U.S. market valuations have now reached what they were in 1929, and are therefore the second highest in the country’s history.

Only the Dotcom Bubble was higher.

Currently:

- The cyclically-adjusted price-to-earnings (CAPE) ratio of the S&P 500 is over 31.

- The average S&P 500 price-to-book value is 3.25, compared to only 2.00 in 2012.

- The Wilshire 5000 market capitalization to GDP ratio is over 135%.

- Investor allocation to equities is now at 40% of household financial assets, one of its highest rates in history.

By any metric you monitor, this is an expensive market.

Valuations don’t strongly predict what the market will do over the next year or so, but these metrics are historically strongly associated with poor long-term returns. The annualized return over the next decade from 2017 to 2027 is not likely to be great for U.S. equities.

Low interest rates are giving bond investments terrible returns, and therefore investors are being forced into equities if they want decent results. But over time, as valuations are driven higher, it dilutes the rate of return equities will provide as well. Many people would say we’re in an economic bubble.

Fortunately, not every stock is extremely expensive. And the tactic selling of options can help you secure lower entry prices.

Union Pacific Corporation (NYSE:UNP)

Many investors might think of railroads as old businesses that probably perform poorly during recessions due to their cyclical nature.

But the surprising truth is, all five Class I railroads in the United States remained profitable straight through the 2007-2009 financial crisis and severe recession. Over the last couple of decades, improvements in automation have substantially increased their flexibility and reduced their fixed costs. The on-board personnel required to safely operate a freight train is minimal, and engines can be added or removed from the tracks based on shipping demand.

Bill Gates saw this trend and has been a long-term shareholder of Canadian National Railway. Warren Buffett’s company Berkshire Hathaway (NYSE:BRKa) bought the entire BNSF railroad several years ago. Both of these super-investors have long-term bullish outlooks on North American freight rail.

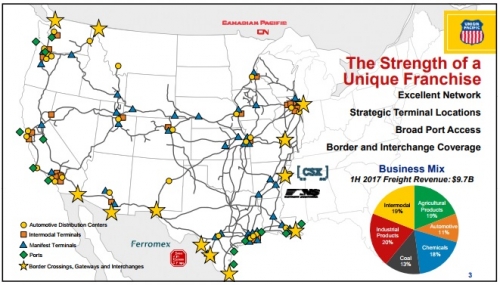

Unfortunately, the stock price currently reflects the robustness of the company. The price-to-earnings ratio is about 20x, which isn’t exactly cheap. The company is well-diversified with a strong market position over the western two-thirds of the country:

Source: Cowan and Company 10th Annual Transportation Conference Slides

However, you can sell cash-secured put options to secure a lower entry price. By selling put options, you get paid a premium up front in exchange for obligating yourself to buy the stock at a certain strike price before the option expiration date, if the option buyer wants to assign the shares to you.

For example, Union Pacific currently trades for $112.28 as of this writing. You can sell a 3-month January 19, 2018 put option at a strike price of $110 for $3.70/share. You’ll receive the $3.70/share premium up front, and over the next 3 months there could be one of two outcomes:

Outcome A

- If the stock price is above $110 around the time of expiration, the option will expire out-of-the-money. You’ll get to keep your premium and then sell another option for a later date if you want. This will give you a nearly 3.5% rate of return on your secured cash over this three month period, which if repeated throughout the year would result in double-digit returns.

Outcome B

- On the other hand, if the stock price dips below $110 around the time of expiration, you’ll have to buy the shares for $110 regardless of what the stock price is at the time. Since you’ll also get to keep your $3.70/share premium, your cost basis at purchase will be $106.30, which is more than a 5% discount to the current price of $112.28.

For a prudent long-term oriented investor that believes in the fundamentals of this company but wants a slightly better price, this as a win/win situation. You either get to earn premium payments during a flat or rising stock price, or you can get paid to wait to buy on a dip at a discount to current market prices.

Union Pacific currently has strong revenue growth, growing EPS and dividends per share, and a steadily declining share count due to consistent and prudent share buybacks. The dividend is well covered by earnings and free cash flow, and the company’s interest coverage ratio is about 11x, which demonstrates a sound balance sheet. For these reasons and more, I consider it to be a blue chip stock.

Intel Corporation (NASDAQ:INTC)

Intel has always been a good company for selling options on.

Investors have frequently been annoyed during multi-year periods of its flat stock price, but option-sellers are totally fine with it because they keep collecting high premiums and making great returns even during flat periods.

The AMD vs Intel processor debate always rages on between both consumers and investors. But Intel currently is operating on multiple fronts (for example, competing with Samsung (KS:005930) on memory, competing with Xilinx (NASDAQ:XLNX) on FPGAs) and sports a price-to-earnings ratio of about 15, which is below the rest of the expensive market.

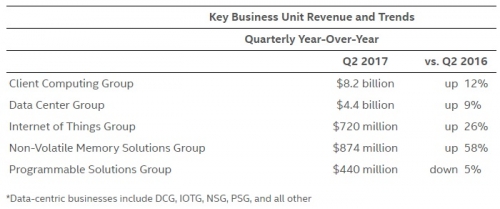

The company is diversifying away from the PC market, has multiple business segments, and revenue trends for almost all of its activities are growing:

Source: Intel Q2 Results

The Non-Volatile Memory Solutions Group is worth highlighting here, considering that revenue growth by percentage is the highest of any segment.

In 2015, Intel re-entered the memory market, and started investing in high-end 3D NAND technology and fabrication capabilities. Unlike normal NAND memory which is set on a two-dimensional plane, 3D NAND promises to be more efficient due to stacking multiple layers on top of each other.

The technology has been out for a few years now, but Intel’s push into it seems to be working well. Intel’s new products in 2017 have helped grow segment revenue considerably, but the large investment in new fabrication capabilities means the segment still is in the red with negative earnings.

If Intel can successfully compete with Samsung, continue their memory segment growth, and mature their product lines into profitable operations to recoup their recent investments in the area, it could be a big moneymaker for the company.

Intel’s stock price is $39.67 as of this writing, and buying at this price will probably do well over the long term in my opinion.

A slightly more conservative way to get into the company is to sell 3-month January 19, 2018 put options at a strike price of $39 for $1.30/share. You’ll receive the $1.30/share premium up front, and over the next 3 months there could be one of two outcomes:

Outcome A

- If the stock price is above $39 around the time of expiration, the option will expire out-of-the-money. You’ll get to keep your premium and then sell another option for a later date if you want. This will give you a 3.4% rate of return on your secured cash over this three month period, which if repeated throughout the year would result in double-digit returns.

Outcome B

- On the other hand, if the stock price dips below $39 around the time of expiration, you’ll have to buy the shares for $39 regardless of what the stock price is at the time. Since you’ll also get to keep your $1.30/share premium, your cost basis at purchase will be $37.70, which is a 5% discount to the current price of $39.67.

Full Disclosure: The author does not currently have any positions in the stocks mentioned, or plans to purchase them within 72 hours.