Investing.com – The euro rose against the U.S. dollar on Wednesday, nearing a 3-week high as traders' risk appetite sharpened after revenue at chipmaker Intel Corp. beat estimates and ahead of key U.S. economic reports.

EUR/USD rose to 1.3665 during the Asian trading session, close to Monday's 3-week high of 1.3692; the pair subsequently consolidated around 1.3648, gaining 0.26%. EUR/USD was likely to find resistance at 1.3818, the high of March 17, and support at 1.3267, the low of March 25.

After the U.S. market closed on Tuesday, Intel, the world’s largest chipmaker, said that second-quarter sales will be about USD 10.2 billion. Bloomberg quoted analysts as having estimated USD 9.72 billion on average.

The euro also surged versus the yen on Wednesday, with EUR/JPY jumping 0.5% to reach 127.52.

Later in the day, the European Union was set to publish a monthly report on industrial production in the euro zone and the U.S. was due to publish closely watched reports on consumer prices and retail sales.

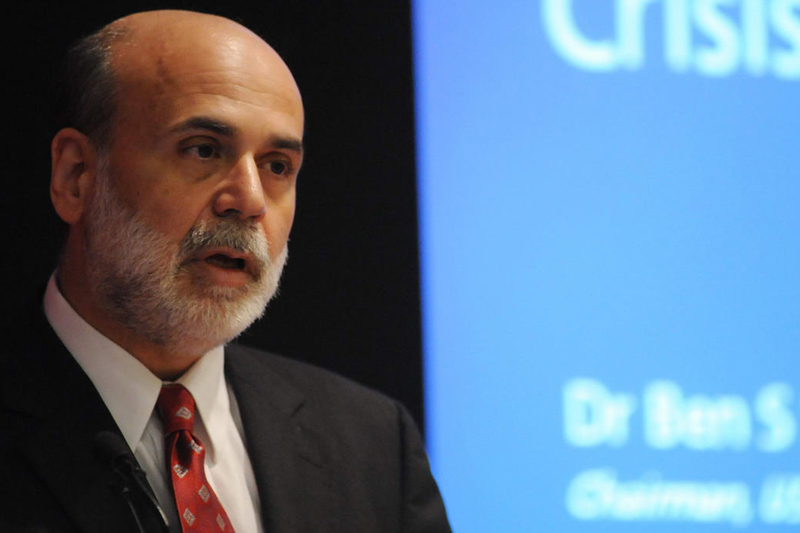

Also Wednesday, U.S. Federal Reserve Chairman Ben Bernanke was scheduled to testify before the Joint Economic Committee of Congress. Traders were likely to scrutinize his comments for clues to future shifts in monetary policy.

EUR/USD rose to 1.3665 during the Asian trading session, close to Monday's 3-week high of 1.3692; the pair subsequently consolidated around 1.3648, gaining 0.26%. EUR/USD was likely to find resistance at 1.3818, the high of March 17, and support at 1.3267, the low of March 25.

After the U.S. market closed on Tuesday, Intel, the world’s largest chipmaker, said that second-quarter sales will be about USD 10.2 billion. Bloomberg quoted analysts as having estimated USD 9.72 billion on average.

The euro also surged versus the yen on Wednesday, with EUR/JPY jumping 0.5% to reach 127.52.

Later in the day, the European Union was set to publish a monthly report on industrial production in the euro zone and the U.S. was due to publish closely watched reports on consumer prices and retail sales.

Also Wednesday, U.S. Federal Reserve Chairman Ben Bernanke was scheduled to testify before the Joint Economic Committee of Congress. Traders were likely to scrutinize his comments for clues to future shifts in monetary policy.