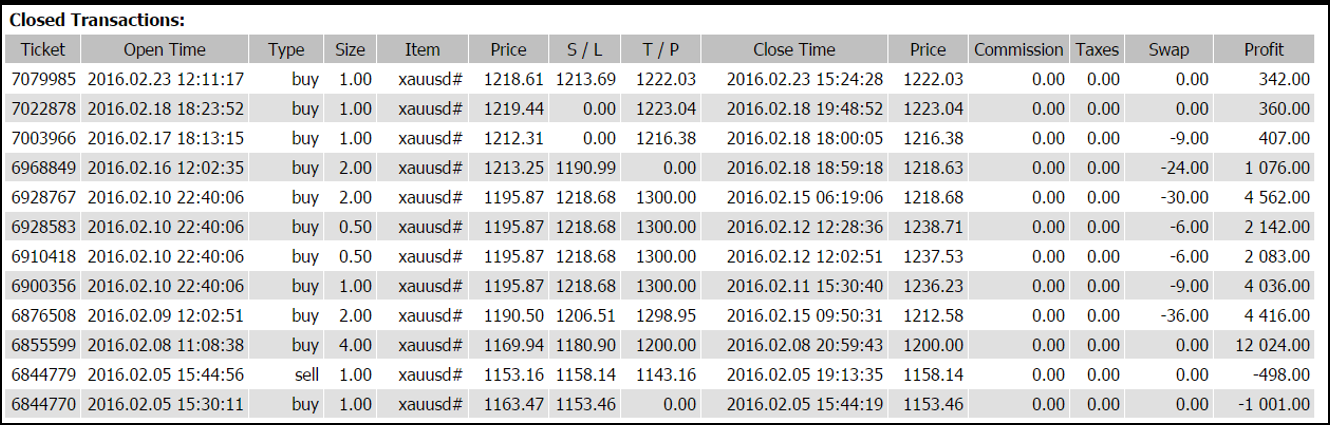

Since the beginning of the year, my most profitable asset has been trading spot gold.

By adapting to current market conditions it has become much easier in my eyes to predict moves in gold on a short-term basis.

Gold in my eyes has always behaved more like a currency than a commodity, and the factors that cause movement are less reliant on physical supply and demand.

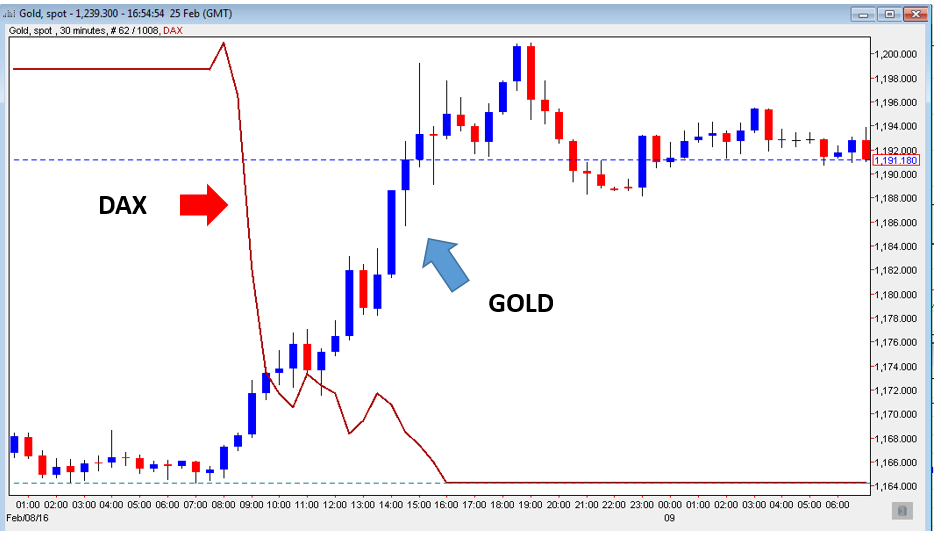

Gold in recent weeks is being used as a short-term hedge against falling stock prices, and as you understand this correlation you will be able to profitably enter multiple positions, as long as this relationship exists.

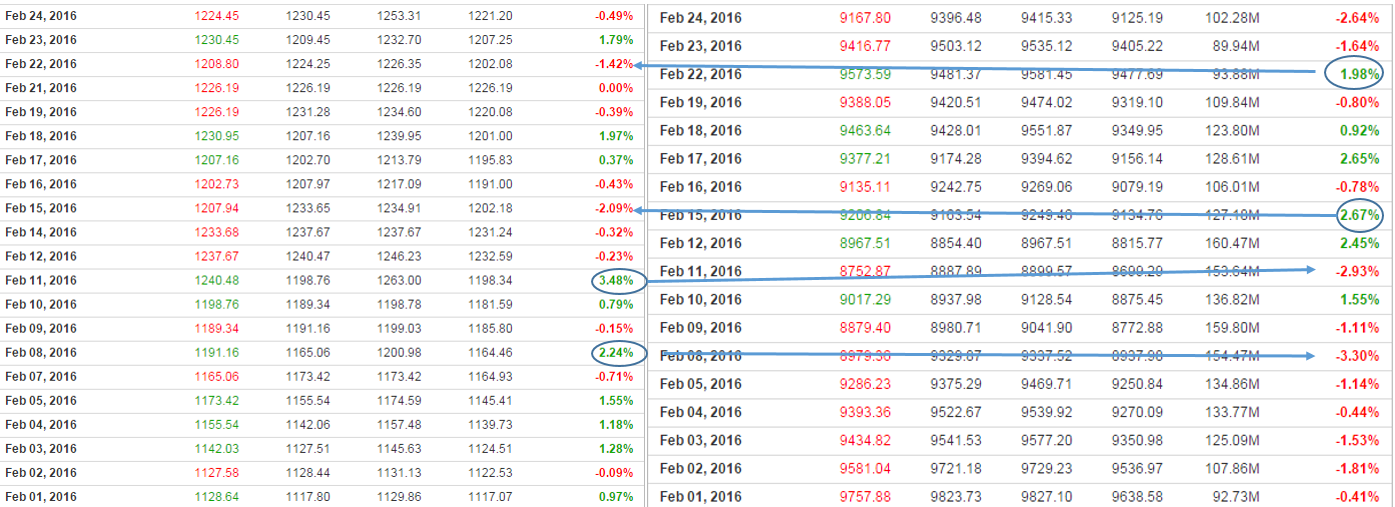

Let’s take a look at recent daily closes for gold compared to the German DAX, in order to give us a clearer picture of the dynamics at work-

As you can see, the correlation is the strongest when the markets are rising or dropping over 2%, and on these types of days you can expect extremely strong trends in gold.

A great example of this can be seen on February 8th as gold moved up over $36 per ounce while the DAX dropped over 300 points.

Gold is notorious for its high volatility. It is important not to close your trades too soon and give yourself a chance to catch a significant move, which is why I usually prefer to work without a take profit (but always a stop loss), in order not miss out on a huge potential return.

In conclusion, I think that as long as these dynamics remain in play, you are doing yourself a disservice if you are not trading gold right now.