The red-hot gold stocks have spent most of March in consolidation mode, grinding sideways near their 2016 highs. Interestingly this month’s rally pause is par for the course seasonally in gold-stock bull markets. Like gold itself, this sector tends to slump to a seasonal low in mid-March before embarking on a strong spring rally in April and May. With gold stocks back in a bull, their seasonality warrants consideration.

Seasonality is the tendency for prices to exhibit recurring patterns at certain times during the calendar year. While seasonality doesn’t drive price action, it quantifies annually-repeating behavior driven by sentiment, technicals, and fundamentals. We humans are creatures of habit and herd, which naturally colors our trading decisions. The calendar year’s passage affects the timing and intensity of buying and selling.

Gold exhibits high seasonality, which seems counterintuitive. Unlike grown commodities like crops, the mined supply of gold is constant year-round. But supply is only half of the fundamental supply-demand equation that drives pricing. Gold’s investment demand happens to be highly seasonal, and that’s what sets gold prices at the margin. Investors favor gold buying far more at some parts of the year than others.

This gold-demand seasonality is well-known and heavily studied. The seasonal gold year starts in late July as Asian farmers begin reaping their harvests. They plow some of their surplus income into gold. That’s followed by the famous Indian wedding season in autumn and its heavy gold buying for brides’ dowries. That culture believes festival-season weddings have greater odds of yielding long, successful marriages.

After that comes the Western holiday season, where gold jewelry demand surges for Christmas gifts for wives, girlfriends, daughters, and mothers. Following year-end, Western investment demand balloons after bonuses and tax calculations as investors figure out how much surplus income the prior year generated for investment. And Chinese New Year gold buying flares up after that heading into February.

These understandable cultural factors drive surges of outsized gold demand between summer and early spring. But interestingly, there is one more gold-demand spike in spring. Over the years I’ve seen a variety of theses explaining this April and May seasonal gold rally, but nothing definitive like for the rest of the year’s gold seasonality. As silly as it sounds, I suspect spring itself is the reason for this demand surge.

Sentiment exceedingly influences investing, which requires optimism for the future. Investors won’t risk deploying their scarce capital unless they believe it will grow. And the glorious increased daylight and warming temperatures of spring naturally breed optimism. The vast majority of the world’s investors are far enough into the northern hemisphere that spring has a major impact. This seasonality extends to stocks too.

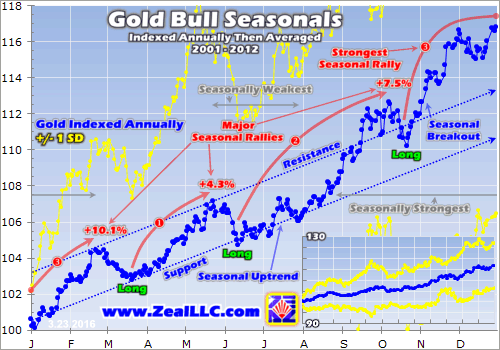

Whatever the reason, gold definitely exhibits strong bullish spring seasonality as this chart reveals. As prices behave very differently in bull and bear markets, seasonality differs between them. Gold was in a mighty bull market between April 2001 and August 2011, powering 638% higher. 2012 saw a normal bull-market correction following an incredible upleg, seeing gold down 18.8% at worst from its 2011 peak.

But everything changed in 2013 as the Fed’s wildly-unprecedented open-ended QE3 campaign ramped to full speed. That radically distorted the markets, levitating stocks which crushed demand for alternative investments led by gold. So gold plunged into an artificial bear that year. In Q2’13 alone, it plummeted by 22.8% which was its worst calendar quarter in an astounding 93 years! Gold’s bear continued until late 2015.

Remember the formal threshold for declaring bull and bear markets is a 20%+ counter move from the preceding extreme on a closing basis. And as of early March, gold reentered formal bull-market territory with a 20%+ gain off its mid-December secular low! This new bull has been confirmed by all kinds of major technical signals, including gold’s 200-day moving average turning up, a Golden Cross, and high volume.

So with gold officially back in a bull market in 2016, it’s important to understand its past bull-market seasonality. That extends from 2001 to 2012, with 2013 to 2015 excluded since they were Fed-induced bear-market years. The methodology used for this chart is simple. The gold price is indexed within each calendar year, which keeps percentage price moves comparable across years despite differing prevailing gold prices.

The gold close on the final day of each preceding year is recast at a level of 100, then all of the following year’s daily gold closes are indexed off that. An indexed level of 110 means gold was up 10% year-to-date at that point. Then each calendar year’s individually-indexed gold prices are averaged together to arrive at this gold-bull seasonality. It reveals gold’s tendency to enjoy a strong rally in the spring months.

Between 2001 and 2012, gold averaged a strong 4.3% gain from mid-March to late May. In precise terms it bottomed seasonally on the 15th trading day of March, then peaked seasonally on the 17th trading day of May. So gold’s spring seasonal rally clocks in right at 2 months. Annualize those gains, and gold is rising at a 25%+ pace! That’s excellent even though gold’s spring rally is still its weakest seasonal one.

The Asian-harvest and Indian-wedding-season rally from mid-June to early October averages a 7.5% gain. And the Western-Christmas and Chinese-New-Year one from late October to late February is the largest with a 10.1% average gain. But gold’s spring rally is still very solid and quite profitable to trade. A merely-average 4.3% rally this year from March’s 15th trading day would boost gold to $1297 by late May!

And odds are this year’s spring gold rally will be far better than average. 2016 has proven very different from all recent years in that it is witnessing massive gold investment buying. As the Fed-levitated stock markets threaten to roll over into a new cyclical bear in the Fed’s new tightening cycle, investors have been flocking back to gold at rates not seen since early 2009. That was early in gold’s last powerful bull.

Between gold’s stock-panic low in November 2008 and that August 2011 peak, gold powered 167% higher in 2.8 years. Strong investment buying was the primary driver of that last mighty gold bull, and it has finally returned in 2016. So gold’s spring rally has a high chance of exceeding to the upside this year as investment capital continues flowing in. Nothing begets buying like buying, which gold is seeing in spades.

And as goes gold, so go gold stocks. Gold stocks also exhibit strong seasonality, which is of course the direct result of gold’s own seasonality. Since gold-mining costs are largely fixed when mines are being planned, fluctuations in the gold price flow directly into amplified moves in gold-mining profits. Higher gold prices drive much-higher earnings for the gold miners, which attract in more investors bidding up stock prices.

The ironclad historical relationship between the price of gold, gold-stock profitability, and therefore gold-stock price levels is exceedingly important to understand. If you need to get up to speed, I’ve recently written essays looking at gold-stock price levels relative to gold, and the leveraged impact on gold-mining earnings of even relatively-small gold-price moves. Fundamentally, gold stocks are leveraged plays on gold.

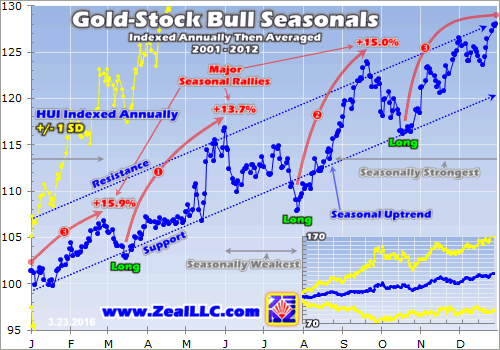

This next chart applies this same bull-market-seasonality methodology used on gold directly to the gold stocks. It looks at average annual indexed performance in the flagship HUI gold-stock index between 2001 and 2012. And as you’d expect given the gold price’s overwhelmingly-dominant influence over gold-mining earnings, gold-stock seasonality naturally mirrors and amplifies gold’s own seasonality.

Gold stocks enjoy strong seasonal rallies corresponding with gold’s own. Yet unlike gold’s which vary considerably, the gold-stock-bull seasonal rallies have been remarkably consistent on average between 2001 and 2012. They ran 13.7%, 15.0%, and 15.9% to gold’s 4.3%, 7.5%, and 10.1%. The gains in gold stocks tended to be more evenly distributed throughout the calendar year than gold’s own, which is interesting.

I’m not sure why. While gold ETFs led by GLD (NYSE:GLD) exist today, they didn’t start growing popular until early 2009. So for most of this gold-bull span, gold stocks were the primary way stock investors gamed gold’s own upside. And when a relatively-small sector like gold stocks builds upward momentum, that buying inertia tends to propel it higher for some time. Gold-stock prices have always considerably leveraged gold rallies.

As represented by the ARCA Gold BUGS, gold stocks’ mid-March seasonal low ahead of their strong spring rally tends to arrive on March’s 12th trading day. And gold stocks’ spring rally tends to peak about a week later than gold’s on June’s 2nd trading day. On average between 2001 and 2012, this flagship gold-stock index powered a very impressive 13.7% higher over that relatively-short spring span! That’s a serious gain.

And with gold stocks absolutely in a bull market again today, their strong spring seasonality has a very high chance of reasserting itself. While the threshold for a new bull market is a 20% closing gain off a major low, gold stocks are very volatile. Yet even if we arbitrarily triple that new-bull threshold to +60%, the HUI still skyrocketed 82% higher between mid-January and mid-March. Talk about bull-market credentials!

With gold stocks inarguably in a powerful new bull, it would be surprising if their spring seasonality did not come back into play this year. And this sector’s consolidating technical action in March suggests it already has. Note above that seasonally gold stocks tend to drift lower in the first half of March before rallying in the second half. The net result is a high consolidation following the strong winter seasonal rally.

And a high consolidation in gold stocks is exactly what we’ve seen this month! Even though the HUI soared in February as investors flocked back to gold, it hasn’t given up those epic gains in March. The gold stocks have generally ground sideways on balance this month, while still powering up to new bull-market highs. Seeing March’s seasonality reassert itself suggests April’s and May’s will return as well.

And a merely-average 13.7% gold-stock rally between mid-March and early June is pretty darned bullish. From mid-March’s HUI closing low, an average seasonal spring rally would boost the HUI to 193. But from the spring rally’s seasonal starting date of March’s 12th trading day, an average rally would catapult the HUI to 208. That would be the best levels gold stocks have seen since January 2015, a great early-bull high.

But like gold, the gold stocks have very high odds of experiencing an outsized spring rally this year for a variety of reasons. They are only starting to mean revert out of mid-January’s extreme fundamentally-absurd 13.5-year secular low. Investors are finally returning to this left-for-dead sector in a big way, as gold stocks’ powerful early-2016 bull has proved. Yet gold stocks’ new bull remains tiny in the grand scheme.

With so much upside momentum really attracting in more capital, gold stocks’ response to gold’s spring rally is likely to continue to be exaggerated. The higher gold stocks run, the more attention and buying they’ll attract. Just like in gold, buying begets buying. Strong rallies grow into virtuous circles, where buying pressure pushes up stock prices which attracts in even more buyers which becomes self-feeding.

Provocatively unlike gold seasonality which sees even gains in April and May, gold stocks’ seasonality is lumpy. April has been flat on average seasonally, followed by an abrupt surge in May. I doubt this lagging pattern will play out again this year. Thanks to their radical outperformance of every other stock-market sector in 2016, interest in gold stocks is exploding. Traders aren’t going to wait until May to buy.

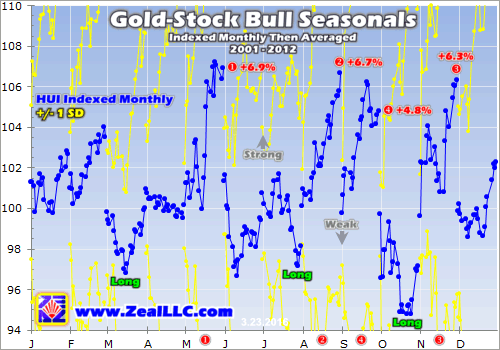

Nevertheless, May is the strongest month of the year for gold stocks seasonally in bull markets. This next chart breaks down gold-stock seasonality as exhibited by the HUI into calendar months. Each is indexed to 100 as of the previous month’s final close, and then individual calendar months’ indexes are averaged across the gold-stock-bull calendar years. These monthly seasonals highlight May’s importance.

As gold stocks’ spring rally soars in May, that is actually the best calendar month of the year for this sector seasonally! May saw average gold-stock gains of 6.9% between 2001 and 2012, exceeding the August, November, and September averages of 6.7%, 6.3%, and 4.8%. Gold stocks enjoy heavy buying in May before their summer doldrums kick in, the seasonal lull in gold-demand spikes in June and July.

So it’s very important for investors and speculators alike looking to ride the gold-driven spring gold-stock rally to deploy well before May’s surge. And the best time seasonally to add new gold-stock positions is during March’s consolidation. That’s the seasonal slump before the spring surge. And the setup for this year’s gold and therefore gold-stock spring rallies is exceptionally bullish, the best witnessed in many years.

Gold has enjoyed massive investment-capital inflows in early 2016 for one primary reason. Stock markets levitated for years by epic record Fed easing were starting to roll over into a new cyclical bear. With the Fed hiking interest rates for the first time in 9.5 years in mid-December, finally staking ZIRP, the first new tightening cycle in a decade was underway. That’s a serious problem for Fed-levitated stock markets!

Trading up near bubble valuations in an artificially-overextended cyclical bull ripe for a reckoning, the stock markets are exceptionally vulnerable to less central-bank easing. As investors realized this, they remembered how important it is to diversify their stock-heavy portfolios with gold. It is a unique asset that tends to move counter to general stock markets, making it history’s ultimate form of portfolio insurance.

The farther stock markets fell in the first 6 weeks of 2016, the more interested investors grew in adding gold to their bleeding portfolios. But that interest has waned dramatically in the 6 weeks since a sharp bear-market rally erupted in the stock markets in mid-February. As stocks powered higher again, the great downside risks they face in this Fed tightening cycle were forgotten. Complacency has become extreme.

Today this bear-market rally is on the verge of rolling over again. The heavy corporate stock buybacks that have boosted the stock markets are abating heading into their blackout periods leading into Q1 earnings reports. And given the weak corporate-earnings environment, we are going to see all kinds of guidance lowerings and profits and sales misses in the coming weeks. These will really weigh on stock sentiment.

As the stock markets sell off again in the coming months, investors’ interest in owning gold to help offset their losses is going to surge again. Coming from record-low levels of gold investment late last year, the amount of gold buying investors still need to do is enormous. This resurging gold investment demand will reignite gold’s powerful bull this spring, and gold stocks will follow it higher and amplify its gains.

That should make for an exceptional gold-stock spring rally this year. But some traders worry that the gold stocks will get sucked into a general-stock selloff. While stock down days extreme enough to really kindle fear do weigh on gold stocks, over the full courses of major selloffs gold stocks follow gold higher. The first 6 weeks of 2016 were a great example, where the HUI soared 43.3% as the S&P 500 fell 10.5%!

So don’t delay in getting fully deployed in gold stocks for their imminent spring rally. This upside can be played in the leading GDX (NYSE:GDX) gold-stock ETF, which mirrors the HUI. But the elite gold miners with the best fundamentals will see gains trouncing the gold-stock benchmarks. While it’s too late to spend tens of thousands of hours researching this sector to uncover these winners, we’ve already done that hard work.

The bottom line is gold stocks experience a strong spring rally seasonally. This is driven by gold’s own seasonality, where outsized investment demand arises at certain times during the calendar year. Gold experiences a strong spring rally likely driven by the universal optimism this season brings. And since gold drives gold miners’ profitability, their stock prices naturally follow it higher while amplifying its gains.

And gold stocks’ already-strong spring rally is likely to prove exceptional this year. With gold and gold stocks just reentering bull markets, investor interest is really growing in 2016. And as this overextended bear-market rally in general stocks inevitably rolls over, demand for gold and gold stocks will flare again. This sector’s usual March consolidation is the perfect time to deploy aggressively ahead of that strong spring rally.