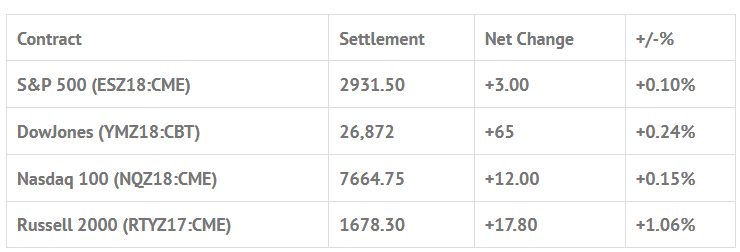

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed lower: Shanghai Comp +1.06%, Hang Seng -1.73%, Nikkei -0.56%

- In Europe 12 out of 13 markets are trading lower: CAC -0.89%, DAX +0.16%, FTSE -0.87%

- Fair Value: S&P +4.46, NASDAQ +25.99, Dow +15.23

- Total Volume: 1.24mil ESZ & 126 SPZ traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Weekly Bill Settlement, Challenger Job-Cut Report 7:30 AM ET, Randal Quarles Speaks 8:15 AM ET, Jobless Claims 8:30 AM ET, Factory Orders 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Treasury STRIPS 3:00 PM ET, Fed Balance Sheet and Money Supply 4:30 PM ET.

S&P 500 Futures: #ES Rallies Then Dumps As 10 Year Note Yield Hits 3.146%

After a weak close on Monday, and a push down to 2924.00, the S&P 500 futures looked tired, but by 7:43 AM CT Tuesday morning the futures shot up to 2940.00. On the 8:30 bell the ES traded 2939.50 initially, then popped up to 2941.00 before pulling back to 2936.75. Just after the pullback I put this out in the MTS forum:

Dboy:(10:00:34 AM): I get the feeling the ES is not going to pullback much

Dboy:(10:00:55 AM) : looks like NQ is trying to hold

A few minutes later the ES made a new high at 2942.25, and then ran up to 2944.75. After that, the futures sold off down to 2935.75 when this headline hit the tape:

(10:08:26 AM) : Sen. Sanders wants to break up JPMorgan (NYSE:JPM), Berkshire Hathaway (NYSE:BRKa) and other large financials.

From there, the ES traded back up to the open before making a lower high, but then on the higher lower ‘Riley Retest’ the ES bounced from 2936.00, back and filled for the next three hours, then ‘double topped’ at 2942.00. Just after 1:30 the futures got hit by a sell program that forced a drop down to 2928.25 at 1:56 CT.

After rallying back up to 2932.75, the ES again dropped down to retest the lows at 2925.50, and then bounced up to 2931.50 going into the close, printing 2930.50 at 3:00, and settling the day at 2931.50, up +3.00 handles, or +0.10%.

In the end it’s all about the failed rallies. If it’s not the China trade wars, it’s the emerging markets. If it’s not the emerging markets, it’s the midterm elections. If it’s not the elections, its higher rates and higher yields. Things seem to be piling up against the bulls, but does that mean the highs are in? I don’t think so, but I do think it’s time to be more careful about the upside.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.