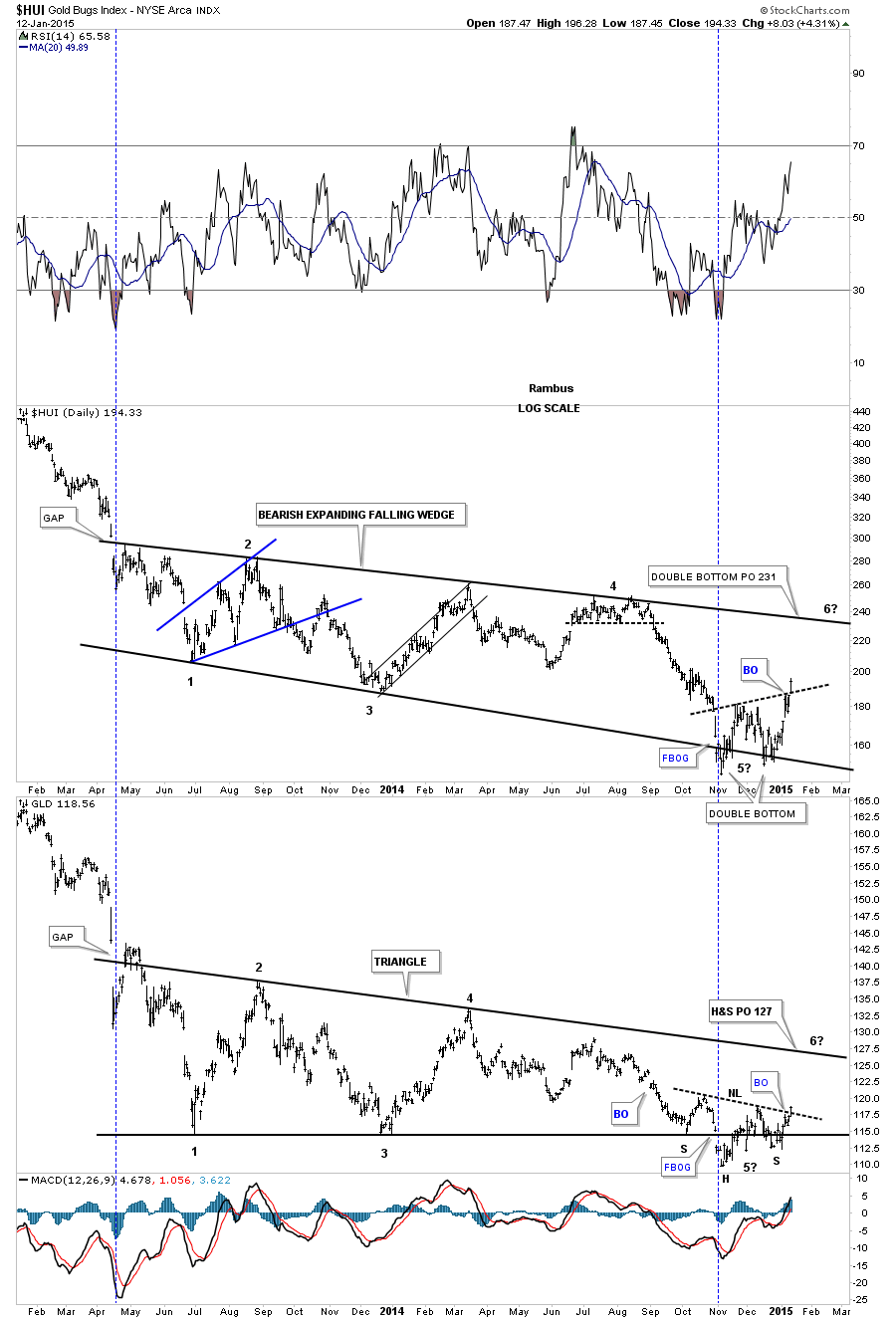

I believe yesterday marked a breakout on the precious metals stock indexes as well as in gold, though they have different reversal patterns. Below is the combo chart we’ve been following that has the HUI on top and the SPDR Gold Trust (ARCA:GLD) on the bottom.

As you can see, the HUI broke above its double bottom trendline yesterday while GLD broke above its neckline. Both reversal patterns have a price objective back up to the top rails of their 18 month consolidation patterns. I’m still viewing this rally off of the November low as a counter trend rally within the bear market. Instead of having just four reversal points it looks like we’ll see at least six to complete their respective consolidation patterns. A serious break above the top rail of the 18 month consolidation would then call into question the validity of the bear market.

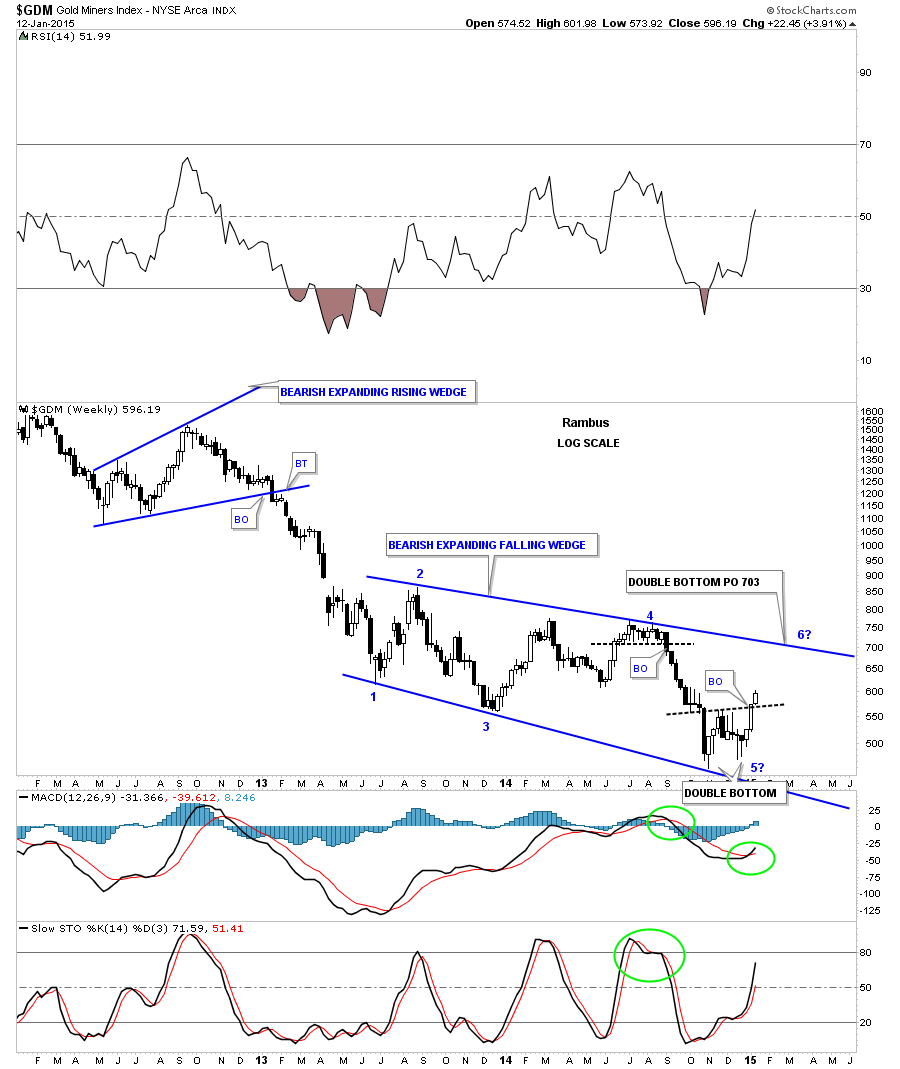

Below is a weekly chart for the ARCA Gold Miners ETF (GDM) that shows its 18 month blue bearish expanding falling wedge. The double bottom has a price objective up to the 700 area which coincides with the top rail.

Our line in the sand is now the double bottom trendline. Above is bullish and below is bearish. Note the price action at reversal point #4. If you recall, we went short on the breakout of that black dashed horizontal trendline using Direxion Daily Jr Gld Mnrs Bear 3X (NYSE:JDST) and Direxion Daily Gold Miners Bear 2X (NYSE:DUST). You can see the string of black candles that accompanied that decline. This week is just getting started but we have two white candles in place so far.

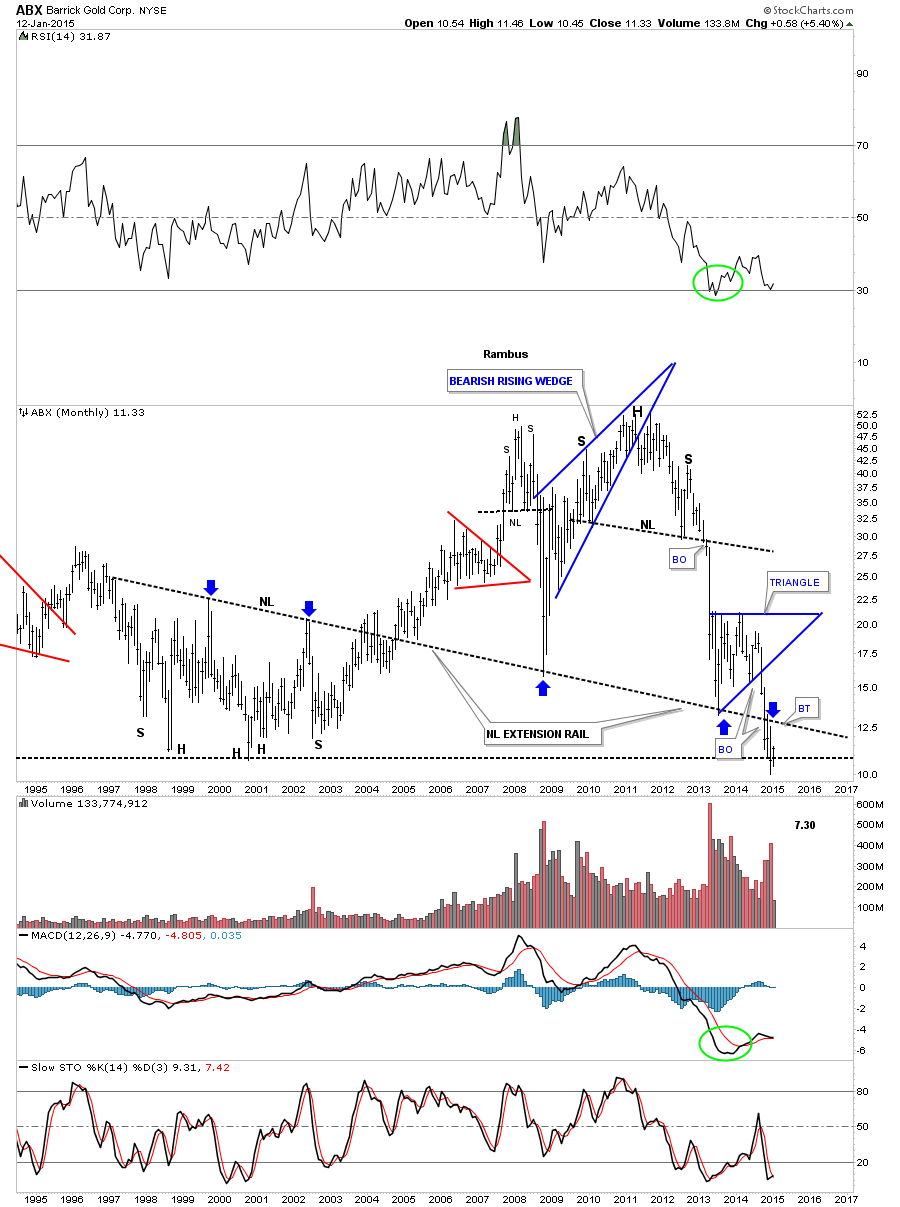

Let's now look under the hood to see what is running these indexes, starting with one of the big ones Barrick Gold Corporation (NYSE:ABX). The monthly chart shows where the neckline extension rail may come into play if we get this counter trend rally to the upside.

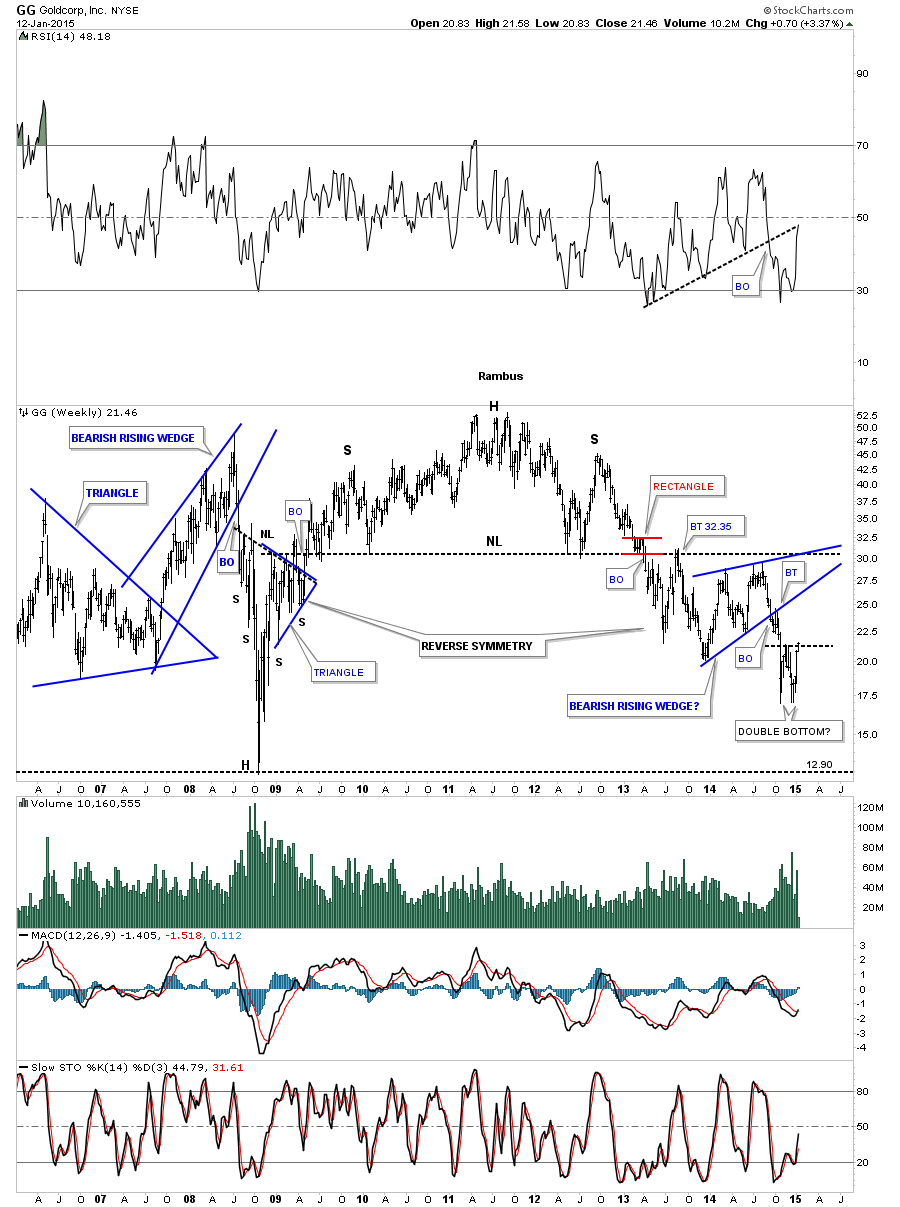

The weekly chart for Goldcorp Inc (NYSE:GG) shows it trying to break out from a small double bottom. It could backtest the bottom rail of the blue bearish rising wedge again.

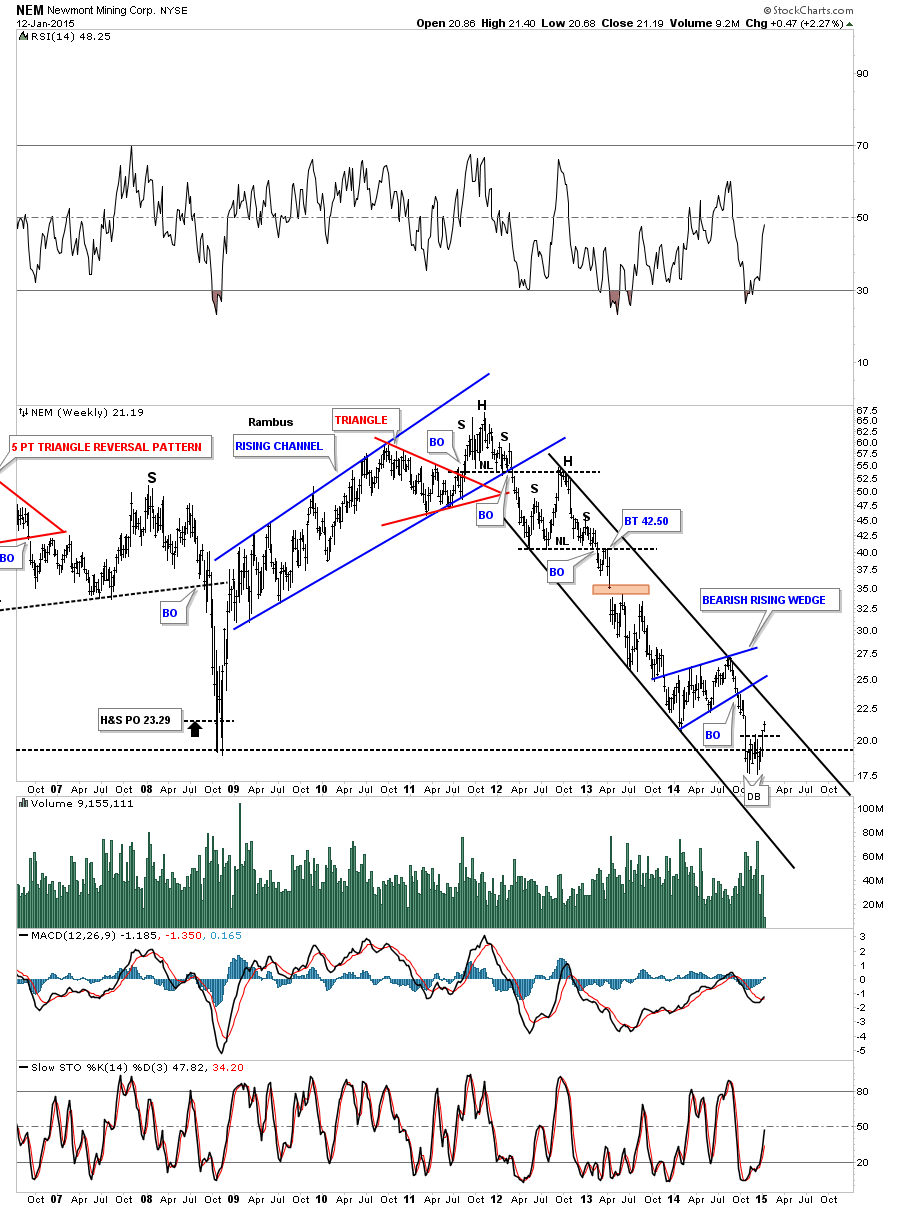

Newmont Mining Corporation (NYSE:NEM) is another big cap PM stock that is breaking out above a small double bottom.

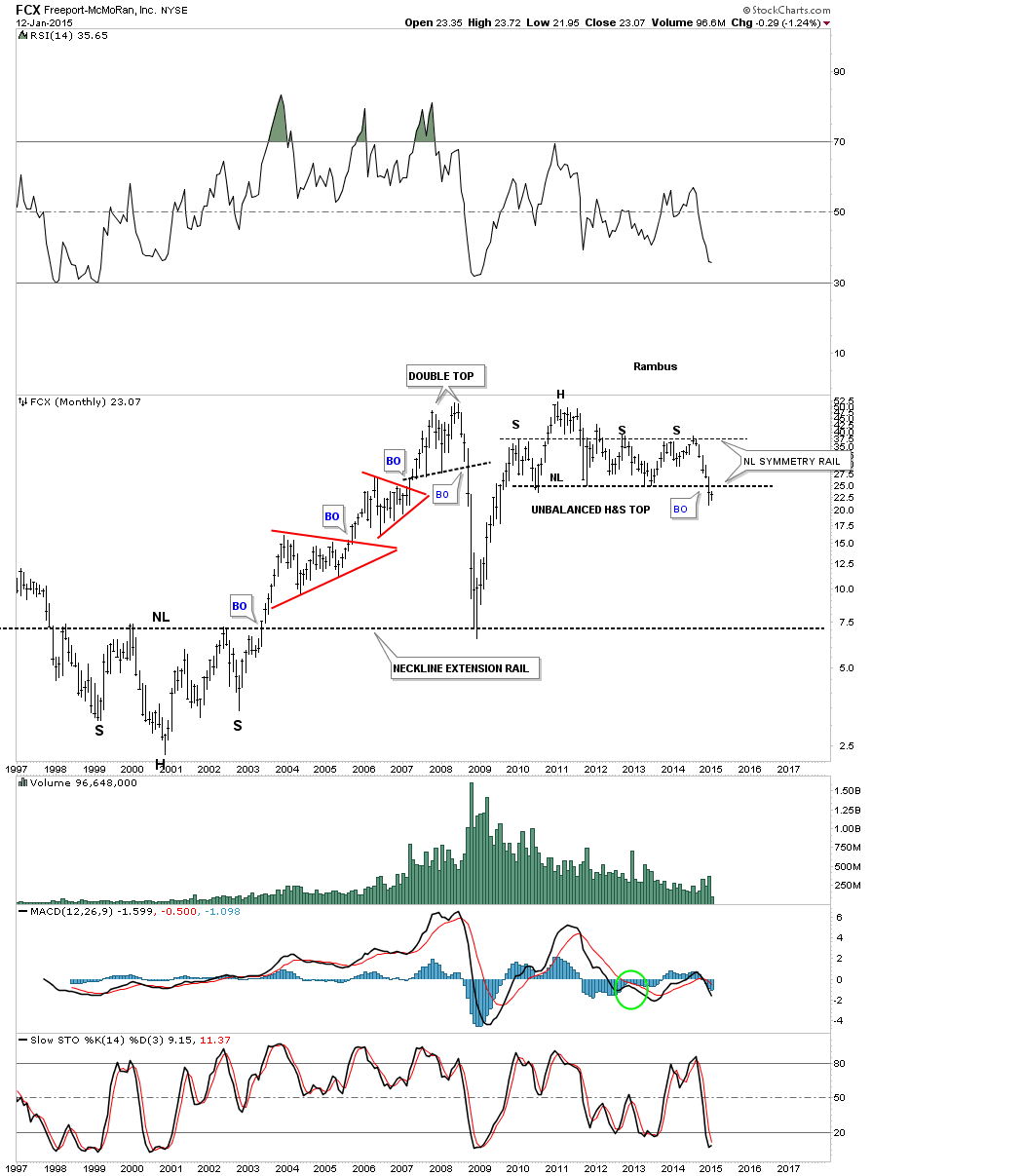

It looks like Freeport-McMoran Copper & Gold (NYSE:FCX) is in the process of backtesting the neckline from an unbalanced H&S top.

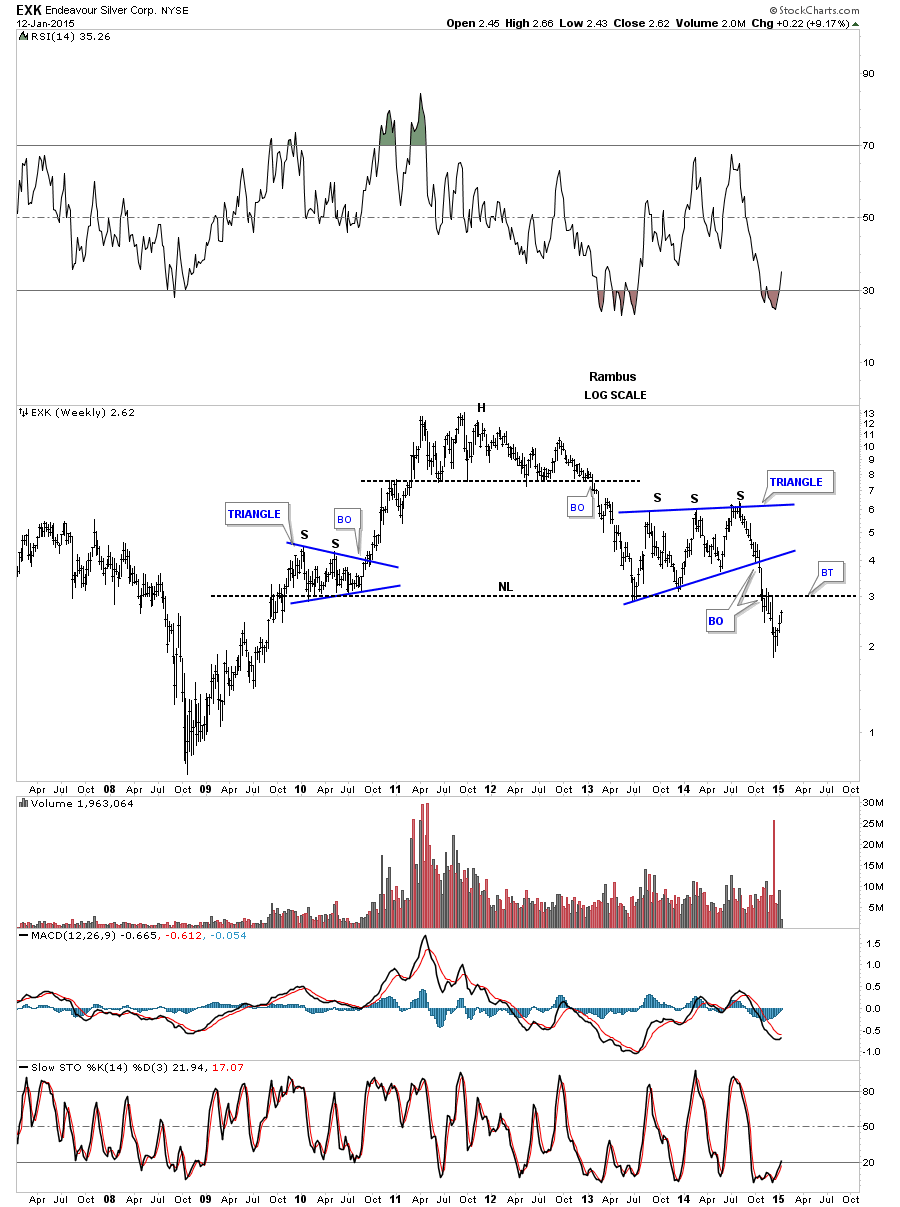

Endeavour Silver Corp. (NYSE:EXK) looks like it too is in the process of backtesting its potential multi year neckline.

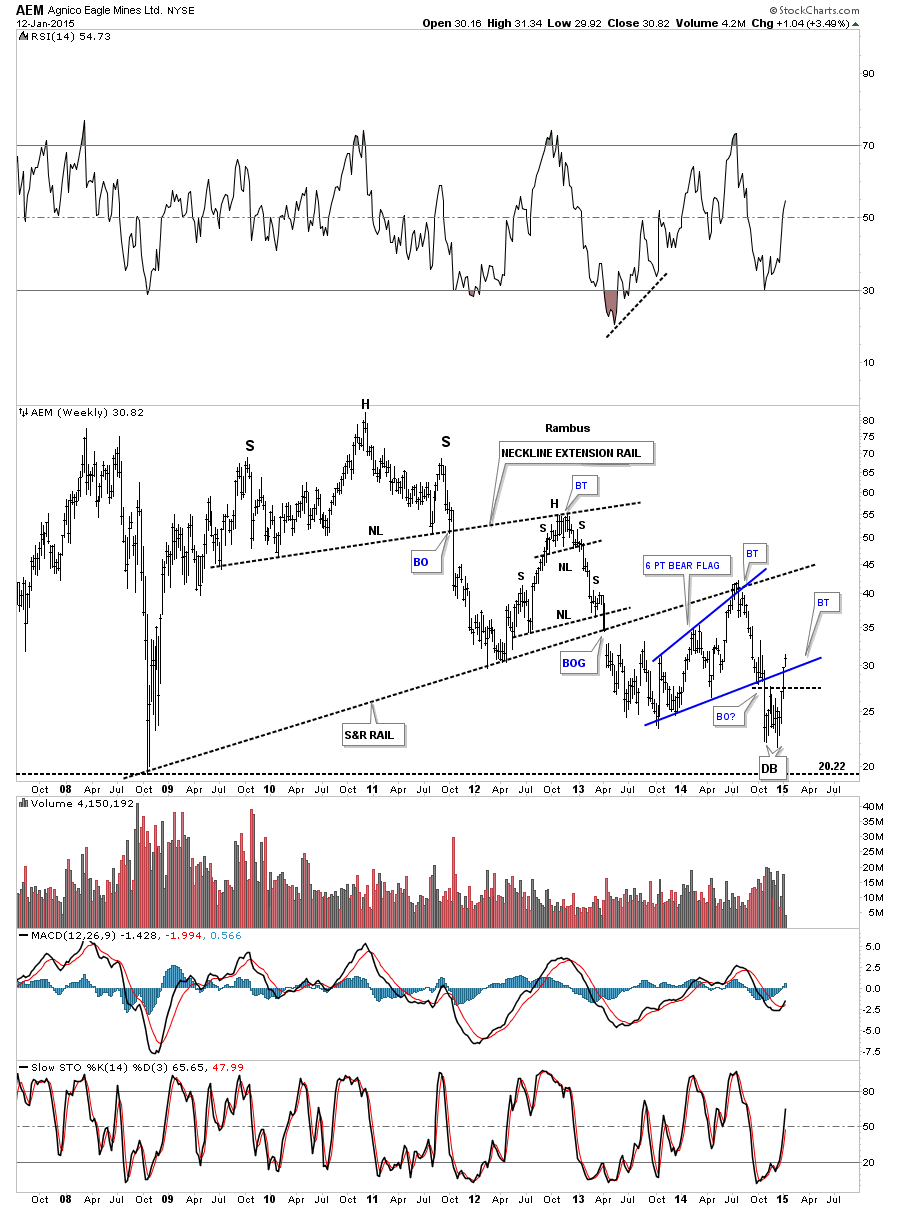

Agnico Eagle Mines (NYSE:AEM) is showing some strength after breaking out from its double bottom and is now breaking above the bottom blue rail of a 6 point expanding bear flag.

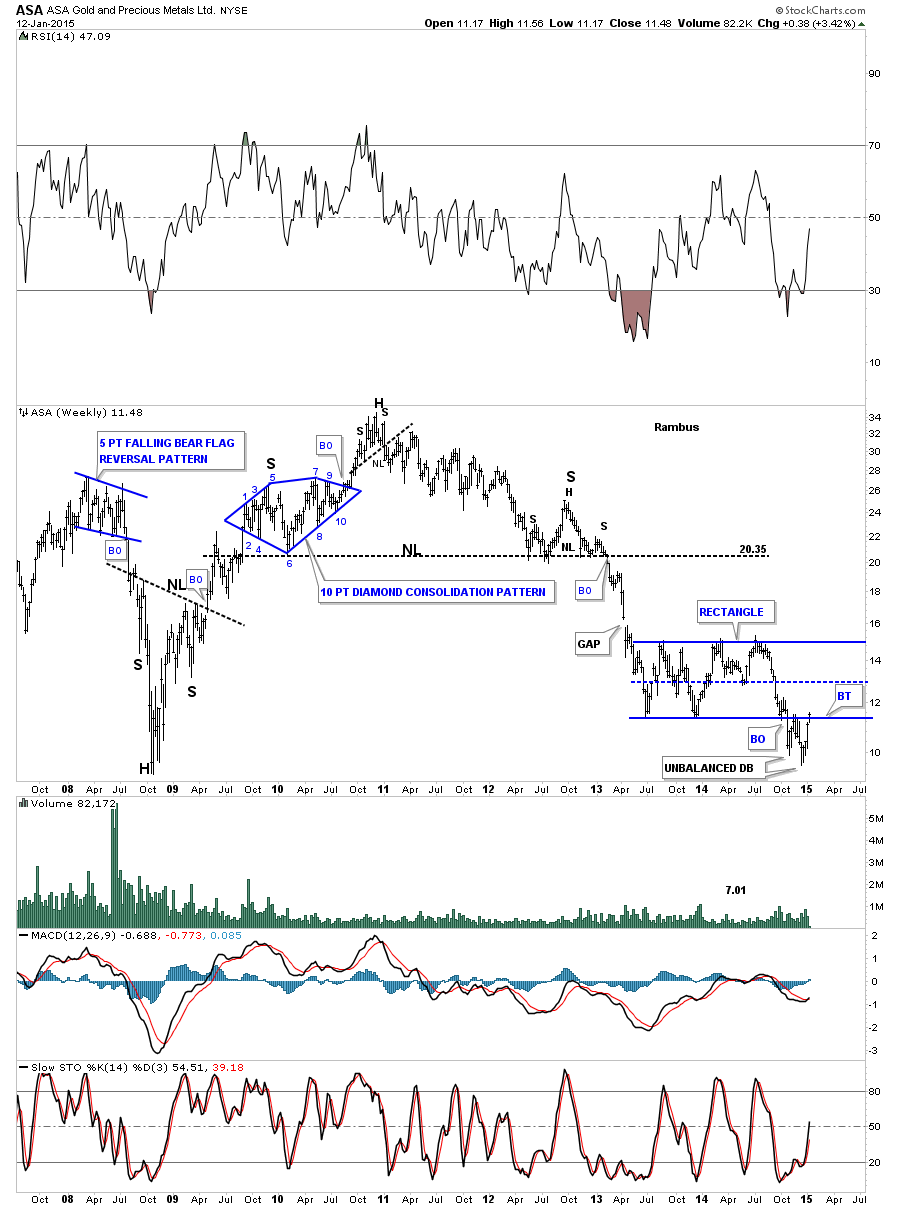

ASA Gold and Precious Metals (NYSE:ASA) is showing some strength by closing back above the bottom rail of a well defined rectangle.

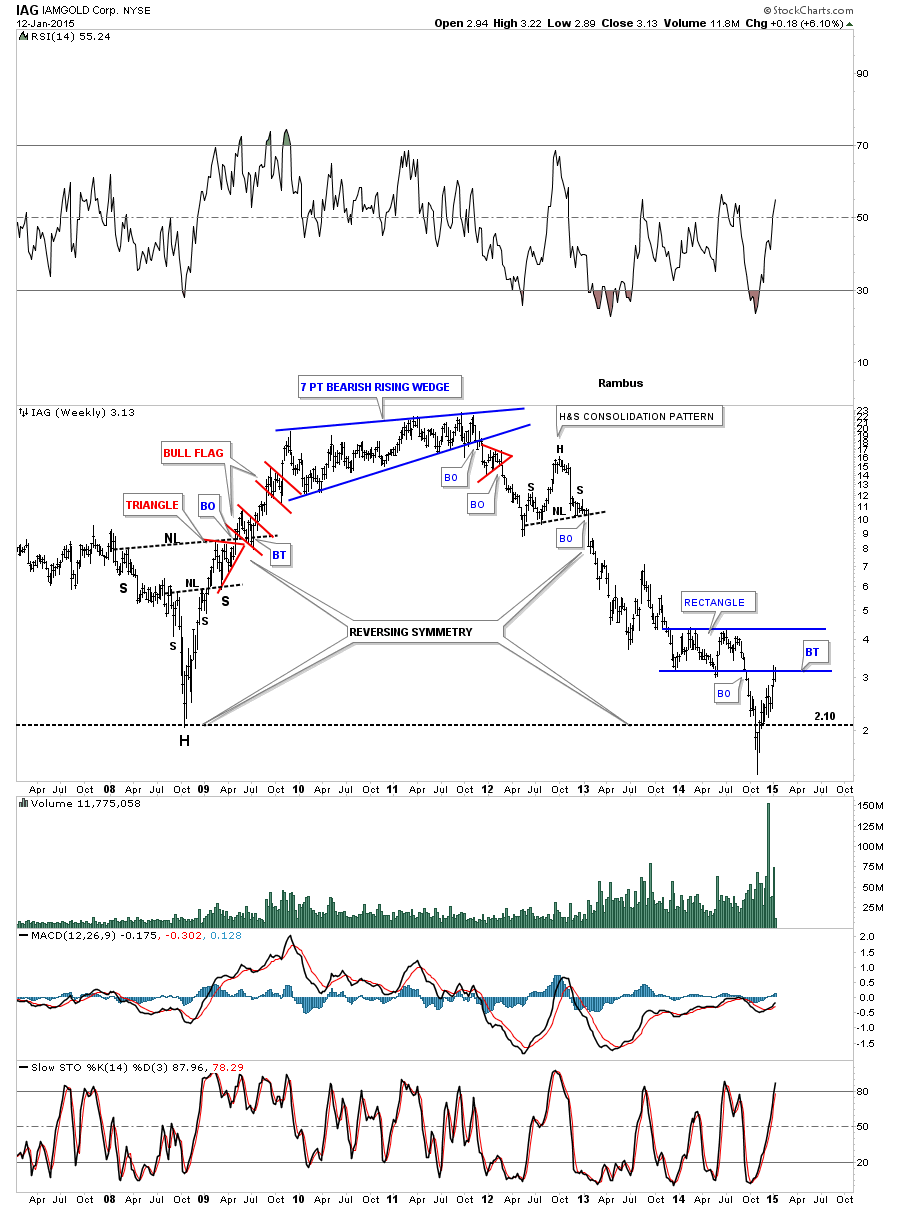

IAMGold Corporation (NYSE:IAG) hit the bottom rail of its blue rectangle but sold off on the initial hit. This is one to keep an eye on.

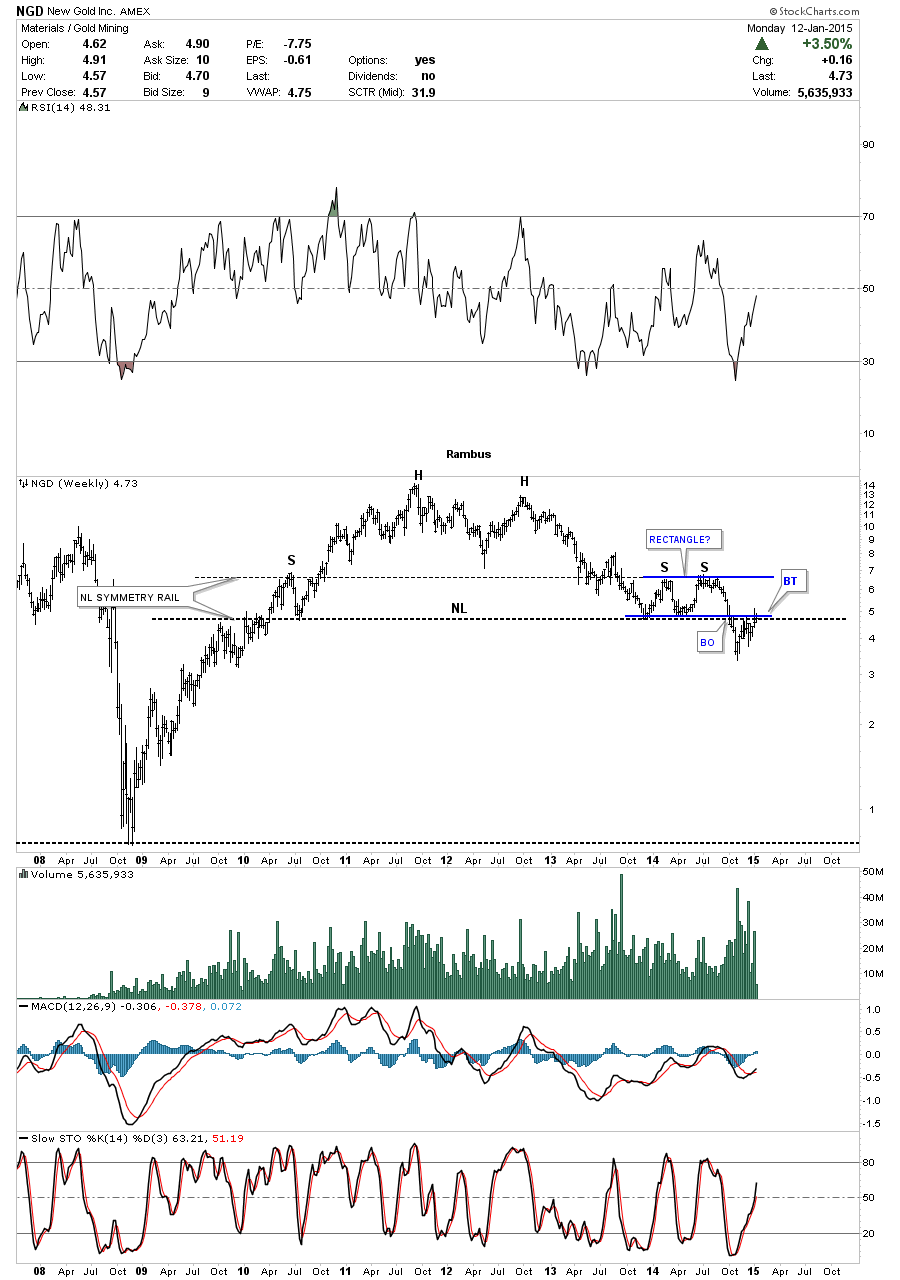

New Gold (AMEX:NGD) is attempting to backtest its multi year neckline.

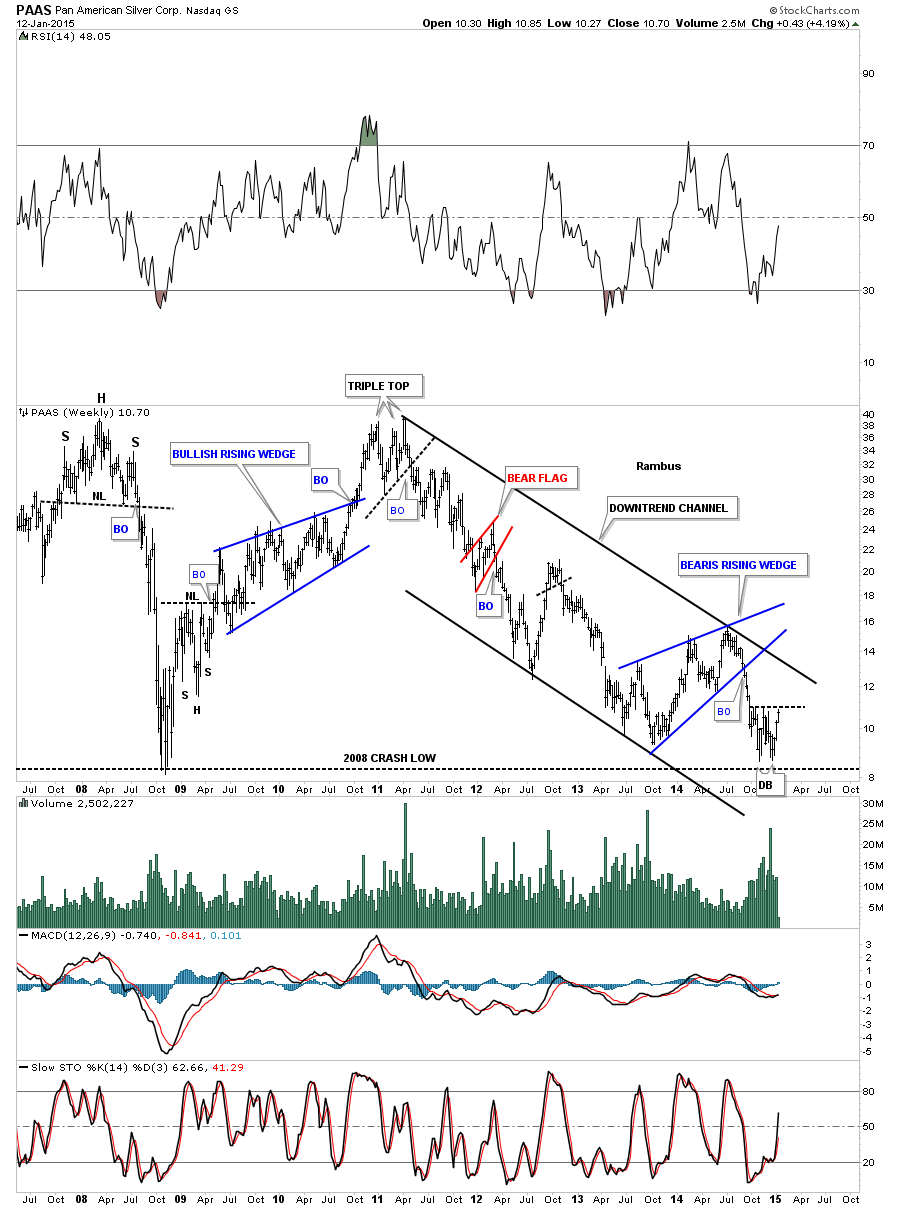

Pan American Silver (NASDAQ:PAAS) is showing a potential small double bottom within the major downtrend channel.

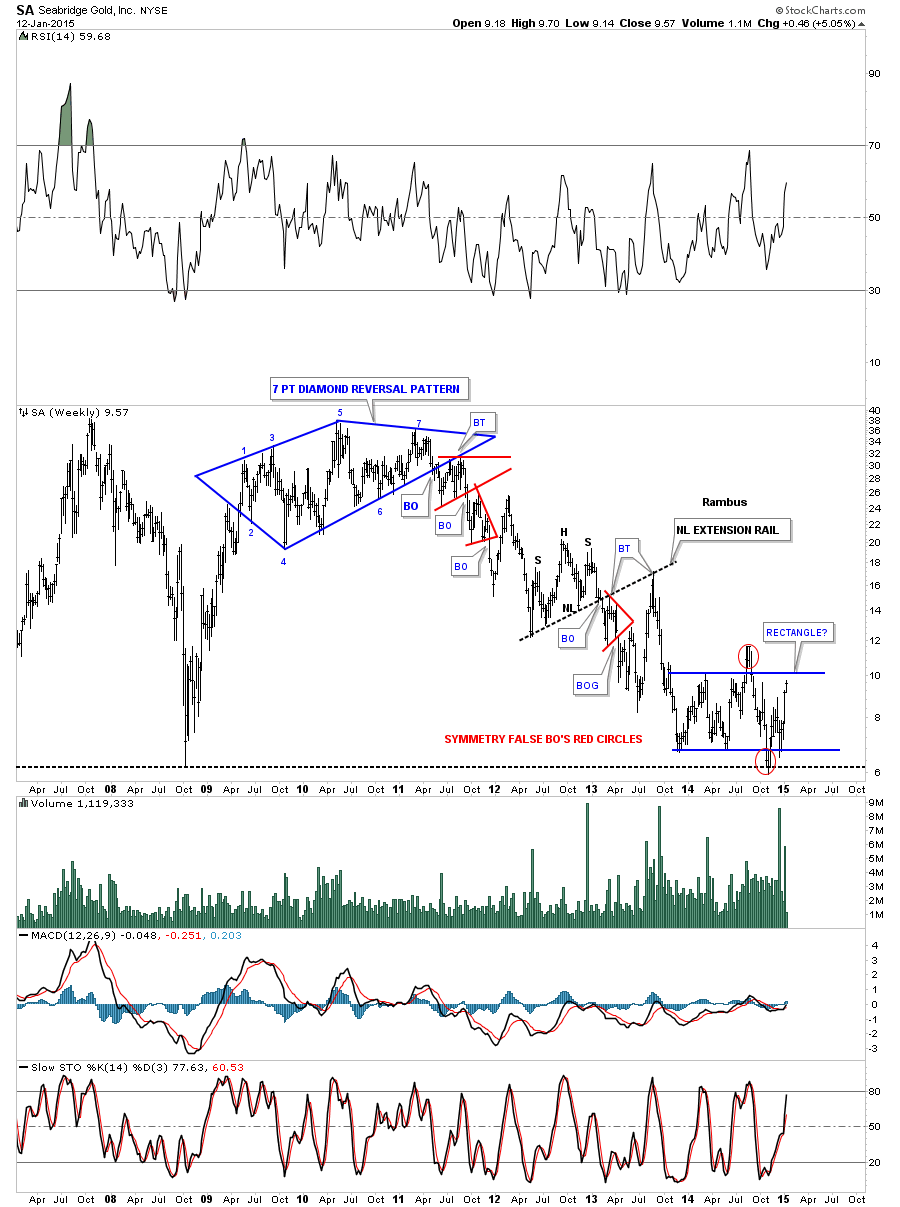

Seabridge Gold (NYSE:SA) is still chopping around in a big, one year loose rectangle.

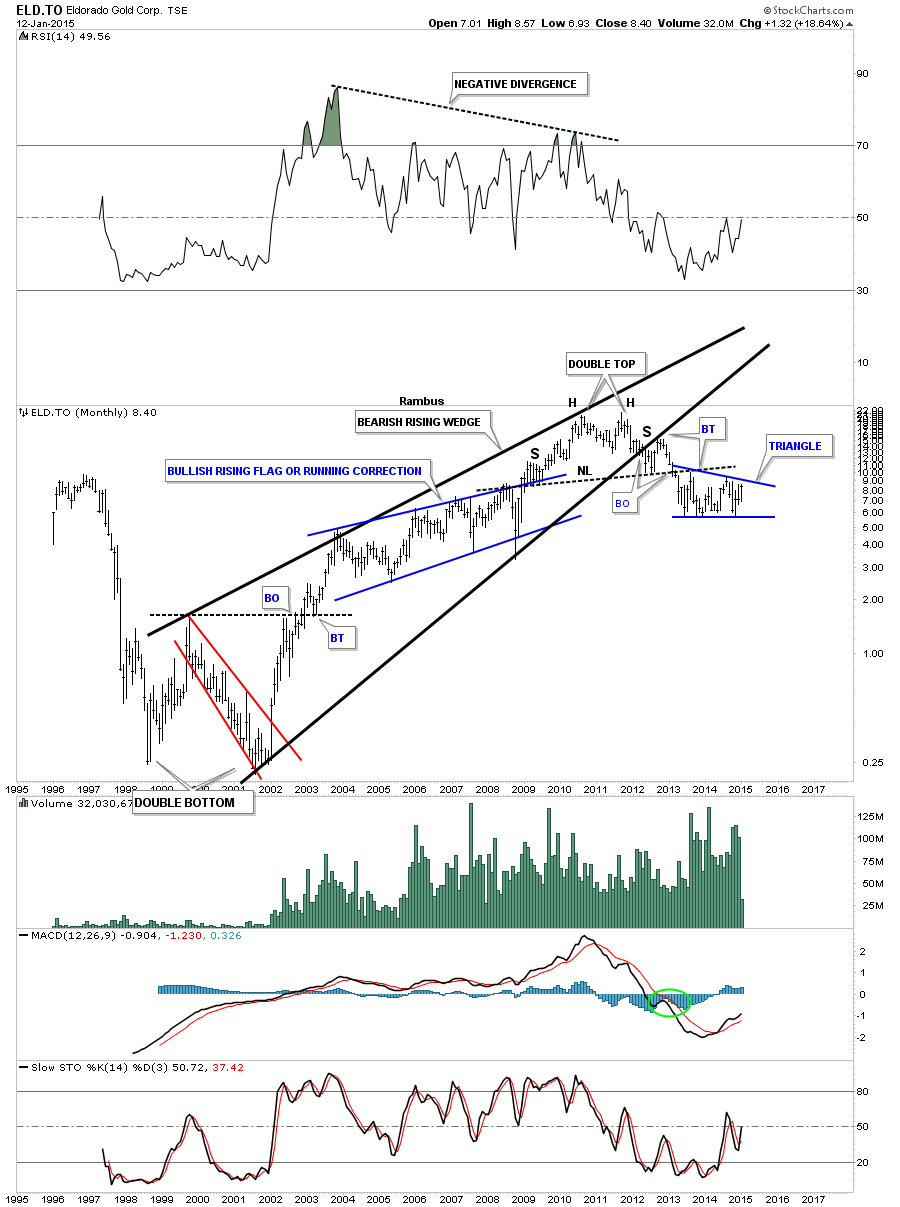

Eldorado Gold (TO:ELD) is trading inside the blue triangle which is located just below the big neckline.

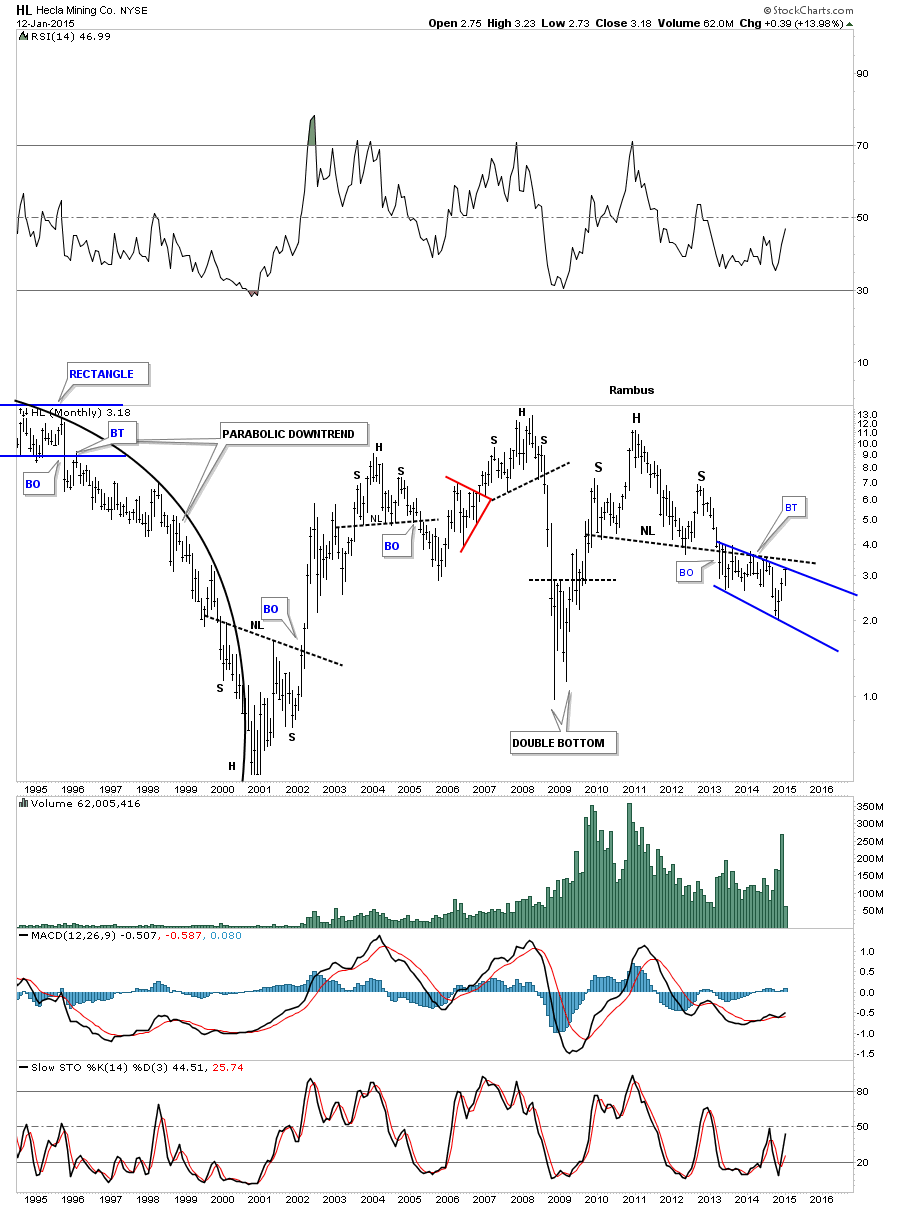

Hecla Mining (NYSE:HL) is still chopping around below its big H&S neckline.

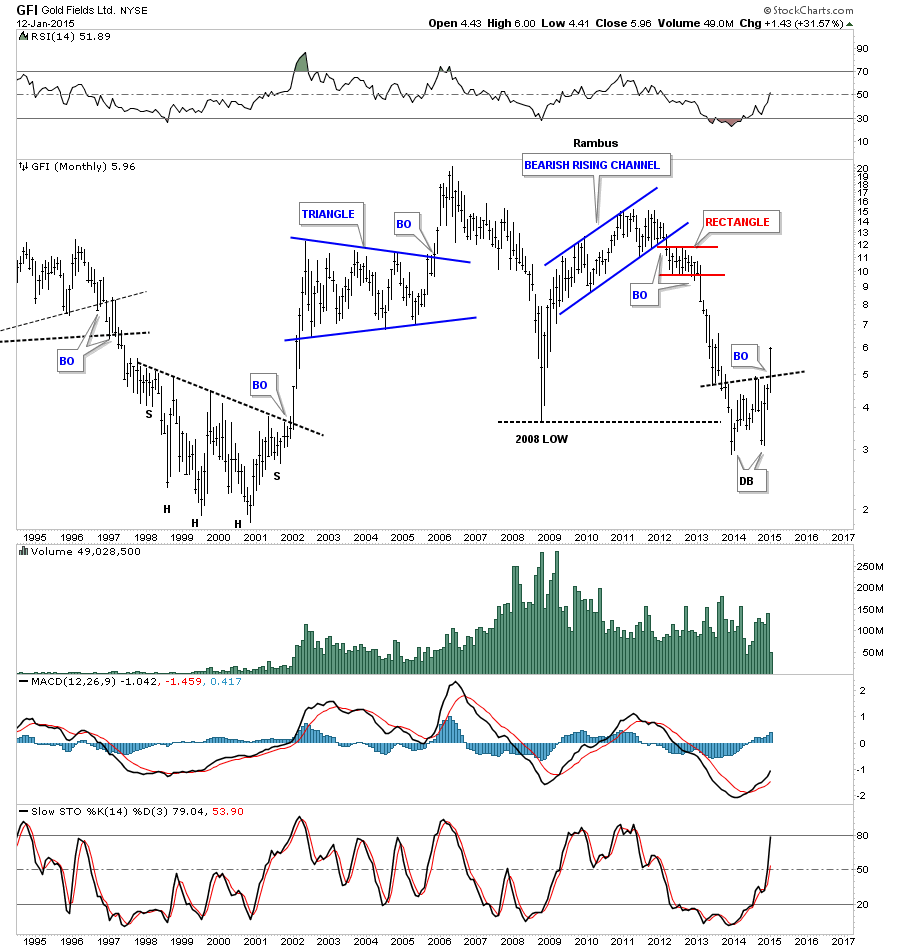

Gold Fields (NYSE:GFI) is showing some relative strength by breaking above its double bottom trendline.

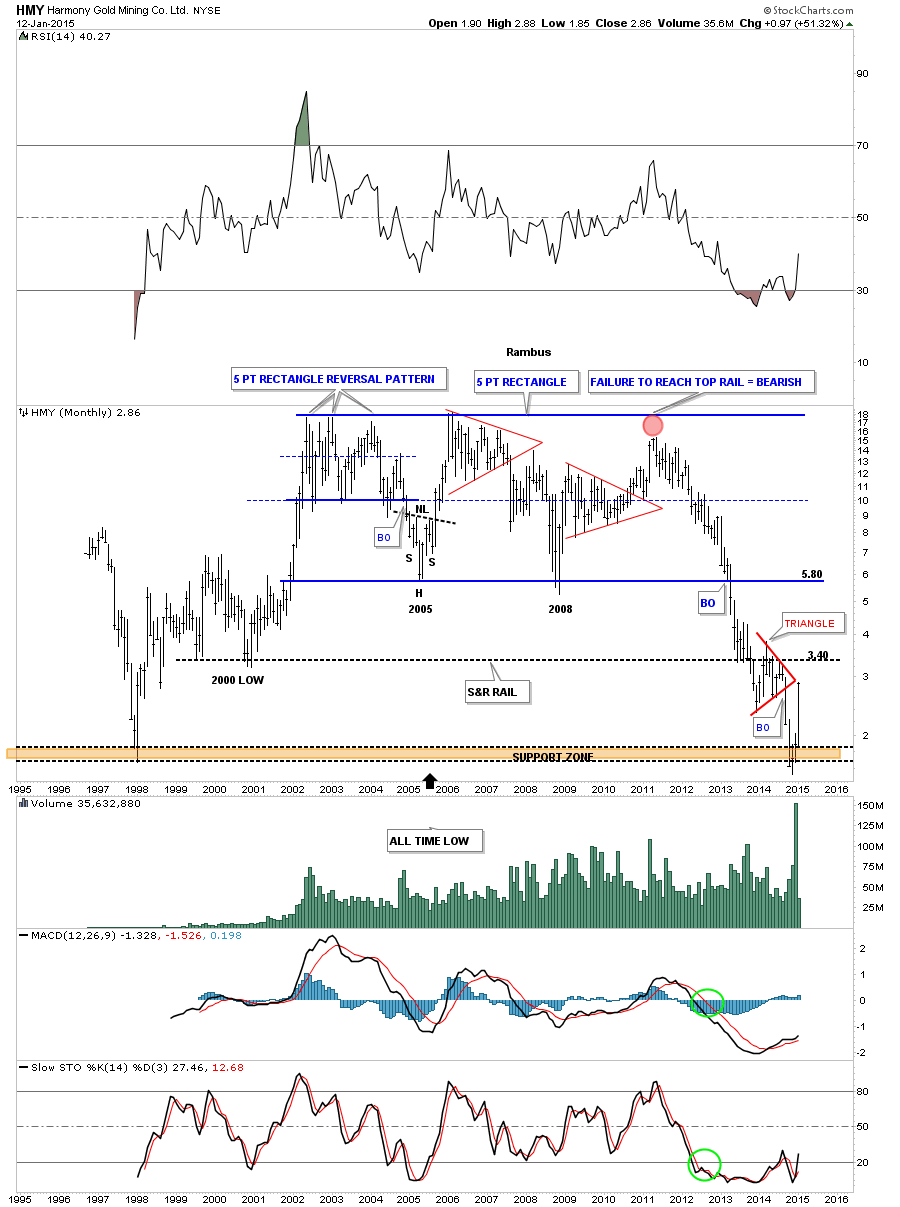

Harmony Gold Mining (NYSE:HMY) is another South African producer that is looking strong on a relative basis.

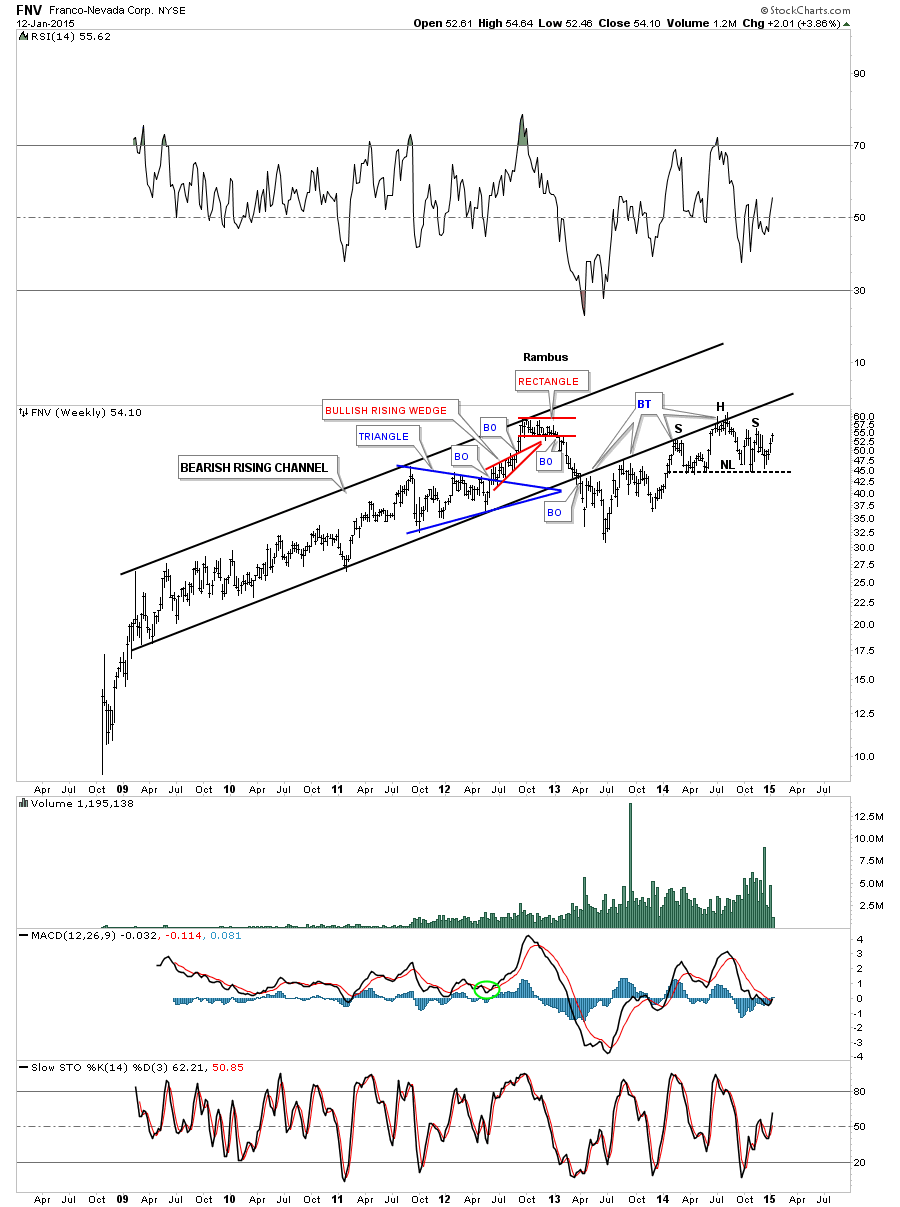

Franco-Nevada (NYSE:FNV) is still trading below the bottom rail of the huge rising channel. Maybe it will backtest the bottom black rail again for the 5th time if the PM stock remain buoyant.

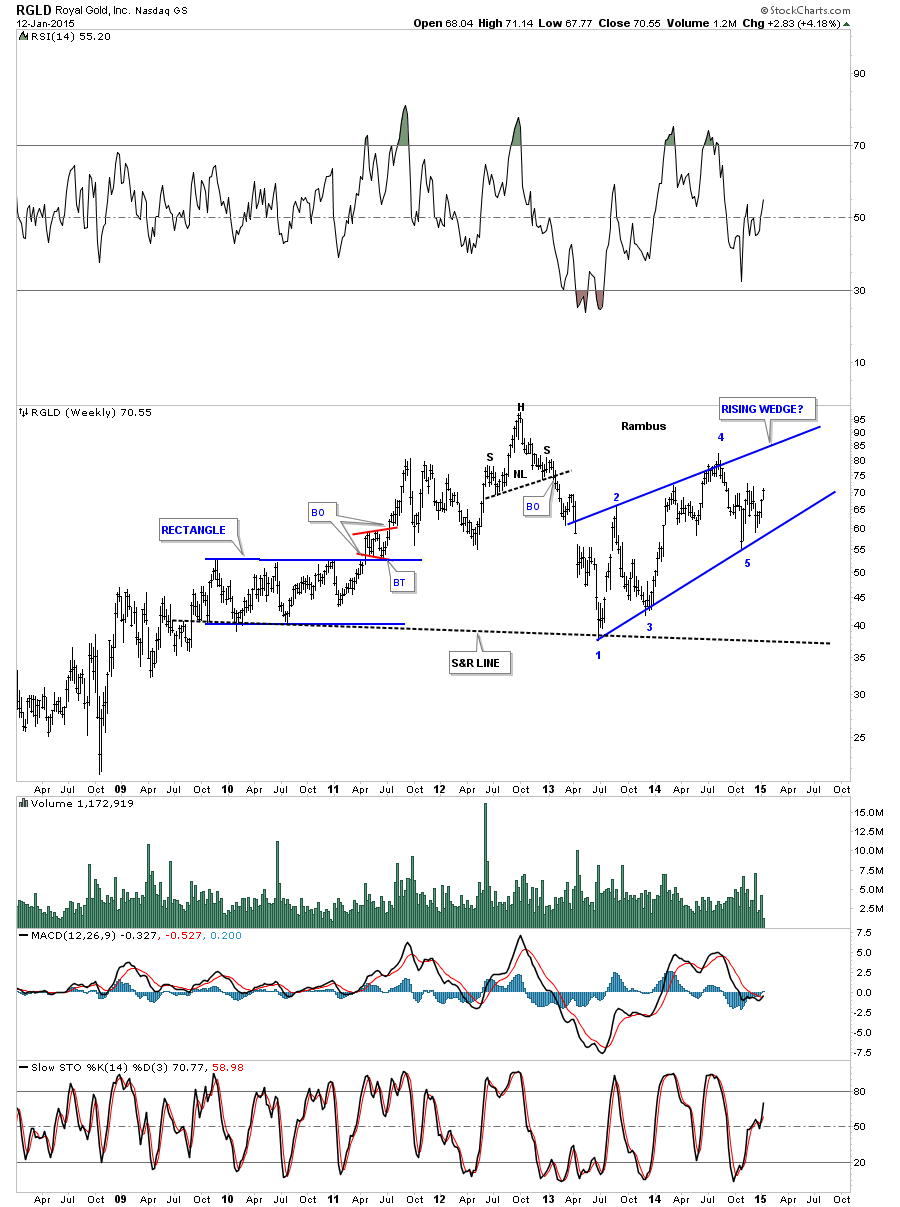

Royal Gold (NASDAQ:RGLD) is still chopping around inside a rising wedge, creating a possible 5th reversal point.

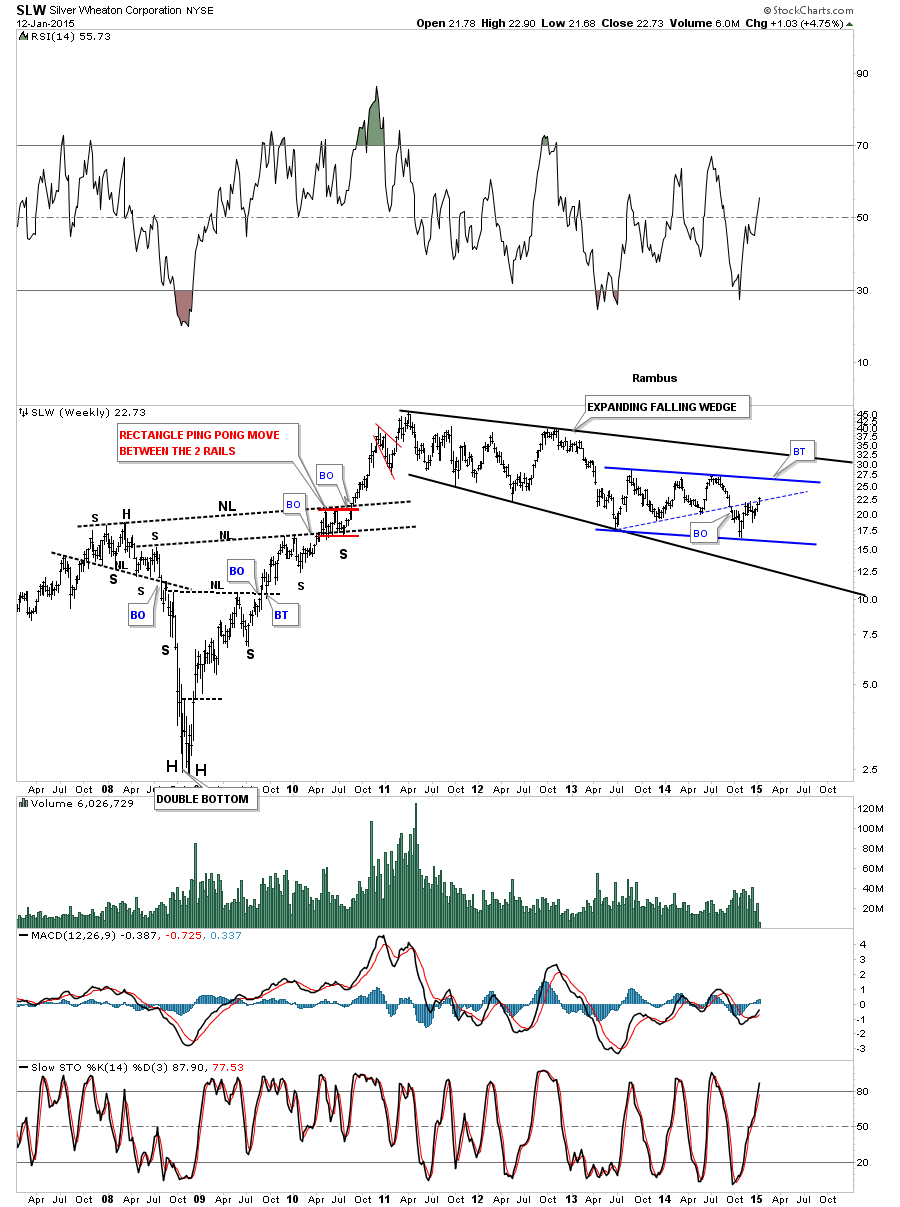

Silver Wheaton (NYSE:SLW) is trading back inside the blue triangle which is part of a bigger consolidation pattern in an expanding falling wedge.

I’ll keep a close eye on these stocks and others for clues to see how high they may move. Right now it’s still a mixed bag with some looking more bullish than others. The top rail of the expanding falling wedge, on the GDM chart above, will tell the tale if or when we get there.