Shareholder activism and public sentiment are putting increasing pressure on companies to address environmental, social and governance (ESG) issues. In a previous post, we discussed socially-responsible investing. Today, we re-visit the topic and look at two exchange-traded funds (ETFs) that address social inclusion, gender equality and diversity.

As the pandemic changes personal and professional lives, a large number of of people may be re-evaluating their priorities as global citizens, individuals, employees, consumers and investors. Metrics by fund managers and anecdotal evidence suggest more investors are paying attention to ESG criteria in their investment decisions.

According to recent research by Deutsche Bank (NYSE:DB), five ESG topics stand out: employee wellness, accounting practices, climate change, corporate supply chains and social inclusion.

S&P Global's #ChangePays initiative has released various statistics on the economic benefits of social inclusion. In an article titled, "Adding More Women To The U.S. Workforce Could Send Global Stock Markets Soaring,” the authors highlight:

"For every 1% of GDP growth, the S&P 500 returns 3.4% on average annually... Acceleration in U.S. GDP growth under increased female labor force participation could add a whopping $5.87 trillion to global market capitalization in 10 years."

We are likely to see increased debate around the topic as both social and economic benefits make a strong case for a more inclusive life not only in the U.S. but worldwide. With that information, here are two ETFs that could be worth exploring as interest in these issues escalates.

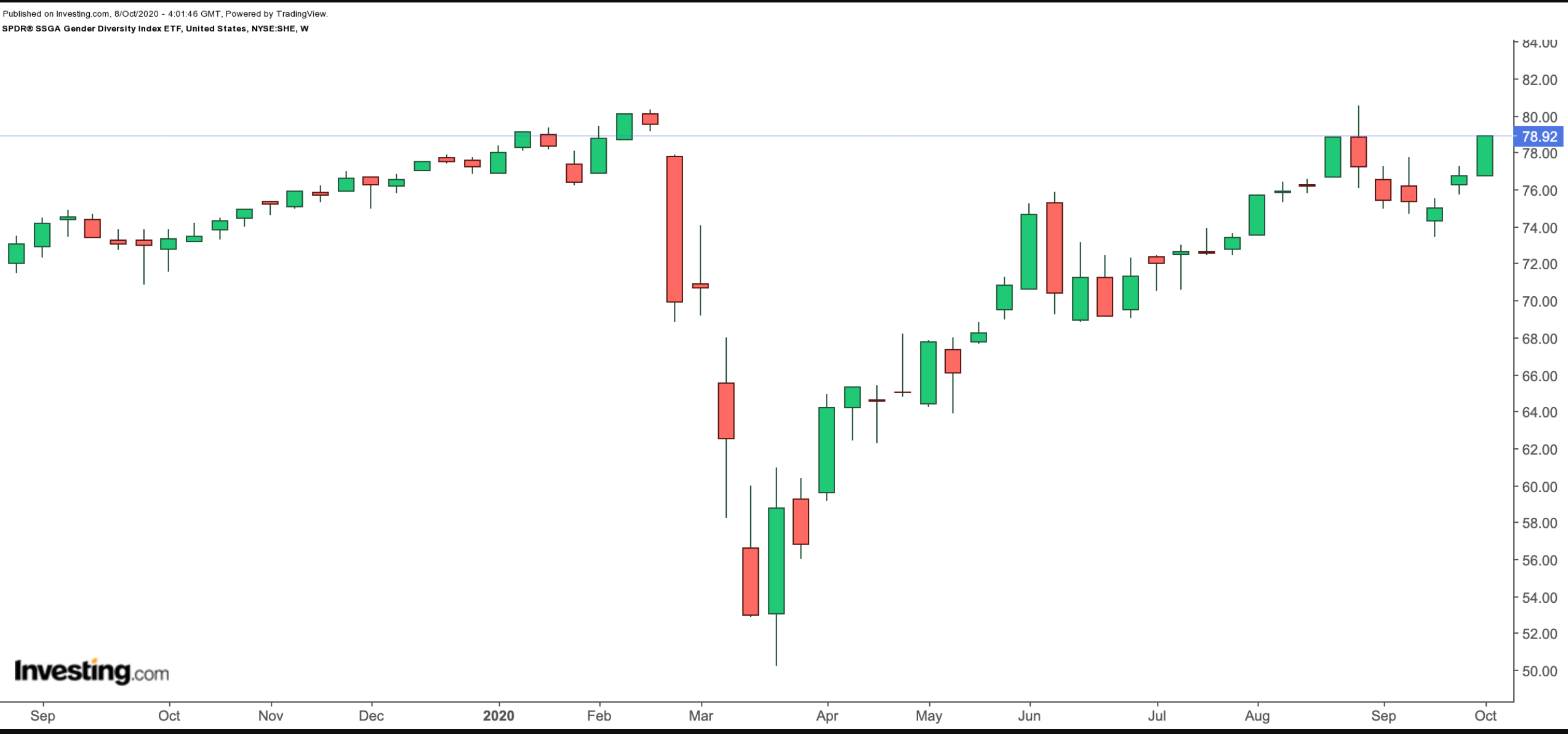

1. SPDR SSGA Gender Diversity Index ETF

Current price: $78.92

52-week range: $50.19 - $80.51

Dividend Yield: 2.01%

Expense ratio: 0.20%

The most recent "Women in the Workplace" study by McKinsey states:

"Progress toward gender parity remains slow. For every 100 men promoted to manager, only 85 women were promoted—and this gap was even larger for some women: only 58 Black women and 71 Latinas were promoted."

Our first fund, the SPDR® SSGA Gender Diversity Index ETF (NYSE:SHE), provides exposure to U.S.-based businesses with higher levels of gender diversity within senior leadership than other companies in the same sector.

SHE, which has 166 holdings, tracks the SSGA Gender Diversity index. The fund started trading in 2016 and has around $135 million under management.

The top 10 holdings constitute around 40% of the fund. Among these businesses are PayPal (NASDAQ:PYPL), Texas Instruments (NASDAQ:TXN), Visa (NYSE:V), Johnson & Johnson (NYSE:JNJ) and Netflix (NASDAQ:NFLX).

In terms of industry weightings, Information Technology (29.85%), Healthcare (14.48%), Consumer Discretionary (12.95%), Communication Services (8.99%) and Financials (8.53%) head the list. The index ranks firms within each sector by several gender diversity ratios.

Since the start of the year, the fund is up about 1.5% and hit an all-time high on Sept. 2. Given the increased volatility levels during the current earnings season, short-term profit-taking is likely in the fund.

Another ETF that concentrates on global businesses with firm policies supporting gender equality is the Impact Shares YWCA Women's Empowerment ETF (NYSE:WOMN). Fund managers note, "Impact Shares is a 501(c)(3) non-profit organization, that donates all net advisory profits from WOMN’s ETF management fee to the YWCA.” Year-to-date (YTD), the ETF is up close to 18%.

2. Impact Shares NAACP Minority Empowerment ETF

Current price: $$26.30

52-week range: $17.03 - $27.35

Dividen yield: 0.90%

Expense ratio: 0.75%

Social inclusion has several dimensions, including racial diversity. John Streur, president and CEO of investment management firm Calvert Research and Management, recently penned an article titled, “Corporations and Investors Must Do More to Combat Racism."

He said:

"This is an ESG problem.... As investors, we need to do a better job differentiating companies based on where they stand on these critical issues, and push hard for positive change.... [I]t is our duty as shareholders to hold them accountable for inaction."

Our second fund, the Impact Shares NAACP Minority Empowerment ETF, provides exposure to U.S. businesses that have strong racial and ethnic diversity policies in place.

NACP, which has 175 holdings, tracks the Morningstar Minority Empowerment Index. The fund was launched in 2018 and currently has about $9 million under management.

The top 10 companies make up about 35% of assets. Alphabet (NASDAQ:GOOGL), Amazon.com (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Bank of America (NYSE:BAC), Microsoft (NASDAQ:MSFT), Home Depot (NYSE:HD), Johnson & Johnson, Procter & Gamble (NYSE:PG), SolarEdge Technologies (NASDAQ:SEDG) and Visa are among the holdings.

YTD, the fund is up 12%. It hit an all-time high Sept. 2.

A final note: like WOMN, NACP is also a non-profit ETF. It donates “all net advisory profits to the National Association for the Advancement of Colored People (NAACP)." However, the fund “is not sponsored, endorsed or promoted by NAACP.”