By Ruma Paul, Sudipto Ganguly

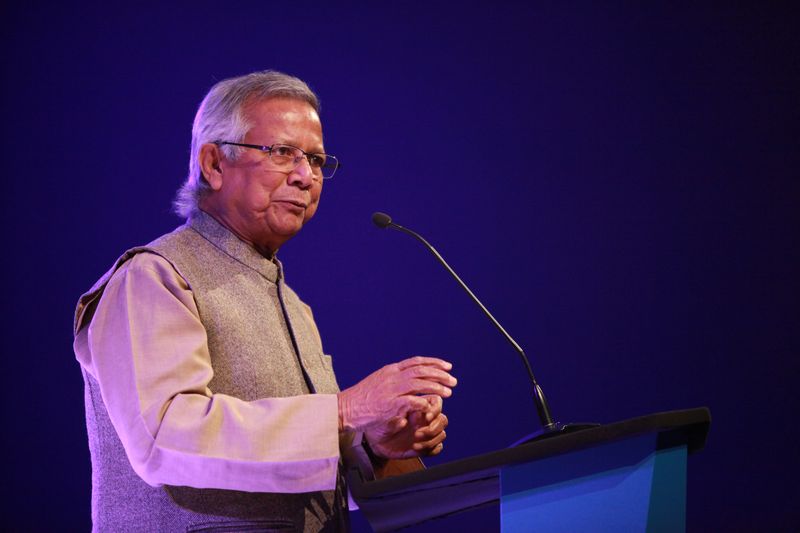

DHAKA (Reuters) -Nobel laureate Muhammad Yunus, the pioneer of the global microcredit movement who could shepherd Bangladesh's new interim government, was an arch foe of Prime Minister Sheikh Hasina who has resigned and fled the country.

Known as the "banker to the poor", Yunus and the Grameen Bank he founded won the 2006 Nobel Peace Prize for helping lift millions from poverty by providing tiny loans of sums less than $100 to the rural poor who are too impoverished to gain attention from traditional banks.

Their lending model has since inspired similar projects around the world, including developed countries like the United States where Yunus started a separate non-profit Grameen America.

As his success grew, Yunus, now 84, flirted briefly with a political career, attempting to form his own party in 2007. But his ambitions were widely viewed as having sparked the ire of Hasina, who accused him of "sucking blood from the poor".

Critics in Bangladesh and other countries, including neighbouring India, have also said microlenders charge excessive rates and make money out of the poor. But Yunus said the rates were far lower than local interest rates in developing countries or the 300% or more that loan sharks sometimes demand.

In 2011, Hasina's government removed him as head of Grameen Bank, saying that at 73, he had stayed on past the legal retirement age of 60. Thousands of Bangladeshis formed a human chain to protest his sacking.

In January this year, Yunus was sentenced to six months in prison for violations of labour law. He and 13 others were also indicted by a Bangladesh court in June on charges of embezzlement of 252.2 million taka ($2 million) from the workers' welfare fund of a telecoms company he founded.

Although he was not jailed in either case, Yunus faces more than 100 other cases on graft and other charges. Yunus denies any involvement and said, during an interview with Reuters, the accusations were "very flimsy, made-up stories".

"Bangladesh doesn't have any politics left," Yunus said in June, criticising Hasina. "There's only one party which is active and occupies everything, does everything, gets to the elections in their way."

He told Indian broadcaster Times Now that Monday marked the "second liberation day" for Bangladesh after its 1971 war of independence from Pakistan following the exit of Hasina.

Yunus is currently in Paris undergoing a minor medical procedure, his spokesperson said, adding he has agreed to the request of students who led the campaign against Hasina to be the chief adviser of the interim government.

Yunus was an economist teaching at the University of Chittagong when famine struck Bangladesh in 1974, killing hundreds of thousands of people and leaving him searching for better ways to help his country's vast rural population.

That opportunity came when Yunus came across a woman in a village near he university who had borrowed from a moneylender. The amount was less than a dollar but in return the moneylender gained the exclusive right to buy everything she produced at a price to be determined by the moneylender.

"This to me was a way of recruiting slave labour," Yunus said in his Nobel acceptance speech. He found 42 people who had borrowed a combined $27 from the moneylender and lent them the funds himself - the success of that endeavour spurring him on to do more and think of credit as a basic human right.

"When I gave the loans I was astounded by the results I got. The poor paid the loans on time every time."