Make no mistake: now is the time to buy dividend stocks. That’s because stocks tend to rally from Election Day to the end of the year—no matter which party wins.

The important thing is that the election, and the uncertainty it brings, is over.

The post-election surge is already on, with the S&P 500 jumping 6% since the market close on Nov. 2. Plus we’ve got a nice seasonal effect working in our favor, as stocks tend to gain from October to May.

A Second Chance to Buy Cheap

But don’t worry—if you haven’t used this opportunity to set yourself up for some strong upside (and growing dividend payouts) you’re not too late

This election has left us with another historical marker that stocks are headed higher from here.

For one, the federal government is now divided, with a Biden presidency, Democratic control of the House of Representatives and Republicans likely to hang on to their majority in the Senate (depending on the results of a couple run-off elections in Georgia).

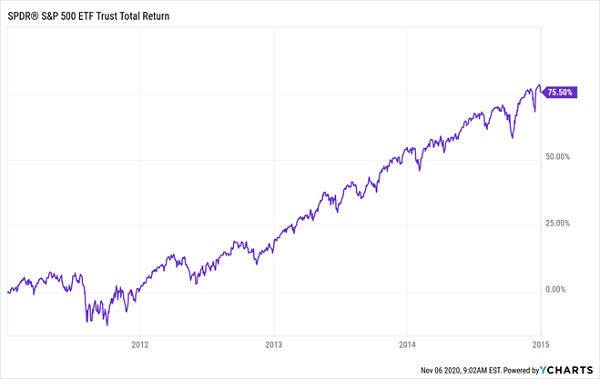

This combination hasn’t occurred since 1885 to 1889, during the administration of Democrat Grover Cleveland, so we don’t have an exact historical match to look at here. But we came close from 2011 to 2015, when Democrats held the Senate and White House and Republicans controlled the House. That combo helped stocks return a gaudy 76% in just four years!

Stocks Soar in Divided Government

I think we’re headed for a similar performance in the next four years. Our portfolios should get an assist from a couple other factors on our side, too.

2 More Factors Driving Our Stocks (and Dividends) Higher

It’s been many months since the economy received a multi-trillion-dollar stimulus package. With the political order for the next two years now lined up, what better way for our elected officials to celebrate their wins than with stimulus, part two?

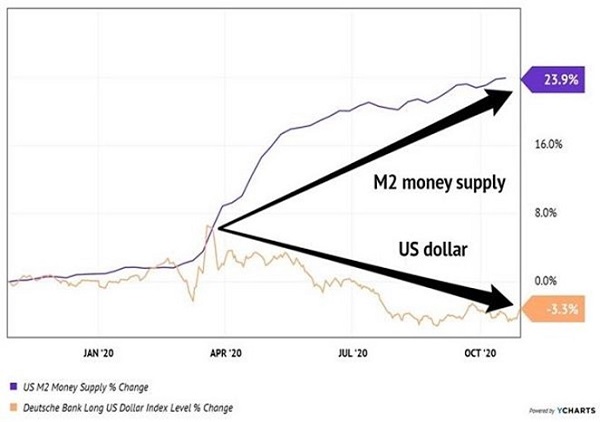

After all, they needn’t worry about who will foot the bill. Our money supply, as defined by the Federal Reserve’s own “M2” measure, is already up a breathtaking 24% year over year, with another “dollar dump” likely on the way:

Money Printer Will Keep On Printing

In theory, it is you and I, the taxpayers, will be on the hook for the bonds Uncle Sam issues to help rev up the economy.

But let’s be honest. Federal Reserve Chair Jay Powell is simply going to print as much stimulus money as he can. Which brings us back to dividend stocks. When the Fed prints money, equities are the place to be. They go up faster than bonds! And select dividend payers are likely to cruise higher.

But we do want to take out some “insurance,” because these are not normal times. So we’re going to key in on one group of “low drama” names that have been tossed over the side in recent months—utility stocks.

2 “Bond-With-Upside” Utility Picks to Consider Now

I don’t usually write about utilities, for one simple reason: they usually don’t yield enough. Fortunately in recent months, investors have tossed out some perfectly good utility dividends. I gave you an example of a strong utility pick in my November 3 article, when we discussed Midwestern utility WEC Energy Group (NYSE:WEC), whose payout has surged 216% in the last decade.

I’d also add regional utility Exelon (NASDAQ:EXC), whose electricity and gas businesses serve 10 million customers, mostly in the US Northeast.

Savvy investments under CEO Chris Crane have nicely shifted Exelon’s power mix toward renewables. That helps it stay within environmental regulations, which are likely to be strengthened under a Biden administration.

At the same time, Exelon has invested heavily—to the tune of $4.5 billion this year alone—to make its operations more robust. That’s helped it steer through 2020’s active storm season; despite the storms and COVID-19, Exelon boosted its full-year earnings guidance to $3 to $3.20 a share when it reported third-quarter earnings, a big jump from its previous forecast of $2.80 to $3.10.

The company shifted from paying a static dividend four years ago to delivering steady payout growth. That rising payout has helped pull the shares higher—until this year, that is, when investors inexplicably sold off the stock.

Dividend and Share Price Part Company … For Now

With Exelon’s rising earnings and healthy balance sheet (long-term debt is a reasonable 31% of assets), it’s nicely positioned to drive its dividend (and share price) higher.

Exelon sports a 3.6% yield today, and a five-year beta rating of 0.42, making it 58% less volatile than the market. In a world where Treasuries yield just 0.8%, a growing 3.6% dividend backstopped by a steady share price has a lot of appeal. Expect investors to catch on to that and bid Exelon’s shares back up.

Here’s a 6.6% Utility Dividend (With Upside)

You can bulk up your dividends even more when you buy utilities through a closed-end fund (CEF) like the Reaves Utility (NYSE:UTG). This fund gives you access to top US utilities like WEC, NextEra Energy (NYSE:NEE) and Comcast (NASDAQ:CMCSA).

It also diversifies your utility holdings beyond America, with 22% of its portfolio in Canada, including power provider Fortis (NYSE:FTS) and BCE (NYSE:BCE), our northern neighbor’s main telecom provider.

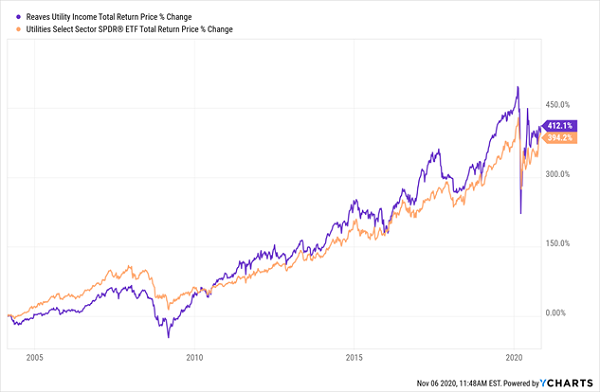

Here’s something else you’ll like: UTG pays an outsized 6.6% dividend—and it makes that payout monthly. And its stability just about matches that of Exelon: with a five-year beta rating of 0.65, UTG is 35% less volatile than the market. It’s also cruised past utility benchmark Utilities Select Sector (NYSE:XLU) since inception:

High-Yield CEF Beats the Benchmark

Here’s something else that adds to UTG’s appeal: because of its high payout, most of the return you see above was in cash, not here-today, gone-tomorrow paper gains.

UTG does trade at a 0.65% premium to its net asset value (NAV, or the value of the stocks it owns), which may lead you to think it’s overpriced. But this fund regularly trades at much bigger premiums—as high as 12.8% last June—so we can expect some price upside from its growing premium, too.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."