratio of over 70%, meaning more than 70% of their annual EPS is handed out to the company's stakeholders as a dividend.

Looking Ahead

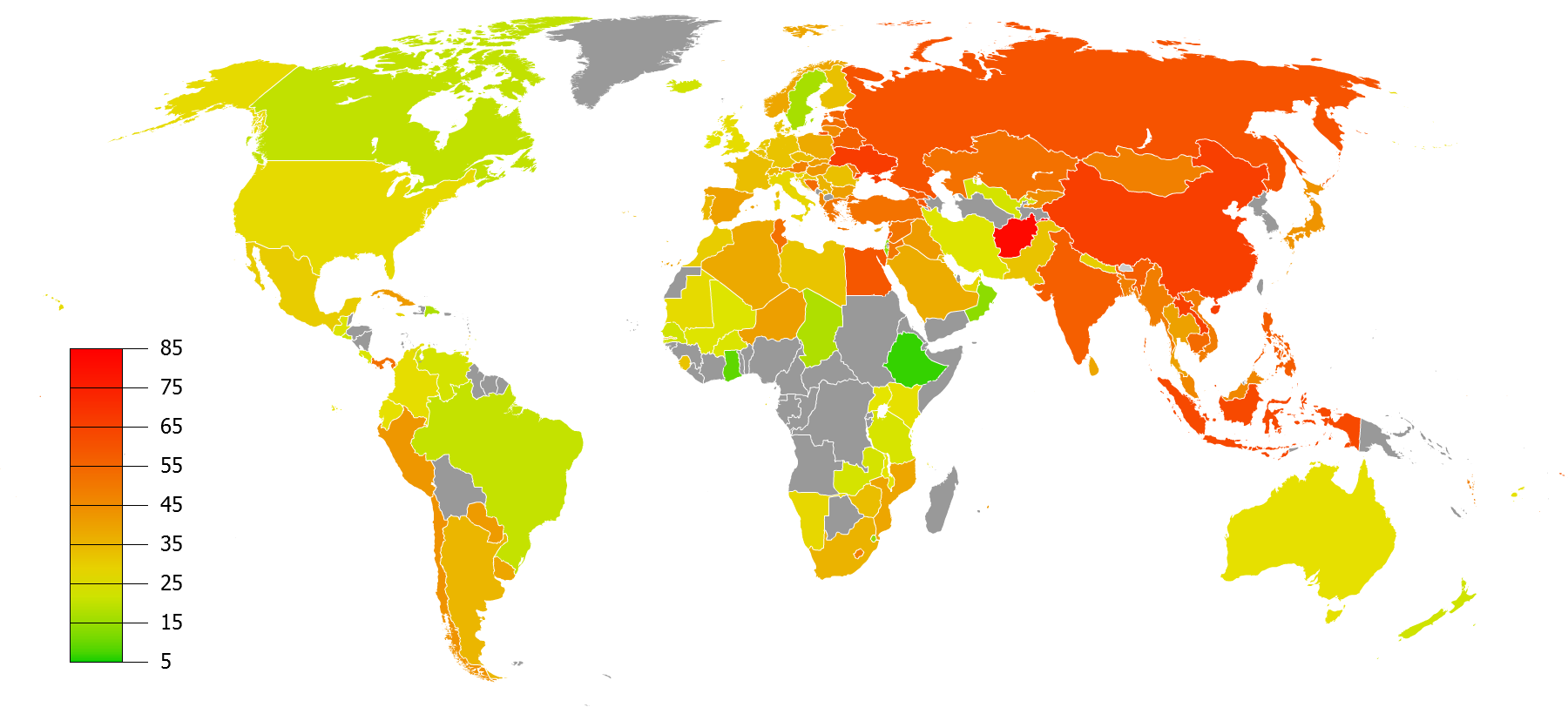

Though the U.S smoking rate is at an all-time low—a CDC study found only 16.8% Americans currently smoke, down from 20.9% in 2005—outside of the US, growth prospects for tobacco companies are considerably stronger. According to a WHO report in 2008, over half the adult male population in such emerging market countries as China, India, Russia and Indonesia are smokers.

Given that these four countries alone constitute about a third of the global population, there's still a lot of market share to go around.

Overall, tobacco companies are holding a strong position at the moment. Their products are relatively inexpensive, highly addictive, and in countries where alcohol is frowned on for religious reasons, tobacco is the legal 'sin' of choice for public occasions, adding to its popularity.

With stocks that perform well, distribute a strong dividend, and are well positioned globally—at least over the short term—they look poised to succeed. The longer term outlook is muddier, however.

Scientific discoveries and more aggressive anti-smoking legislation could cripple tobacco companies eventually, although this could take decades to play out. And ever mindful of the potential loss of market share that might be on the way, tobacco companies haven't been standing still. Fear of obsolescence has spurred them to create their own lines of electronic cigarettes, which now have their own, albeit smaller, niche.

Our conclusion? Right now, tobacco may be bad for your health, but it could be pretty good for your portfolio.