By George Georgiopoulos and John O'Donnell

ATHENS/FRANKFURT (Reuters) - Greek borrowing costs leapt and bank shares were hammered on Thursday after the European Central Bank abruptly pulled the plug on its funding for the country's financial sector in what Athens labelled an act of coercion.

The ECB decision to cancel its acceptance of Greek bonds in return for funding shifts the burden onto Athens' central bank to finance its lenders and marks a further setback for the government's attempt to negotiate a new debt deal with its euro zone peers.

The Athens Stock Exchange FTSE Banks Index (FTATBNK) plunged 22.6 percent at the open before recovering somewhat. Three-year government borrowing costs leapt more than three percentage points to nearly 20 percent, leaving Greece utterly shut out of the markets.

"Greece does not aim to blackmail anyone but will not be blackmailed either," A Greek government official said in a statement. "The ECB's decision ... is an act of political pressure to quickly reach a deal."

Greek banks have been given approval to tap an additional 10 billion euros in emergency funding over an existing ceiling if necessary, the official said.

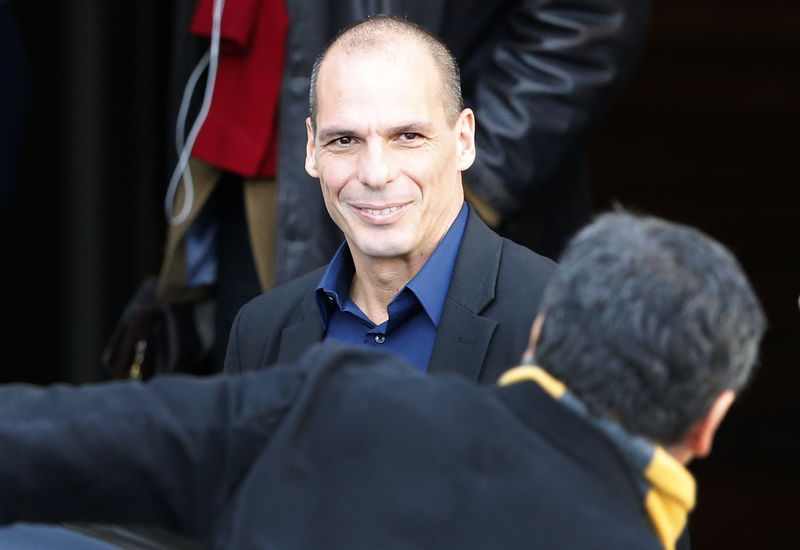

Greek Prime Minister Alexis Tsipras and his finance minister, Yanis Varoufakis, have spent this week touring EU capitals hoping to build support for a debt renegotiation and an easing of austerity measures under the country's bailout programme which both say they have no interest in extending beyond the end of February.

They have found little or no backing in Paris, Rome, Frankfurt or Brussels and on Thursday Varoufakis meets Germany's Wolfgang Schaeuble, the most hardline euro zone finance minister.

European Commission Vice President Valdis Dombrovskis said Athens must extend its bailout programme to gain time to negotiate a longer-term programme.

"In the European Commission's assessment the most realistic way forward is to ... extend the duration of the programme for another couple months or half a year," Dombrovskis told the Reuters Euro Zone Summit.

Varoufakis is unlikely to get any concessions from Schaeuble and the ECB's decision came just hours after he emerged from a meeting with President Mario Draghi and declared the ECB would do "whatever it takes" to support Greece.

A document prepared by Germany for a meeting of EU finance officials, obtained by Reuters, made clear Berlin wants Athens to go back on promises to raise the minimum wage, halt privatisations, rehire public sector workers and reinstate a Christmas bonus for poor pensioners.

"The aim is the perpetuation of the agreed reform agenda (no roll back of measures), covering major areas as the revenue administration, taxation, public financial management, privatisation, public administration, health care, pensions, social welfare, education and the fight against corruption," the paper said.

The new Greek leaders have had a cool reception even in left-leaning countries such as France and Italy which Athens had hoped would support its case for debt relief.

EMERGENCY ROOM

Two Greek banks had already begun to tap the more costly emergency liquidity assistance from the Bank of Greece after an outflow of deposits accelerated after the victory of the hard left Syriza party in a Jan. 25 election, banking sources had told Reuters.

The health of Greece's big banks is central to keeping the country afloat.

The Greek finance ministry said the ECB decision puts pressure on the Eurogroup of euro zone finance ministers to reach a deal that would be "mutually beneficial" for both Athens and its euro zone partners.

Bundesbank chief Jens Weidmann said even emergency lending from the Bank of Greece should be a short-term measure. That credit line can be stopped if a two-thirds majority on the ECB Governing Council vote to do so although such a decision would likely lead to the collapse of Greece's financial system.

"ELA should only be awarded for the short term and to solvent banks," Weidmann told business daily Boersen Zeitung in an interview.

"As the banks and the state are closely bound in Greece, the economic and fiscal policy course that the Greek government follows plays an important role in this assessment," he said.

With the Greek public determined to cast off the stigma of supervision by a troika of EU, IMF and ECB inspectors, the semantics of any new arrangement may be crucial.

A source familiar with the Greek position said after the talks with Draghi: "We are thinking of a bridging programme. You may not call it a 'programme' for political reasons but perhaps a contract."

Tsipras, 40, won power promising to negotiate a debt write-off, reverse some key reforms and end budget cuts. At home, his poll ratings are high and the media is extolling his stance but if he fails to deliver, that may change.