While the S&P 500 may be near all-time highs, that's not the case for stocks in the coal and shipping.

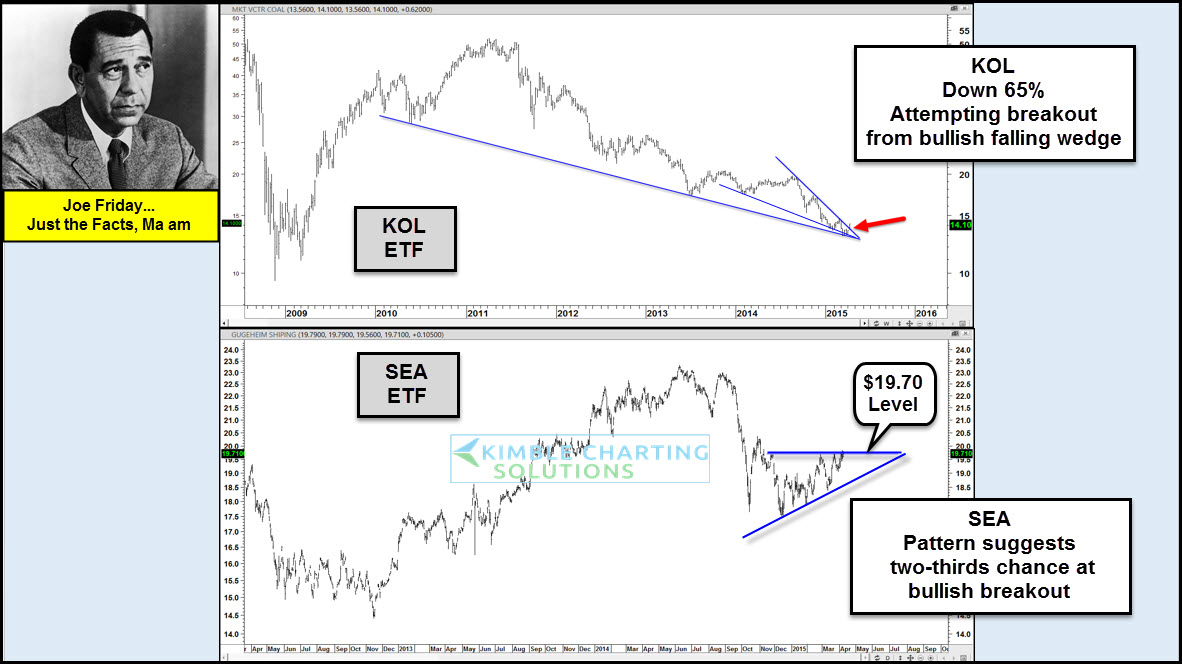

Coal ETF (ARCA:KOL) has declined 65% in the past 4 years while shipping ETF (NYSE:SEA) is a third lower than it was 5 years ago. Neither of them has been good to own on a buy-and-hold basis.

KOL is just above a 4-year falling support line and may be forming a bullish falling-wedge pattern, which suggests a two-thirds chance of an upside breakout. This week, KOL is making an attempt to break the top of the falling-wedge pattern.

Shipping stocks have been sinking over past few years as a well. ETF SEA has, during the past few months, possibly been forming a bullish ascending-triangle pattern, which two-thirds of the time leads to higher prices. Should SEA break above the $19.70 level, it could run to the upside for some time.

Measure-move projections suggest that if SEA breakouts out, it could rally by about 15%.