Open just about any financial news website nowadays, and you’ll see something about “Dow 20,000.” The approaching record high in our famous stock index sure makes for a great headline.

But here’s a fun fact: The Dow is older than the Olympic Games, penicillin and assembly lines. Sure, we update it occasionally, but the index ultimately reflects an antiquated view of American markets. When Charles Dow created the benchmark in 1896, the U.S. was still a developing country. And a handful of old-timey “captains of industry” dominated economic activity.

The Dow is also a price-weighted index. Those work differently than the market-cap-weighted indexes used to measure almost everything else. In short, this record high’s significance to the markets is pretty limited.

So the Dow threshold isn’t a big deal. But that doesn’t mean that 2017 won’t be a big year for investors. Below, we’re looking at two record highs that mean more than the Dow headlines.

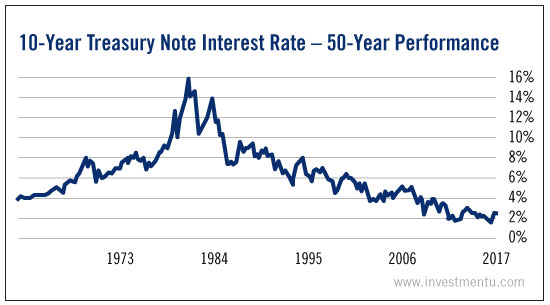

10-Year Treasury At 2.6%

One potential record high this year could send the bond market very low.

The yield on the 10-year Treasury is on the cusp of breaking 2.6%. That’s not an all-time record, but it’s quite a significant short-term high. Many capital managers, such as Janus’ Bill Gross, feel that a significant rise above 2.6% could kill the almost four-decade bull market in bonds. Prices are inversely related to yields.

A bond bear market wouldn’t lead to the collapse of Western civilization. But its implications are pretty staggering. Very few people alive today were old enough to have significant bond holdings during the last bear market. We’d be moving into uncharted territory for the current generation of investors.

If bond prices reverse their long-term course, it could change the way we think about asset allocation. We could see a shift away from multiyear notes. Instead, people might favor bills with shorter maturities. And eventually, rising yields could eat into the performance of dividend stocks and other “bond proxies” (though it hasn’t happened yet).

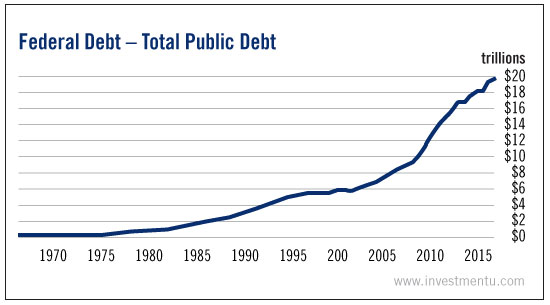

But perhaps even more important than the bond market is the public debt those bonds represent. Our national government has never been known for thriftiness. But in 2017, it may take the debt to a whole new level.

National Debt At $20 Trillion

Generally, when our government changes hands, the new regime reverses course on many issues. And to be sure, we’re seeing some of that with Trump. For example, much ado has been made about his pledge to repeal Obamacare.

But one thing that Obama and Trump have in common is their penchant for spending. President Obama added some $6.6 trillion to the national debt. And President-elect Trump, the self-proclaimed “king of debt,” has talked a big game about fiscal stimulus.

Between the two of them, there’s a good chance our public debt will hit $20 trillion this year.

Alexander Green has written a lot about the financial mess we call entitlement programs. The total unfunded liabilities for Social Security, Medicare and Medicaid are almost $1 million per taxpayer.

That might not be cause for concern if the incoming government was interested in fiscal responsibility. But it isn’t. The national debt will likely continue to hit record highs for the next four years. At the time of writing, the debt clock reads $19,956 billion. If we go beyond 20, it will be even harder for our children to sustain our social programs.

Dow 20,000 is certainly an interesting ceremonial marker. But what does it mean beyond that? Not much. If you’re looking for relevant record highs in 2017, pay attention to U.S. debt markets. And watch the U.S. debt itself. These numbers, unlike the Dow, could impact generations to come.

Thoughts on this article?