We’re almost three months into this crisis and three things are crystal clear:

- Plenty of “household-name” dividend-payers are in big trouble—and not just the ones you see in the news. When the payout cuts come, the resulting share-price drops will crush the unwary.

- Way too many people are clinging to blue chips yielding 2% or 3%. But is such a small payout worth it when you can lose that much in a single trading session?

- We can’t trust any stated yield until we verify a company’s cash flow.

This may sound a bit alarmist, but imagine if I told you in January that by mid-May, Ford Motor Company (NYSE:F), General Motors (NYSE:GM), Walt Disney (NYSE:DIS) and Las Vegas Sands (NYSE:LVS) would have all either eliminated or, in Disney’s case, delayed their dividends. You’d have thought I’d gone mad! Yet here we are.

Today I’m going to show you how to safeguard yourself from the next plunging payout. I’ll also show you two dividend growers to put on your watch list now.

First, though, there’s another threat we need to talk about.

The Feds Go After Your Retirement

If Uncle Sam has his way, the dividends I just mentioned won’t be the last to get clipped. You probably already know the government is taking a tough line, watching how companies use any relief funds they receive and paying particular attention to share buybacks, executive compensation and, yes, dividends!

You could argue—as I do—that dividends should be off-limits. These payouts are a lifeline for retirees, everyday folks trying to get through this crisis with their income (and nest egg) intact.

Nonetheless, dividends do seem likely to attract more scrutiny. Which means we need to comb through our portfolios and weed out any dividend payers that:

- Are in disastrous industries like travel and energy.

- Have rickety balance sheets, with high debt and little cash on hand, and …

- Unsustainable payout ratios, or annual dividends as a percentage of free cash flow (FCF). If any of your stocks pay more than 50% of FCF as dividends, you need to watch them very carefully.

The feds aren’t the only reason why we need to scour our portfolios for these “dividend landmines.”

Reliable Indicator Flashes Red

The (very) obscure Baltic Dry Index (BDI) is my favorite proxy for global shipping, measuring the cost of transporting various raw materials around the globe.

It predicted the grand economic “stop” that happened in March. The BDI began dropping late last year and plummeted to a major low just as the coronavirus started to take its toll in the US.

The BDI began to bounce in February, preceding the stock market’s bounce, and, most importantly, began to roll over again in recent weeks. That caught my attention: if the global economy really is beginning to open up, we should see a bigger pop in the BDI.

The BDI’s New Warning

Our Real Opportunity Is Coming—Let’s Get Ready

Indicators like this are why I’m advising readers to fight the fear of missing out as stocks rise. Truth is, we’ve got plenty of time to deploy our capital.

But as I wrote last Friday, we shouldn’t be idle, either. Instead, let’s get ready for the real rebound to come by building our shopping list and making a few strategic buys of stocks with unusually high dividend yields, unusually big discounts and businesses set to grow post-pandemic. Let’s dial up a couple potential plays now.

Crown Castle to Uncle Sam: Take a Hike

I find myself writing about cell-tower real estate investment trusts (REITs) like Crown Castle International (NYSE:CCI) a lot these days. That’s because they’re perfectly suited to this pandemic. CCI, for example, has 40,000 cell towers across America and counts all major US telcos as “tenants,” including AT&T (NYSE:T), Verizon Communications (NYSE:VZ) and T-Mobile US (NASDAQ:TMUS).

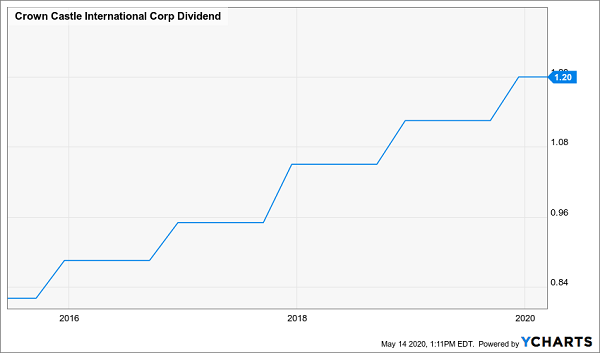

With everyone from corporate execs to grandparents and grandkids Zooming up a storm, it’s safe to say CCI won’t need an assist from Uncle Sam. And with CCI’s funds from operations (FFO, the best metric for a REIT) jumping 8% in Q1, this payout is going nowhere but up. That, in turn, will build on the 3.2% yield you’d get on a buy today.

CCI’s Pandemic-Proof Payout Growth

CCI also stood by its 2020 guidance, the midpoint of which is $6.12 in per-share FFO, up nearly 8% from 2019. The payout accounts for 78% of the 2020 figure, which sounds high but is actually very conservative for a REIT.

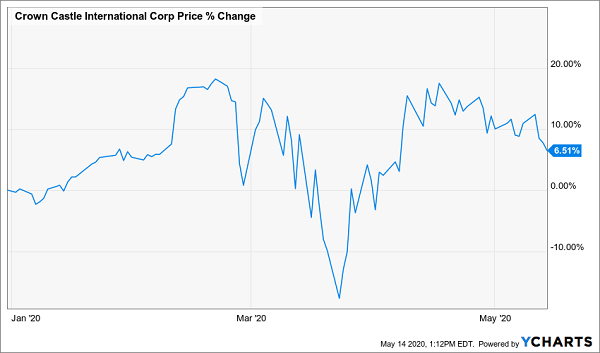

Finally, CCI has pulled back a bit from the 17.5% year-to-date gain it hit in April, giving you a nice entry point if you’re looking to deploy some cash now:

Buy Window Opens

MasterCard Could Triple Its Payout Tomorrow

Mastercard (NYSE:MA) isn’t on any dividend investor’s radar: it yields around 0.6%, so you certainly couldn’t live on its dividend.

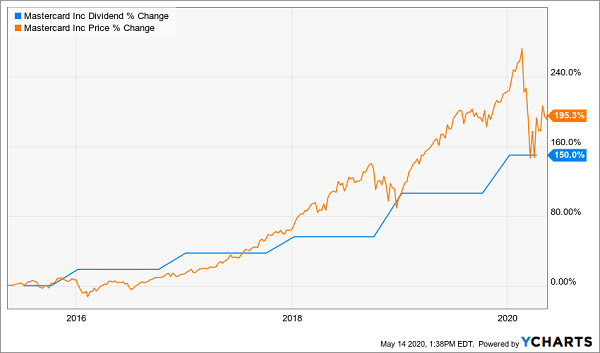

The company’s appeal lies in its explosive dividend growth: as you can see below, MasterCard’s payout has tripled the last five years. Like a loyal puppy, the share price has followed:

MasterCard’s Dividend Pumps Up Its Stock

The truth is, a rising dividend is the No. 1 driver of share prices, for the simple fact that many stocks boast charts like this one. You can clearly see the share price bounce higher with each payout hike.

Can MasterCard keep its dividend growth growing? You bet. Its payout ratio is a microscopic 17.7%, and its balance sheet is spotless, with $12.5 billion of long-term debt and almost the same amount—$10.7 billion—in cash.

In other words, MasterCard could triple its dividend tomorrow and the payout would still be rock-solid! And with the pullback we’ve seen the company’s shares this year, you’ve got a chance to buy for much less than you could in February. And you’d be getting in just as e-commerce—a major driver of transactions on MasterCard’s network—accelerates, and paper currency heads for the museum.

FOMO Will Lead to Heartbreak

As I said earlier, we’ve got lots of time to deploy cash, so don’t let the daily gyrations of the S&P 500 get the better of you. The key to success will be to avoid dividend payers whose business models have been forever overturned by the pandemic—like shopping-mall REITs, casinos, airlines and energy producers—and focus on those set to thrive in the new normal we’re headed toward.

6 Accelerating Dividends To Buy Before This Lockdown Ends

MasterCard and Crown Castle are two examples of post-pandemic winners, and I’ve named 6 more in the just-released issue of my Hidden Yields service.

Just last Friday, the May issue reveals 6 dividend growers from our portfolio I see as perfect buys now and in the “new normal” we’re headed toward. They include:

- The animal-health play whose dividend soared 22% in the last year. With more people adopting pets during the lockdown, this company is in the catbird seat for even faster payout growth post-pandemic!

- This auto insurer is saving a ton of cash! With fewer people driving, this company is raking in big savings. It recently returned more than $600 million to customers in a savvy goodwill move—I expect the rest to find its way to us as dividends.

- The railway whose payout surged 22% last year! It’s playing a critical role supplying the North American economy now, and is one of the most efficient operators out there. It can scale up for the rebound at the drop of a hat, driving its share price—and your dividends—even higher.

- PLUS 3 more accelerating payouts ripe for buying now.

As I said, you can find these 6 portfolios “best buys” in the May issue of Hidden Yields.

In addition to the latest issue, you’ll also get a free special report laying out my 7 top stocks with big upside in the years ahead. These 7 “Recession-Proof” buys complement the latest Hidden Yields issue because they’re all “set it and forget it” plays set for gains of 15% a year—enough to double your nest egg in 5 years!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."