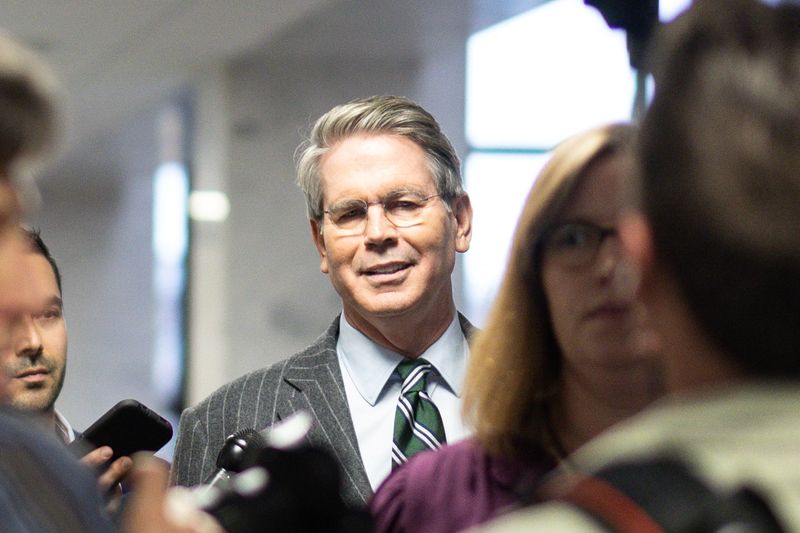

(Reuters) -Scott Bessent, the investor selected by President-elect Donald Trump to be his Treasury secretary, will divest from his Key Square Group hedge fund and other investments, according to a letter to the Treasury Department's ethics office.

Bessent outlined the steps he would take to "avoid any actual or apparent conflict of interest in the event that I am confirmed for the position of Secretary of the Department of Treasury," according to the letter.

The money manager, tapped by Trump on Nov. 23 to be the top U.S. economic policymaker, said he would resign from his position in Bessent-Freeman Family Foundation.

He also plans to shutter Key Square Capital Management, the investment firm he founded, according to the New York Times (NYSE:NYT), which first reported Bessent's divestments.

Reuters reported in November that if Bessent were to take a job in the new administration, Key Square could be wound down, sold, or put in "sleep mode."

A spokesperson for Bessent declined to comment.

On Friday, Trump repeated the financial arrangement that he made during his first term, handing over daily management of his multi-billion-dollar real estate, hotel, golf, media and licensing portfolio to his children when he enters the White House.