- Investing in cheap undervalued stocks priced under $10 can offer potential growth without the need for significant capital.

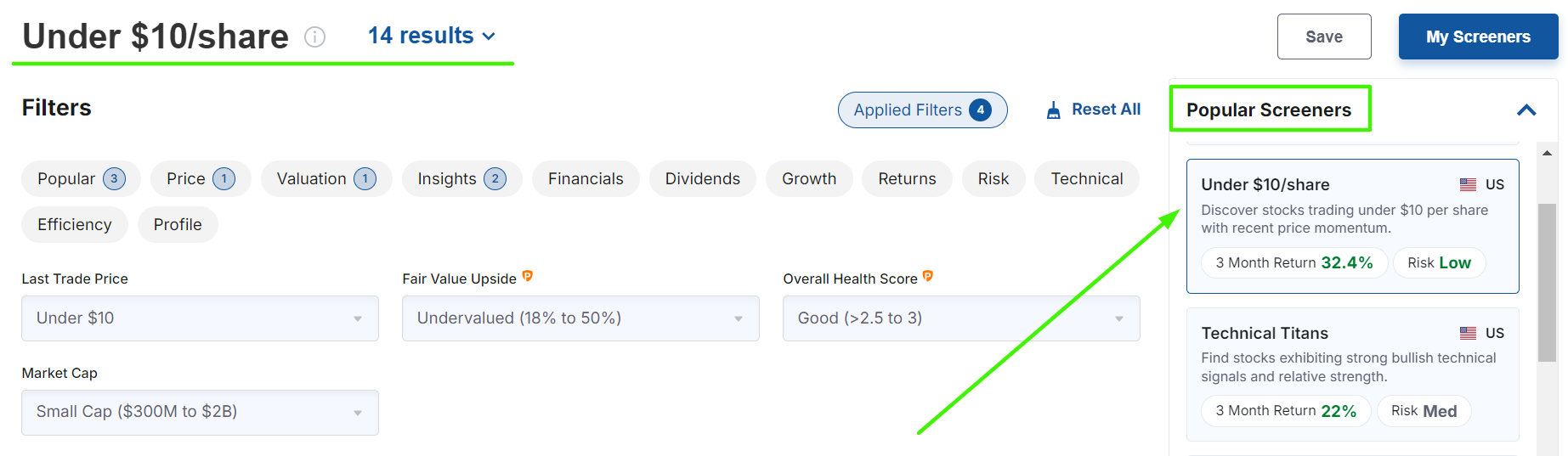

- Using the Investing.com 'Under $10/Share' stock screener, I searched for high-quality stocks currently trading under $10 with massive upside potential.

- The stocks chosen for this list present compelling investment opportunities thanks to their attractive business metrics and long-term growth potential.

- Get started for free: discover winning stocks today by accessing the new Investing.com screener here!

In the world of investing, finding high-quality stocks at bargain prices can be the key to generating significant returns.

While stocks under $10 often come with higher risks, they also offer the potential for substantial rewards, especially when they're undervalued according to robust financial models.

Using the 'Under $10/Share' stock screener on Investing.com, I've identified these ten undervalued stocks under $10, all with massive upside potential as per the AI-powered Fair Value price models from InvestingPro.

Source: Investing.com

Let's explore why these under-the-radar companies are worth owning. The list below is sorted by market cap.

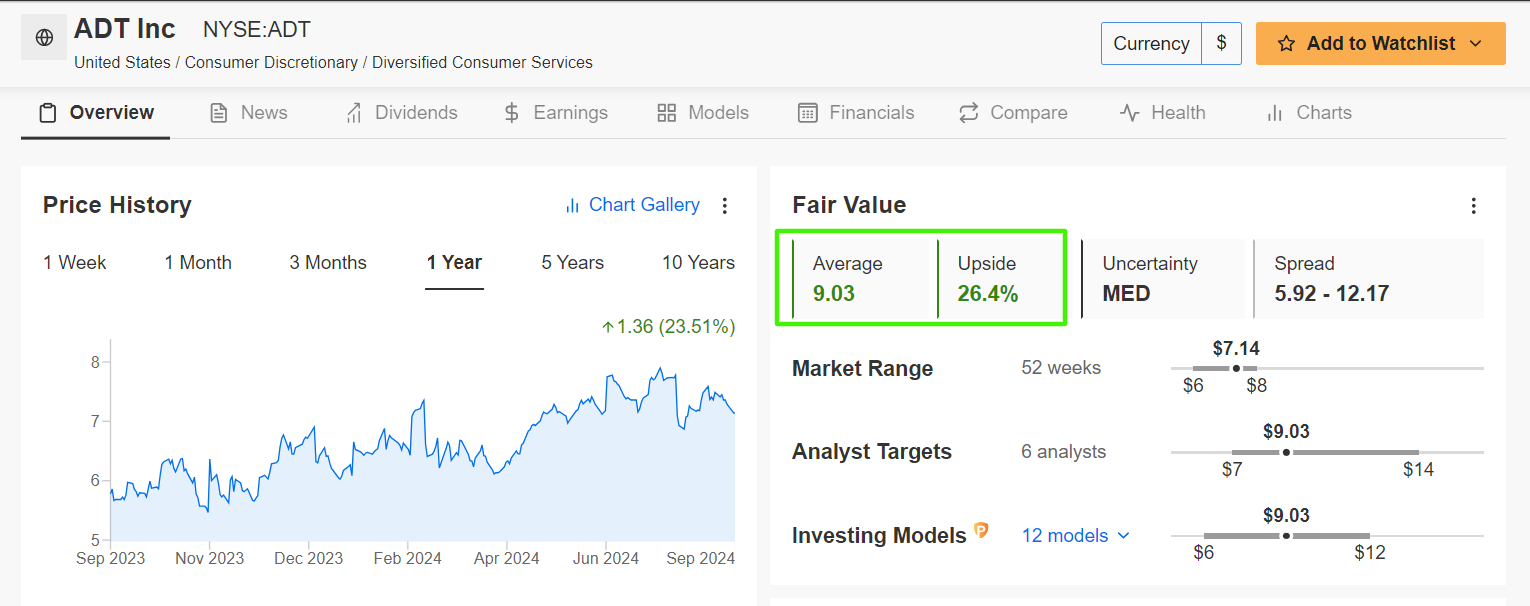

1. ADT

- Current Price: $7.14

- Fair Value Estimate: $9.03 (+26.4% Upside)

- Market Cap: $6.4 Billion

ADT (NYSE:ADT) is a leading provider of security, automation, and smart home solutions.

The company has been steadily expanding its product offerings and customer base, benefiting from the growing demand for smart home technology and enhanced security systems.

With strong recurring revenue from its subscription services and potential for growth in commercial markets, ADT is poised for a significant upside.

The InvestingPro Fair Value model suggests that the stock is substantially undervalued, making it an attractive buy at current levels.

Source: InvestingPro

ADT stock could see an increase of about 26% from Tuesday’s closing price, bringing it closer to its ‘Fair Value’ of $9.03 per share. Shares have gained 23.5% in the past year.

2. Global Business Travel Group

- Current Price: $6.92

- Fair Value Estimate: $8.18 (+18.2% Upside)

- Market Cap: $3.3 Billion

Global Business Travel Group (NYSE:GBTG) is one of the world’s largest travel management companies, offering a comprehensive suite of services to help businesses manage their travel needs efficiently.

As the global economy continues to show resiliency and business travel rebounds, GBTG is well-positioned to benefit from increased corporate spending on travel. The company's focus on technology and innovation, combined with its strong market position, supports its growth potential.

Source: InvestingPro

The stock’s undervaluation, according to InvestingPro’s models, indicates a compelling opportunity for investors.

There's potential for a gain of almost 18% from yesterday's close, aligning it with its 'Fair Value' price target estimated at $8.18 per share. GBTG stock is up 14.4% in the past 12 months.

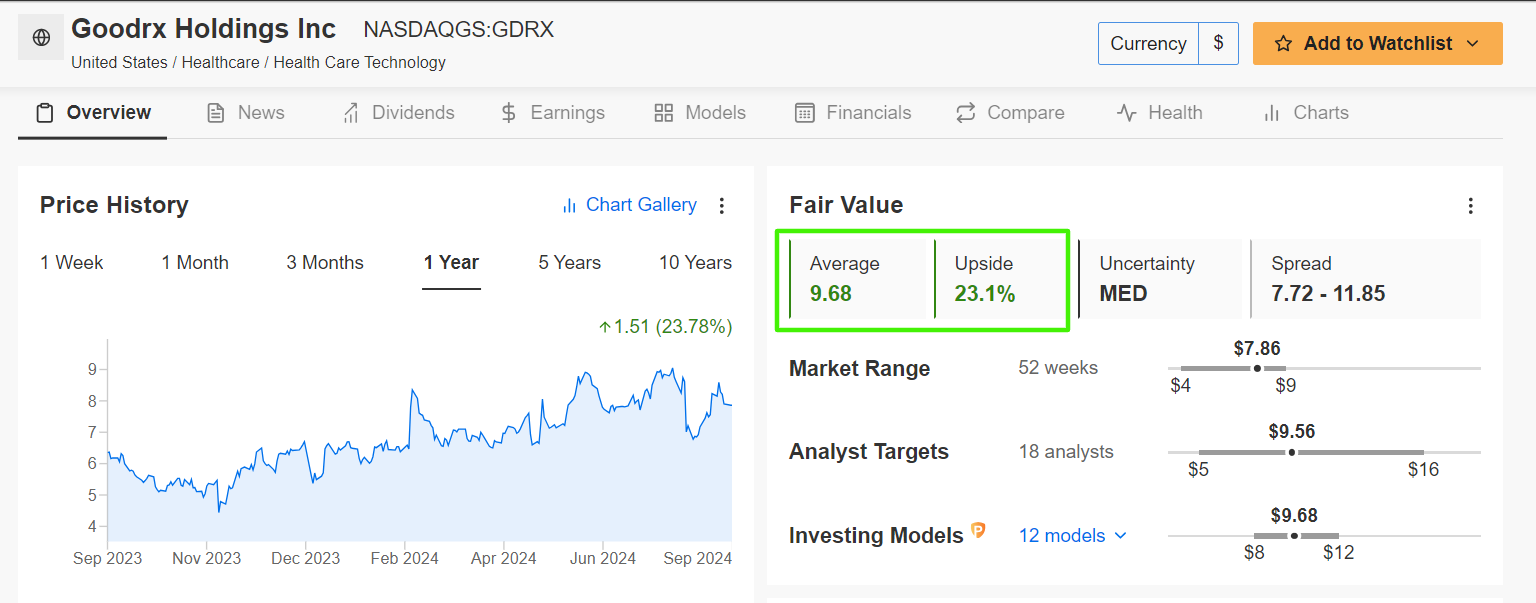

3. GoodRx Holdings

- Current Price: $7.86

- Fair Value Estimate: $9.68 (+23.1% Upside)

- Market Cap: $3.0 Billion

Goodrx Holdings (NASDAQ:GDRX)operates a platform that helps consumers find affordable prescription medications. With healthcare costs continuing to rise, GoodRx’s services are becoming increasingly essential, driving growth in its user base and revenues.

The company’s innovative approach to healthcare cost savings and its expansion into telehealth services are expected to propel its stock higher in the coming years. Not surprisingly, InvestingPro’s AI-powered models highlight GoodRx as significantly undervalued, with ample upside potential.

Source: InvestingPro

There's a possibility of a 23.1% increase from last night’s closing price, moving it closer to its 'Fair Value' set at $9.68 per share. GDRX shares have climbed 23.8% during the past year.

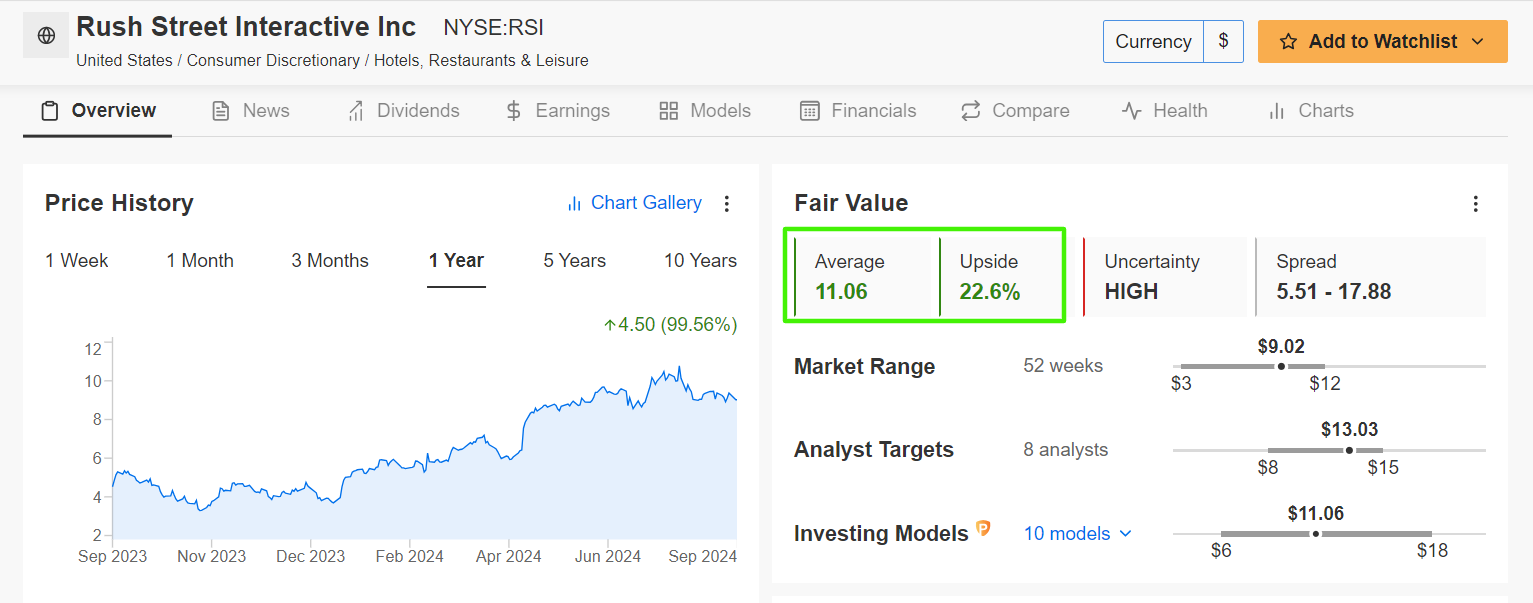

4. Rush Street Interactive

- Current Price: $9.02

- Fair Value Estimate: $11.06 (+22.6% Upside)

- Market Cap: $2.0 Billion

Rush Street Interactive (NYSE:RSI) is a leading online gaming and sports betting company, operating in multiple states across the U.S. The company’s focus on customer experience, innovative product offerings, and strategic partnerships with major sports leagues and media companies have positioned it for long-term growth.

As the online gaming market continues to expand, Rush Street Interactive is expected to see significant revenue growth. InvestingPro’s models suggest that the stock is currently undervalued, offering strong upside potential.

Source: InvestingPro

There's a projected increase of 22.6% from last night’s close, moving RSI shares closer to their 'Fair Value' benchmark of $11.06. The stock has soared by a whopping 99.6% in the past year.

5. Alignment Healthcare

- Current Price: $9.81

- Fair Value Estimate: $10.80 (+10.1% Upside)

- Market Cap: $1.9 Billion

Alignment Healthcare (NASDAQ:ALHC) provides healthcare services to seniors through its Medicare Advantage plans, focusing on personalized care and advanced technology.

The company is well-positioned to capitalize on the aging population and the growing demand for senior-focused healthcare solutions. With a scalable business model and strategic partnerships, Alignment Healthcare is set for long-term growth.

Source: InvestingPro

The stock’s undervaluation, as indicated by InvestingPro’s Fair Value models, makes ALHC an attractive investment opportunity. Anticipated growth of 10.1% from Tuesday's closing price could bridge the gap to $10.80 per share. Alignment Healthcare’s stock has gained 69.4% over the past 12 months.

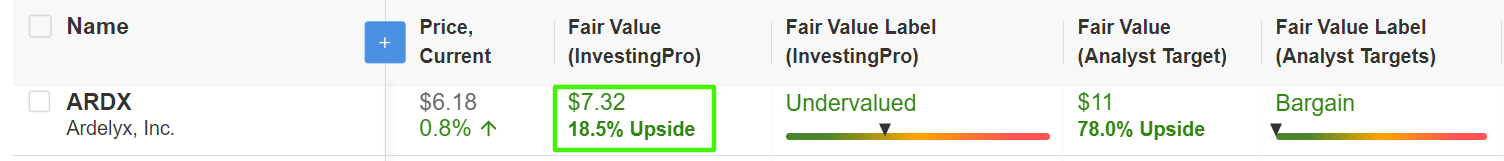

6. Ardelyx

- Current Price: $5.63

- Fair Value Estimate: $7.32 (+18.5% Upside)

- Market Cap: $1.3 Billion

Ardelyx (NASDAQ:ARDX) is a biopharmaceutical company focused on developing innovative therapies for unmet medical needs, particularly in the areas of kidney and gastrointestinal diseases. The company’s lead product, IBSRELA, has received FDA approval and is showing promise in the market.

Ardelyx’s pipeline of drug candidates and its strategic focus on high-demand therapeutic areas position it for future success. InvestingPro’s models suggest that Ardelyx is currently undervalued, offering substantial upside potential for investors.

Source: InvestingPro

There's potential for an 18.5% climb from last night's closing price, bringing ARDX stock towards its 'Fair Value' estimate of $7.32 per share. Ardelyx shares are up 22.6% in the past year.

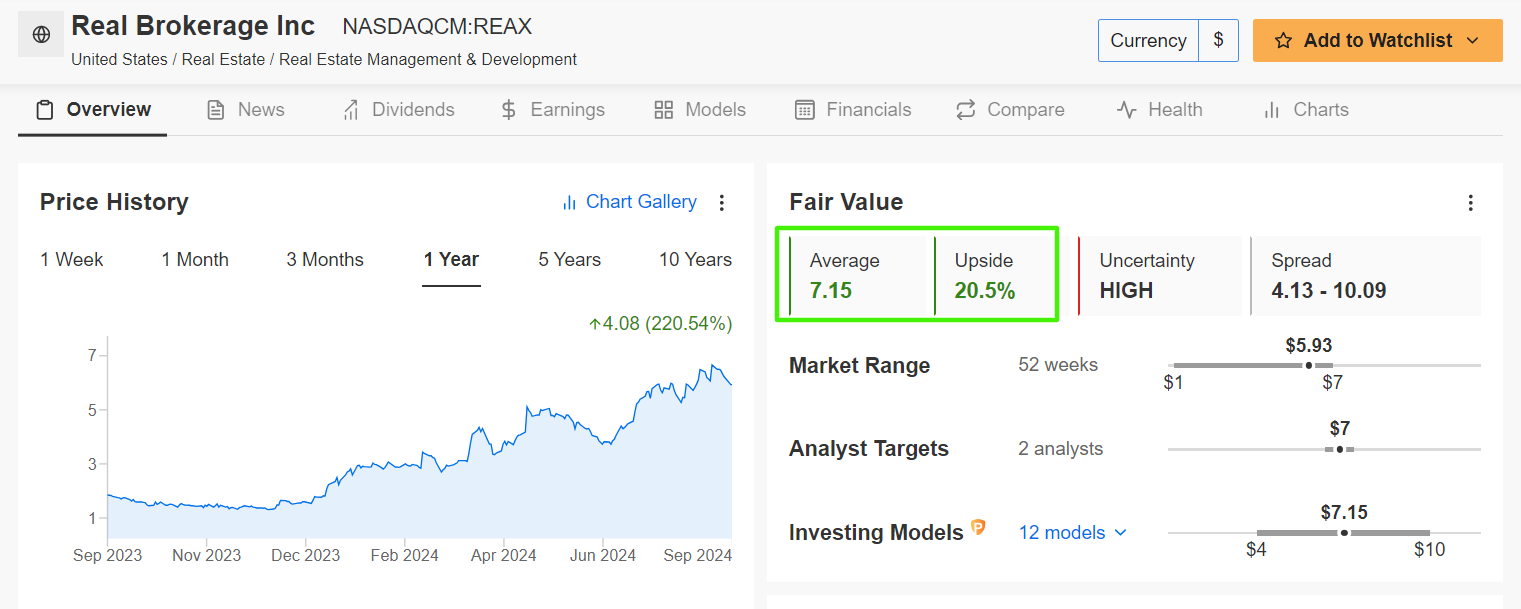

7. Real Brokerage

- Current Price: $5.93

- Fair Value Estimate: $7.15 (+20.5% Upside)

- Market Cap: $1.2 Billion

Real Brokerage (NASDAQ:REAX) is a technology-powered real estate brokerage firm that provides agents with tools and data-driven insights to enhance their productivity. The company’s innovative platform and competitive commission structure have been attracting top talent in the real estate industry, driving its growth.

As the real estate market continues to evolve, The Real Brokerage is poised to gain market share. InvestingPro’s AI-powered Fair Value models indicate that REAX stock is undervalued, presenting a significant investment opportunity.

Source: InvestingPro

There's potential for a gain of 20.5% from the current market value to $7.15 per share. The Real Brokerage’s stock has rallied by a massive 220% in the last 12 months.

8. National Energy Services Reunited

- Current Price: $9.00

- Fair Value Estimate: $11.12 (+23.5% Upside)

- Market Cap: $859.6 Million

National Energy Services Reunited (OTC:NESR) is a leading provider of oilfield services in the Middle East and North Africa region. The company offers a wide range of services, including drilling, production, and well services, to support the energy sector.

With increasing energy demand and the potential for higher oil prices, NESR is well-positioned for growth. The stock’s undervaluation, as highlighted by InvestingPro’s Fair Value models, makes it an attractive option for investors looking to gain exposure to the energy sector.

Source: InvestingPro

There's a possibility of a 23.5% increase from the current price, bringing NESR stock closer to the 'Fair Value' estimation of $11.12. National Energy Services shares have gained 80% during the past year.

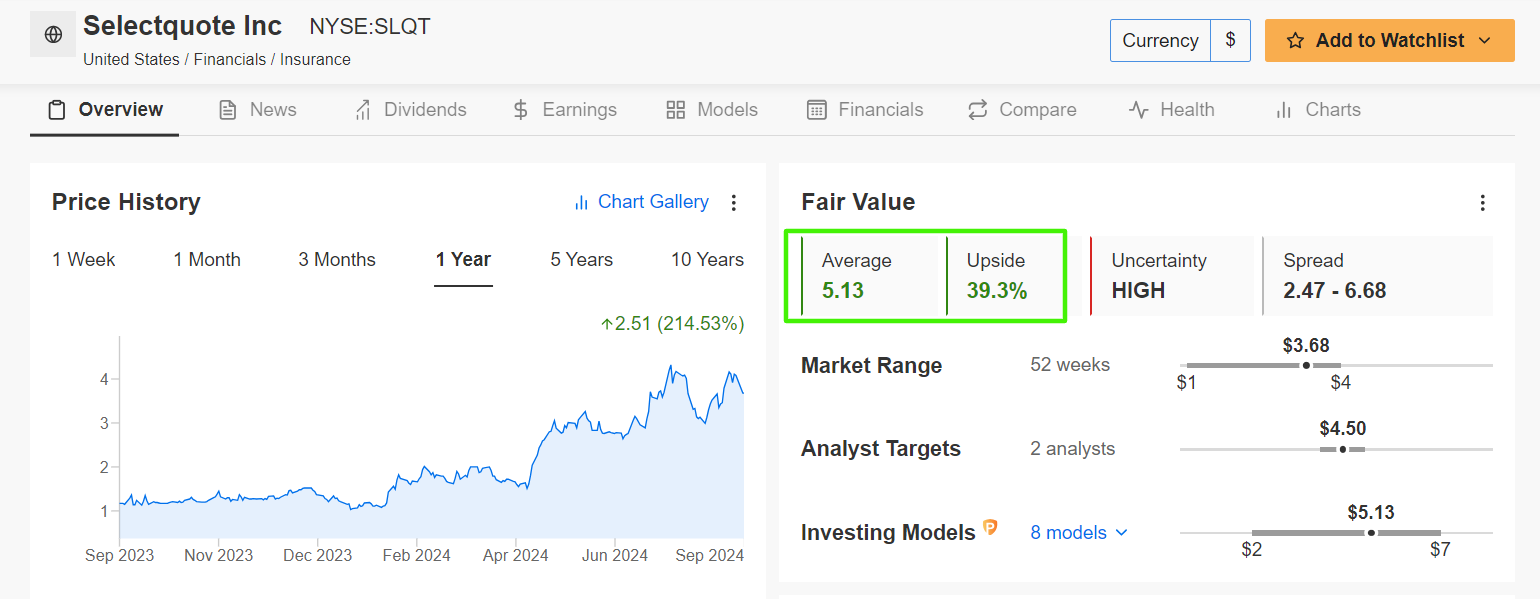

9. SelectQuote

- Current Price: $3.68

- Fair Value Estimate: $5.13 (+39.3% Upside)

- Market Cap: $622.5 Million

Selectquote (NYSE:SLQT) is a technology-driven insurance distribution platform that connects consumers with a variety of insurance products, including life, health, and auto insurance. The company’s data-driven approach and extensive network of insurance carriers provide a competitive advantage in the industry.

As consumers increasingly turn to online platforms for insurance needs, SelectQuote is well-positioned for growth. The stock’s undervaluation, according to InvestingPro’s Fair Value models, indicates significant upside potential.

Source: InvestingPro

SLQT shares could see an upswing of approximately 39% from Tuesday’s closing price to $5.13. SelectQuote has seen its stock soar by 214% throughout the past year.

10. SIGA Technologies

- Current Price: $7.72

- Fair Value Estimate: $12.52 (+62.2% Upside)

- Market Cap: $550.9 Million

SIGA Technologies (NASDAQ:SIGA) is a pharmaceutical company focused on developing and delivering solutions for unmet medical needs, particularly in the area of infectious diseases. The company’s lead product, TPOXX, is the first antiviral drug approved for the treatment of smallpox and has the potential for broader applications.

With growing concerns about bioterrorism and infectious disease outbreaks, SIGA is well-positioned to benefit from increased demand for its products. InvestingPro’s AI-powered models indicate that SIGA is currently significantly undervalued.

Source: InvestingPro

InvestingPro's 'Fair Value' price projection for SIGA is $12.52 per share, suggesting a prospective gain of 62.2% from the current price. SIGA Technologies shares are up about 85% in the past year.

Conclusion

Each of these 10 undervalued stocks under $10 offers unique growth opportunities driven by strong tailwinds and robust business models. As highlighted by the InvestingPro AI-powered Fair Value models, these stocks are not only attractively priced but also have substantial upside potential.

Investors looking for high-reward opportunities may find these stocks to be compelling additions to their portfolios, especially as they are positioned to benefit from favorable market trends in the months and years ahead.

The Investing.com stock screener is a powerful tool that can help you identify stocks with this criteria, making your investment decisions easier and more informed.

By registering for free on Investing.com, you can unlock the full potential of this tool and take your stock market investing to the next level.

Start using the Investing.com stock screener today and discover the power of smart stock selection!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.