By Muyu Xu and Melanie Burton

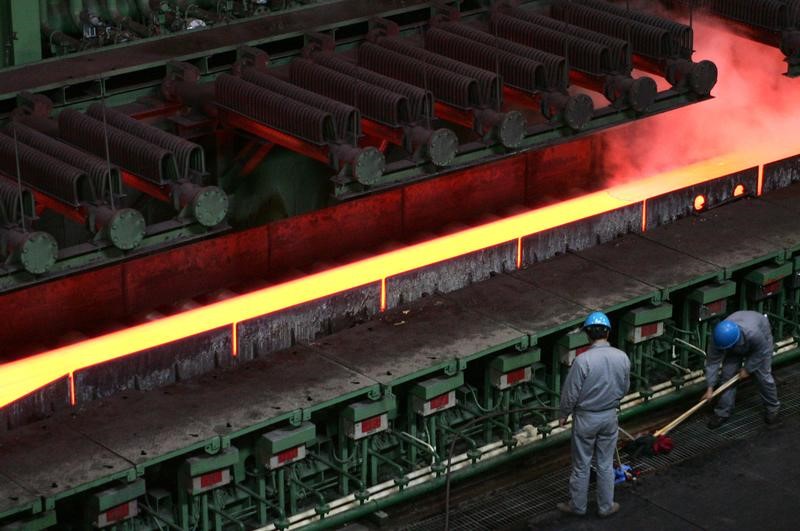

BEIJING/MELBOURNE (Reuters) - China churned out record amounts of steel and aluminum in June as producers rushed to cash-in on rallying prices in the wake of a drive by Beijing to crack down on output of low-grade metal.

That could fuel concerns the world's top steel producer will export more metal, stoking global oversupply and fanning tensions with the United States after it accused the nation of flooding international markets with cheap aluminum and steel.

U.S. President Donald Trump has threatened to use a Cold War-era law to restrict imports for national security reasons as bilateral talks between Washington and Beijing continue.

China has long-denied that it has been offloading metals abroad at the expense of foreign producers.

Chinese steel output last month rose 5.7 percent from the year before to a record 73.23 million tonnes, surpassing April's all-time high of 72.78 million tonnes, data from the National Statistics Bureau showed on Monday.

Aluminum production jumped 7.4 percent year-on-year to 2.93 million tonnes, exceeding December's record of 2.89 million tonnes.

Export data last week showed steel products shipments fell last month, while aluminum sales abroad were steady.

But analysts said the latest numbers should not be seen as provocative move ahead of a decision by the United States on possible import tariffs.

"It's wrong to think that this is some sort of unified, homogenous voice that is deliberately making some provocative statement to the U.S," said Paul Adkins, managing director of aluminum consultancy AZ China.

"That couldn't be further from the truth. What we're really seeing, if anything, is ... a lack of a coordinated response (from Chinese producers)."

Analysts said the increases came as local steel and aluminum prices rose after the government cut back on metals producing capacity earlier in the year as it battles a glut in supply and looks to clamp down on pollution.

"The reason that prices were higher in the first place was the expectation of Chinese cutting back supply of aluminum and steel, yet that is what is inducing its high utilization rates," said Mark Pervan, chief economist at AME Group in Sydney.

Steel rebar margins were almost 1,000 yuan ($147.77) per tonne in June, enticing mills to increase output, said Bai Jing, analyst at Galaxy Futures.

"China's crackdown on low-end steel has left a capacity gap in the market," she said.

In the first half of the year, China eliminated around 120 million tonnes of low-end steel capacity. By May, the country had fulfilled nearly 85 percent, or 42.4 million tonnes, of its 2016 steel capacity cutting target.

The data came as better-than-expected GDP numbers brightened demand prospects for metals and spurred gains in prices, with steel rebar rising 2 percent.