- Worries over rising interest rates, persistently high inflation, and slowing economic growth have been the primary drivers of market sentiment in recent months

- Investors will continue to pile into defensive-minded dividend stocks at the expense of high-growth technology companies amid the current market backdrop

- Philip Morris International and Kimberly-Clark should be on your watchlist, thanks to their strong fundamentals, reasonable valuations, and growing dividend payouts

Wall Street’s major averages have gotten off to a difficult start to 2023 as sentiment continues to be dictated by worries over the Federal Reserve’s ongoing plans to raise interest rates to combat persistently high inflation.

While steep declines have whacked non-profitable high-growth tech companies, defensive-minded value stocks with strong dividends have enjoyed impressive returns over the past year. Indeed, the iShares S&P 500 Value ETF (NYSE:IVE) has outperformed the iShares S&P 500 Growth ETF (NYSE:IVW) by a wide margin in the past 12 months as investors dumped risky stocks for safer bets.

Taking that into account, I recommend buying shares of Philip Morris International (NYSE:PM) and Kimberly-Clark (NYSE:KMB) to weather the market volatility expected in the new year. Both stocks — which easily beat the market in 2022 — offer relatively high dividend yields and are still reasonably valued, making them attractive defensive plays amid the current market backdrop.

Philip Morris International

- Dividend Yield: 5.04%

- Market Cap: $156.2 Billion

As I look for new investment ideas at a time of such uncertainty, Philip Morris International meets my strict criteria of profitable value companies that do well in challenging macroeconomic environments.

The cigarette-and-tobacco manufacturing company has proven over time that it can sustain a slowing economy and still provide investors with higher dividend payouts.

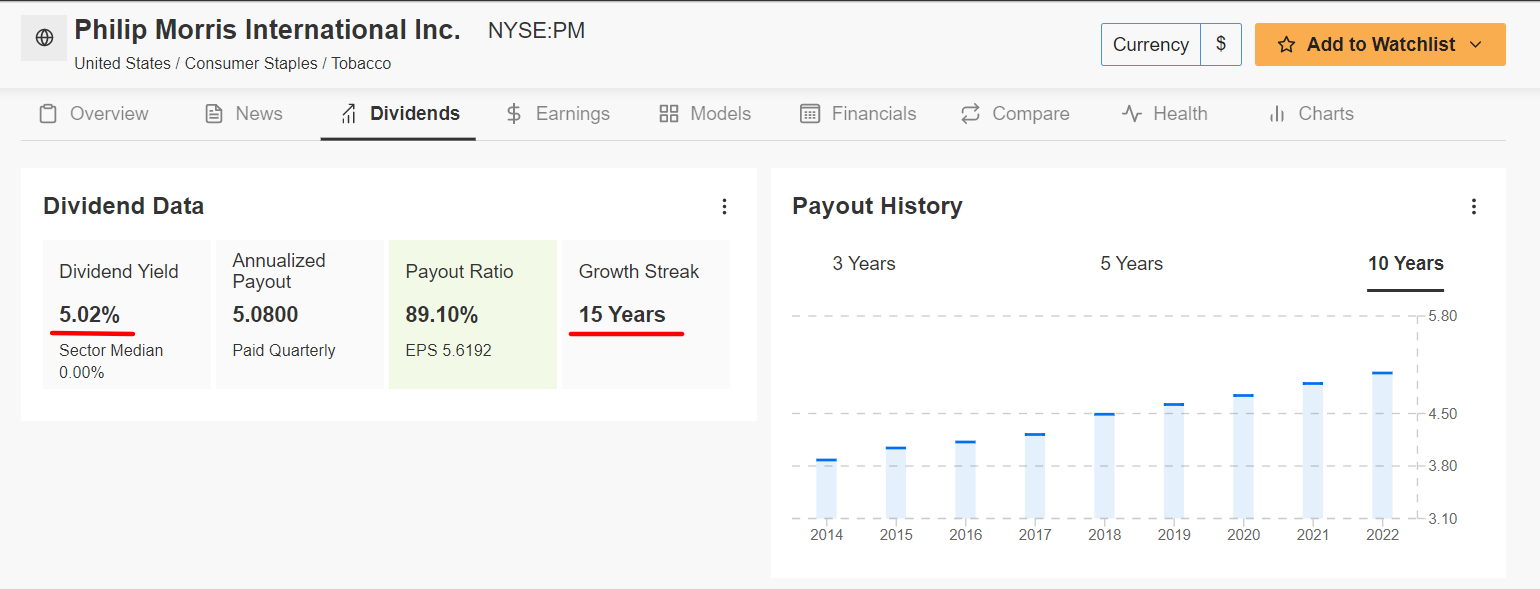

In fact, Philip Morris has increased its annual dividend for 15 years in a row, and shares currently yield 5.04%, more than triple the implied yield for the S&P 500 index, which is 1.67%.

With the dividend payout ratio set to come in above 85% for the current fiscal year, Philip Morris appears in place to build on its impressive streak of annual dividend growth, demonstrating the strength and resilience of its business.

Source: InvestingPro

I believe that Philip Morris shares are a solid pick for the year ahead as defensive-minded consumer staple companies with strong dividends and attractive valuations usually tend to outperform in a recessionary environment.

Philip Morris, which was spun off from Altria (NYSE:MO) in 2008, is the largest cigarette and tobacco company in the world, based on net sales. Its most recognized and best-selling product — which is sold in over 180 countries — is the Marlboro brand. Its portfolio also includes the IQOS smoke-free heated tobacco device, which is the top brand in the reduced-risk non-combustible heat-not-burn space.

In general, stocks of defensive companies whose products are essential to people’s everyday lives, such as cigarette manufacturers, tend to perform well during a tough market.

PM stock — which fell to a recent 52-week low of $82.85 in late September — closed at $100.82 on Tuesday. At current levels, the ‘Big Tobacco’ company has a market cap of $156.2 billion.

Shares of Philip Morris rose 6.5% in 2022, a far better performance than the iShares US Consumer Staples ETF (NYSE:IYK) which tracks the space and was up 1.5% last year.

Kimberly-Clark

- Dividend Yield: 3.42%

- Market Cap: $45.7 Billion

Kimberly-Clark is another top dividend-paying stock with an exceptional track record when it comes to returning cash to shareholders, regardless of economic conditions.

As such, KMB is a good option in my opinion for investors looking to shield themselves from further bear market volatility thanks to its continuous efforts to return capital to shareholders, mainly through dividend payouts.

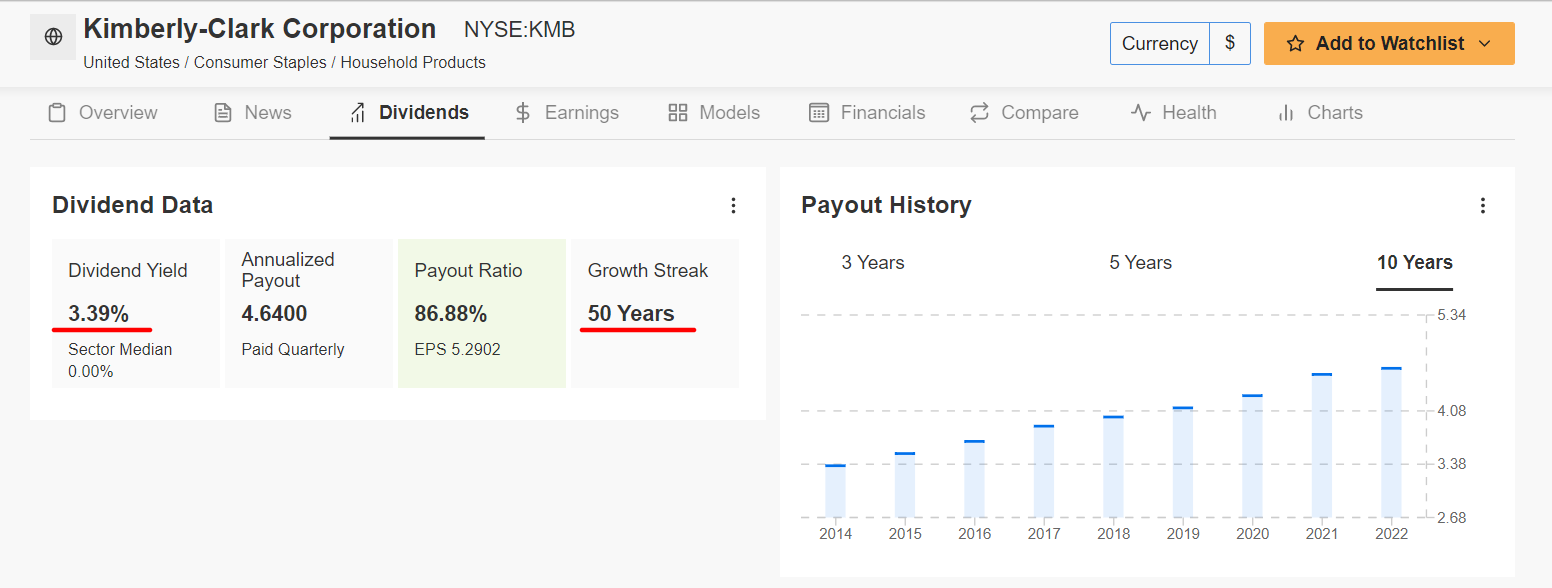

Not only do shares of the consumer products giant currently yield a market-beating 3.42%, but the company has raised its annual dividend for 50 consecutive years, earning the prestigious status of ‘Dividend King’. The ‘Dividend Kings’ are a group of just 48 stocks that have increased their annual dividend payout for at least 50 years in a row.

In addition to boosting dividends, Kimberly-Clark has also returned capital to stockholders by using share buybacks.

Source: InvestingPro

Kimberly-Clark is well-placed to achieve ongoing growth amid the difficult operating backdrop as consumers cut back spending on discretionary items and divert more spending into basic needs.

The well-diversified global consumer products company operates in 175 countries and sells a range of products that consumers need regardless of the condition of the economy, including diapers, paper towels, and tissues. Some of its most recognized brands include Huggies diapers and baby wipes, Kleenex facial tissue, Cottonelle and Scott toilet paper, and Kotex feminine hygiene products.

Taking that into consideration, I expect Kimberly-Clark to put in a strong performance in 2023, with shares likely to break out to fresh all-time highs, thanks to its illustrious track record of shareholder returns combined with its leading position in the households & personal products space.

KMB — which slumped below $110 per share in October to reach the lowest since January 2019 — closed at $135.54 last night, about 15% away from its all-time high of $160.16 touched in August 2020. At current levels, the Irving, Texas-based company has a market cap of $45.7 billion.

Shares ended 2022 with a yearly loss of just 5%, outpacing the annual performance of major industry peers, such as Procter & Gamble (NYSE:PG) (-7.3%), Colgate-Palmolive (NYSE:CL) (-7.7%), and Clorox (NYSE:CLX) (-19.5%).

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). I remain long on the Energy Select Sector SPDR ETF (XLE) and the Health Care Select Sector SPDR ETF (XLV).

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.