Well, we're now past the half-way point in this most interesting of years... Clearly a lot has changed since the start of the year. So I thought it would be helpful to take a quick progress check on the "10 Charts to Watch in 2020".

In the original article, I shared what I thought would be the 10 most important charts to watch for multi-asset investors in the year ahead (and beyond).

In this article, I have updated those 10 charts and provided some fresh commentary.

With all that's gone on, some of my initial thoughts and expectations from the original article got set slightly off track in some cases and went wildly wrong in others. So this is quite a good exercise to go through in terms of examining the question, "where to from here?"

Note: I have included the original comments from back at the start of the year, so you can quickly compare what I'm thinking now vs what I said back then

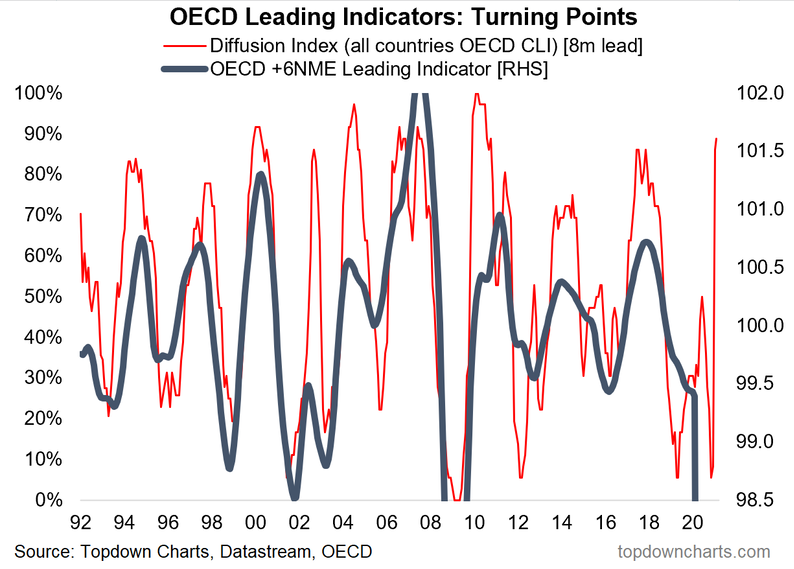

1. Global Economy

The original call was for a synchronized global economic upturn. Instead we got a procession of global economic shut-downs in response to the pandemic. On the bright side, massive and coordinated stimulus efforts (coordinated across countries and monetary and fiscal policy) have been implemented to deal with the economic shock. So in my view, there will indeed be a global economic upturn, but it will be delayed (due to the shutdowns) and potentially accentuated (due to the stimulus).

"Global Economy -- a turning point in the global economic cycle: 2019 basically saw a global manufacturing and export recession. Yes Recession. But looking forward, I have a growing list of leading indicators pointing to a recovery in 2020, and the below is one of them. The diffusion index of OECD leading indicators has made a clear turnaround after reaching a decade low. I will be watching for a turn up in the main global indicator (and for the diffusion index to continue to edge higher/stay higher)."

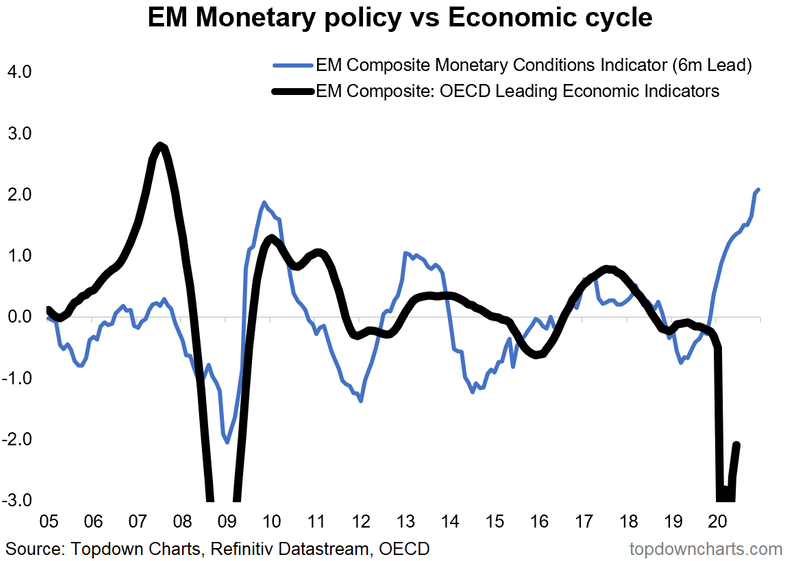

2. Emerging Markets

On a similar note, late last year emerging market central banks had been very busily and aggressively easing monetary conditions - part of the global policy pivot. As mentioned, this year brought the policy panic - with a second wave of easing kicking off in March. While the pandemic experience varies widely across emerging market economies, this substantial and building tailwind should not be ignored, and emerging market economies could surprise to the upside (later this year and into 2021).

"Emerging Markets: a big part of the 2020 recovery thesis is the global monetary policy pivot. Not many have noticed, but EM central banks have been particularly aggressive in easing policy (and by the way, they have the most traditional policy ammunition available). Given some of the cycle indicators have already begun to stabilize for EM I have a strong degree of confidence that we will see a cyclical upturn across emerging economies in the coming months and quarters."

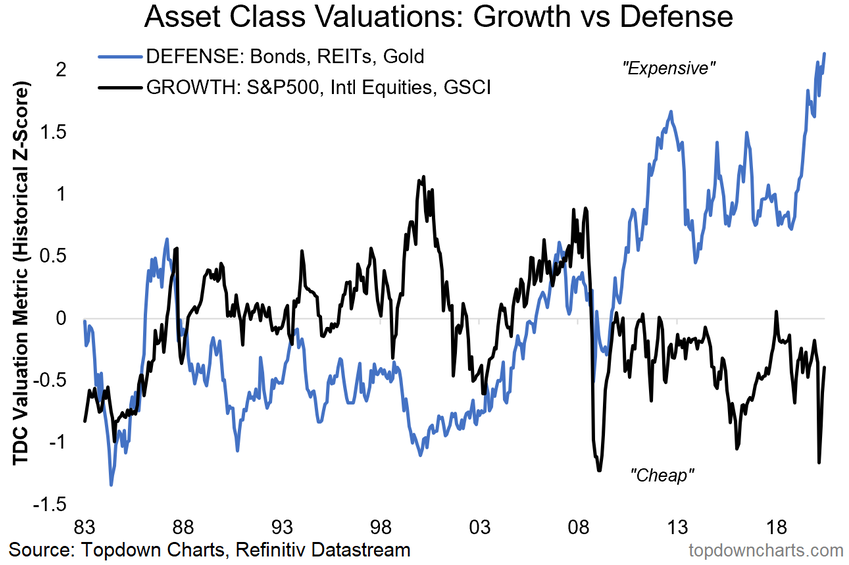

3. Growth Assets vs Defensive Assets

It should be no surprise that investors have bid up the valuations of defensive assets given all that's gone on. Indeed, by our valuation metrics defensive assets are trading at record high valuations. Again, it puts into question the defensive nature of these assets when valuations are this high. Meanwhile, growth assets remain somewhat cheap (more so commodities and global ex-US equities).

"Growth Assets vs Defensive Assets: this chart says it all in terms of where investors have been positioned, and it tells you that defensive assets may not necessarily be “safe” given such expensive valuations. Indeed, a global economic rebound could well make defensive assets a source of risk, rather than a hedge of risk."

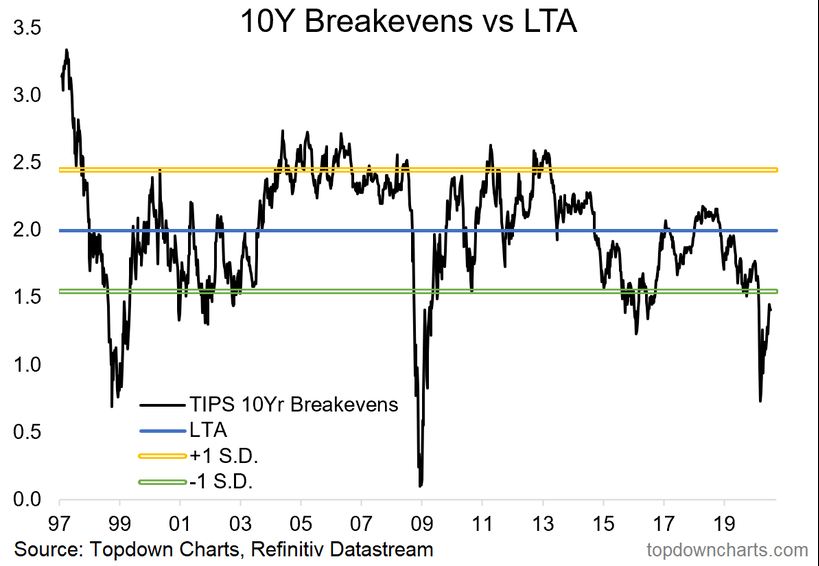

4. TIPS breakevens

Well, breakevens went from cheap, to REALLY CHEAP, and back to quite cheap. Right now we are in the middle of a global wave of deflation, and that deflationary impulse is entirely cyclical and one-off in nature. As the pandemic progresses and economies open back up, that stimulus aspect is going to come increasingly into focus. We could well wake up a year from now to find the global economy "overstimulated". In that case, we will be talking about inflation upside/overshoot risk (which would probably be good for TIPS breakevens).

"TIPS breakevens look cheap, and should rebound if we get better growth. This will also tend to put upward pressure on bond yields (i.e. nominal yield = real yield + inflation expectations). This is closely tied in with the commodities picture [chart 7]."

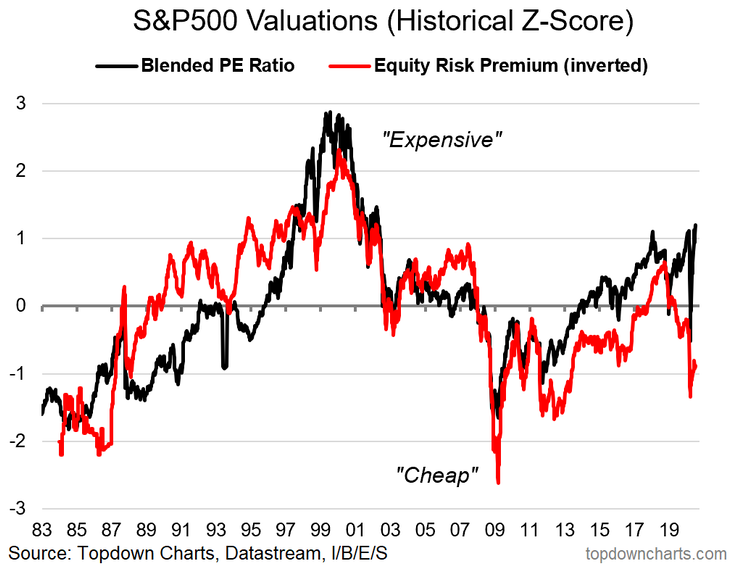

5. US Equity Valuations

What a contentious topic. A lot of folks have been blindly quoting off forward PE figures, telling us that the market is wildly overvalued. Now I don't disagree that absolute valuations are elevated, but I have made it fairly clear that the forward PE is completely useless in the type of scenario we find ourselves in right now.

But let's not dwell on that.... The chart below uses a blended PE ratio to show where absolute valuations are tracking and it is indeed expensive; tracking just over 1 standard deviation above long term average. [BUT] The equity risk premium on the other hand still shows the market as "cheap" -- being nearly 1 standard deviation *below* long term average (note: I have inverted the ERP to align the signals of the two indicators in the chart). Of course we could just say that bonds are simply expensive. Either way, we have a picture of the market being expensive vs history but cheap vs bonds.

"US Equity Valuations: the downside of likely higher bond yields is that all else equal it will squeeze the ERP (equity risk premium), which in contrast to absolute valuations, still looks cheap/attractive. Indeed, you can argue it's quite rational to be bullish equities even as absolute valuations are historically high if the equity risk premium provides enough of a cushion."

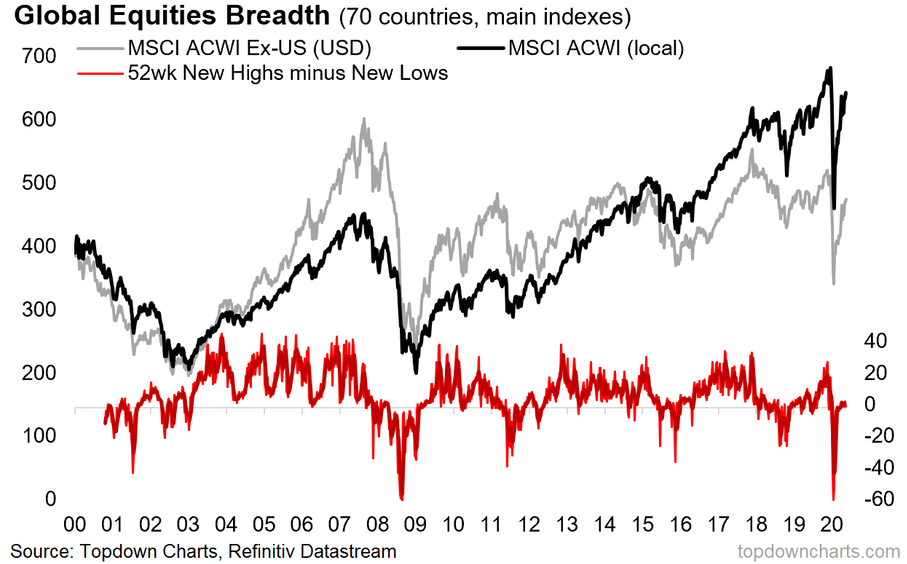

6. Global Equities

That new cyclical bull market call got derailed as global equities crashed in Q1. Note: let's not get mixed up here - Q1 was a crash, not a bear market. The interesting thing is, since the crash, a number of signals have lit-up that usually show up during the emergence of a new cyclical bull market. So maybe we'll look back on this as a historic reset moment that set the scene for another big cyclical bull market. Given the amount of stimulus in the system it seems like the path of lease resistance -- barring some major new bad news coming along (it is 2020 after all!*).

"Global Equities: it looks like we’re in a new cyclical bull market (based on a fairly familiar and reliable global equity market breadth signal). This chart and a few other global equity market breadth indicators helped pick the big breakout late last year. It's quite likely that if the new cyclical bull market does get derailed somehow, that we see early warning signs show up in this chart. So this will be a key one to watch for risk asset allocations."

*while many lament the year 2020, it is not the worst year. Not even close.

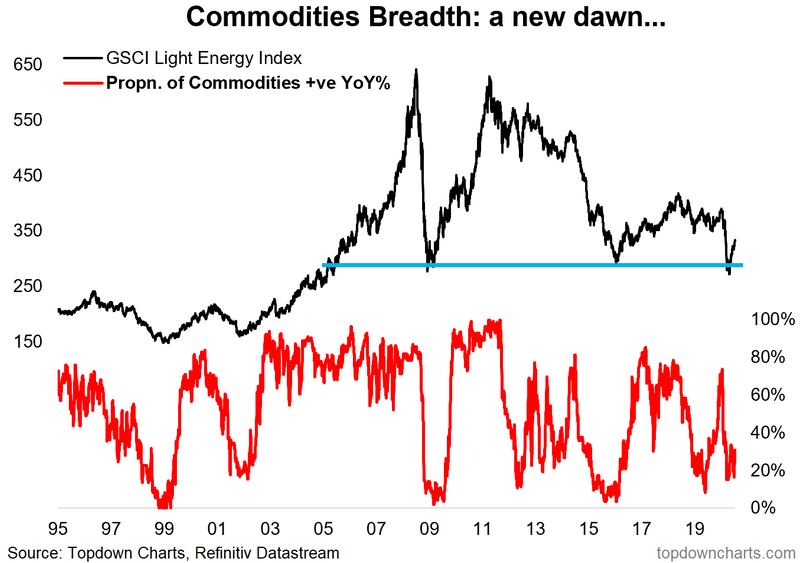

7. Commodities

This year saw commodities go from bad to worse to catastrophic; culminating in an unthinkable negative oil price. Naturally, that was a good chance to double down on my initial bullish views on commodities, with breadth and sentiment indicators getting washed out, valuations dropping close to record lows, and commodity Capex getting crushed. Aside from all that, commodities will be a key and direct beneficiary of economic normalization and any eventual "overstimulating" of economies.

"Commodities (at an asset class level) have also seen a familiar market breadth pattern emerge, which points to a cyclical bull market (lines up with relatively light positioning, cheap valuations, and a prospective better macro backdrop). The outlook across the individual commodities that make up this index is a bit more nuanced, but the aggregate/asset class view looks fairly straightforward based on the sum of evidence from our indicator set."

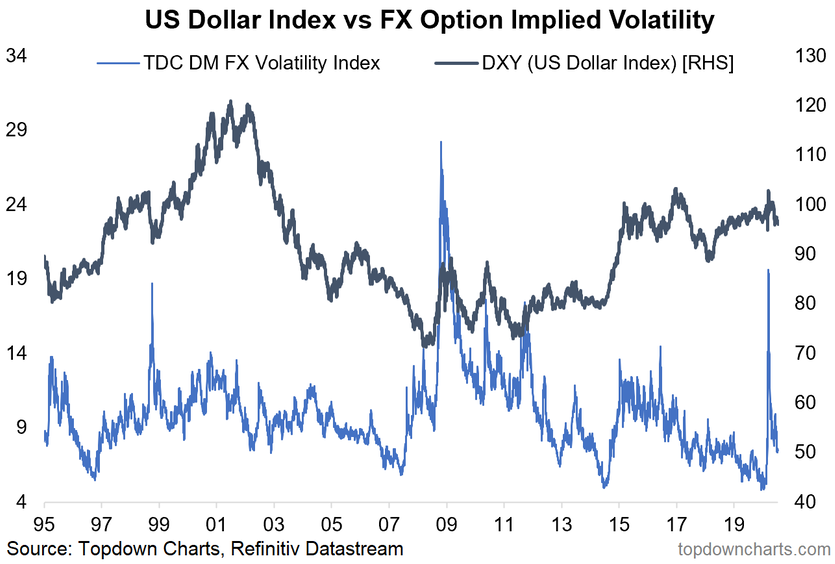

8. FX Volatility

Yes. To answer the question below, 2020 did bring the return of volatility for the US dollar (and everything else). But what has not yet been quite as forthcoming is a large/rapid move in the US dollar index. It's given both bulls and bears a few rounds of excitement and disappointment as false breakouts to the up and downside have taken place. Again, the year is not over by a long shot, and some notably bearish clouds are looming ahead for the US dollar, so we'll see what H2 brings for the DXY (and EMFX!).

"FX Volatility: one key piece of the puzzle for commodities is the US dollar, and while I continue to maintain a bearish bias there, one thing I am very mindful of is the crunch in FX volatility. Typically crunches in volatility like this tend to be resolved in a violent fashion: that is, it could be a harbinger of a large/rapid move (agnostic of direction). So, will 2020 bring a return of volatility for the US dollar?"

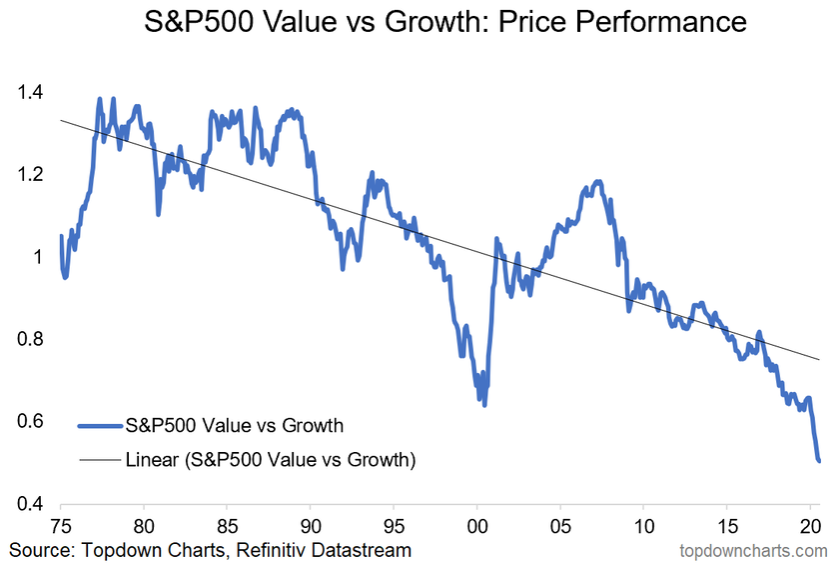

9. Value vs Growth

It seems that hardly a week has gone by without value making a new all-time low vs growth. The valuation case is there (value stocks are much cheaper than usual vs growth stocks), but the macro catalysts are yet to fall into place (a key one would be higher bond yields). Having said that, value stocks don't necessarily need to shoot the lights out to put in good relative performance... maybe all that needs to happen is just for the increasingly frothy tech element of growth stocks to undergo a healthy (or maybe not so healthy) correction. I think there are a few things falling into place here, so while the trend is not your friend, don't write it off entirely.

"Value vs Growth: the investment strategy graveyard is littered with failed calls for a turnaround in the performance of value vs growth stocks. But I think we could be close to the much-awaited and much-forecast turning point. Relative value between the two cohorts is at the lowest point in 20 years, and in terms of macro catalysts, my expectations for higher bond yields, better growth, and higher commodity prices will help the sectors that are slightly over-represented in value vs growth. So don't forget about value."

10. China

Lastly an update to that interesting property vs stocks chart for China. China A-shares went on a tear in the last couple of weeks, with 2014/15 memories being evoked. Indeed, the chart below highlights how China A-shares can get a boost from rotation effects given how retail-driven the market is, and how domestic investors have few options when it comes to investing given the difficulty of moving funds offshore. Keep a close eye on the Shanghai Composite, as this is one of those classic ON/OFF markets... when it's on it's on.

"China: last but not least, this chart shows Chinese property price growth vs China A-shares. It’s a useful chart for China watchers and global investors in general, but it’s of particular interest now because property price growth is rolling over, and that could be good news for China A-shares. Because the marginal speculative investment dollar in China is basically trapped in the country, you tend to see this succession of chasing one hot asset after another. Thus, we could start to see a rotation effect between property and stocks in China, and that (along with cheap valuations, easier monetary policy, better global growth, and a trade deal/truce) could drive a potentially explosive new bull market in China A-shares."

Key Takeaways

- Expect stimulus to drive a sharper than expected recovery in growth as economies reopen.

- Expect emerging markets, in particular, to start surprising to the upside later this year and next as substantial monetary easing works its way through the system.

- Deflation is the main game right now, but inflation risks should not be dismissed.

- Defensive assets have become extremely expensive (and therefore risky?)

- US equity valuations are both very expensive (vs history) and very cheap (vs bonds).

- Global equities are in a new bull market.

- Commodities are set up for a new dawn.

- The US dollar may well be in the process of entering a bear market.

- Value stocks are overdue a turnaround vs growth stocks (but a few things need to happen).

- Chinese equities could go further and faster than you expect.