Investing.com’s stocks of the week

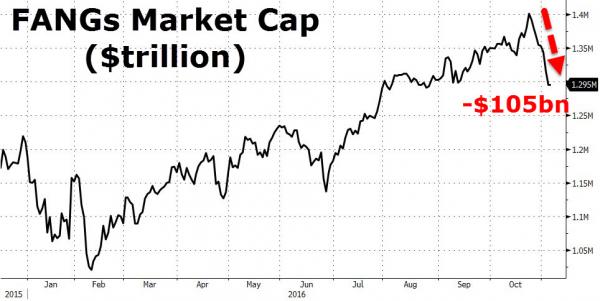

In the last week, the so-called “FANG” stocks (Facebook Inc (NASDAQ:FB), Amazon.com Inc (NASDAQ:AMZN), Netflix Inc (NASDAQ:NFLX), Alphabet Inc (NASDAQ:GOOGL)) have stumbled. As earnings and outlooks disappointed, shareholders have awoken to the new normal low growth world and wiped over $100 billion in market capitalization of the four horsemen of the Fed’s wealth creation bubble.

FANGs are now down 8 days in a row (no doubt helping fuel the S&P 500’s massive nine-day losing streak):

Losing a massive $108 billion in market cap during that time frame:

This is the biggest drop in these four names since the February growth scare — which was only saved by massive coordinated global central bank money-printing, and which is simply not about to happen this time.

Leading the way lower over the past eight sessions has been Apple Inc (NASDAQ:AAPL), which has plunged nearly 8% since the October 25 close. Trouble for AAPL began on that very date, when the company reported mixed fiscal Q1 earnings results. As the shares continue to drop, they’re now reaching a critical technical support level, which if crossed could lead to significantly more downside.

Facebook (NASDAQ:FB), too, has seen significant declines, falling well over 8% in the past eight sessions, while Alphabet (NASDAQ:GOOGL) is down 5.7%, and Netflix (NASDAQ:NFLX) down 3.5%.

Year-to-date, GOOGL shares are now essentially flat, while AAPL is up 3.4%, NFLX up 6.69%, and FB is still up 15.36% since the beginning of 2016. The benchmark S&P 500 has gained 2.29% in the same period.