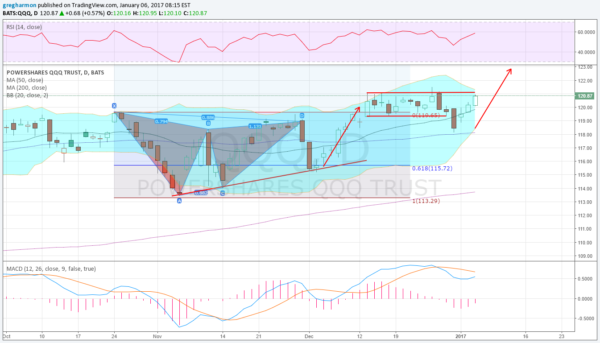

The chart below shows the price action in the Nasdaq 100 ETF QQQ since the end of October. That's when it went through a bearish harmonic Bat pattern. It was the one index that did not rocket higher following the election. The price retraced 61.8% of the Bat before reversing higher to a new all-time high December 13. And it has consolidated from there. It has made three higher highs, by pennies, but has clearly shown resistance at about 121.10 for a month.

What could be the key to a prolonged run higher is the 3-day pullback into the end of the year. This came back to the 50-day SMA, reset the RSI and MACD lower in the bullish ranges and started a squeeze in the Bollinger Bands®. Since the calendar turned to 2017, the price has moved higher and will start Friday just below that 121.10 with momentum surging. A push through would give a target to about 123 on a Measured Move, not a major move but a good break out to start.